Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

We are pleased to announce the release of the latest edition of Berkeley Lab’s Tracking the Sun annual report, describing pricing and design trends for grid-connected, distributed solar photovoltaic (PV) and PV-plus-storage systems in the United States. The report is based on data from roughly 3.2 million systems installed nationally through year-end 2022, representing more than 80% of all systems installed to date.

The report, published in slide-deck format, is accompanied by a narrative summary, interactive data visualizations, a public data file, and summary data tables, all available through the link above. The authors will host a webinar summarizing key findings from the report on October 4th at 10:00 am Pacific. Please register for the webinar here: https://lbnl.zoom.us/webinar/register/WN_HJi2ka8iR-KCU7eY5du4AA (link is external).

The following are a few key findings from the latest edition of the report.

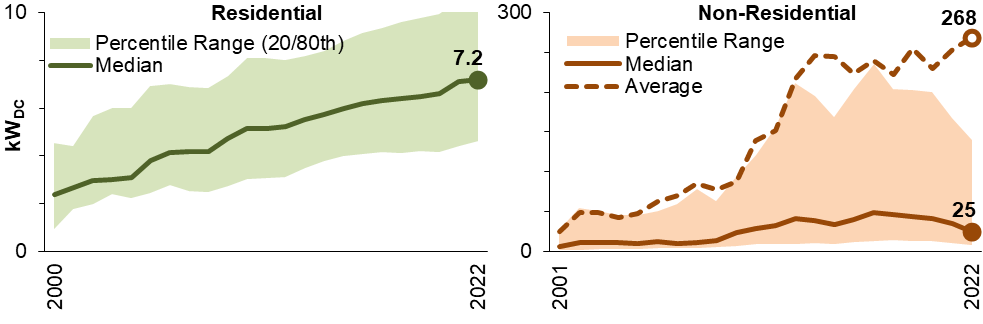

Residential systems are getting larger. Residential system sizes have been rising steadily over the past two decades, driven by declining costs and rising module efficiencies (see Figure 1). As of 2022, the median size of new residential installs was 7.2 kW, compared to just 2.4 kW in 2000. As with many elements of the analysis, these results are heavily driven by California, which makes up a large share of the sample, and where residential system sizes are relatively small. Median residential PV system sizes in most states were well above 8 kW in 2022, and in many states were above 9 kW. Non-residential system sizes have followed a more irregular trajectory over time and span a wide size range. The majority of systems are relatively small, with a median size of 25 kW in 2022, but the distribution has a long upper tail.

Figure 1. System Size Trends over Time. For the purposes of this report, “non-residential” systems include non-residential roof-mounted systems of any size and ground-mounted systems up to 5 MW-AC. Image: Berkeley Lab’s Tracking the Sun annual report

Battery storage is increasingly being paired with both new and existing PV systems. In 2022, 10% of all new residential PV installations and 7% of all non-residential installations included battery storage. Hawaii had, by far, the highest residential attachment rates in 2022 (96%), while attachment rates in California were 11%, and most other states had attachment rates of 5-10%. In addition, storage is increasingly being added to pre-existing PV systems. In 2022, 23% of all new paired PV+storage systems in the U.S. consisted of storage retrofits onto existing PV systems.

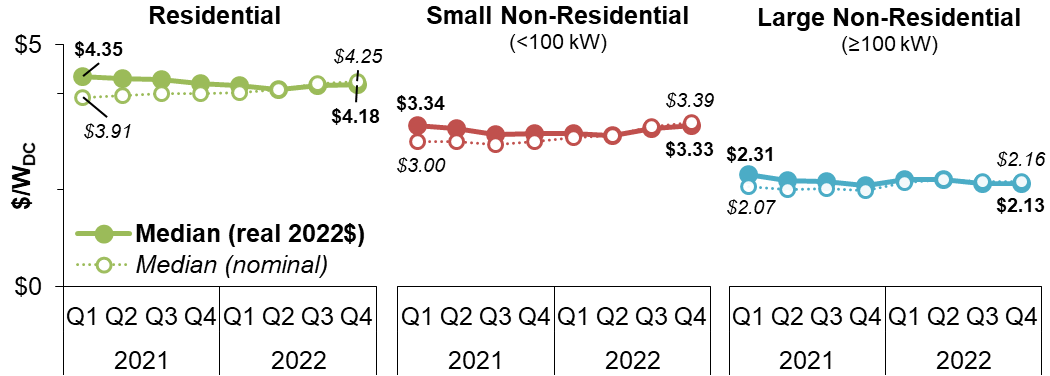

PV system prices rose in nominal terms, but continued to fall in real, inflation-adjusted dollars. From the first quarter of 2021 through the last quarter of 2022, median installed prices for stand-along PV systems rose in nominal dollars by $0.1-0.3/W (or 4-13%), depending on the market segment. For residential and large non-residential systems, the increase in nominal prices was below the rate of inflation, and thus prices in real inflation-adjusted terms fell by roughly $0.2/W in both segments. This is in line with the average rate of real price declines over the past decade. The report also presents pricing trends for paired PV+storage systems and discusses the reasons why reported installed prices may differ from other common PV pricing benchmarks.

Figure 2. Quarterly Median National Installed Prices over 2021-2022. These prices represent the up-front price paid by the customer, prior to receipt of any incentives, and can include loan-financing fees bundled into the prices charged by installers. For the purposes of this report, “large non-residential” systems are larger than 100 kW, capped at 5 MW-AC if ground-mounted. Image: Berkeley Lab’s Tracking the Sun

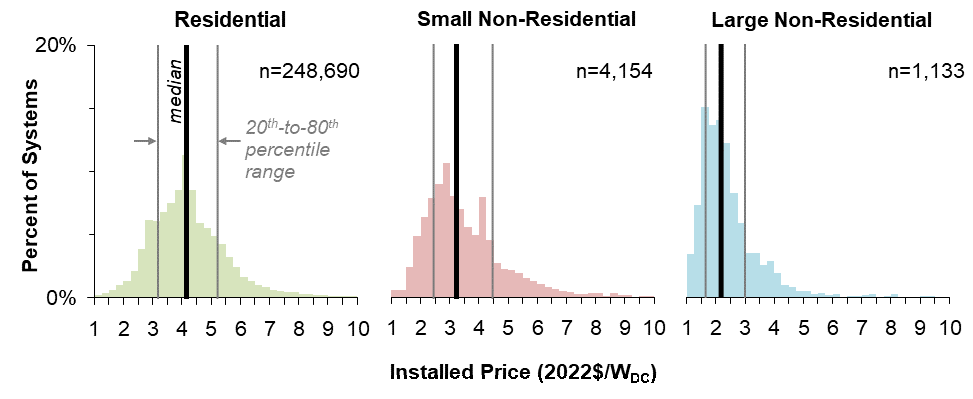

PV system prices vary widely across individual projects. Among stand-alone PV systems, installed prices vary by roughly $2/W between the 20th and 80th percentile values for both residential and small non-residential customers, and by roughly $1.3/W for large non-residential customers (see Figure 3). That pricing variability reflects differences in project characteristics as well as features of the local market, policy, and regulatory environment. The report shows how installed prices vary based on a number of project characteristics, including system sizing and module and inverter technology, as well as differences across states and installers. The report also includes a multi-variate regression that provides a more precise estimation of the effects of key pricing drivers related to system design, market features, and installer experience.

Figure 3. Installed-Price Distributions for Stand-Alone PV Systems Installed in 2022. Berkeley Lab’s Tracking the Sun

We thank the U.S. Department of Energy Solar Energy Technologies Office for their support of this work, as well as the numerous individuals and organizations who generously provided data for this ongoing effort.

Berkeley Lab’s Tracking the Sun annual report PDF

Courtesy of Electricity Markets & Policy (EMP) Berkeley Lab

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

EV Obsession Daily!

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

Tesla Sales in 2023, 2024, and 2030

CleanTechnica uses affiliate links. See our policy here.