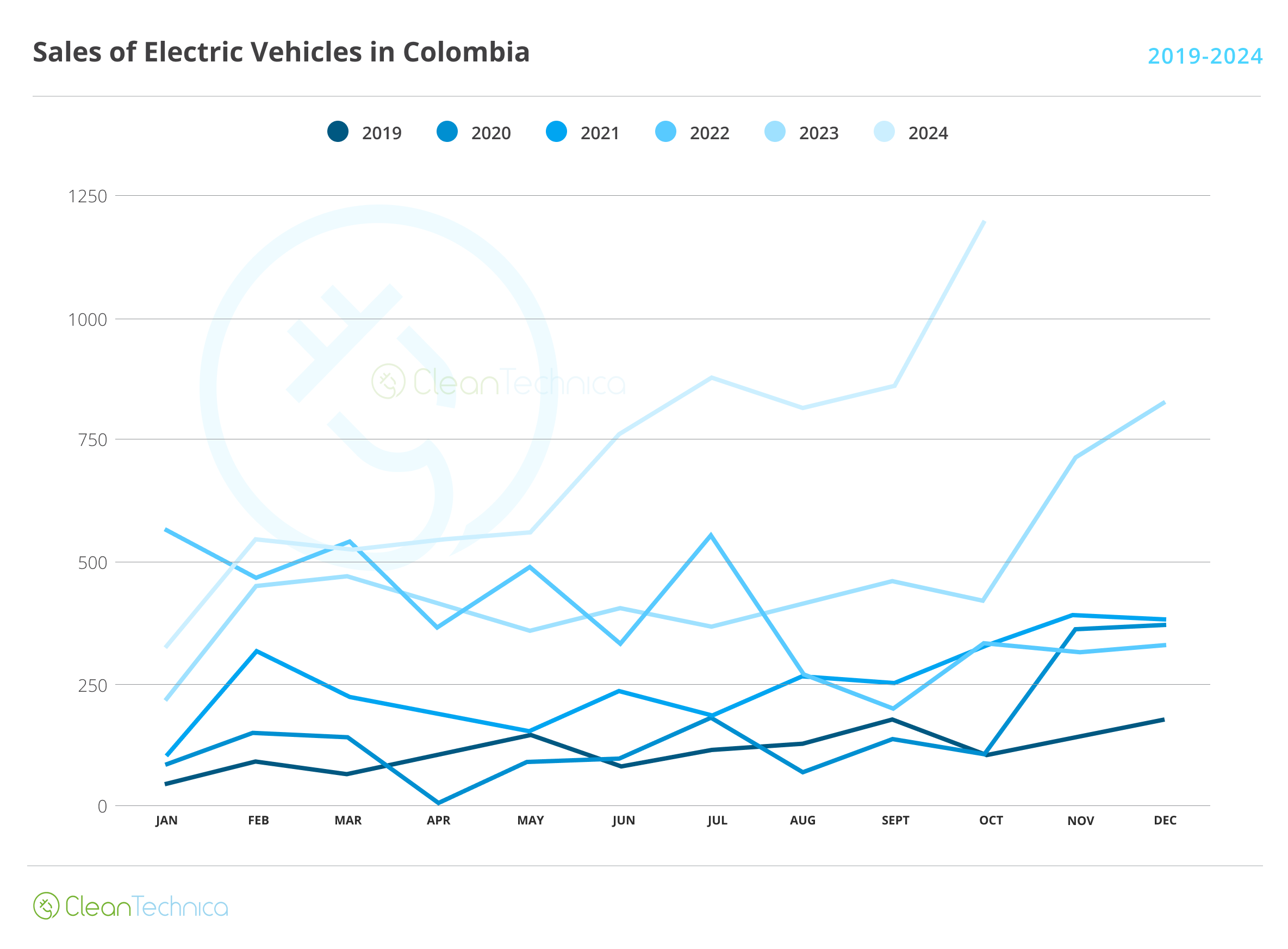

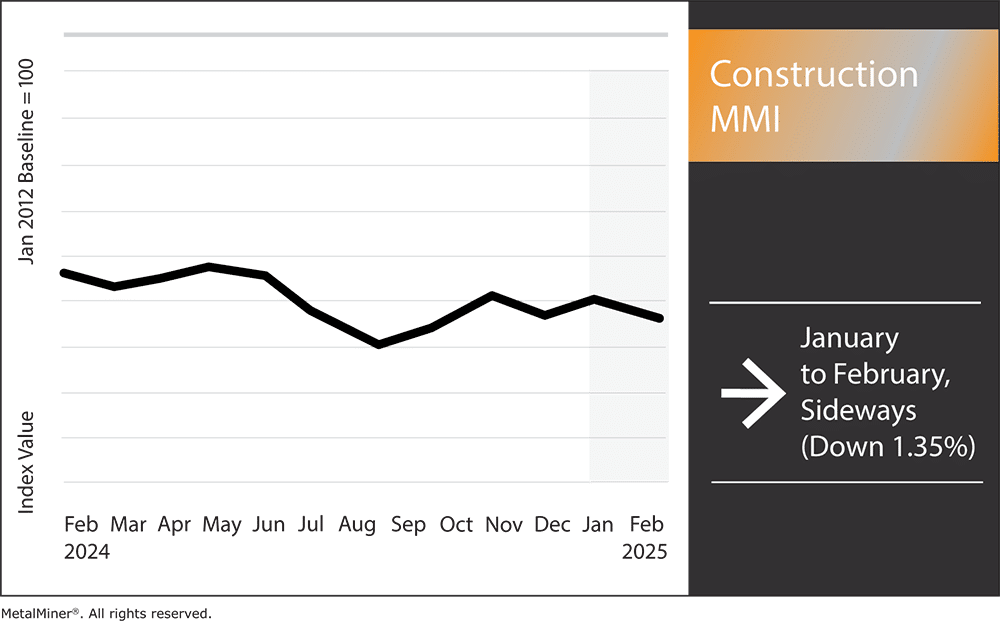

The Construction MMI (Monthly Metals Index) held its sideways trend, budging down a slight 1.35%. Meanwhile, the U.S. construction industry faces a complex landscape shaped by recent policy changes, Trump tariffs and other economic factors.

Tariffs and Their Effect on Construction Materials

Steel remains a fundamental component of modern construction, playing a crucial role in buildings, bridges and infrastructure. Key materials such as H-beam steel and steel rebar provide essential strength and reinforcement for dozens of types of projects. But with a newly imposed 10% tariff on Chinese steel imports, contractors and developers will likely experience some price increases.

Don’t volatility caused by tariffs ruin your bottom line. Sign up for MetalMiner’s free weekly newsletter and gain access to timely insights on the latest metal market trends and pricing.

China’s Dominance in Steel Exports

In 2024, China’s steel exports climbed to 110.72 million metric tons, reflecting a 22.7% rise from the prior year. This surge largely stemmed from declining domestic demand, which prompted Chinese manufacturers to offload surplus steel into global markets. As a result, international steelmakers faced mounting pressure to lower their prices in order to compete.

Much of China’s exported steel comprises construction-focused materials, including H-beam steel and steel rebar. With the enforcement of the 10% tariff on Chinese steel and the possibility of an even steeper 25% tariff on all steel imports, procuring these materials from China is becoming less financially viable.

Broader Economic Impacts

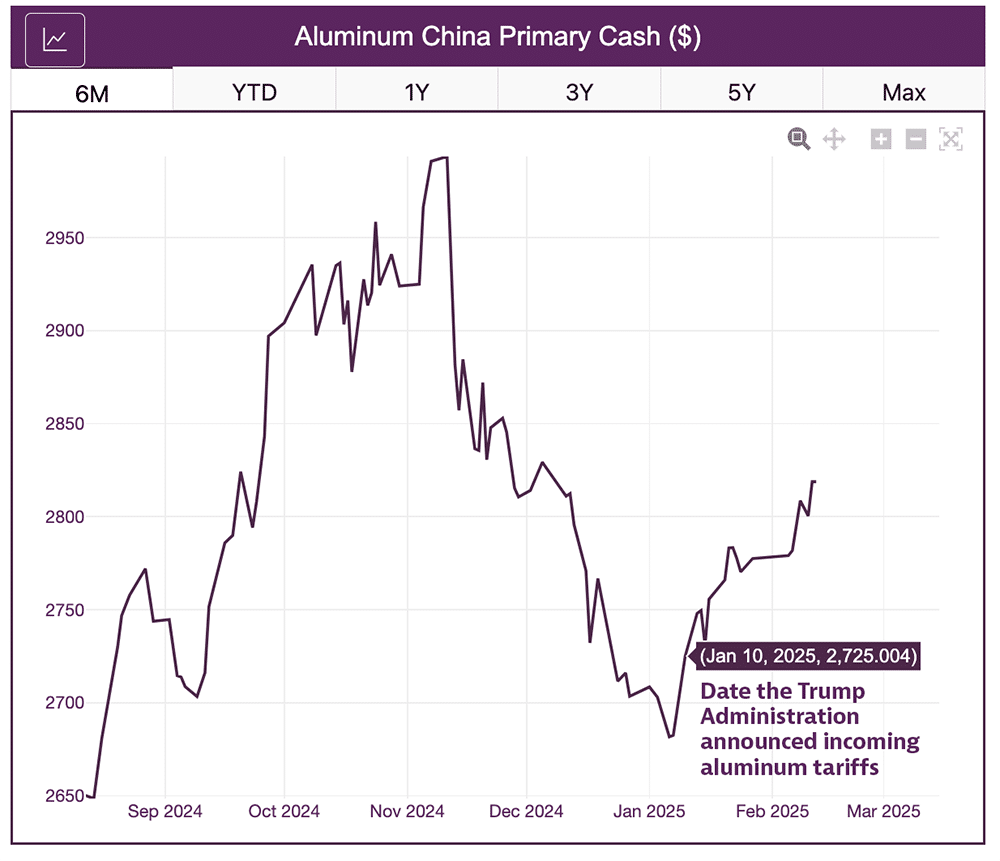

As the price of imported steel and aluminum rises due to the Trump tariffs, the construction industry is bracing for potential financial strain. Many firms argue that higher costs may lead to project delays, scaled-down developments or increased expenses that will ultimately be passed on to end-users.

Small business owners across the construction sector, who are already grappling with tight profit margins due to persistently high interest rates, worry that these tariffs could exacerbate their financial difficulties.

Concerned about the effects of Trump tariffs? Enjoying this article? MetalMiner’s monthly MMI report gives you price updates, market trends and industry insight for steel and 9 other metal industries. Sign up for free.

Possible Long-Term Gains: Comparisons to Pandemic Price Increases

Despite the immediate challenges, some industry experts argue that these tariffs could benefit the domestic steel and aluminum sectors in the long term. By making foreign materials more expensive, policymakers aim to promote domestic production, potentially fostering increased investment in U.S. manufacturing and creating new jobs in these industries.

For instance, the construction industry saw substantial price increases during the COVID-19 pandemic due to labor shortages, supply chain interruptions and increased demand. In addition to this, materials like steel and lumber saw price increases during the pandemic that were far higher than anticipated price increases under the new tariffs.

According to this historical comparison, tariffs may have a more predictable and controllable effect than the market instability that occurred during the pandemic, even though the current Trump tariffs will still raise expenses.

How the Industry is Responding to Trump Tariffs

Industry organizations urge construction firms to be proactive in navigating these pricing fluctuations. The Sheet Metal and Air Conditioning Contractors’ National Association (SMACNA) recently advised companies to adjust contracts in anticipation of cost increases and to explore domestic sourcing options where practical.

Additionally, many businesses are leveraging market intelligence tools such as MetalMiner to stay ahead of price movements. Platforms like MetalMiner provide real-time metal price updates, forecasts and cost analysis tools, helping companies make informed purchasing decisions and implement strategies to reduce tariff-related expenses.

Construction MMI: Noteworthy Price Shifts

- European commercial 1050 aluminum sheet moved sideways, dropping 2.86% to $3,709.11 per metric ton.

- Chinese H-beam 200mm steel moved sideways, falling 0.16% to $441.72 per metric ton.

- Lastly, Chinese steel rebar moved sideways as well. In total, prices fell by 2.65% to $481.91 per metric ton.