Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Yesterday, Zimbabwe’s Finance Minister, Professor Mhtuli Ncube, presented the 2025 National Budget under the theme “Building Resilience for Sustained Economic Transformation.” There were a lot of mixed reactions to most of the stuff announced in that proposed budget. Most of the feedback focused on the plethora of additional taxes proposed in a number of areas. Most citizens were not too happy about all the new taxes, as there is a feeling that people in Zimbabwe are already facing a relatively high tax burden before these additional taxes that are set to be introduced in January of 2025. Some of the uproar was brought about by the proposed new “Fast Foods Tax.”

Introducing the new fast food tax, the Finance Minister said, “the consumption of highly processed food has been identified as one of the factors responsible for the prevalence of obesity and associated non communicable diseases, hence, the need for Government to promote responsible consumption of such foods.

“In view of the above, I propose to introduce a Fast Foods Tax on the value of the following food items sold by Fast Food Retail Outlets and Restaurants at a modest rate of 0.5% on the sales value, with effect from 1 January 2025:”

- Shawarmas

- French fries

- Fried/Flame Grilled Chicken

- Doughnuts and similar products

- Tacos (Yes, a new tax on tacos)

- Burgers and hot dogs

- Pizza

The minister said he wants to “promote healthy eating,” but you can see why a lot of people are not happy. In a tough economic environment, people don’t want to be paying more to get their pizza or chicken and french fries!

Zimbabwe’s economy is also now one of the most informalized economies in the world, which doesn’t help efforts to grow the tax base through formal channels. To try and tap into this informal economy as well as the small to medium enterprises sector, the Minister also announced the mandatory registration for Corporate and Personal Income Tax for the following operators:

- Fabric merchandisers

- Clothing merchandisers/boutiques

- Car spare parts dealers

- Car dealers (small informal car dealers that dominate the used vehicle import and retail market)

- Grocery and kitchenware merchandisers

- Hardware store operators

- Lodges (short term accommodation, guest houses)

The inclusion of car dealers is an interesting one. Here, car dealers probably refers to the majority of independent used car traders, which are responsible for over 90% of vehicle imports and sales in Zimbabwe. The majority of vehicles imported into Zimbabwe every year are used vehicles from places such as Japan and the United Kingdom. In the same budget presentation, the Minister noted that for the period from January 2024 to September 2024, $527 million worth of vehicles had been imported into Zimbabwe. Over the past 6 years, over $3.08 billion worth of vehicles have been imported into Zimbabwe. In a country with annual import bill of about $8 billion, you can see why the minister wants to add more taxes for this sector to try and raise more money.

So, Zimbabweans will start the new year with a lot more taxes! However, there was some relief in the electric vehicle sector, which is a good development. The minister said, currently, electric motor vehicles attract a customs duty of 40% (same rate as ICE vehicles), while electric tractors attract a duty of 0%. I didn’t know electric tractors had a customs duty of 0%. That’s pretty cool! I hope this will help to incentivize the adoption of electric tractors.

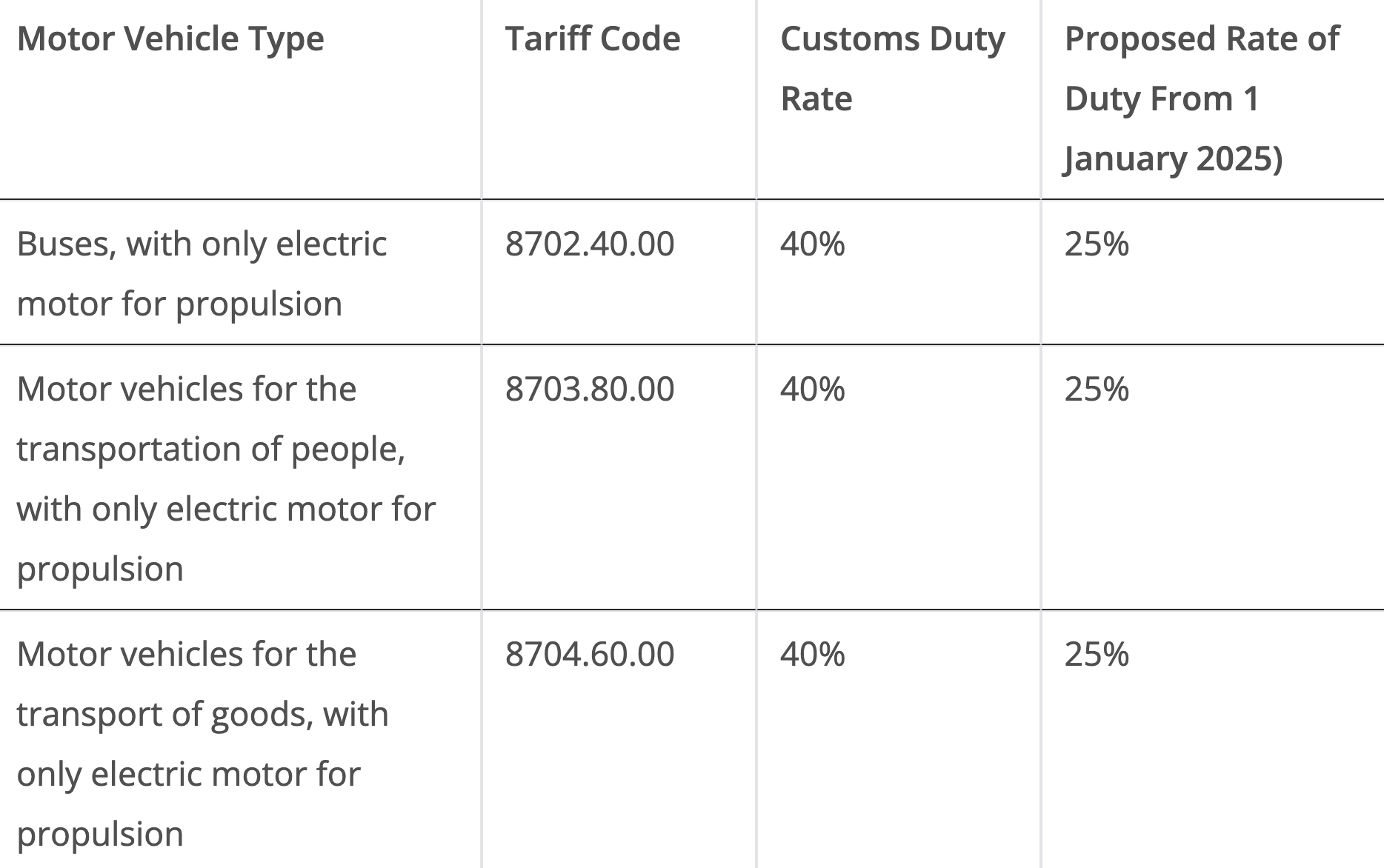

The minister added that, “Cognisant of the need to promote use of eco-friendly vehicles, which will result in reduced carbon emissions, I propose to reduce Customs Duty on Electric Motor Vehicles, with effect from 1 January 2025, as shown in the table below:

The reduction to 25% is a positive development. That helps EVs get a slightly more favorable import duty framework than ICE vehicles, which will remain at the 40% rate. It’s a start, however, I was hoping Zimbabwe would have joined several African countries, such as Zambia, that have removed import duties on EVs. I guess half a loaf is better than nothing right? The reduction of import duties in countries like Mauritius and Ethiopia has helped to accelerate adoption of EVs. Let’s wait and see how much of an impact this reduction will have on Zimbabwe’s electric vehicle sector next year.

There was more good news! The minister said that “In order to incentivise the use of Electric Vehicles, I, further, propose to extent Rebate of Duty on equipment used for setting up Electrical Vehicle Solar Powered Charging Stations, imported by Approved Operators, also starting on 1 January 2025.”

This is great news. EVs and solar PV make a great combination. As the prices of solar panels and stationary battery storage continue to fall at record rates, this will make the business case for establishing solar-powered electric vehicle charging stations more feasible, especially in off-grid areas. This will help increase the penetration of electric vehicle charging networks, helping EV drivers go more places and help to reduce range anxiety.

A good example of a recent solar-powered electric vehicle charging station project is the off-grid EV charging station in Wolmaransstad, Northwest province, South Africa. The station boasts six state-of-the-art DC fast charging points for EVs, and two AC charging points for plug-in hybrids. The DC fast chargers are able to charge a vehicle in about 25 minutes. Motorists will also be able to enjoy a cup of coffee and a bite to eat at the farm stall located at the station. The site has 280kWp solar PV paired with a 546kWh stationary battery pack. With South Africa just next door, these kinds of sites make good case studies for Zimbabwe. Solar-powered charging stations are now a reality in this part of the world, and now is a good time to scale up development of these across the region.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy