- Company shares fall to all-time lows, market value plummets

- Siemens Energy, govt confirm talks after media reports

- Government well disposed but wants stakeholders to chip in

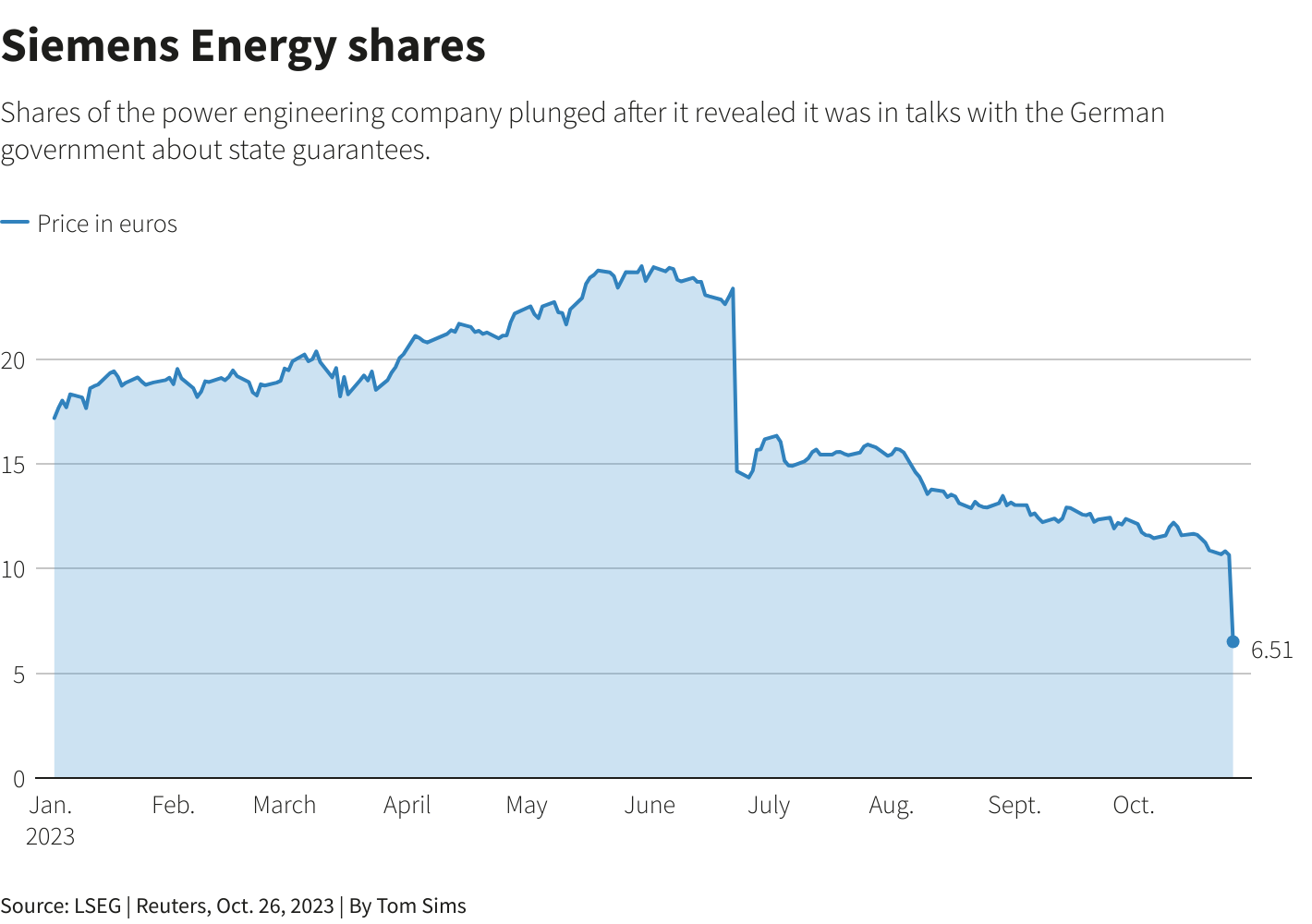

BERLIN, Oct 26 (Reuters) – Shares in Siemens Energy (ENR1n.DE) plunged nearly 40% on Thursday, wiping 3 billion euros ($3.16 billion) off its market value, after the company said it was in talks with the German government about state guarantees after major setbacks at its wind division.

A spokesperson for the German economy ministry also confirmed the talks, describing them as “close and trustworthy”. Siemens Energy shares slid to all-time lows on the news, down more than 39% at 1055 GMT, implying a 3.3 billion euro loss in market value since Wednesday.

Quality problems emerged this year at the power engineering company’s wind unit Siemens Gamesa centred on rotor blades and gears in newer onshore wind turbines, drawing the ire of top shareholder and former parent Siemens AG.

Siemens Gamesa has booked billions in losses.

Due to the losses, Siemens Energy fears it will struggle to secure guarantees from banks, and has approached the government and Siemens to obtain a guarantee framework, said business news weekly WirtschaftsWoche, which first reported the talks along with Spiegel magazine.

The weekly said Siemens Energy is seeking up to 15 billion euros in guarantees.

The German state would assume liability for 80% of an initial 10 billion euro funding tranche, while banks would be liable for the remaining 20%, WirtschaftsWoche said.

A spokesperson for Siemens AG, which according to the report was being asked to guarantee a second tranche of the remaining 5 billion euros, declined to comment. Siemens remains an anchor investor in Siemens Energy, retaining a 25.1% stake.

In a statement confirming the talks, Siemens Energy also said its financial results in 2023 are expected to be fully in line with previous guidance, and that Siemens Gamesa is working through its quality issues.

It did not comment on the financial details of a targeted package. Siemens Energy’s budgeting process is still ongoing and no decisions on the 2024 annual budget or any specific financing measures have yet been taken by the executive board, it said.

Government sources in Berlin declined to comment on the size of a possible package. The government was ready to help Siemens Energy while stakeholders also will have to play their role, they said.

The German government wants to support industry amid the transition to a low carbon economy and the European Commission has just released an action plan to keep Europe’s wind industry in a global leadership position.

In August, Siemens Energy said the problems at Gamesa would be the main factor inflating its net loss in 2023 to 4.5 billion euros, more than six-fold year-on-year.

Spiegel magazine cited sources close to the company as saying the losses might turn out to be higher.

Top managers at Siemens Gamesa, the world’s largest maker of offshore wind turbines, have been replaced without resulting improvements in profitability.

Globally the company operates 79 sites, including sales and service offices, research and development centres, and 15 factories to produce components such as blades.

J.P. Morgan said in a note that the energy transition will require substantially higher rates of investments, which will bring commercial opportunities for Siemens Energy and sector peers.

Guarantee lines given to customers needed to rise accordingly, a development J.P. Morgan sees also applying to Vestas, Prysmian and Nexans.

($1 = 0.9493 euros)

Reporting by Matthias Inverardi, Christian Kraemer and Alexander Huebner; Writing by Vera Eckert, Friederike Heine and Miranda Murray; Editing by Sabine Wollrab, Rachel More, Jan Harvey and Susan Fenton

Share This: