NEW YORK, May 20 (Reuters) – Major U.S. fuel makers returned billions in capital to shareholders in the first quarter and boosted share repurchase programs, even as refining margins softened from recent records and utilization rates fell.

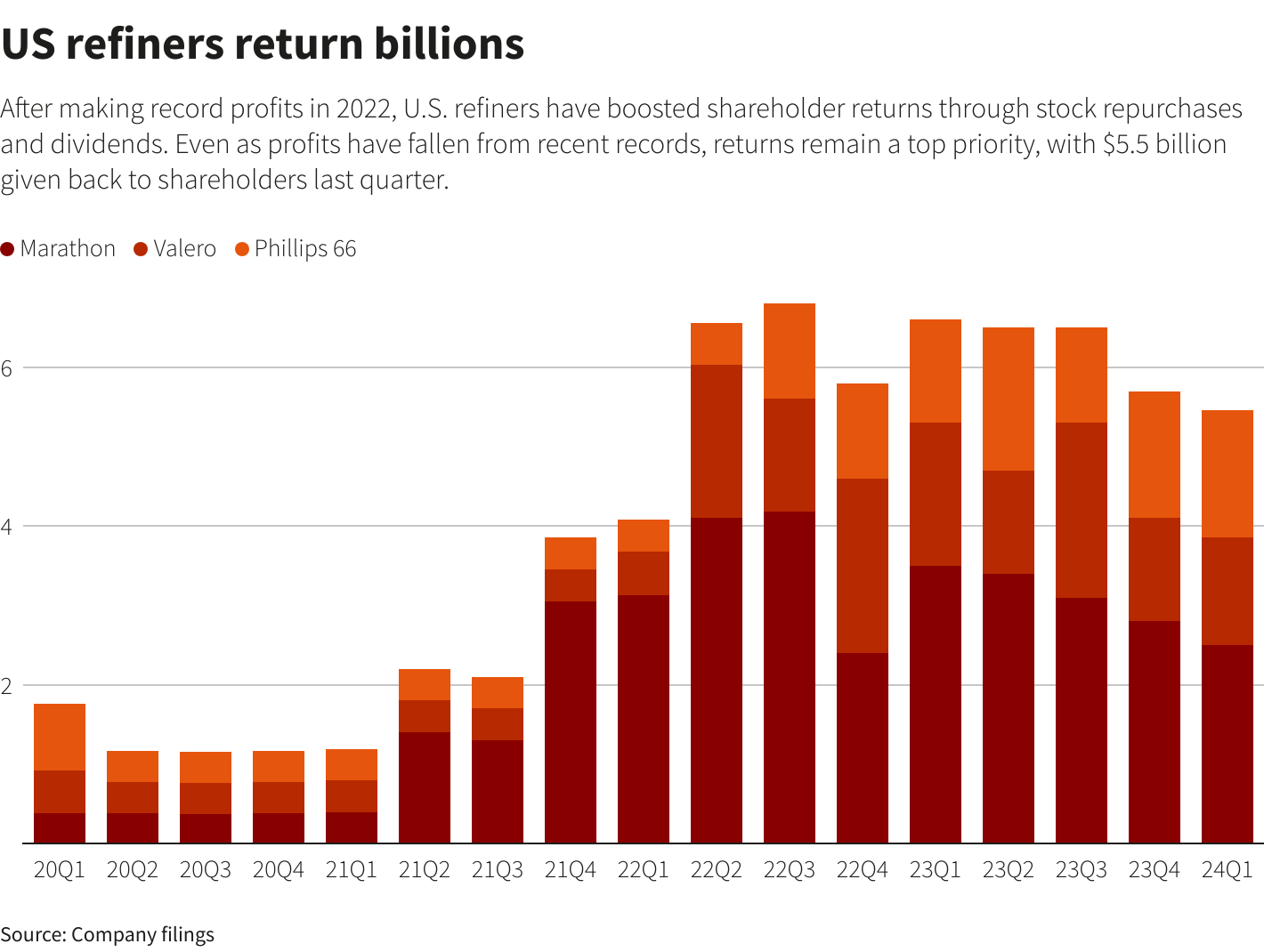

Three of the biggest U.S. independent oil refiners – Marathon Petroleum (MPC.N), Phillips 66 and Valero Energy – earned combined adjusted profits of $2.93 billion and returned $5.5 billion to shareholders through stock repurchases and dividends in the first quarter, according to Reuters calculations.

That compares with $6.6 billion returned during the same quarter a year ago, when profits totaled $7.75 billion.

Refiners are tapping into their exiting cash to pay for buybacks and capital returns to shareholders, said Matthew Blair, managing director at TPH&Co. Many companies are carrying excess cash because spending on growth projects has been limited, he said.

Even with lower year-on-year profits, investors have responded positively to their return of capital strategy, which Wall Street has pushed for in recent years following weak returns in the sector.

Year-to-date, shares of Valero are up more than 21%, while Marathon is up about 18%. That compares with the S&P 500 energy sector’s 11.70% increase so far this year.

“Refining margins were a little softer year-over-year but refiners are still making significant money to the point where they can pay heavy dividends,” Brian Kessens, a senior portfolio manager at investment management firm Tortoise, said in an interview.

Refining margins have scaled back from the peaks hit after Russia’s invasion of Ukraine in 2022, amid a rise in global refining capacity that has led to a drop in fuel prices.

Marathon paid out $2.5 billion to its shareholders during the quarter and boosted its repurchase authorization by an additional $5 billion despite taking a hit due to weaker margins and heavy turnaround activity at its facilities. The company has approximately $8.8 billion available under its share buyback authorizations.

Marathon’s crude capacity utilization was 82% during the quarter, down 9% from the previous quarter.

“We continue to believe share repurchases make sense at the current share price level,” Marathon CEO Michael Hennigan told investors during the company’s earnings call in April.

Shares of Marathon are currently around $173 each, down from a high of $219 in April.

Dallas, Texas-based HF Sinclair announced a new $1 billion share buyback program after beating first-quarter earnings expectations, while Valero returned $1.4 billion to shareholders in the first quarter.

DEMAND OUTLOOK

U.S. refiners have a favorable market outlook as they come out of seasonal maintenance and crank out more fuel for the upcoming summer driving season, executives said.

Refinery runs are expected to increase from an average of 15.4 million barrels per day in the first quarter to 16.2 million barrels in the third quarter, the U.S. Energy Information Administration said in its monthly forecast in May.

“Within our own domestic and export business, we are seeing steady demand year-over-year for gasoline and growth for diesel and jet fuel,” said Marathon’s Hennigan, adding that global oil demand is expected to continue to set records for the foreseeable future.

For the year, the EIA is forecasting global oil and liquid fuels consumption will rise by about 1 million bpd this year to 102.9 million bpd.

Profit margins for diesel have been soft in recent months as refineries around the world boost their supplies and mild weather in the northern hemisphere and slow economic activity put a dent in demand.

“Prices for diesel are in contango … but we are constructive,” said Brian Mandell, executive vice president at Phillips 66, referencing a market structure that indicates abundant supply.

“We do think the market will come back,” he added.

Share This: