Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

While there are regular reports about sales performances of the best selling EVs, as one can see here, here, and here, reports on the deployment of the all-essential batteries for these EVs are much less frequent.

Nevertheless, they are a critical element in the EV transition, and big business too.

Demand for lithium-ion batteries in the automotive sector grew around 65% last year, up to 550 GWh from 330 GWh in 2021. So, which companies are leading the way in supplying the EV industry?

Taking Charge at the Top

Batteries for light electric vehicles (cars, SUVs, LCVs, and pickup trucks) had a faster production growth rate (+57%) than EVs (+39%) in 2023, as the market had several models introduced with bigger batteries, while others had their batteries super-sized.

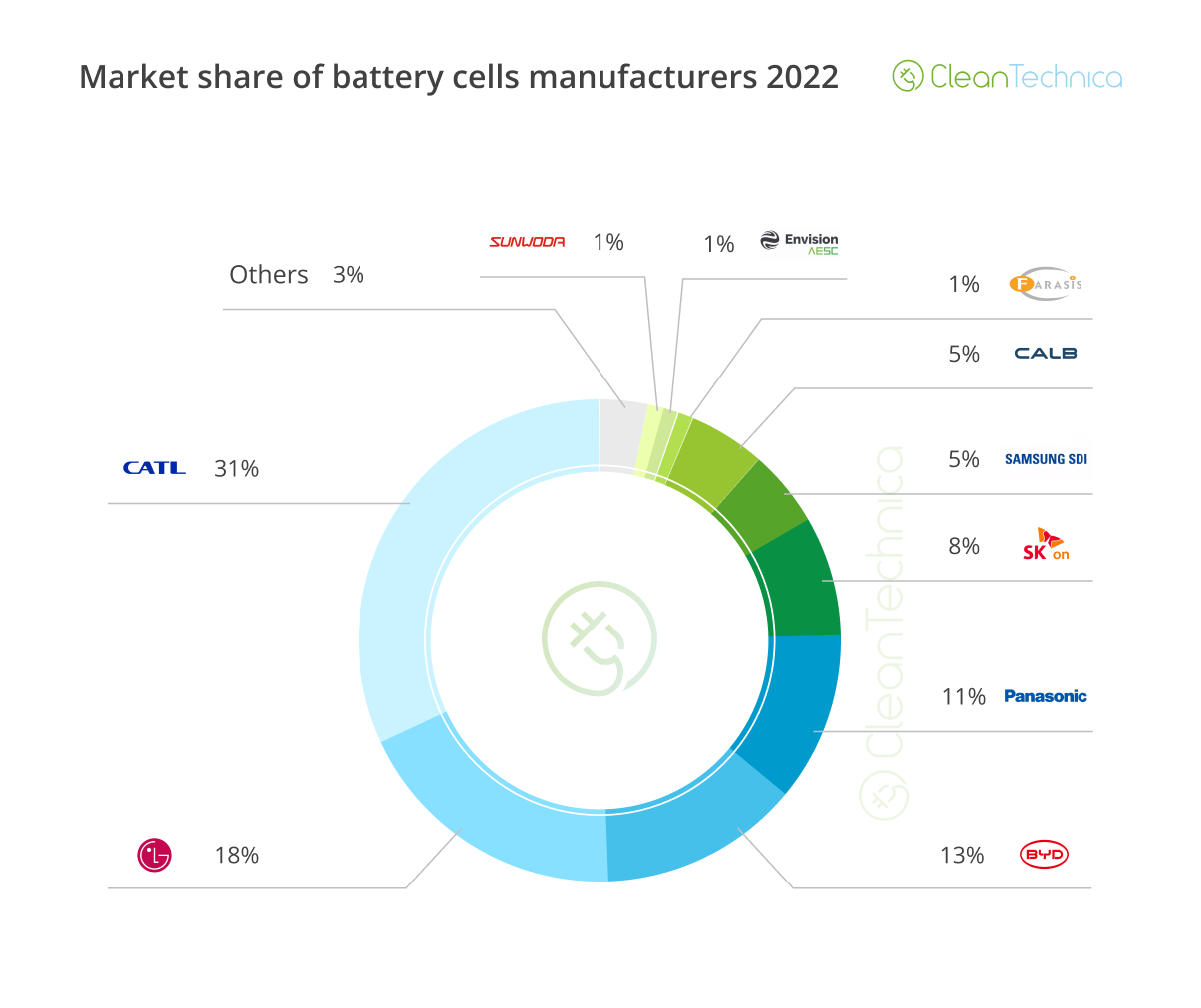

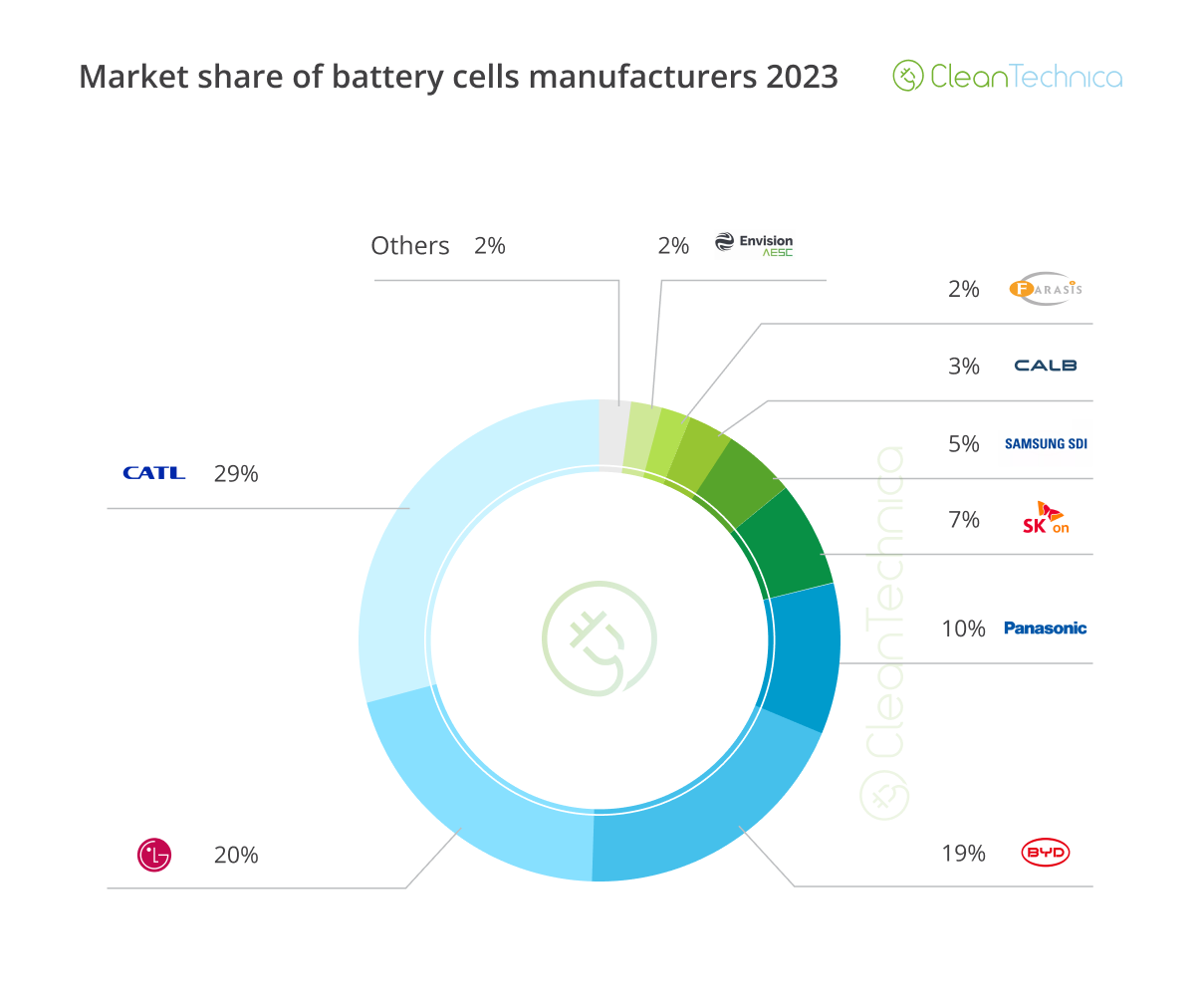

CATL continues to lead the charge, but it has dropped share, from 31% to 29%, due to a slightly under-average growth rate. Maybe with the recent Qilin battery and the upcoming (and promising) Shenxing batteries, the battery maker will recover its lost share.

As for LG, it kept second place, but it is seeing fast growing BYD (+101% YoY) threaten its silver medal, with the Chinese everything battery maker jumping from 13% in the first half of 2022 to 19% in the same period of this year. Expect BYD to surpass LG in the near future — if not this year, then surely in 2024.

Panasonic, once upon a time a leader in the automotive EV business, continues its slow slide down the table. It’s now in 4th, with 10% share, down from 11% last year. With its main client, Tesla, now effectively a multi-supplier OEM when it comes to batteries, and without another large client coming to fill in the gap, the Japanese battery maker is losing in this race, in no small part due to the small EV investments that its compatriot automotive companies are still pursuing.

#6 Samsung followed the market, and then slow growing CALB was in 7th, but the highlights are coming up behind it — #8 Farasis Energy (+135% YoY), #9 Envision AESC (+125%), and #10 Sunwoda (+113%) are all looking to catch up to the ones ahead. They’ve seen significant growth rates. That’s thanks to the success of GAC and the addition of Mercedes as a client in the case of Farasis. As for AESC, the ongoing relation with Nissan is the bread and butter of the company, but the big reinforcement this year is the addition of the US operations of Mercedes. While it is not significant in the total number of EVs sold, when we remember that each EQS SUV has a 108 kWh battery … it does make a difference. Finally, Sunwoda is greatly benefitting from the growth of the Leap Motor startup, of which is its main battery supplier.

With the EV market continuing to grow fast, between 40 to 50% YoY, and average battery size increasing, expect the battery market to continue growing even faster, with +50% growth rates likely in the next couple of years.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

EV Obsession Daily!

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

Tesla Sales in 2023, 2024, and 2030

CleanTechnica uses affiliate links. See our policy here.