By Robert Simpson

In the rapidly evolving world of critical metals, particularly lithium, Century Lithium [LCE-TSXV; CYDVF-OTCQX; C1Z-Frankfurt] has emerged as a significant player, particularly due to its early moves in Clayton Valley, Nevada. This article, based on an interview with President and CEO Dr. William (Bill) Willoughby who explains Century Lithium’s strategic decisions, technological innovations, and the challenges they face as they navigate the complexities of lithium extraction and broader market dynamics.

Century Lithium first began acquiring property in Clayton Valley in early 2016, a period when the market was just beginning to recognize the critical importance of metals like lithium. This foresight placed Century Lithium ahead of the curve, acquiring properties in Clayton Valley just as the global focus on critical metals was beginning to sharpen. This strategic move allowed the company to position itself effectively, with 2,286 hectares of property in Esmeralda County, Nevada, and led to the discovery of an extensive resource of lithium bearing claystone.

Century Lithium first began acquiring property in Clayton Valley in early 2016, a period when the market was just beginning to recognize the critical importance of metals like lithium. This foresight placed Century Lithium ahead of the curve, acquiring properties in Clayton Valley just as the global focus on critical metals was beginning to sharpen. This strategic move allowed the company to position itself effectively, with 2,286 hectares of property in Esmeralda County, Nevada, and led to the discovery of an extensive resource of lithium bearing claystone.

Reflecting on the timing of their entry, Willoughby noted, “That was at an early point in the lithium boom. All the attention in Clayton Valley was on lithium brines, including Century. In a stroke of good fortune, the Company discovered it was sitting on one of the largest lithium claystone deposits in the U.S. Owing to its location and other factors, our deposit, which is named Angel Island after a prominent topographical feature on the property, gives us a significant strategic advantage towards its development.”

The timing was crucial. It coincided with the early developments of other major players in Nevada, such as Lithium Americas at Thacker Pass and Ioneer at Rhyolite Ridge. Century Lithium’s focus on lithium extraction from clay set them on their way to advancing their project to the feasibility stage, particularly in how they approached the challenges and opportunities that this type of deposit presented.

Interest in extracting lithium from clay deposits grew as lithium prices reached new highs but faced new and different metallurgical challenges as compared to brine and hard rock sources. However, Century Lithium has made significant strides in developing a commercially viable flow sheet that leverages chloride leaching—a process that offers both operational and environmental advantages.

Interest in extracting lithium from clay deposits grew as lithium prices reached new highs but faced new and different metallurgical challenges as compared to brine and hard rock sources. However, Century Lithium has made significant strides in developing a commercially viable flow sheet that leverages chloride leaching—a process that offers both operational and environmental advantages.

“Our extensive research and development on the project has created what we believe is a commercially viable flow sheet,” Willoughby stated. “Our process is based on chloride leaching, which we discovered to be both operationally and environmentally superior for our particular lithium deposit.”

The company’s recently completed Feasibility Study outlines a flow sheet that uses hydrochloric acid leaching. This decision was driven by certain deposit-specific operational difficulties identified in the Pre-Feasibility stage. Chloride leaching not only facilitated a more straightforward extraction process but also brought potential downstream benefits, such as an easier production of a finished lithium product.

Environmentally, the method is also potentially beneficial. The use of saline solutions in the leaching process aligns with the natural conditions in Clayton Valley, an endorheic basin rich in saltwater brine. By integrating locally derived salt and potential renewable energy sources, such as solar and geothermal, Century Lithium has developed a process that conserves water and minimizes environmental impact.

“Our chloride leaching process allows us to conserve water and use locally derived salt, which is compatible with the environment of Clayton Valley,” Willoughby explained. “This is crucial for minimizing our environmental footprint and supporting the project’s economics.”

“Our chloride leaching process allows us to conserve water and use locally derived salt, which is compatible with the environment of Clayton Valley,” Willoughby explained. “This is crucial for minimizing our environmental footprint and supporting the project’s economics.”

A key component of Century’s project and the use of chloride-based leaching is the chlor-alkali plant. The chlor-alkali plant provides the ability to produce the key reagents on-site from the electrolysis of a sodium chloride solution. The chlor-alkali plant represents a greater capital investment relative to that of a sulfuric acid plant but has important environmental and economic benefits for the sustainability of the project. These include replacing the purchase and transportation of sulfur with regionally sourced salt, and a reduction in emissions and the physical footprint of the operation with dryer, non-sulfate tailings.

In addition, Willoughby notes that the chlor-alkali plant will generate significant quantities of surplus sodium hydroxide for sale and these surplus amounts have the potential to represent a major offset to the project’s operating costs. “When you factor that in” says Willoughby, “our estimated operating costs have the potential to come in at the low end of the cost curve, possibly as low as the operating costs for producing lithium from brine.”

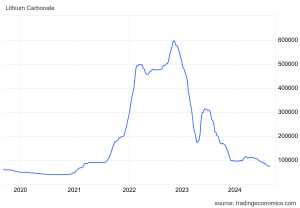

One of the most pressing challenges facing Century Lithium, and indeed the entire lithium industry, is the recent volatility of lithium prices. The company’s Feasibility Study was based on a long-term price of $24,000 per tonne for lithium carbonate, but recent market fluctuations have seen spot prices drop to around $10,200 per tonne.

Despite this downturn, Century Lithium remains optimistic. “You can’t focus solely on the day-to-day pricing in the lithium market,” Willoughby advised. “One has to look at the long-term outlook, and the consensus is that prices will rebound, particularly as the demand for electric vehicles and renewable energy storage solutions continues to grow.”

Century Lithium’s strategy involves advancing their project through permitting and financing stages, ensuring that they are well-positioned to capitalize on price rebounds when they occur. The company recognizes that building a lithium project is a long-term endeavor, and they are committed to progressing their operations in anticipation of future market conditions.

“Our current goals for the project are primarily related to permitting and financing,” Willoughby said. “And we’re focused on keeping the project moving forward so that when prices rebound, and they will, we’ll be ready to take advantage.”

As with any mining project on public lands in the United States, Century Lithium must navigate a rigorous regulatory environment. The permitting process is time-consuming requiring baseline work and collaboration with local and federal agencies. For Century Lithium, this involves working closely with the Bureau of Land Management and local regulatory agencies to identify and address any potential social or environmental impacts related to the project’s development and eventual operation.

“We’ve completed most of our baseline work and are now working with local and federal agencies on finishing items related to our plan of operations,” Willoughby explained. “at this time, we do not see any major obstacles, but it’s a process that takes time and effort.”

A significant milestone for Century Lithium has been the addition of a lithium carbonate stage to their extraction facility. This development allows the company to produce high-purity lithium carbonate—an essential material for the growing EV market—on a pilot scale. This achievement demonstrates both the technical viability of their process, and the potential for Century’s project to become a supplier of high-quality lithium directly to OEMs.

A significant milestone for Century Lithium has been the addition of a lithium carbonate stage to their extraction facility. This development allows the company to produce high-purity lithium carbonate—an essential material for the growing EV market—on a pilot scale. This achievement demonstrates both the technical viability of their process, and the potential for Century’s project to become a supplier of high-quality lithium directly to OEMs.

By successfully producing lithium carbonate at the pilot plant level, Century Lithium has shown that their process works from start to finish, from clay extraction to the final lithium product. This end-to-end capability is a crucial differentiator in a market where many other companies remain in the exploration or early development stages.

Century Lithium is an attractive investment option. The stock currently trades for about 25 cents Canadian, although the corporation is worth far more than that.

Willoughby outlined a number of important characteristics that make investing in Century Lithium appealing, such as the company’s Clayton Valley lands’ suitability for mining, existing infrastructure, and minimal environmental impact. Compared to many other U.S. lithium projects, Century Lithium is further along in its development. The company is years ahead in terms of project advancement, having already finished a Feasibility Study and made significant progress in its pilot plant operations.

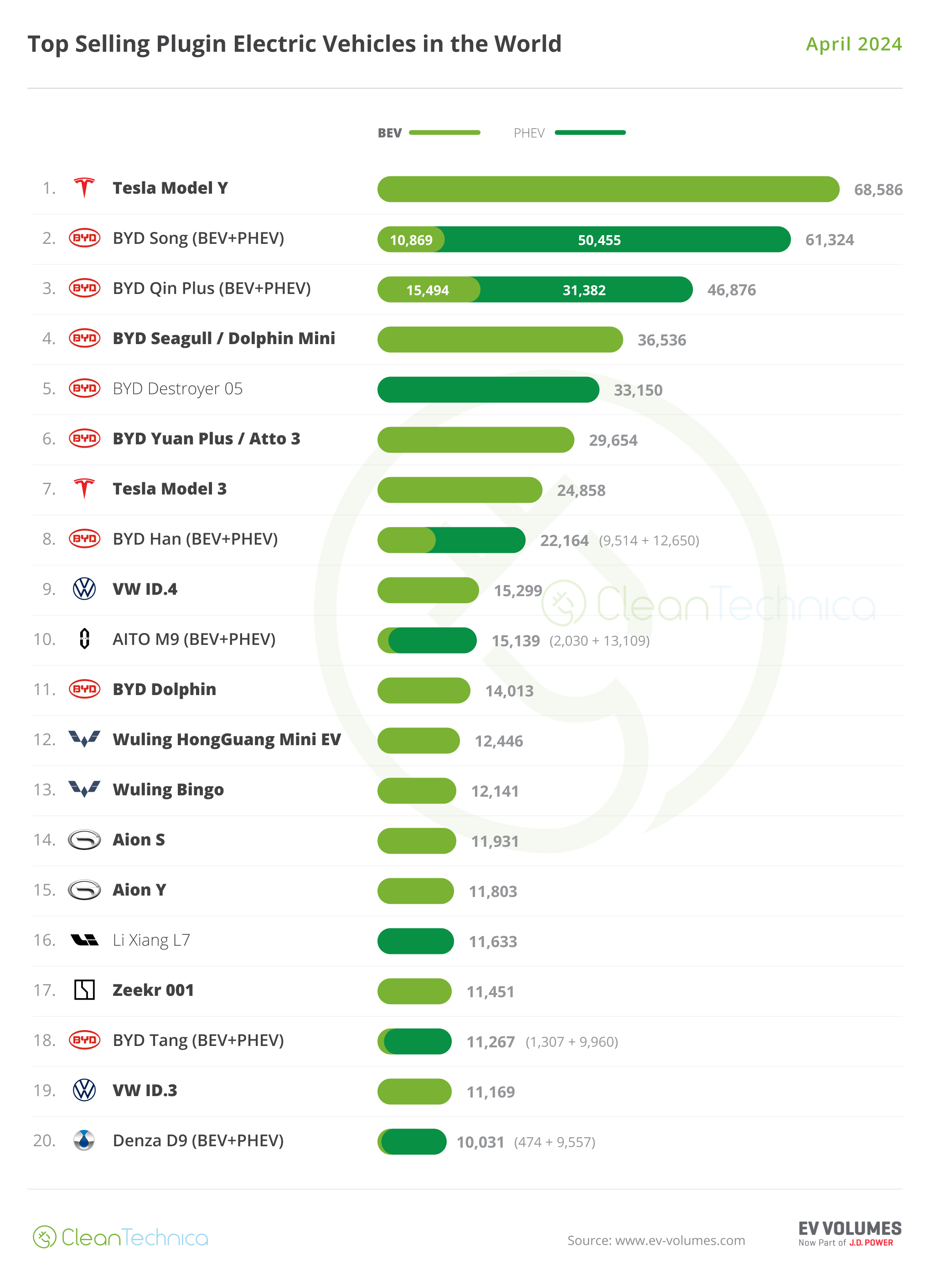

Additionally, Century Lithium stands to benefit greatly from government activities targeted at securing crucial resources as a possible domestic supplier of lithium for the United States. With the rise of electric vehicles and renewable energy storage, there will likely be a sustained demand for lithium. This places Century in the forefront of national initiatives to increase the availability of domestic lithium resources. Lastly, the long-term picture for the market is still favorable. With the rise of electric vehicles and renewable energy storage, there will likely be a sustained demand for lithium.

Additionally, Century Lithium stands to benefit greatly from government activities targeted at securing crucial resources as a possible domestic supplier of lithium for the United States. With the rise of electric vehicles and renewable energy storage, there will likely be a sustained demand for lithium. This places Century in the forefront of national initiatives to increase the availability of domestic lithium resources. Lastly, the long-term picture for the market is still favorable. With the rise of electric vehicles and renewable energy storage, there will likely be a sustained demand for lithium.

“I think we as a Company offer a great deal of value,” Willoughby stated confidently. “We are technologically advanced with a proven lithium resource, and we are years ahead of other companies that are still in the exploration stage. The potential for growth is tremendous, especially as the market for lithium strengthens.”

Century Lithium’s early entry into the lithium market, coupled with its innovative approach to extraction of lithium from clays, and strong focus on environmental sustainability, positions the company as a leader in the industry. Despite current market challenges, the company’s strategic vision and technological advancements provide a solid foundation for future growth.