Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Remarkably, in 2022 the USA managed to get a greenhouse gas price through Congress. It wasn’t on carbon dioxide, the biggest problem, but it was on methane, the second biggest greenhouse gas problem we humans create. Perhaps more remarkably, it was explicitly on the oil and gas industry and excluded the human-caused biological sources of this potent greenhouse gas. How much is this going to add to the cost of dirt cheap natural gas in the USA?

It came into effect in January of 2024, a bouncing New Year baby balloon inflated by methane. What’s the price tag? The one on the box says $900 per ton of methane, but what does that really mean? The first thing it means is that it’s equivalent to a tax on carbon dioxide of $36. That’s pretty close to the current California cap and trade settlement average of $35.20 for May 2024. That’s well under the current Canadian carbon price of US$59.20. It’s far under the EU’s emission trading scheme price of US$81 per ton, and farther under the peak ETS price of $109.

It’s vastly under the US social cost of carbon — harmonized with Canada and fairly well-aligned with the EU’s ETS budgetary guidance for business cases for carbon intensive projects — of $190 per ton of carbon dioxide or equivalent. But it’s a price. How much of a price is it for US consumers though? And will it be added to exports?

Until recently, most people thought that natural gas was an innocuous bridge fuel, not entirely carbon free, but much, much better than coal. The natural in natural gas, a random term that stuck decades ago and became ubiquitous, didn’t hurt. The fossil methane industry must bow down to the gods of lucky marketing annually and sing hosannas to whoever came up with it and whatever circumstances made it stick.

It isn’t remotely innocuous. It’s merely less horrible than coal in a few ways.

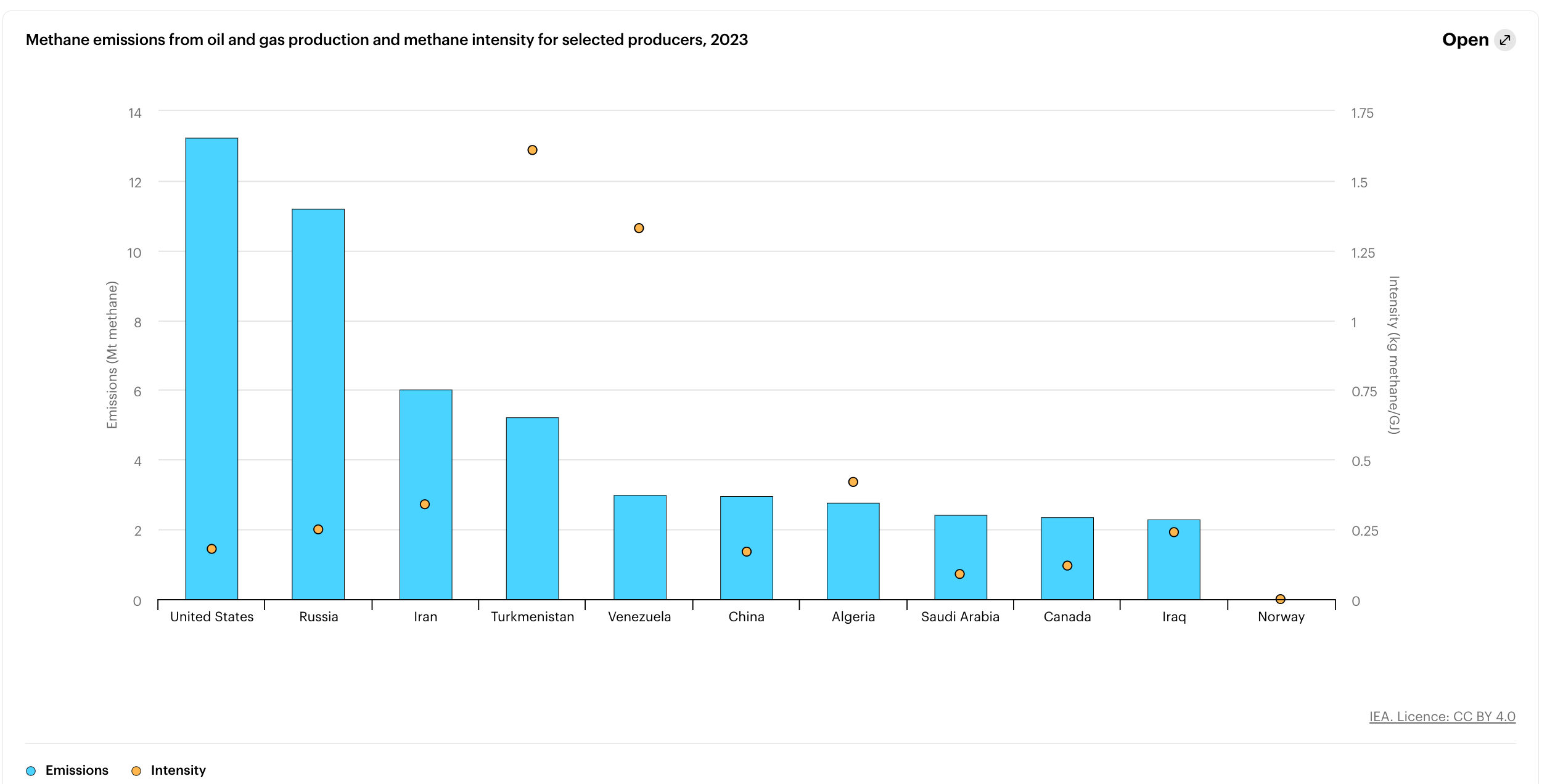

This is a chart from the International Energy Agency. It shows the methane emissions per country from oil and gas facilities. You’ll notice the American exceptionalism in all of its glory. Yes, the United States emits more methane from its oil and gas industry than any other country in the world. Turkmenistan has more per capita, but the USA is a world-flogger when it comes to the high global warming potential gas that is methane, just as it was a world-flogger with its historical carbon dioxide emissions.

While the USA likes to tout how much its electrical generation emissions have come down since 2007 — not the 1990 baseline that most of the world prefers — that’s only carbon dioxide emissions, not methane emissions. Dumping coal generation, with 600 plants dropping to 241 plants, gives Americans the warm fuzzies. Methane emissions should give them the cold shivers.

The amount from the chart above means that the USA’s actual greenhouse gas emissions from electrical generation haven’t actually gone down at all, they’ve just pivoted from carbon dioxide to methane. Do the math yourself. I’ll wait. The immediate, 10-year, and 20-year global warming potential of methane should be weighing on your mind.

But most Americans don’t care about that. Nor, frankly, do most people in the world compared to the pressing concerns about income, security, and who will be kicked off of whatever reality show is hot right now. No judgment. People are people and hence human. One of my metrics for whether a climate solution will work or not is whether it requires human beings to change en masse. If so, it’s not a solution. Accept human nature. Exploit it if you can.

They will care when the price for methane leakage starts showing up on their monthly utility bills. At least, some of them will. Definitely the bottom 20% of income earners in the USA. Perhaps the bottom 40%. There’s the potential for over 20% increases for households. Corporations will care a lot because it’s a bottom line expense for them. While humans are fuzzy System One thinkers — go read Kahneman’s Thinking, Fast and Slow — most of the time, corporations are System Two thinkers much more of the time. Extra cost for energy makes them sit up and take notice, even if most of them sit up long after the fact.

So how much will they be paying? Virtually no US consumer, and the vast majority of businesses, have any idea.

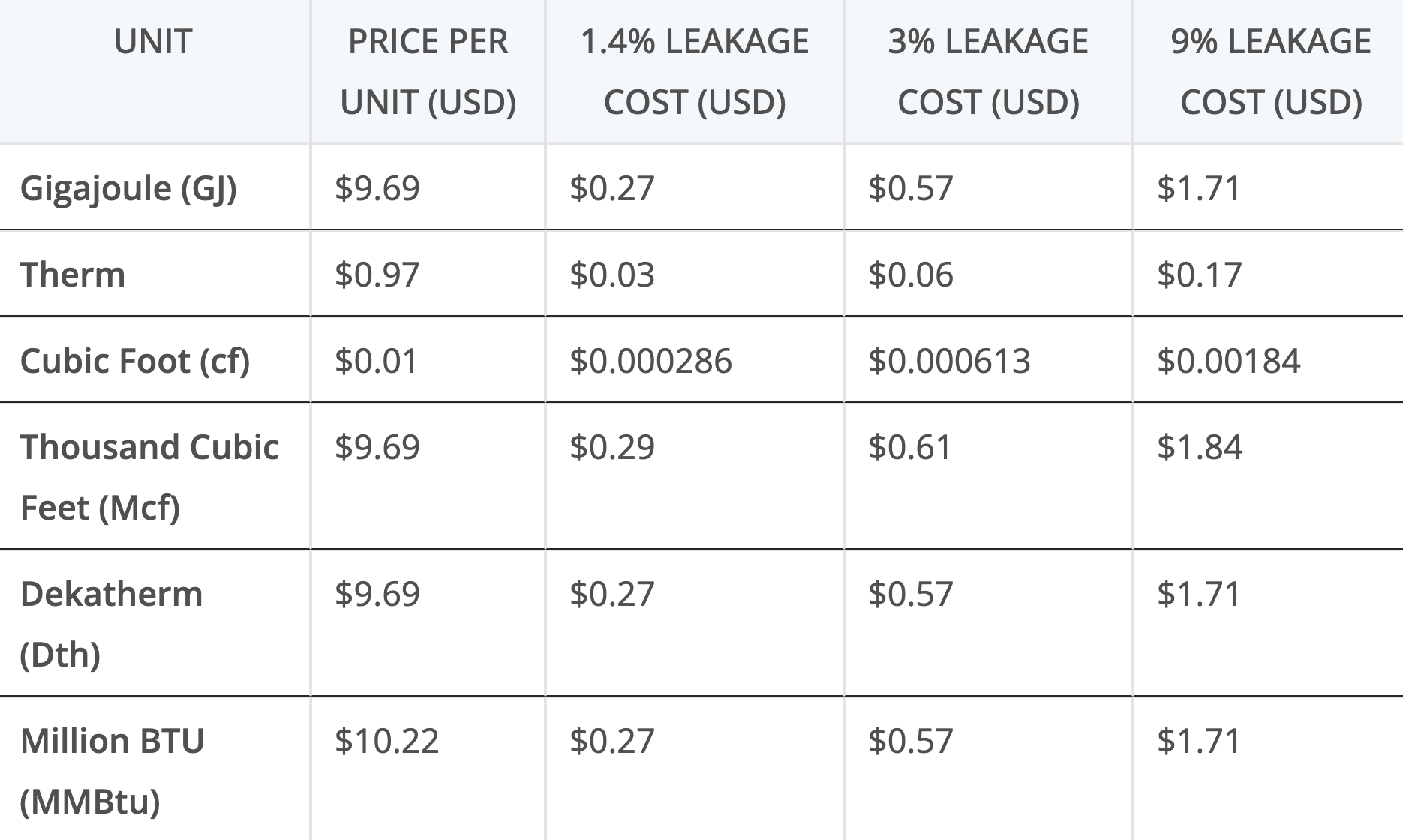

Why? First off, how many Americans are even aware of this? I was surprised when I heard about it in March at an EU-Canada methane emissions reduction seminar I was moderating in Calgary. I pay a lot of attention to this kind of thing professionally. 99% of Americans don’t. The odds that even 1% of Americans are aware of this today approach zero. And how many will be able to figure this out? The price is per ton. Americans buy natural gas in cubic feet, MMBtu, therms, and dekatherms. Very few people outside of the industry have the ability to make the conversion.

But that doesn’t mean it won’t affect them. Costs that the oil and gas industry incur get passed on to consumers. In general, costs get passed on with a markup, but for this exercise, let’s pretend that the natural gas industry in the USA will be a virtuous entity and only increase consumer prices as much as production, processing, distribution, and methane prices increase.

Let’s return to methane leakage. USA’s oil and gas industry, until recently, was a cozy club that asserted that only 1.4% of the industry’s delivered product leaked. But satellite methane detection proved what people like US academic Robert Howarth had been testifying to Congress about for years, that US methane missions from the exploration, extraction, processing, and distribution chain were much higher than reported.

Methane leaks due to ground seepage occur when methane escapes from the fractured rock formations into the atmosphere, bypassing the wellhead and other containment systems. This is particularly prevalent in fracking operations due to the extensive use of hydraulic fracturing fluids that can create new pathways for gas migration. Shale oil also fractures these rocks in a similar way, leading to ground seepage. Howarth’s studies suggest that fracking for shale gas results in significantly higher methane emissions compared to conventional natural gas extraction. The estimated methane leakage rates from shale gas operations range from 3.6% to 7.9% of the total production, which is substantially higher than conventional natural gas.

Then the International Council on Clean Transportation and others found that anything that burned methane was quite a lot less efficient at turning methane into carbon dioxide with flames than everyone had thought, with methane slippage from almost all natural gas burning engines in fossil fuel facilities and ships pumping out double the high global warming gas than was previously assumed, and methane flaring stacks working nowhere near as well as advertised, when they were even used at all as local operators shut them off due to neighbor’s complaints.

Now studies are finding that with fracking gas, shale oil gas, gas-pressure powered actuators, venting from storage tanks in over pressure conditions, methane slippage and more, emissions might be as high as 9% of all of the natural gas lifecycle from well to customer. Other studies suggest 3%. What does that mean?

Let’s start with a hundred tons of natural gas, just because the United States methane greenhouse gas price is in tons. Actually, it’s in metric tons not in Imperial tons, long tons, or short tons, measures the USA insists on using. A metric ton is 2,000 kilograms, those weird units that every other country in the world adopted long ago. This doesn’t help anybody in the USA figure out the implications.

Regardless, the math isn’t hard. Let’s take a customer who buys 100 tons of natural gas. At 1.4% leakage they have to pay for 1.4 tons of gas in addition to the gas they get, but at US methane tax rates, not retail rates. At 3% leakage they have to pay for 3 tons at high rates. At 9%, 9 tons. Remember, the current US price on methane leakage is $900 per ton.

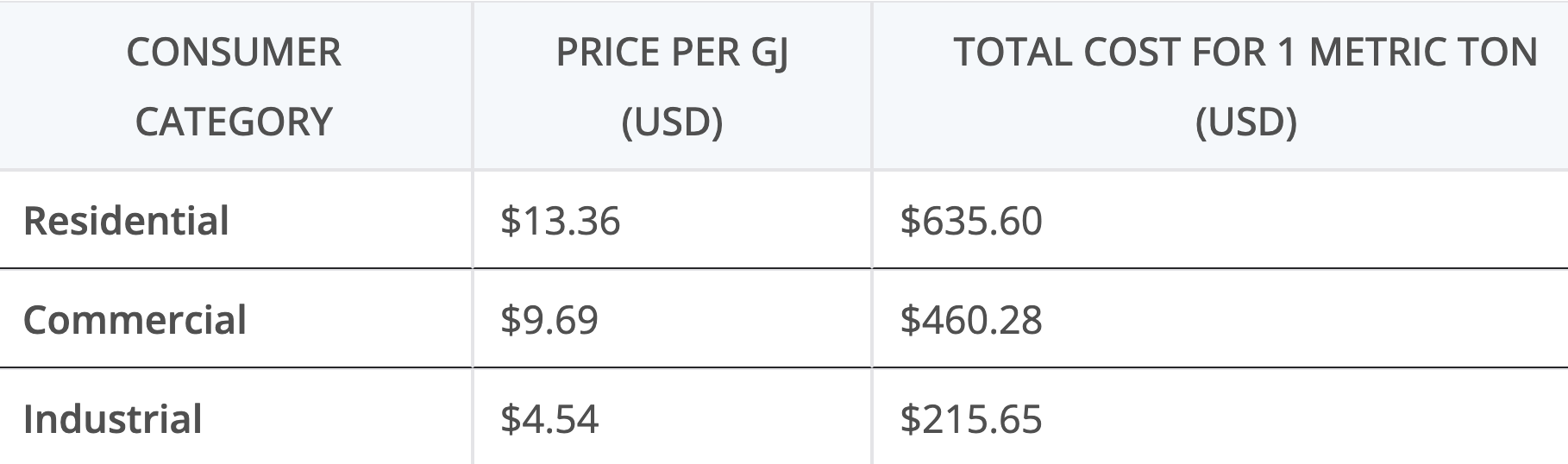

What does a ton of natural gas cost?

How much does the methane leakage cost the natural gas providers, and hence the minimum that they will pass on to their customers? For 1 metric ton of natural gas, the cost adder due to methane leakage at a rate of 1.4% is $12.60, at 3% is $27.00, and at 9% is $81.00, based on a methane tax rate of $900 per metric ton.

Of course, no one in the States buys natural gas by the ton, never mind knowing how much of it leaks. Units of measurement are a persistent challenge in climate action, and this one is no different. Let’s break it out by several standard units used in the States, but starting at the commercial rate. Industrial users adjust downward for the average price per unit, residential customers, adjust upward.

Are these the prices added to natural gas in the USA today? It’s going to be interesting to find out, as while the USA’s methane price is supposed to be inclusive of everything gas production, processing, and distribution related, in some cases it will be very hard to attribute fracking or shale oil ground emissions to any producer. And this is the USA, where firms are going to be self-reporting, more than not.

What is clear is that nobody believes the 1.4% numbers any more. The 3% numbers are most likely to be charged and hence passed on. That’s not too bad initially, only 4.5% extra on bills for commercial users, a little lower percentage for households and a higher percentage for industrial consumers, once again assuming a straight pass through of costs.

But the methane price is going up, to $1,200 per ton in 2025 and $1,500 per ton in 2025. What’s that going to be doing to gas prices in units people understand?

Consumers will be paying at least 9% more for their heat, at least, unless the industry can cut emissions. Thankfully, a lot of the emissions are reasonably cheap to eliminate, and the US industry is working on the easy pickings.

When I facilitated an EU-Canada oil and gas industry methane emissions reduction workshop this year, it was clear that there were a lot of relatively inexpensive solutions for leakage from well heads, pipes, actuators, storage tanks, and engines that power the system. The most ironic was Shell’s high-priority replacement of natural gas burning engines on their facilities with electric motors. Others included replacing natural gas pressure driven actuators on pipelines with liquid nitrogen delivered weekly to facilities. There are innumerable more.

And it was clear that no oil and gas operator had a clue where methane was leaking from their operations without measuring it everywhere regularly. Shell had no idea that their engines were a major source of slippage, but assumed another part of their operations were the problem. There were several stories about specific high emissions leakage events that dwarfed normal operational leakage that were mostly not observed, and so not counted.

The best operator present, which was leading in action for monitoring and avoidance, was still challenged to get sufficient degrees of regular monitoring at a reasonable cost. Their perimeter methane-detecting, optical gas imaging cameras were challenged by wind conditions and sight-lines. Their monthly monitoring services couldn’t see the thief hatches on top of the gas storage tanks, a substantial source of leaks. Aerial methane detection passes by manned aircraft with lidar which could spot thief hatch leakage and everything else were infrequent and had to be coordinated with a lot of facilities to be remotely cost effective.

Satellite methane detection means that the industry can no longer hide, but it often doesn’t help them operationally because the resolution is too low. MethaneSAT achieves a resolution of 100 meters across track by 400 meters along track, GHGSat offers a resolution of about 25 meters per pixel, and PRISMA and EnMAP both provide a resolution of 30 meters per pixel. Commercial firm Orbital Sidekick’s hyperspectral imaging satellites, part of the GHOSt constellation, offer a resolution of 8 meters. A thief hatch is 20 to 30 centimeters across, far under the resolution provided by PRISMA, EnMap, and Orbital Sidekick.

I suggested getting the monthly service vendor to add drones with solid-state lidar sensors to their service to look at the thief hatches. The last time I had checked the prices of solid-state lidar units, a few years ago, they were around $2,500, but I was unsurprised to find that they were as low as $200 now. OGI cameras would work too. That’s challenged by rules about line-of-sight flying of UAVs and the size and complexity of the facilities, although the USA is leading in commercial and industrial beyond visual line of sight UAV permissions. I imagine the news about what Ukraine is doing to oil and gas facilities in Russia with UAVs will make this an interesting conversation, however.

None of them will do anything for unconventional oil and gas methane emissions. When fracking or shale oil extraction occurs, fossil methane leaks. It’s obvious from satellites, but impossible to prevent because of the nature of the beast. It’s unclear at present what percentage of the 9% observed emissions are from the extraction process as opposed to preventable processing and distribution emissions. And it’s challenging to figure out what tonnages of leaked methane firms will be paying for. It won’t be zero, but it’s obviously in their best interests to get low-balled numbers accepted.

In discussions with people involved in the space, regional ground seepage emissions are not attributed to individual companies, and so won’t be taxed. Once the biggest and most easily addressed issues are fixed, ground seepage will continue because the USA is addicted to fracking and shale oil. It’s become the world’s largest exporter of both crude oil and LNG due to the unconventional oil revolution that they started working on after the OPEC Oil Crisis of 1972. Oil and gas are about 2% of the US GDP right now, in part due to those exports, but that’s down a lot from their peaks in the early 1980s and set to decline a lot more.

What does this mean for budgeting for the methane price in the USA for commercial and industrial consumers? They should be looking at the 9% leakage rate and $1,500 price point as the energy cost that they are at risk of. For commercial rates, that’s a 28% cost increase for energy. For industrial consumers, it’s a 56% cost increase. They should be comparing that to the cost of heat pumps at commercial and industrial electricity rates, and commercial and industrial solar.

Firms in the USA which have run a tight ship on methane leakage despite industry norms, aligning with European standards voluntarily and accepting minor profit slippage as a replacement for methane leaks, will be in a much better position in the coming years. The implications of the methane tax are changing the oil and gas industry’s competitive landscape.

This is, by the way, going to directly impact LNG shipment price points. The methane price cares about emissions on US soil, so the leakage will be priced. The average price per gigajoule for US LNG was $5.39, down near industrial rates, so it’s quite possibly going to be 50% more expensive for purchasers abroad as well. That increase puts them in the same range as Malaysian and Indonesian average prices, so those countries will pick up business while the US industry loses it, especially in Asia due to proximity, hence lower shipping costs.

Of course, the answer to methane leakage is to stop using the stuff wherever possible as quickly as possible. Stop burning it for energy, about two-thirds of US use. Stop making ammonia for fertilizers with it, another 6-7%. Capture anthropogenic biomethane from landfills, dairy barns, and other points sources for as much of the remainder as possible. Stop fracking and unconventional oil extraction. We have alternatives for the large majority of natural gas and oil, it’s just a matter of deploying them as rapidly as possible to shrink the outsized methane problem from one end while stringent monitoring, reporting, verification, and leak prevention address it from the other end.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.