Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

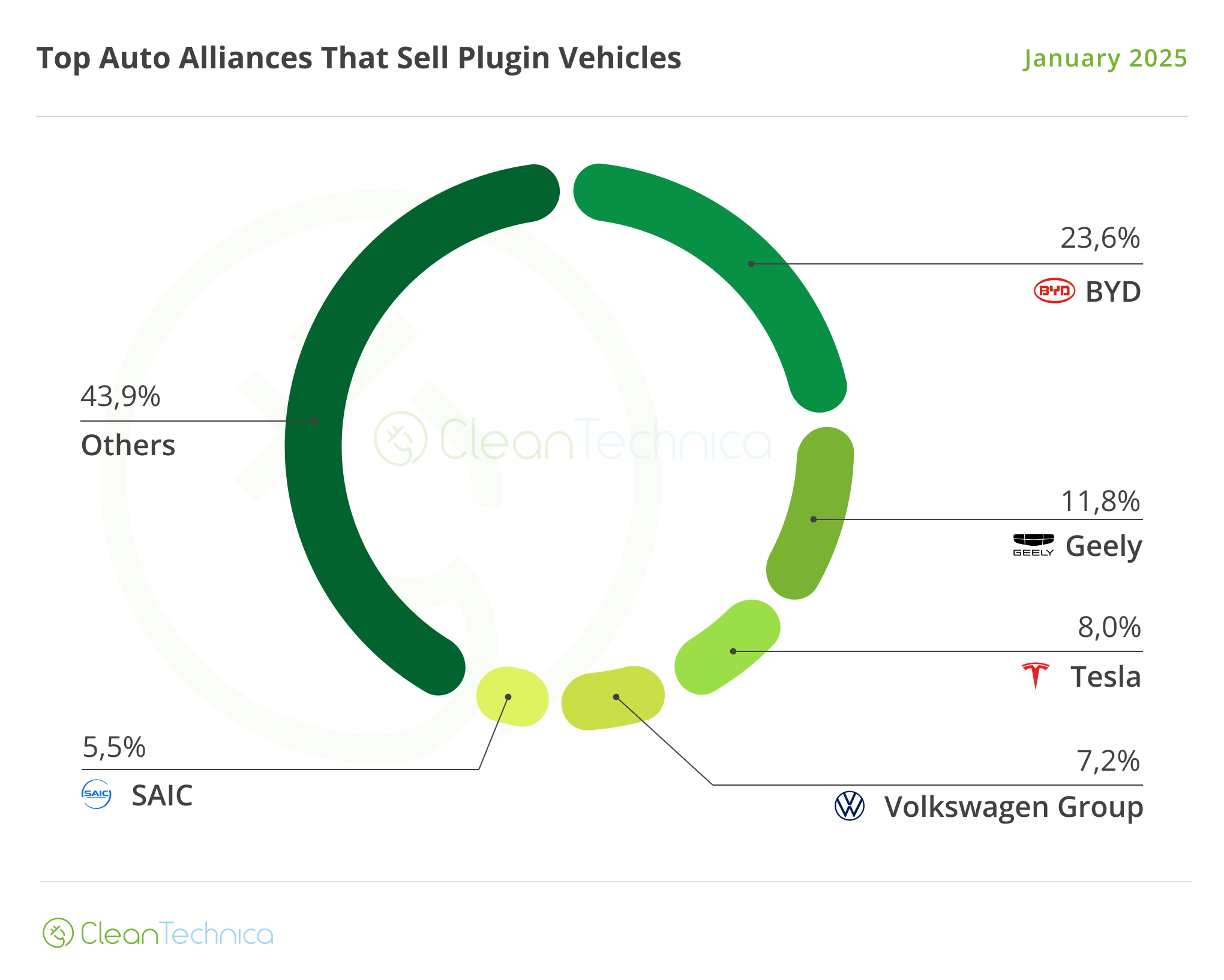

Plugin vehicle registrations were up 18% year over year (YoY) in January, to over 1.2 million units, with BEVs being the driver of growth (+24% YoY) compared to PHEVs (+8%).

Share-wise, 2025 started with plugin vehicles getting 19% share of the global auto market (12% BEV). The global market was helped by significant volumes in markets outside the spotlight being on the upswing. Just looking at markets registering more than 1,000 units in January, there is a constellation of countries with 100%-plus growth rates, a majority of them in Asia. That includes Malaysia, the Philippines, and Vietnam, but elsewhere there are also Denmark, Chile, Colombia, Turkiye, Saudi Arabia(!), and the UAE.

Of these, the most dramatic success story is Vietnam, mostly thanks to the growth of local hero Vinfast. EV sales grew 311% YoY, to over 11,000 units in January. Turkiye is an even more singular story, because not only is there a local brand growing fast, Togg, but BYD is also experiencing exponential growth there, pulling the local EV market share north of 10% and forcing legacy OEMs to play ball if they want to avoid a second China-scenario in a 1.2 million units/year market…. In January, this market registered over 8,000 EVs, translating to 129% growth rate.

With a price war happening in several markets, and others receiving new, cheaper models, expect the global EV market to continue growing at a solid pace. We could end this year at above 25% EV market share (17% BEV market share).

Last month, BEVs grew to over 816,000 units, pulling the BEV share within plugins to 65%, a 4 percentage point increase over what was happening a year ago.

What happens in the Chinese market is always important globally — this market represented 59% of all global sales of electric cars in January.

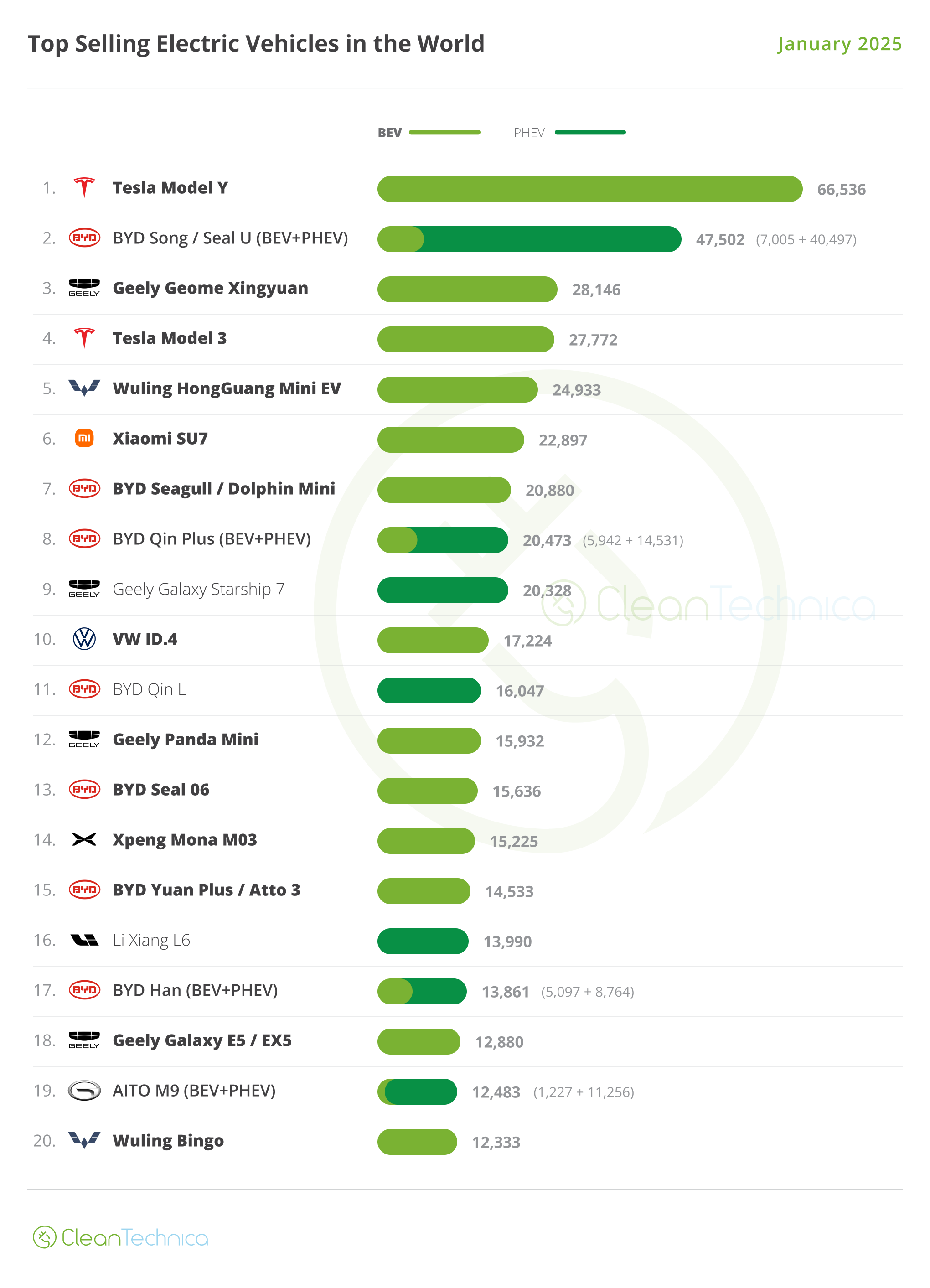

Looking at the best selling models, the Model Y started the race in its usual #1 spot, but it has seen its sales drop by 6%, to 66,536 units, its worst performance since January 2023.

In the runner-up spot, we have the BYD Song, starting the year in the same place as it ended the previous one. But with internal competition heating up, one wonders when BYD will give it a refresh, or will the Song have the same destiny as its Qin Plus sedan sibling — becoming a cash cow for the company, but no longer its star player.

In the last spot on the podium, we have a surprise, the new Geely Geome Xingyuan kicked the Tesla Model 3 off of the podium, thanks to a record 28,146 registrations. This could be one of those signs of times, where a new ruler replaces an older one.

Tesla’s sedan deliveries were down 10% YoY to fewer than 28,000 units, starting the year off the podium in 4th, the first time this happened since 2022 when it was 5th in January. It will be interesting to see how much the Model 3 will recover, and what the Model Y refresh will do to its demand.

With this in mind, it is in the realm of possibility that, for the first time since 2018, the Model 3 could be kept off of the podium. Let’s not forget that the sedan is now on its 8th year…. And Elon Musk is now, uh, … a cartoonish version of himself?

Away from the podium race (or maybe not — time will tell if the upcoming 5-door version will help it get into that select few), the highlight is the tiny Wuling Mini EV, which started the year in 5th. It was fewer than 3,000 units behind the US nameplate. Will the future be bright for the tiny 4-seater?

Just below the bargain basement priced Chinese EV, there is another Chinese EV, but this time on the opposite side of the spectrum. The Xiaomi SU7 started the year in 6th, with close to 23,000 units, all while it has a 6- to 8-month waiting list. The career of this sports sedan is nothing short of astonishing. It is stealing sales from everyone in China, from the Porsche Taycan to the Tesla Model 3. With exports said to be starting in a few months, opening up a whole new avalanche of orders, and with the brand still trying to cope with demand in its domestic market, expect Xiaomi to stay buried deep in its unfulfilled order list in the foreseeable future.

Oh, and a certain YU7 is expected to start doing to crossovers what the SU7 is doing now to sedans… #disruption.

Still on the top half of the table, Geely’s BYD Song killer, the Galaxy Starship 7, ended January in 9th, with a record 20,328 registrations. It will be interesting to see how high this SUV will go. Top 5?

In 10th we have a surprise. Thanks to robust results in Europe and the USA, the VW ID.4 had its best result since December 2023, over 17,000 registrations — all this despite some low numbers in China. The Middle Kingdom represented just 20% of the total sales of the ID.4. So … I guess it’s price cut time. Right, VW?

This time, the second half of the table also looks interesting, starting with the two additional Geely models. The little Panda Mini was 12th, with 15,932 registrations, while the compact Galaxy E5 (EX5 in export markets) was 18th, with 12,880 registrations. With four representatives in January’s top 20, Geely finally seems ready to go after all mighty BYD.

Another model that impressed was the #14 Xpeng Mona M03. The startup’s new compact sedan liftback has become its star model, joining the top 20. It should continue to be a regular presence in the coming months, giving much needed volume to Xpeng.

Outside the top 20, a reference goes out to the new Luxeed R7, which scored 11,422 registrations and could join the table soon. Regarding legacy OEM news, the highlights were the production ramp-up of the Kia EV3, with a record 6,276 registrations; the Chevrolet Equinox scoring 6,751 registrations; and the Toyota BZ4X reaching a respectable 6,256 units.

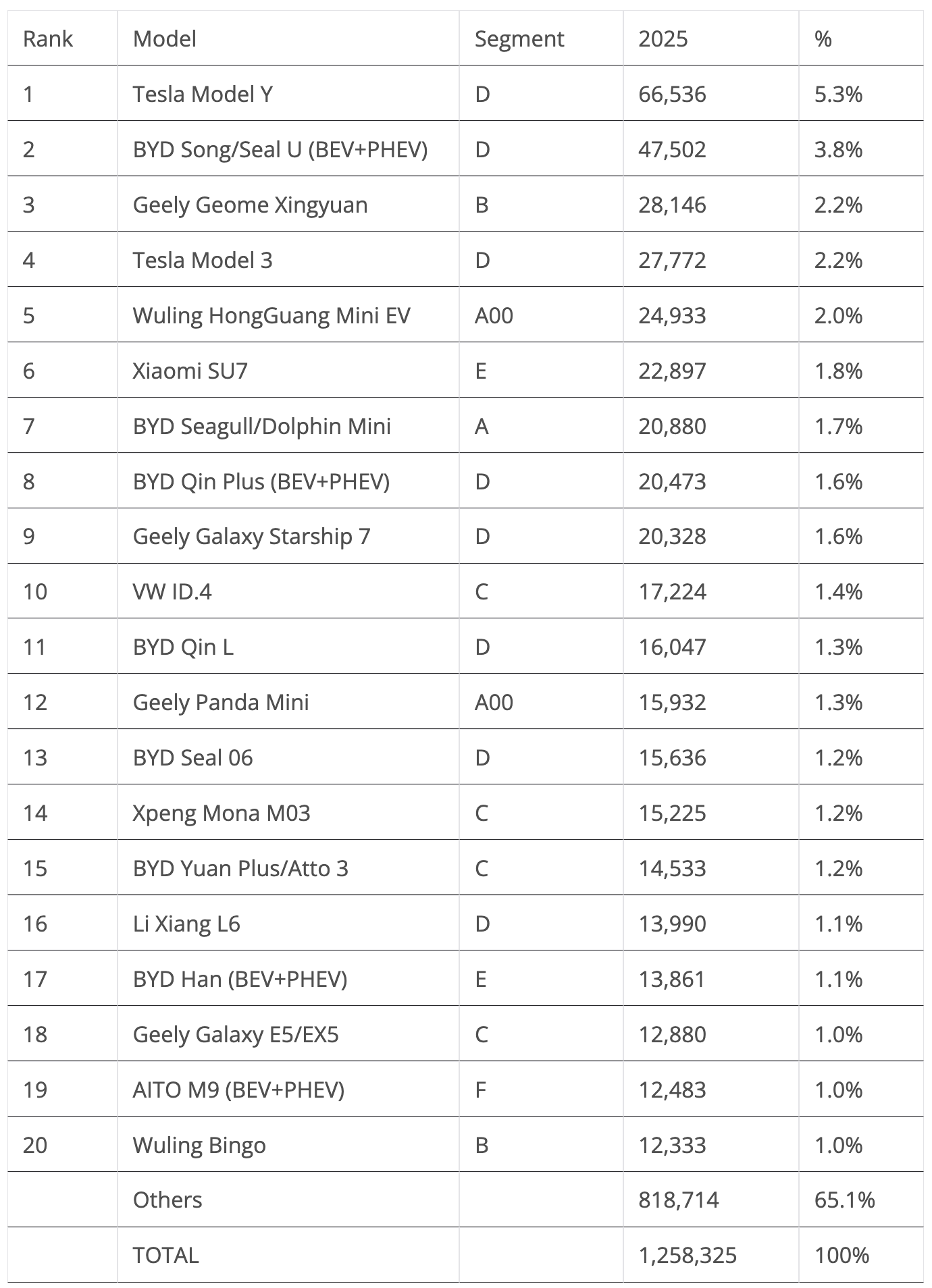

Manufacturers: BYD Starts Ahead

January saw BYD win the monthly manufacturer title, thanks to 278,000 registrations. That was more than double the sales of runner-up Tesla (101,000 registrations). In fact, it was close to triple Tesla’s result.

Tesla’s performance was its worst in two years. Compared to January 2024, the US brand is now more dependent on its domestic market. A year ago, 39% of Tesla deliveries were in the USA, 38% in China, and the Rest of the World (ROW) represented 23%. Now its domestic market represents 49% of sales, China 33%, and the ROW 18%.

True, with the world becoming more nationalistic, it is natural that Tesla sales become more home-based. However, while a sales loss in China is understandable due to the market’s highly competitive environment (after all, foreign OEMs are being decimated there), and a 15% drop can be considered reasonable compared to 50%-plus drops of other foreign OEMs, in the rest of the world (meaning the global market beyond the USA and China), Tesla was down a staggering 26%. Further, this is while the plugin market share in the ROW was up by 24%. And the initial results from February aren’t that encouraging….

Which begs the question: Does Tesla have an Elon problem? Whether it does or not, or whether it will significantly affect Tesla’s performance, I will leave that discussion to you.

But one thing is certain: while the USA Tesla is looking inwards and deciding what its future will look like, the rest of the world is moving on. Tesla’s competitors are gaining ground, especially one called … Geely.

About aforementioned Geely, the Chinese make was the biggest surprise in January, jumping into the 3rd spot with almost 93,000 registrations. That’s a new record for the brand, AND it achieved this in one of the weakest months of the Chinese EV market….

This is mostly thanks to the ramp-up of the Geome (Xingyuan) and Galaxy (E5, Starship 7, and L7) lineups, which added to the sure volumes of the Panda Mini EV. The rest of the lineup will help make Geely not only a strong candidate for the podium, but it could also make Geely the first automaker to try to go after the top two.

Regarding the remaining positions in the top half of the table, the biggest surprise was Xpeng jumping to 7th, beating Li Auto as the best selling startup. With the Mona M03 and P7+ (8,114 units) running at full speed, the make is hoping to cement its position in the top positions with the refresh of the G6 and the introduction of its G7 crossovers.

Another brand on the rise is #9 Toyota, with the Japanese make benefitting from strong sales of its BZ4X SUV and its PHEV lineup. With Toyota hoping for lofty numbers from its upcoming Urban Cruiser compact crossover, we could see the company stabilizing in a top 10 position. Sure, it’s not even close to the podium, but at least it is already showing up on the radar….

On the bottom half of the table, the highlights were Ford showing up at #19 thanks to a growing lineup (new Ford Explorer EV and Capri) and Lynk & Co joining the table at #20 thanks to the success of its 08 midsize SUV and the landing of its Z20 (02 in export markets) crossover BEV, which had an impressive 6,413 registrations in its debut month.

So, we had three brands from Geely (Geely, Volvo, and Lynk & Co) on the table, with a fourth (Zeekr) probably joining soon.

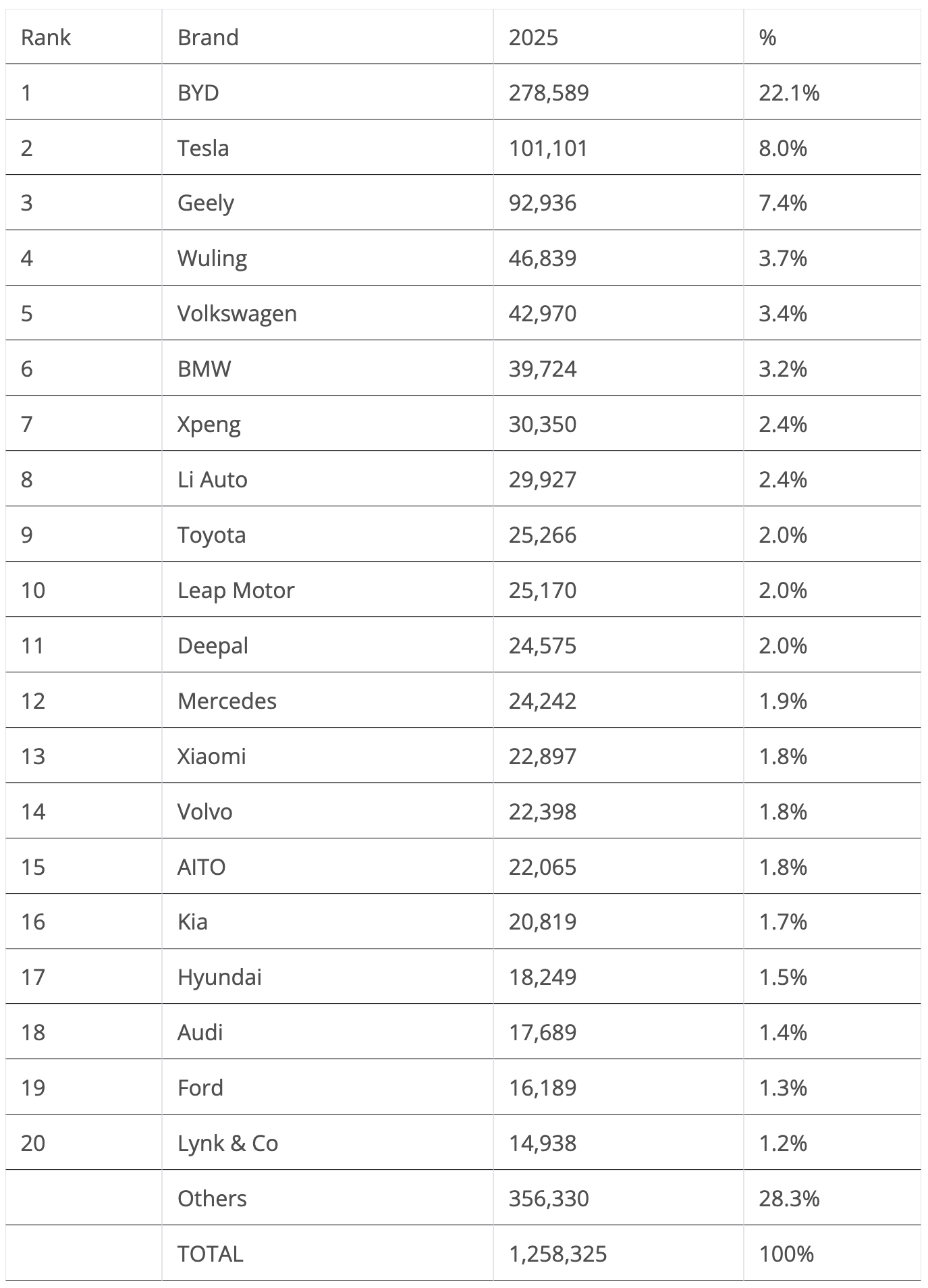

Looking at OEMs, BYD (23.6%, up from 19.8% in January 2024) is once again starting out ahead. Though, there’s a surprise in the runner-up position, as Geely (11.8%, compared to 9.7% a year ago) surpassed Tesla (8%, down from 10.7%) and is the new silver medalist — thanks to strong results across its long lineup of brands.

Comparing Geely’s and Tesla’s current performance with what was happening two years ago, in January 2023, the contrast between these two heavyweights is even clearer, with a rising Geely (11.8% now vs 5.8% two years ago) and a falling Tesla (8% now vs 15.2% then).

Empires rise, empires fall. And at this moment, Tesla’s management still believes it can play at the big boy table with two and a half models, compared to the dozens that both BYD and Geely have.

And here lies another reason why Tesla is stagnating and/or falling. People are different. They have different tastes, different needs … and like to have different choices. Preferably with regular updates. And that’s something Tesla has also neglected.

Instead of going after pipe dreams, like FSD and the like, if Tesla had been properly managed, it would have launched a new generation Model S around 2022 and Model X in 2023, both preferably with 800V architecture; a compact platform would have been launched in 2024, at the latest, with hatchback and crossover versions; the Model 3 would have had a station wagon body since around 2022; and a proper 7-seat version of the Model Y with extended wheelbase would have been launched around 2024.

With this lineup, Tesla would have enough arguments to compete against the best of China. As it is, the company is just coasting on brand recognition and inertia.

But I digress. Back to the OEM table, thanks to a strong January, Volkswagen Group (7.2%, up from 6.2% a year ago) started the year in 4th, ahead of #5 SAIC (5.5%, down from 6.1% share a year ago), which saw its breadbasket Wuling start 2025 in the slow lane.

Outside the top 5, Chery (4.5%) started 2025 in 6th, ahead of BMW Group (3.6%), which continues sailing on stormy seas.

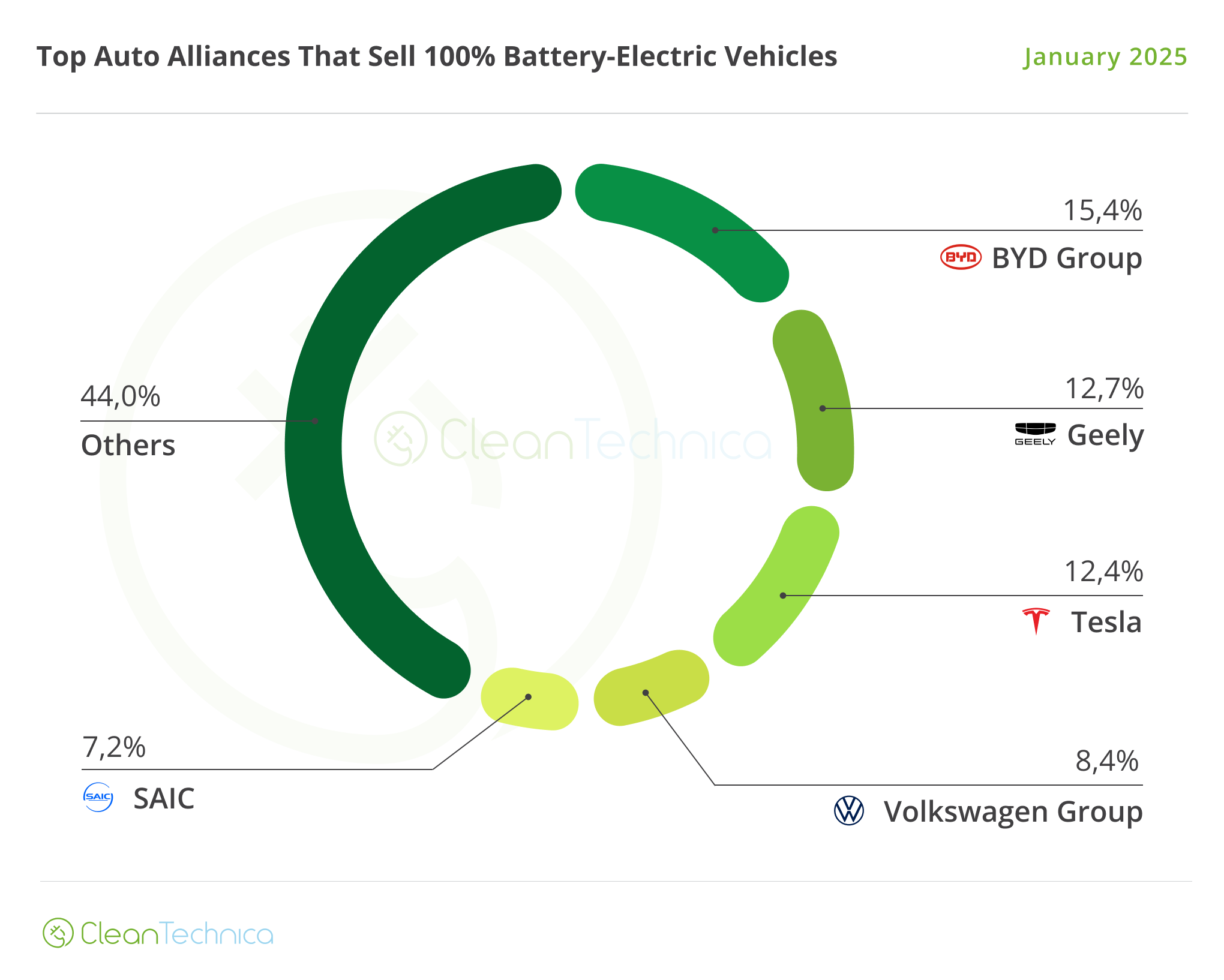

Looking just at BEVs, there were 816,427 registrations in January, or 65% of total plugin sales, with a shocking shakeup at the top.

Long running leader Tesla dropped to 3rd, with 12.4% share, a steep fall from the 17.6% of a year ago (and an even bigger fall from the 22.8% share of January 2023).

Both BYD and Geely profited from Tesla’s never-ending share slide, with both rising one position. BYD climbed into the leadership spot, with 15.4% share, while Geely is the new runner-up, with 12.7% share.

But unlike the PEV table, in this one, Tesla is expected to recover ground in March. Maybe it could even reach the leadership spot again. It will be interesting to see how these three will behave in March. Bring on the popcorn!

Off the podium, #4 Volkswagen Group had a strong start (8.4% vs 6.9% a year ago), keeping #5 SAIC (7.2% now vs. 7.7% then) behind it. Will the German OEM stay comfortable in 4th throughout the year?

Outside the top 5, Chery (4.3%) is 6th, followed by Hyundai–Kia and BMW Group, both with 3.7% share.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy