Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

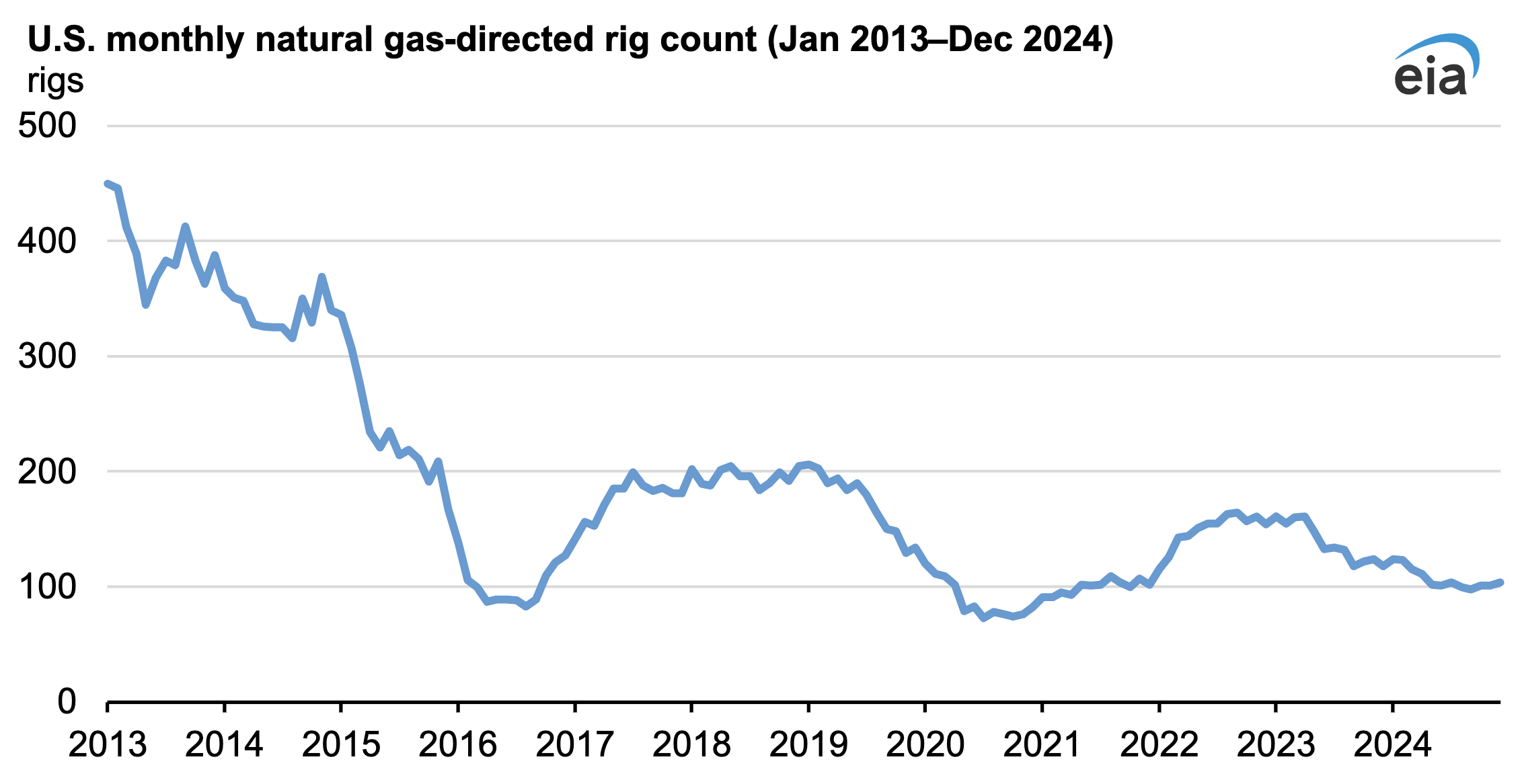

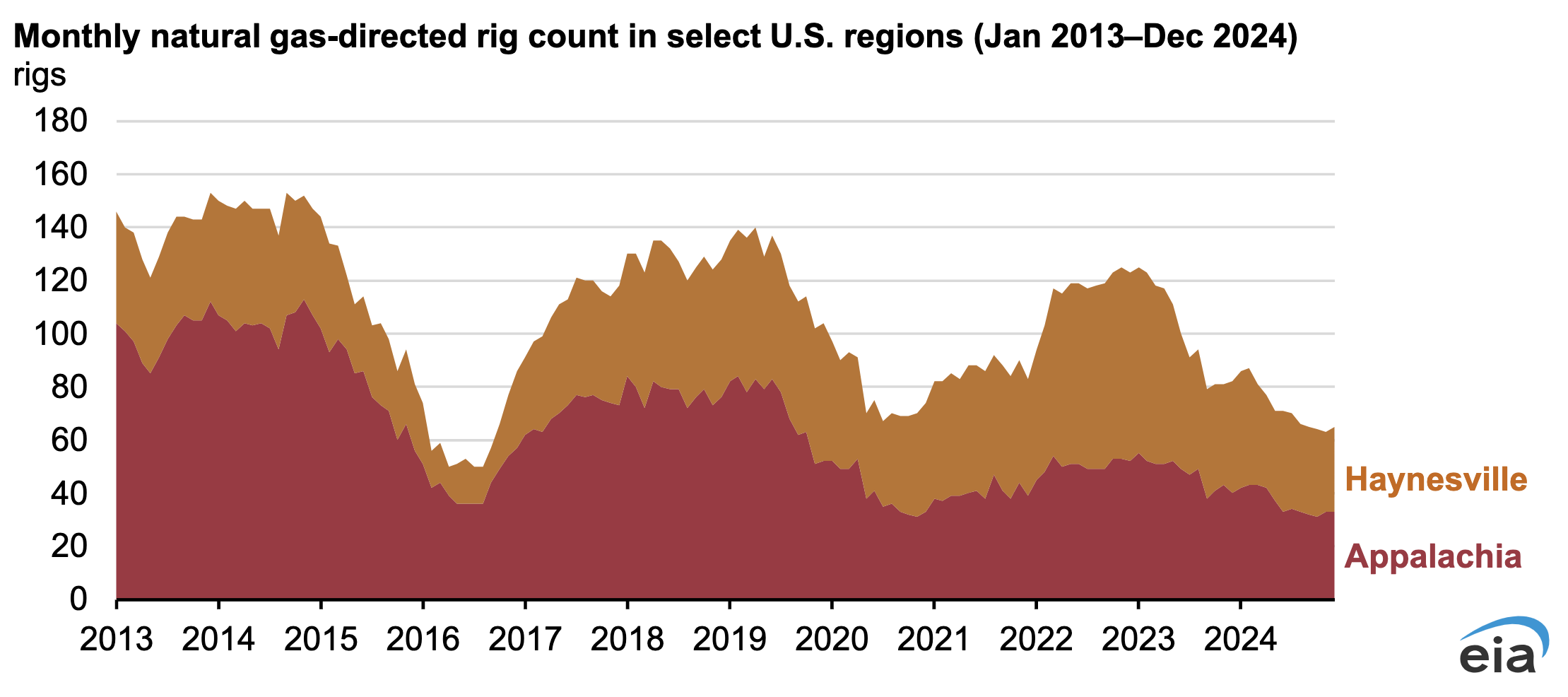

The number of rigs deployed to drill for natural gas in the United States decreased over the last two years. U.S. natural gas-directed rigs decreased 32% (50 rigs) between December 2022 and December 2024. This decline has been concentrated in the natural gas-rich Haynesville and Appalachia regions, where the combined natural gas rig count declined by 34% during 2023 (43 rigs) and by 24% during 2024 (21 rigs). The decline in drilling rigs coincides with record-low natural gas prices for most of 2024 and the wider adoption of advanced drilling and completion technologies.

In the Haynesville region, which spans Texas and Louisiana, drilling costs tend to be higher than in other plays because Haynesville wells are drilled to greater depths, usually between 10,500 feet and 13,500 feet deep. As natural gas prices have generally declined over the last two years, rigs in the Haynesville have decreased 55% since December 2022 (39 rigs) as drilling has become less economical. Consequently, marketed natural gas production in the Haynesville region has declined 7% over the same period.

Similarly in the Appalachia region, which includes natural gas produced from the Marcellus and Utica plays, rigs have declined 37% since December 2022 (19 rigs) with the drop in natural gas prices. As a result, growth in marketed natural gas production has been limited to 4% over the same period.

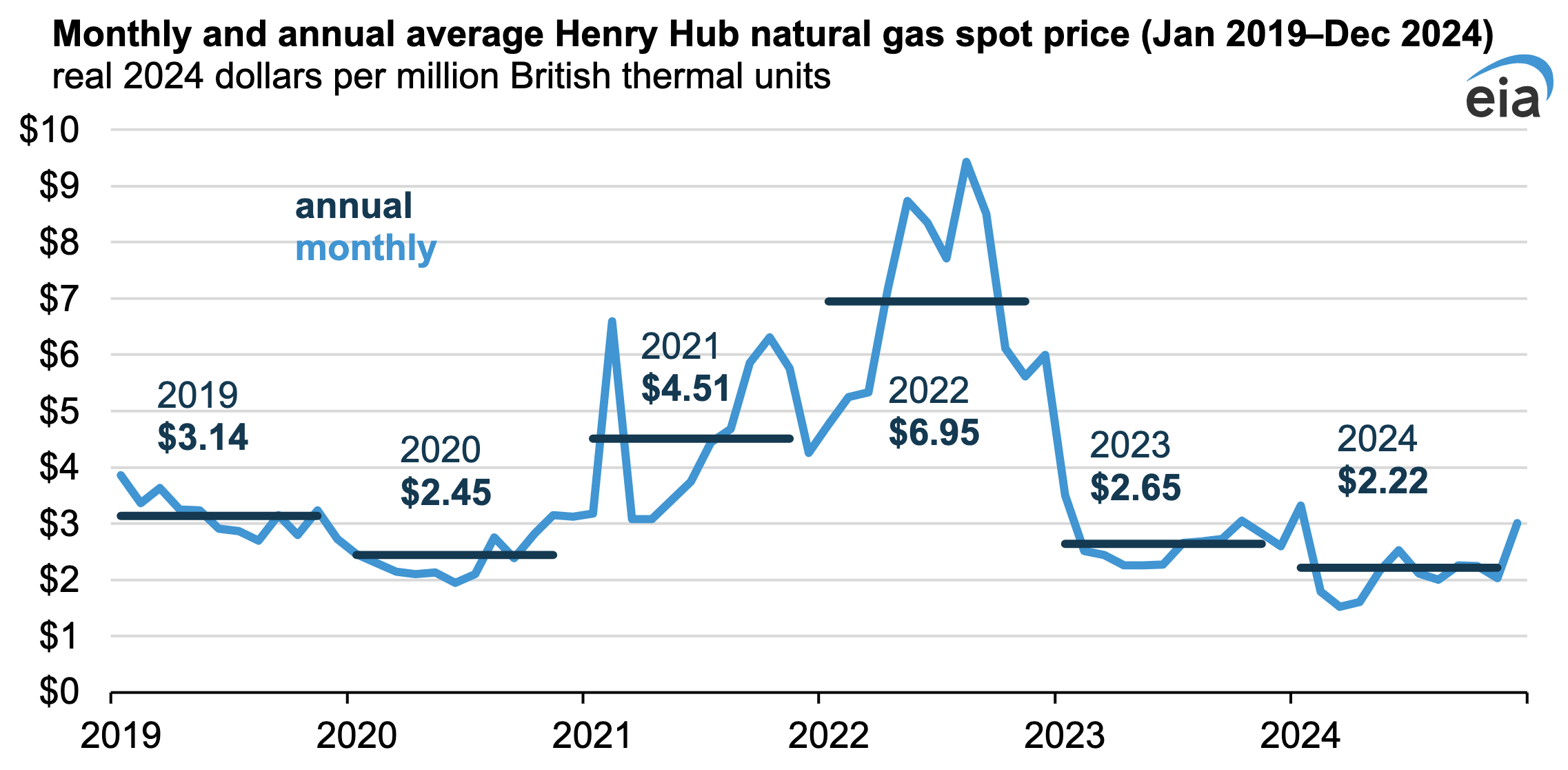

The extent to which producers respond to price changes depends on several factors, such as uncertainty around future prices, contracts, volatility in the market, and price hedging; current costs of materials, equipment, and labor; and availability of transportation and storage.

After the U.S. benchmark Henry Hub natural gas price reached a 14-year high of $6.95 per million British thermal units (MMBtu) in 2022, it fell 62% in 2023 ($4.31/MMBtu) and a further 16% in 2024 ($0.43/MMBtu). The Henry Hub price in 2024 was the lowest ever reported after adjusting for inflation, with March 2024 marking the lowest average price of $1.51/MMBtu.

Producers in natural gas-rich regions have responded to these persistently low prices by drilling less—as reflected in the declining rig counts—and even by curtailing production, which has grown inventories of drilled but uncompleted wells. If natural gas demand and prices continue to rise, producers could be in a better economic position to complete these wells, potentially allowing them to quickly increase production.

Originally published on Today in Energy. Principal contributors: Kenya Schott, Trinity Manning-Pickett

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy