Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

The Ports of Los Angeles and Long Beach handle nearly 40 percent of US shipping container traffic; decarbonizing the equipment that handles these containers needs to begin now.

Ocean ports around the world represent major sources of coastal air pollution, with fossil fuel-powered ships, trucks, and heavy equipment in use at port terminals. In Southern California, home to two of the busiest container ports in the county, that pollution is a particularly acute challenge given the proximities to large metropolitan populations. In fact, the Ports of Los Angeles and Long Beach moved more than 16 million TEUs, or nearly 40 percent of imported containers, in the United States in 2023. Those containers include everything from clothes to lifesaving medical equipment. When containers arrive on US shores, they rely on a network of heavy-duty infrastructure known collectively as cargo handling equipment to get them off boats and ultimately into consumer hands.

Cargo handling equipment, also known as container handling equipment, refers to the cranes, top handlers, forklifts, and tractors that load and unload shipping containers on and off boats. Today, most cargo handling equipment runs on diesel. Replacing diesel cargo handling equipment with zero emissions alternatives will improve local air quality and health in neighboring communities and reduce climate impacts.

But roadblocks remain, including a lack of data to support terminal operators, ports, labor unions, and other key stakeholders in making decisions about technology pathways and plans for needed charging and hydrogen refueling infrastructure.

That’s why RMI and the Mission Possible Partnership analyzed the total cost of ownership for four types of cargo handling equipment: to provide stakeholders with an understanding of the zero-emissions technologies available today, how the total cost of battery electric and hydrogen-powered equipment compare with diesel powertrains, and the green electricity and hydrogen needed at the port to power net-zero equipment.

Addressing cargo handling equipment is essential for decarbonizing POLA and POLB

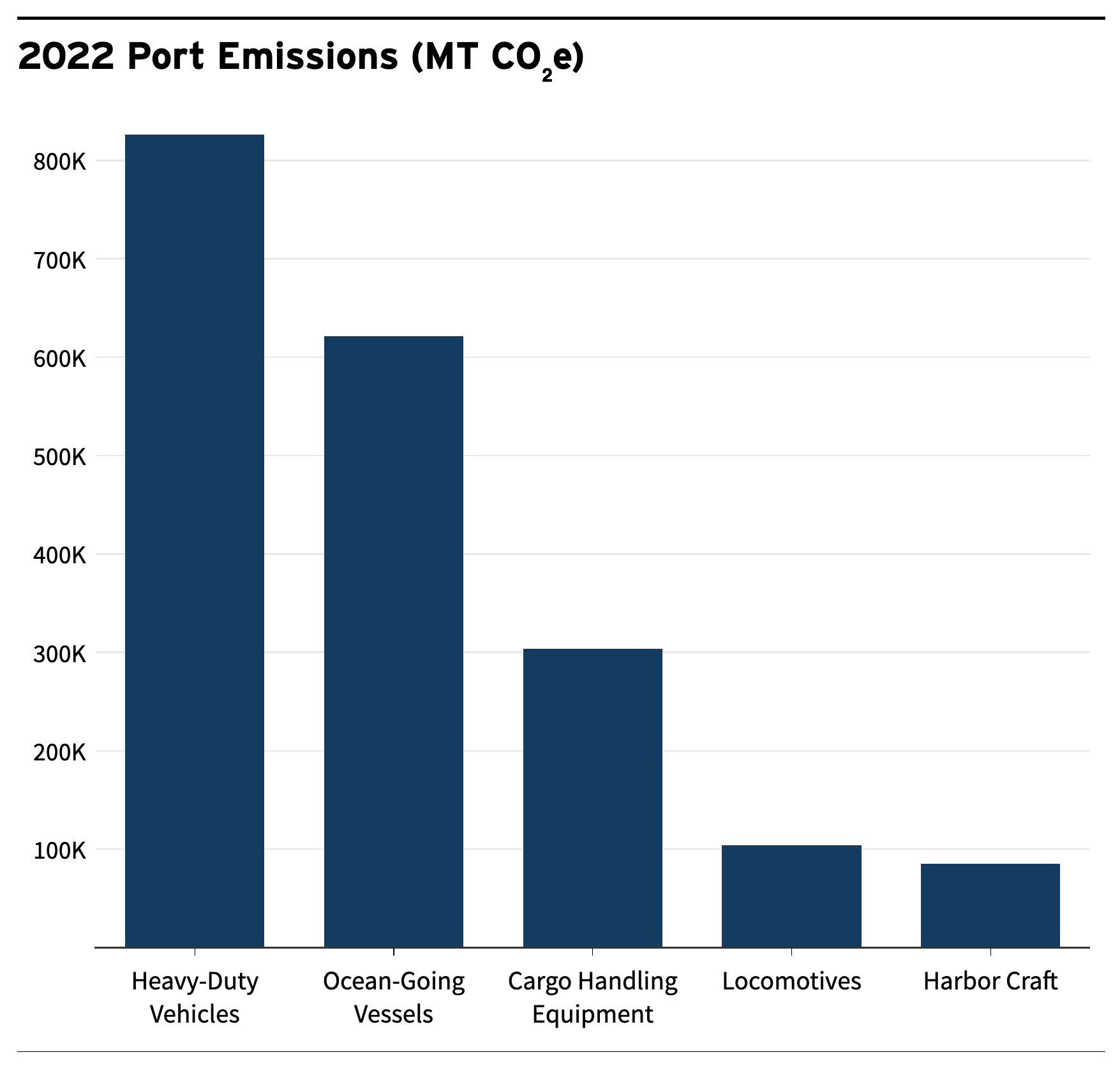

It’s impossible to decarbonize ports without a focus on cargo handling equipment. While most port emissions come from heavy-duty vehicles and ocean-going vessels, cargo handling equipment still accounts for more than 15 percent of port emissions at POLA and POLB. The majority of cargo handling equipment emissions come from two tools: top handlers and yard tractors. Of the more than 3,000 pieces of cargo handling equipment in operation at the ports, yard tractors (48 percent), forklifts (17 percent), top handlers (12 percent), and rubber-tired gantry (RTG) cranes (5 percent) continue to use primarily diesel internal combustion engine technology.

Exhibit 1. Ports of Los Angeles and Long Beach Combined Emissions Profile

Emissions from cargo handling equipment disproportionately impact communities adjacent to the ports who are exposed to elevated levels of toxic air pollution resulting from diesel trucks, idling ships, and cargo handling equipment. In fact, a recent study found nitrogen oxide air pollution emissions were 2.7 times higher and tailpipe-emitted fine particulate matter emissions were 2.2 times higher than certification standards. The neighborhoods closest to POLA and POLB are designated disadvantaged communities under California SB 535 and the federal Justice 40 Initiative, which allocate public funding to communities that are marginalized by underinvestment and overburdened by pollution.

Many of the technologies exist today — and are only getting better

Several terminal operators at POLA and POLB are already piloting or deploying zero-emissions cargo handling equipment. For example, more than 60 percent of cargo handling equipment at The Long Beach Container Terminal is already electric, and at least seven other terminals have begun or recently concluded pilot programs for battery electric yard tractors or RTG cranes. However, more than three thousand pieces of equipment will need to convert to zero emissions to meet the 2030 net-zero goal.

The good news is technology readiness levels (TRLs) are improving for zero-emissions cargo handling equipment. Across all cargo handling equipment types, battery electric powertrains have the highest TRL when considering battery electric and hydrogen fuel cell solutions across four types of cargo handling equipment. However, it’s important to note that other factors including space constraints, operational profiles, electricity and hydrogen distribution infrastructure availability, and labor/end-user preferences all influence operator technology choice.

Exhibit 2. Technology readiness levels for battery electric and hydrogen fuel cell cargo handling equipment by type.

Zero-emissions yard tractors and RTG cranes are cost-competitive with diesel today

As technologies improve, zero-emissions cargo handling equipment is becoming cost-competitive with its diesel-powered counterparts.

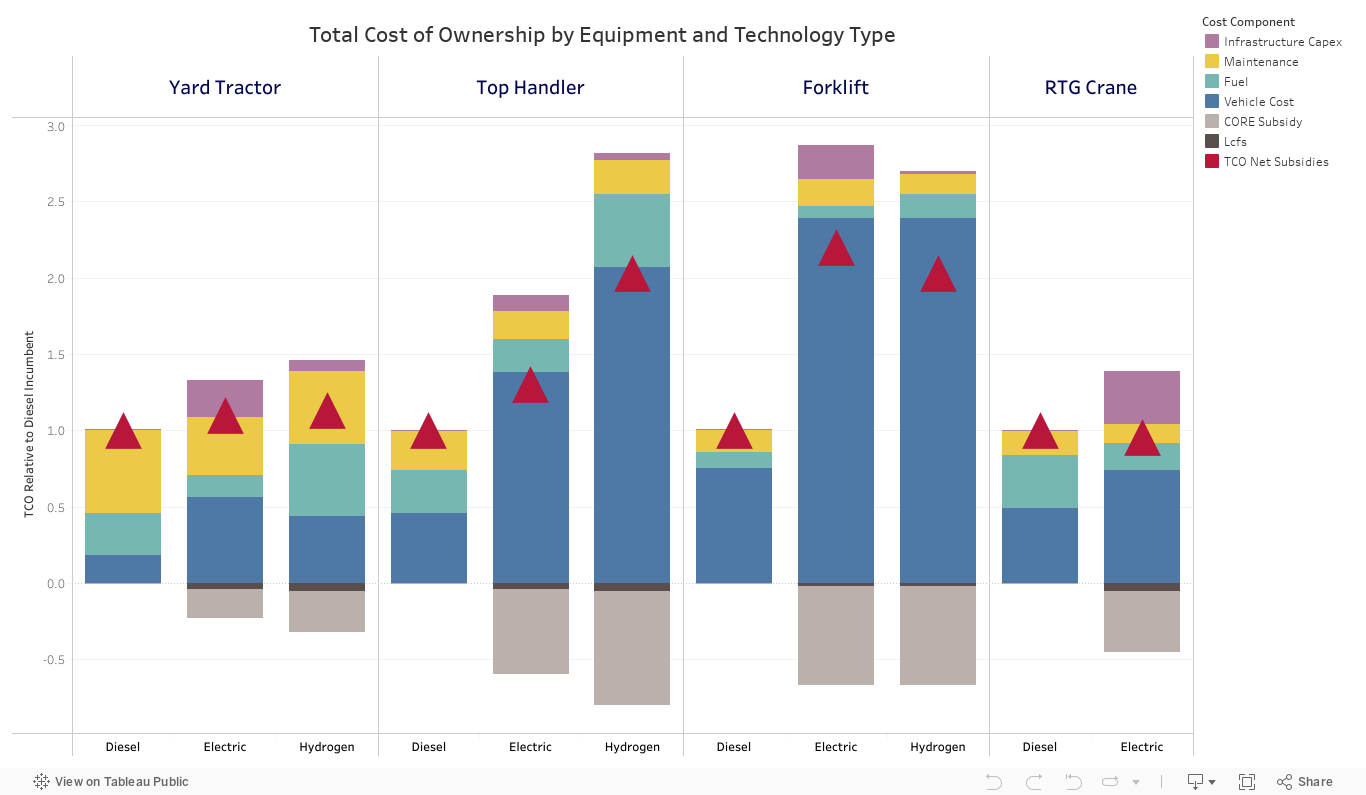

RMI and MPP calculated the 12-year total cost of ownership (TCO) of the four equipment types, considering diesel, electric, and hydrogen powertrains for each. The TCO considers upfront vehicle purchase price and infrastructure costs as well as long-term factors such as maintenance and fuel. California state incentives offered through the Low Carbon Fuel Standard (LCFS) program and Clean Off-Road Equipment (CORE) Voucher Incentive Project are also included.

Exhibit 3. 12-year total cost of ownership (TCO) of four cargo handling equipment types, considering diesel, electric, and hydrogen powertrains

We find that zero-emissions yard tractors and RTG cranes are cost-competitive with diesel today (Exhibit 3).

Overall, hydrogen powertrains appear economically competitive with battery-electric models for yard tractors and high-capacity forklifts, with hydrogen top handlers being significantly more expensive than their electric counterparts. The TCO of hydrogen RTG cranes was not evaluated due to that market segment already being captured by electric models.

Hydrogen yard tractors require more fuel expenditure than electric models, but this cost can be offset because hydrogen units benefit from lower upfront purchase prices after incentives are applied, making both powertrains competitive with diesel. Electric and hydrogen top handlers are both more expensive than diesel due to their large upfront pricing not being sufficiently mitigated by purchase incentives. Hydrogen forklifts are competitive with electric due to reduced infrastructure costs, but both alternative fuel vehicles are much more expensive than diesel, largely due to high upfront purchase prices. Electric RTG cranes are competitive with diesel due to the technology’s maturity and the support of purchase incentives.

However, these findings need to be verified with additional study. Publicly available data on model pricing and maintenance costs are sparse, with hydrogen fuel prices and infrastructure costs also largely uncertain.

Public and private finance can come together to enable turnover of cargo handling equipment

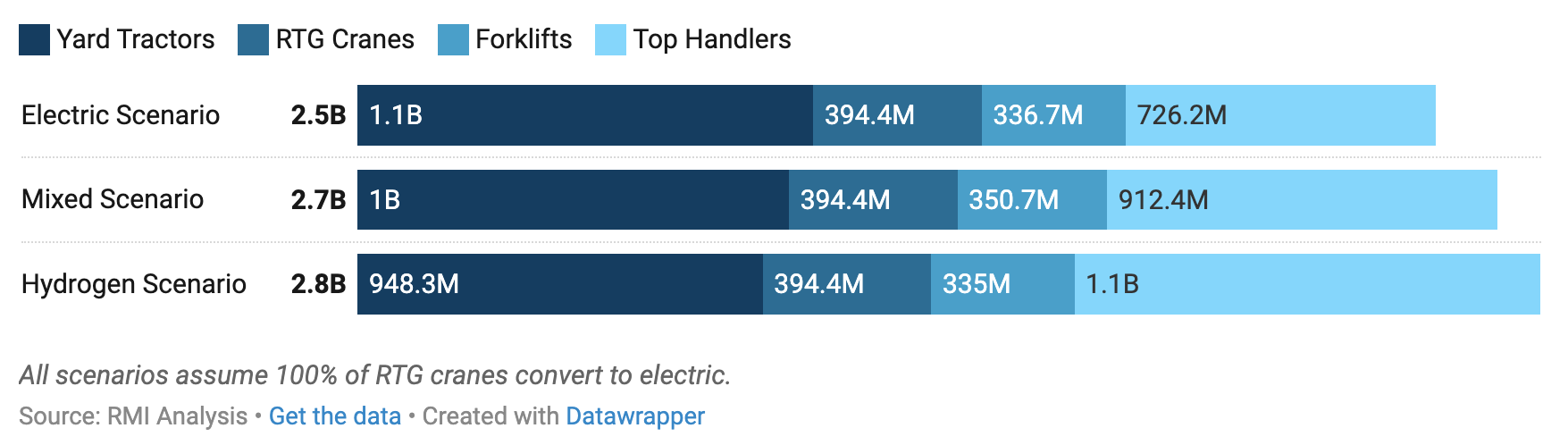

Across the fleet of cargo handling equipment at the San Pedro Bay Ports, RMI analysis shows replacement or conversion of remaining CHE to zero-emissions will cost more than $2.5 billion depending on the split between hydrogen and electric equipment. Results from the same analysis of total costs across POLA and POLB under a mixed scenario — comprising both hydrogen and electric powertrain replacements for existing equipment — would require more than $1 billion to replace 1,500 yard tractors and more than $900 million to replace 400 top-handlers. By comparison, of POLA’s $2.6 billion annual budget, only $15 million is allocated toward zero-emissions port electrification.

Exhibit 4. Total Cost of Full Cargo Handling Equipment Conversion at POLA and POLB

Terminal operators and other developers can leverage incentives and research tools like the RMI DIRT tool to identify appropriate cost-saving measures to reduce costs on the path to net zero. Federal tax incentives for the purchase of qualifying new equipment can reduce the per-unit capital expenditure by up to $40,000 even before factoring in upstream production and manufacturing tax credits from the Inflation Reduction Act. California has additional incentives that can reduce the purchase price of new cargo handling equipment by 30 to 55 percent, depending on the vehicle and powertrain.

Additionally, many terminals at US ports are owned by financial institutions or beneficial cargo owners (BCO) who can leverage private capital for the transition. For example, financial institution owners of port terminals could leverage collateralized loans or OEM-backed financing for equipment purchases across multiple facilities to reduce procurement costs. Additionally, common facility ownership at ports presents an opportunity to jointly procure equipment, creating economies of scale.

Systems planning for green electricity and hydrogen must start now to meet the ports’ 2030 goal

Replacing existing diesel cargo handling equipment with net-zero alternatives will require significant volumes of green electricity and/or green hydrogen to be delivered to ports.

Upgrades will be necessary for electrical grid infrastructure serving the ports to accommodate the increased load from recharging hundreds of pieces of equipment, like the upgrades Southern California Edison are already planning for a new transmission-level substation and other grid enhancements to serve an expected increase in demand at POLB. Infrastructure for hydrogen delivery and refueling will also be necessary to ensure cost-effective delivery of zero-emissions fuel.

Terminal operators may also face site constraints in addition to limited electric capacity. Electric refueling infrastructure often requires more space than diesel pumps because one electric charger supports fewer vehicles than a diesel pump. These chargers can also present a spike in site-wide power usage, and the lead time for getting the power capacity upgrades at a site to support charger installation can be significant. Similarly, building hydrogen refueling infrastructure and securing low-cost hydrogen will require coordination across terminal operators and other buyers of hydrogen for trucking and shipping.

Conclusion: Decarbonizing goods movement in the United States and beyond

Converting to zero-emissions cargo handling equipment is just one piece of decarbonizing ports and goods movement. Actors across the value chain — beneficial cargo owners, terminal operators, ports, OEMs, utilities, and energy suppliers — all have a role to play in ensuring a rapid and cost-effective transition. Further, environmental justice groups are advocating for a transition away from diesel, while labor groups are working to ensure the transition does not displace union jobs. Cargo owners are increasingly interested in choosing carriers with more sustainable operations, creating pressure for fleets to decarbonize.

Maritime trade will continue to be an essential part of our modern way of life, but we can diminish its climate impact. Reducing port emissions in the United States and globally is essential to meeting climate goals, decarbonizing goods movement, and reducing harmful pollution in neighboring communities.

About Clean Industrial Hubs

The insights discussed above come from RMI and the Mission Possible Partnership’s Clean Industrial Hub in Los Angeles, California, that accelerates industrial and heavy transportation decarbonization in the region. Clean industrial hubs bring together policymakers, financial institutions, project developers, and community-based organizations to enable groundbreaking decarbonization projects in the hardest-to-abate sectors. In Los Angeles, RMI and MPP’s analyses, convenings, and tools support stakeholders working to advance zero-emissions trucking, low-carbon cement plants, sustainable aviation fuel, and decarbonized ports, by increasing the size, scale, and speed of critical climate investments that benefit the environment, the economy, and communities. This work is done in partnership with the Bezos Earth Fund.

By Mia Reback, Nocona Sanders, Andrew Waddell, Pablo Muñoz © 2024 RMI. Published with permission. Courtesy of RMI.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy