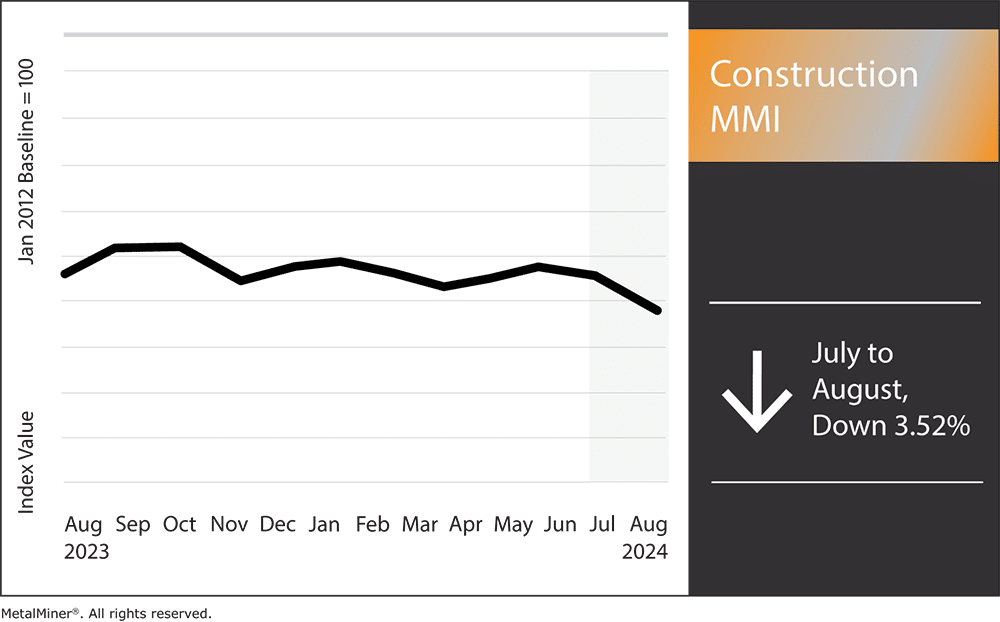

The Construction MMI (Monthly Metals Index) finally broke free of its year-long sideways trend, but only slightly. All in all, price action moved down by 3.52%, adding to questions about the state of US manufacturing. Iron ore, h-beam, and steel rebar prices dropping were the main components driving the index down.

In general, numerous factors continue to pull at the construction index. Most anticipate that the construction index will experience more bearish action for the remainder of 2024 due to fewer construction projects, high interest rates, and drops in base metal prices. This is with the possible exclusion of steel, which experts anticipate will seek a new bottom in the near future.

US Manufacturing Boom, or US Manufacturing Recession?

The status of US manufacturing is a contentious topic for economists, legislators, and business stakeholders. One camp claims that reshoring and smart investments are driving a massive comeback in domestic manufacturing. Conversely, others argue that the sector faces formidable obstacles, which may indicate the beginning of a manufacturing downturn.

Level up your metal sourcing game in the face of US manufacturing changes. Join MetalMiner’s weekly newsletter list and get exclusive access to metal market intelligence and macroeconomic news.

The Case for a Manufacturing Boom

There are several arguments supporting the idea of a US manufacturing boom team. First, there has been a discernible rise in domestic investment, especially in industries like semiconductors and electric vehicles. This trend started even before the US passed new industrial policies meant to increase homegrown production.

A major focus of these investments has been the corporations’ dedication to reshoring, or bringing manufacturing jobs back to the US, as they work to improve supply network dependability and reduce their reliance on foreign production.

Furthermore, the spike in nationwide manufacturing projects lends credence to the boom argument. These initiatives, which range from building new factories to expanding existing ones, are more than just ways to increase output. Furthermore, they also serve as a larger plan to ensure that the U.S. manufacturing sector is ready for the future. The emphasis is on high-tech sectors, which are essential to preserving competitiveness on the world stage.

The Federal Reserve and Economic Conditions

A crucial aspect of any discussion of US economics is the Federal Reserve’s present position on interest rates. The fear is that increased borrowing rates may deter investors from funding expansion and new manufacturing initiatives.

On the other hand, proponents of the boom contend that the manufacturing sector remains robust. They argue that customer preferences for locally made items combined with government incentives mean that there is still a strong demand for goods made domestically, even in the face of increased interest rates.

Elevate your construction market intelligence, Subscribe to MetalMiner’s free Monthly Metals Index report to gain a deep understanding of the dynamics affecting a variety of markets, along with 9 other metal industries

Arguments for a US Manufacturing Recession

Despite the positive forecast, there is a strong case to be made that US manufacturing could be in a recession already. The continuous labor shortage is one of the issues. It seems a lack of interest in manufacturing employment by younger generations and an aging workforce have made it difficult for the manufacturing sector to recruit and retain talented people. The lack of manpower has, in turn, raised production prices and created inefficiencies, which may inhibit expansion.

Contradictory data on domestic manufacturing percentages provides additional support for a manufacturing slowdown. While certain industries are flourishing—such as semiconductors and electric vehicles—others are not. The manufacturing sector may not prove as resilient as it appears, as manufacturing output in several traditional industries has stagnated or even decreased.

Adding to recessionary fears is the global economic slump, which has been partially exacerbated by supply chain disruptions and geopolitical tensions.

The question of whether US manufacturing is experiencing a boom or a recession is complex and multifaceted. On the one hand, there are undeniable signs of growth, particularly in high-tech industries and through substantial investments in domestic production. On the other hand, labor shortages, rising interest rates, and mixed performance across different sectors suggest that the manufacturing renaissance may not be as widespread as some believe.

Construction MMI: Noteworthy Price Shifts

Stop scrambling to react to rapid metal price fluctuations. MetalMiner Insights gives you the foresight to proactively plan your metal spend.

- Chinese h-beam steel dropped 3.53%, leaving prices at $454.46 per metric ton.

- Chinese steel rebar fell 4.4%, bringing the price to $516.70 per metric ton.

- European aluminum commercial 1050 sheet dropped by 4.22% to $3,143.20 per metric ton.

- Finally, aluminum bar prices traded flat, remaining at $2,962.63 per metric ton.