Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Following up on our report on the top selling electric vehicle models in the world, here’s a broader look at the top selling auto brands and auto groups/OEMs.

Top Selling Auto Brands

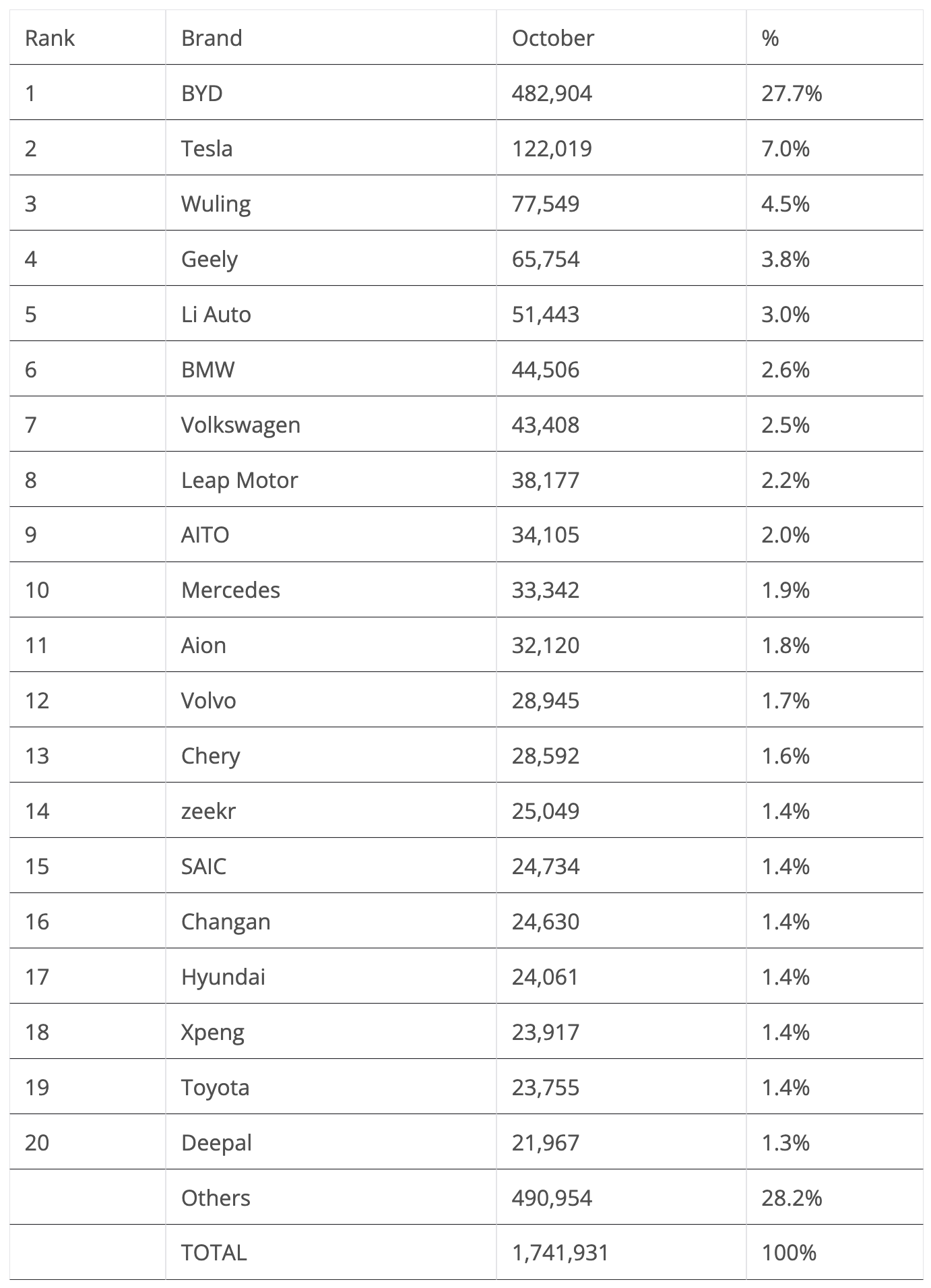

In October, #1 BYD, now deep into pricing out the competition (fossil fueled and electric…) didn’t disappoint. It scored some 482,000 registrations, which is, of course, a new record. With sales at this level already, one starts to wonder how high the Shenzhen make’s sales could go. Would 800,000 units per month be possible?

As for Tesla, it continues randomly switching between black and red, between growth and dropping sales. After a 24% drop in September, the company stayed in the black in October, if by only 6%. As of 2024, there were five growth months (January, May, July, September, and October) and five months in the red (February, March, April, June, and August).

Regardless of what happens in 2024, expect 2025 to be a year of growth, with the Model Y refresh, the Cybertruck ramp-up, and (maybe) a new, cheaper model in the second half of the year — with the question now being: “By how much?”

Below the top two, we have three Chinese brands, with Wuling winning the last position on the podium with close to 78,000 registrations, another record, followed by #4 Geely, which got 65,000 registrations, a new record — and this performance is the most important of the three, as Geely has a number of models ramping up (Geely Galaxy E5, Geome Xingyuan) or in the pipeline (Geely Galaxy Starship 7). Expect it to continue rising in the table in 2025, probably ending the year in 3rd.

In 5th, we have Li Auto. Despite not hitting a record result, it was up 27% YoY.

A few positions below, the highlights also came from China, with four brands scoring record results. #8 Leapmotor scored 38,000 registrations, its third record performance in a row. #14 Zeekr had a record 25,000 registrations. In #18, we have XPeng, which had a record 24,009 registrations, with the new Mona M03 representing almost half of XPeng’s deliveries. And in #20, we have Changan’s premium brand, Deepal, which, thanks to a record result of its S7 SUV (11,970 units), saw its deliveries reach a record 22,000 units.

A final mention goes out to Xiaomi, which ended the month at the gates of the table with a record 20,726 registrations. That is no small feat for a make that, for now at least, only has one model in its lineup.

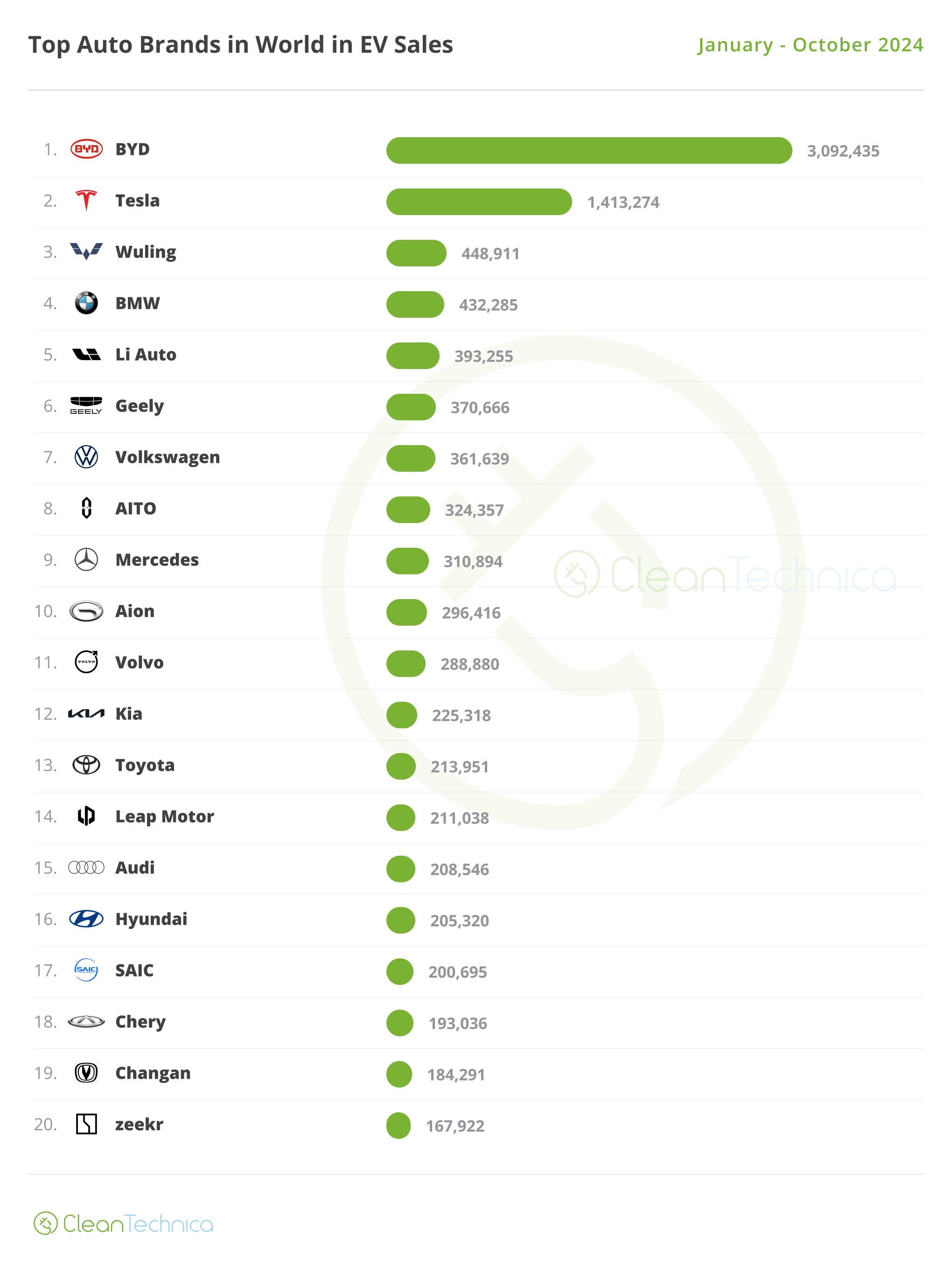

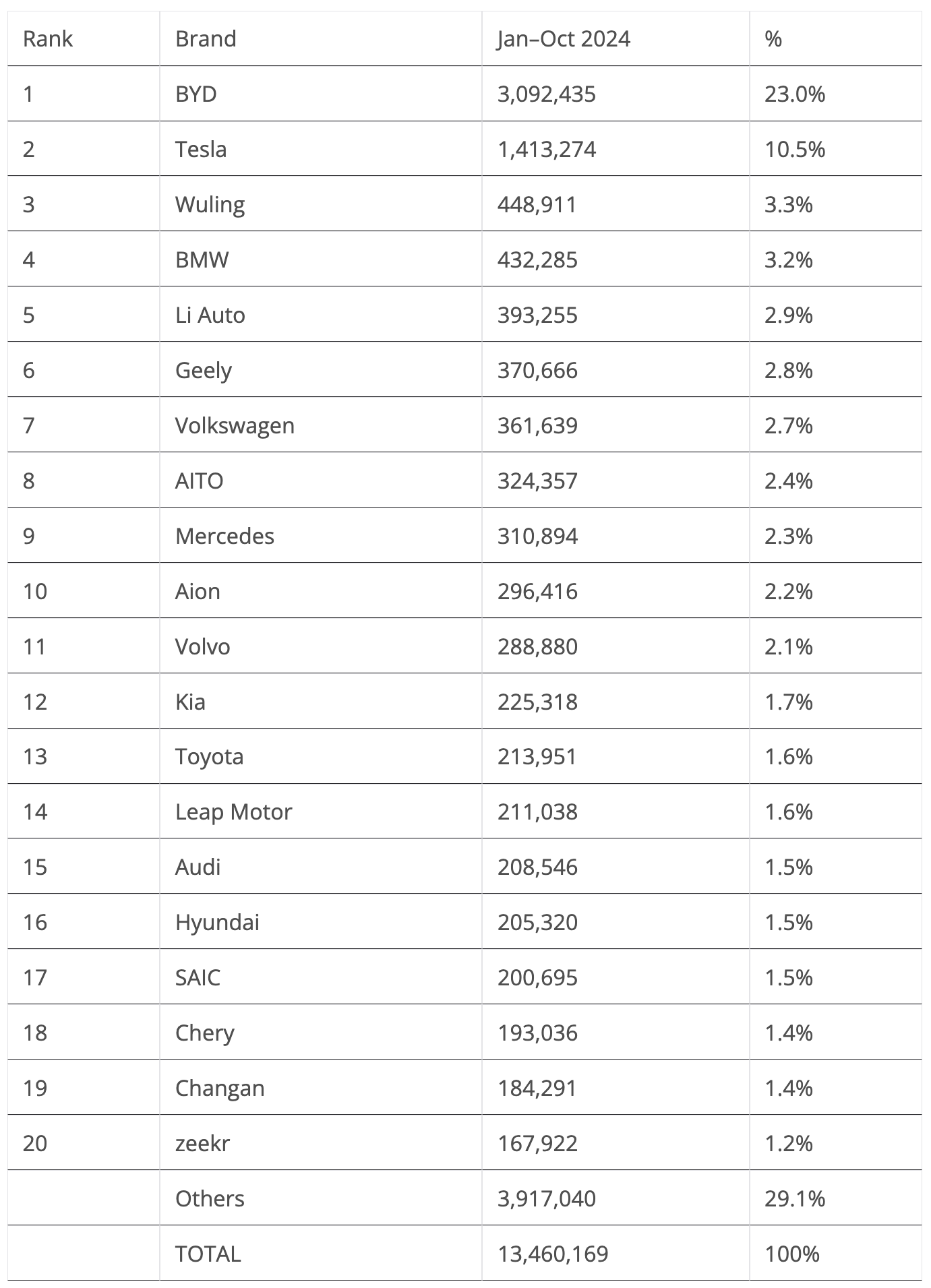

In the YTD table, while BYD has double the sales of Tesla, and the US brand has three times as many registrations as the third placed brand, the last position on the podium saw a position change, with Wuling surpassing BMW. The Chinese brand benefitted from large volumes coming from its hot sellers, the Wuling Mini EV and the Bingo hatchback.

There was also a position change in the 6th position, with Geely surpassing Volkswagen in what can be seen as an “apprentice surpassing its master” sort of thing. Will Geely now go after #5 Li Auto? One thing is for sure: the Taizhou make is quite possibly the strongest contender for the bronze medal in 2025.

In the second half of the table, Leapmotor profited again from a never-ending record streak of performances to continue climbing up the table, jumping three positions to 14th!

Chery was up to #18, while we now have a new brand on the table down at the bottom. Zeekr joined the best sellers in #20, the 3rd Geely brand on the table, and the 11th Chinese make among the best sellers.

Top Selling Auto Groups

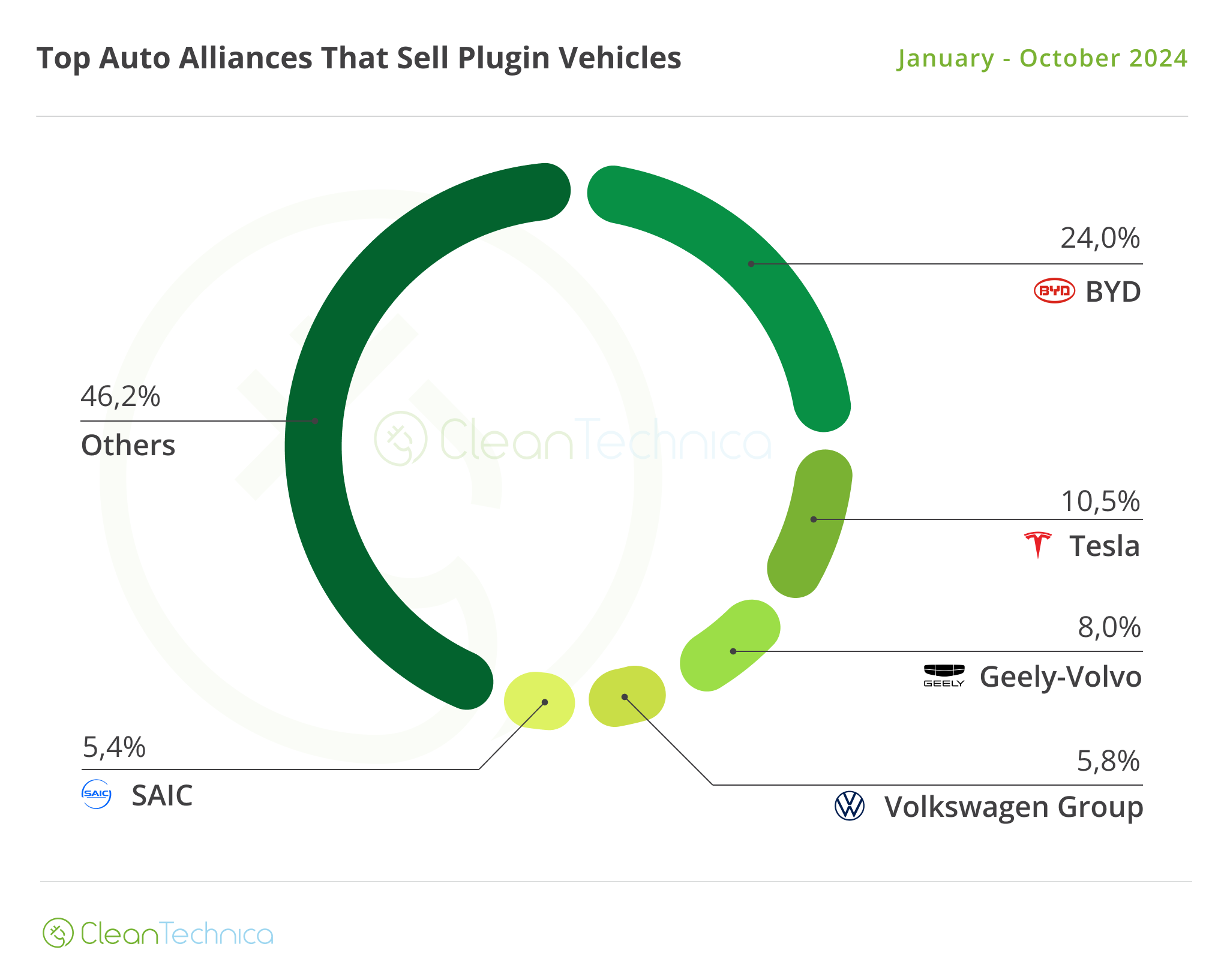

Looking at registrations by OEM, #1 BYD again gained share, thanks to refreshes and new model launches, going from 23.4% to its current 24% (it had 22.1% a year ago). Tesla ended October with 10.5 % share (it had 13.4% in the same period of 2023).

3rd place is in the hands of Geely–Volvo, with the OEM growing by 0.1% to 8% share. Along with BYD, Geely is the only other OEM to grow share in the top 10, going from 6.7% in October 2023 to its current 8%.

Considering Tesla’s eroding share and Geely’s continued growth, could we see the Chinese juggernaut threaten Tesla’s silver medal? Maybe in Q3 of 2025 it could very well happen.

Meanwhile, Volkswagen Group stayed in 4th (5.8%, down 0.1%), but lost some of its advantage over #5 SAIC (5.4%, up from 5.3%). Thanks to Wuling’s positive output, the Shanghai-based OEM managed to compensate for the slow month from the rest of the lineup.

Below SAIC, #6 Changan (3.6%) surpassed #7 BMW Group (3.5%, down from 3.6% in September). Further underlining the current sales blues of legacy OEMs, #8 Hyundai–Kia was down by 0.1% (in this case to 3.3%) and #9 Stellantis was down 0.2% (to 3%).

A worrying sign of the Stellantis performance is that in 12 months it has lost almost a third of the EV share it had in October 2023 (4.4% then vs. 3% now), so the CEO’s recent resignation (unfortunately) comes as no big surprise….

I almost feel like saying it’s not EV sales that are down, it’s legacy EV sales that are falling….

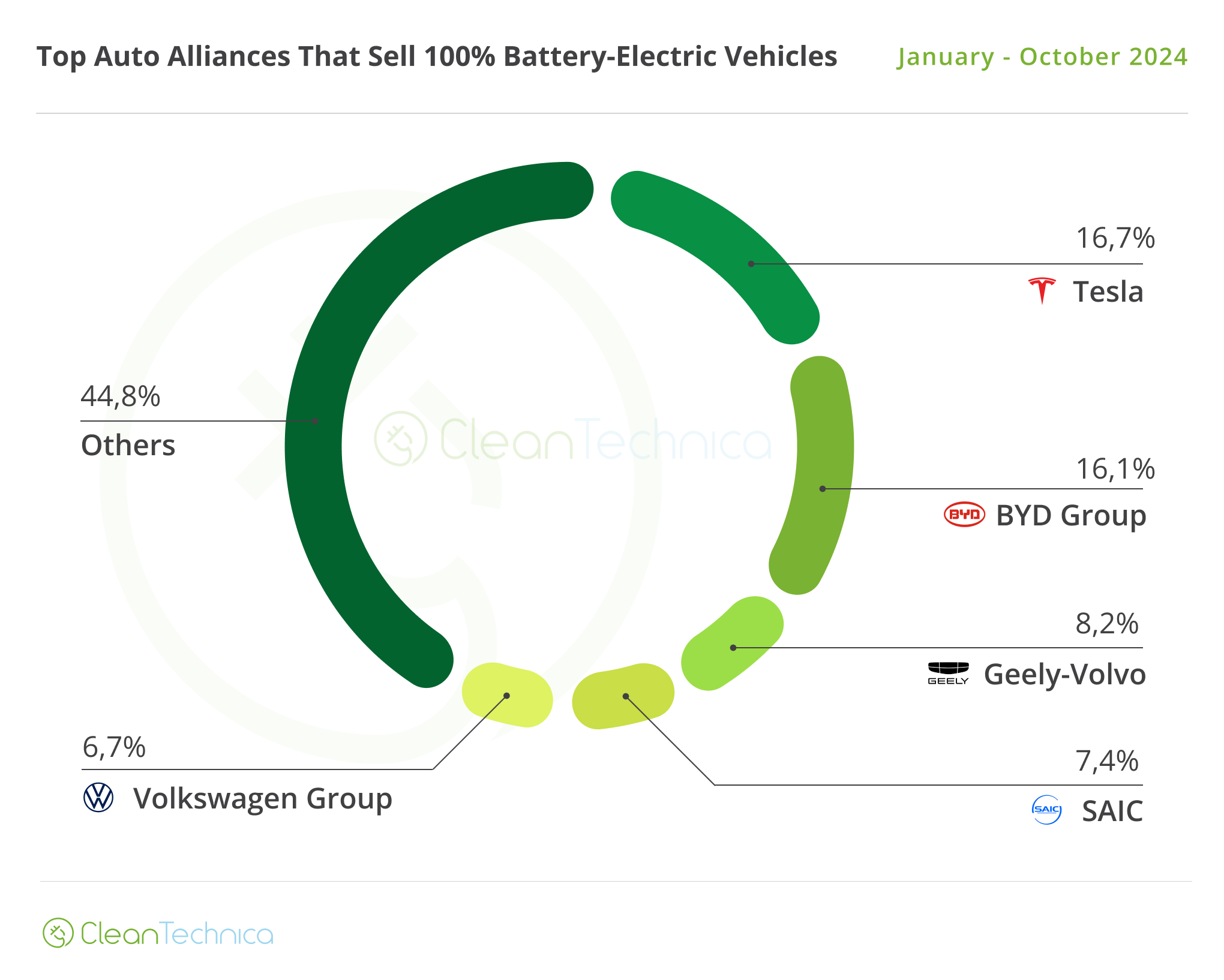

Looking just at BEVs, Tesla remained in the lead with 16.7% share, but it has lost 2.6% share compared to the same period last year. In second is BYD (16.1%, down from 16.2% in September). With Tesla losing share, we might see BYD surpass it in the first half of 2025. It is not doing so sooner, because the Shenzhen OEM is now focusing on PHEVs, so expect only significant growth on its BEV side starting in Q2 of next year.

Geely–Volvo (8.2%, up from 7.8%) was up strongly thanks to good results across its long lineup of brands. Comparing the OEM’s performance to where it was 12 months ago, the progress is visible, jumping from 6.2% share in October 2023 to its current 8.2%!

SAIC (7.4%) is also on the rise, much thanks to Wuling, with the Shanghai OEM having a significant advantage over #5 Volkswagen Group (6.7%, down from 6.8% in September), which should remain there through the end of the year.

Below the top 5, BMW Group (4.1%, down from 4.2% in September) is steady in 6th, followed by #7 Hyundai–Kia (4%, down 0.1%).

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy