The Federal Reserve didn’t do anything at its March Federal Open Market Committee (FOMC) meeting, but Jerome Powell & Company had plenty to say.

The Fed’s dovish rhetoric sent a wave of relief through the markets and drove stocks to yet another all-time high.

People would probably be wise to remember that saying isn’t doing.

What the Federal Reserve Did

The FOMC held interest rates steady, set between 5.25 and 5.5 percent. Rates have been at this level since last July.

The official FOMC statement was substantively the same as the statement issued after the January meeting, featuring the typical mishmash of Fed-speak.

“In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. In considering any adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.”

Make of that what you will.

The only change to the statement was in its overview of job gains. In January, the FOMC reported, “Job gains have moderated since early last year but remained strong.” The March statement removed the phrase, “have moderated since early last year.”

So, from a substantive standpoint, the FOMC meeting was a big yawner.

What the Fed People Said

The March meeting was all about “open-mouth operations.” Since the central bank didn’t do anything, everybody focused on what Jerome Powell and the committee members said.

And they said plenty.

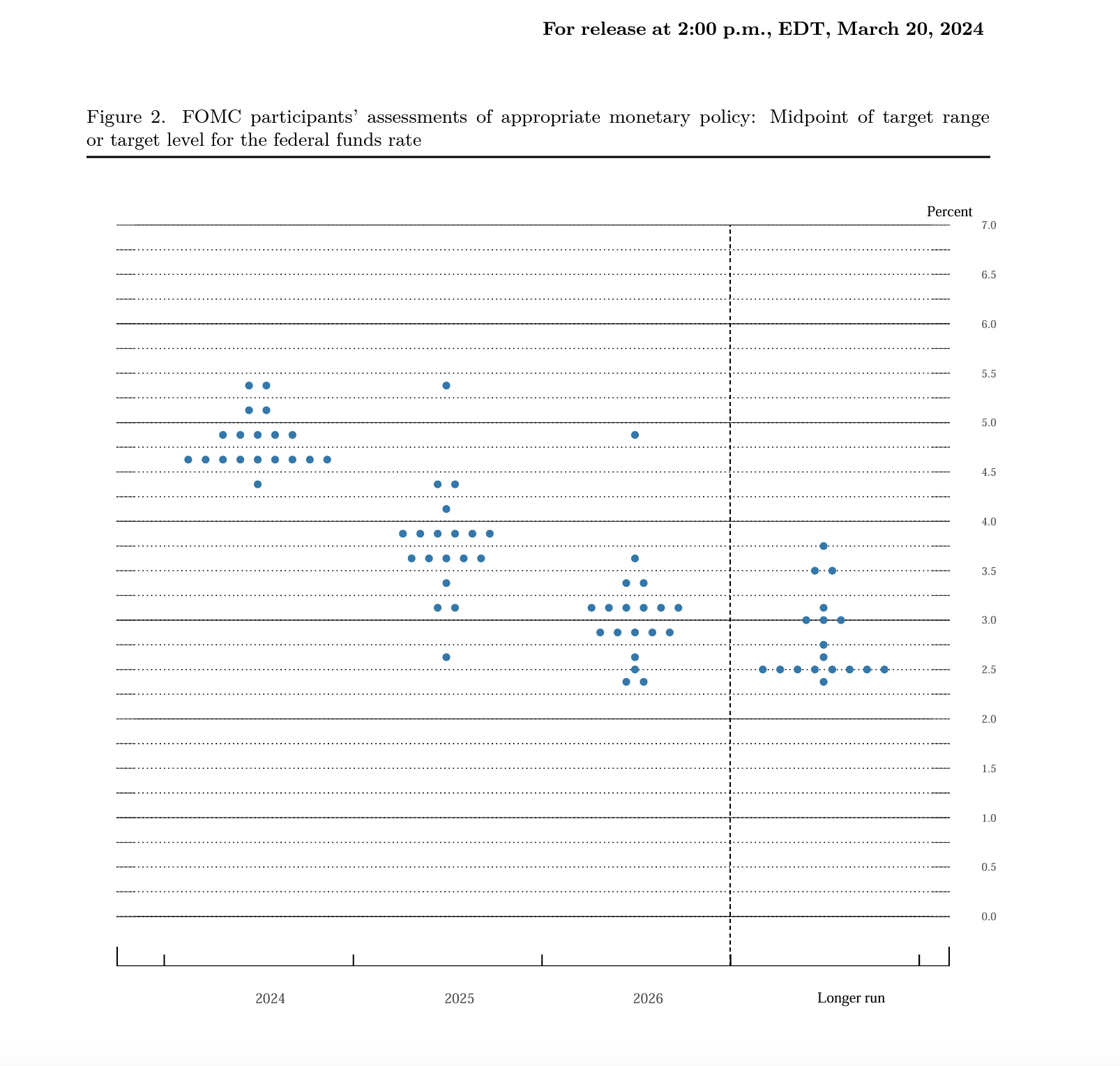

The highlight of the meeting was the release of an updated “dot plot” projecting the trajectory of interest rate policy.

Despite sticky price inflation, the FOMC indicated that it still plans to cut interest rates three times in 2024. If it moves in 25-basis point increments as expected, that would lower rates to between 4.5 and 4.75 percent by the end of the year.

The committee projects additional cuts in 2025, dropping rates to around 3 percent.

Digging into the details, 10 of the 19 FOMC members projected three cuts this year. That was down from 11 in the December dot plot. On the other hand, every committee member now anticipates at least one cut this year. In December, two members projected no cuts.

During his post-meeting press conference, Powell also indicated that the Fed is considering slowing the pace of balance sheet reduction.

“The general sense of the committee is that it will be appropriate to slow the pace of run-off fairly soon, consistent with the plans we’ve previously issued.”

The Fed’s balance sheet has decreased by about $1.42 trillion since it began quantitative tightening. That sounds impressive until you remember that the Fed added nearly $5 trillion during the pandemic. That was on top of the massive blowup of the balance sheet during the Great Recession that the Fed was never able to run off as promised.

Balance sheet reduction is one of the indicators that the Fed was never fully committed to an inflation fight.

In fact, based on the balance sheet reduction plan announced by the Fed when it began its inflation fight, it would take about seven years just to return the balance sheet to its pre-pandemic level.

That’s an awful lot of inflation still bubbling around in the economy. (Keep in mind that inflation is an increase in the money supply. Rising prices are a symptom of monetary inflation.)

One might wonder how the FOMC can still anticipate three rate cuts and a slowing of balance sheet reduction in 2024 given the hotter-than-expected price inflation data so far this year.

According to Powell, hotter data doesn’t necessarily mean inflation isn’t in retreat.

“I think they haven’t really changed the overall story, which is that of inflation moving down gradually on a sometimes bumpy road toward 2%. We’re not going to overreact to these two months of data, nor are we going to ignore them.”

It really comes down to how you’re inclined to spin the data.

The FOMC also released projections on the trajectory of the economy. The Fed now expects even stronger economic growth this year, with GDP rising by 2.1 percent on an annualized basis. That was up from a 1.4 percent estimate in December.

Powell & Company also expects job growth to continue strong.

Notably, a growing economy and a strong labor market were reasons to hold rates higher for longer just a few months ago. On Wednesday, Powell tried to back away from that notion.

“Strong hiring in and of itself would not be a reason to hold off on rate cuts.”

He also insisted that the job market by itself was not cause for concern around inflation.

Easy Money Is One Heck of a Drug

Powell & Company said exactly what the markets wanted to hear.

They are desperate for rate cuts and an easing of monetary policy. While nobody wants to say it out loud, most people realize this economy isn’t built to operate in even a moderately high interest rate environment. There is too much debt in the system. Most people understand that the longer rates remain higher, the more likely it becomes that something in the economy will break.

The promise of rate cuts sent the markets soaring.

You can see from this chart just how strongly the S&P 500 reacted to the Fed’s messaging.

The S&P rose 0.8 percent on the day and closed above 5,200 for the first time.

The Dow Jones also soared, gaining 400 points and setting a new record on Wednesday.

Meanwhile, the NASDAQ jumped by more than 1 percent and also closed at a new record.

Gold charted a new record high as well, with the mainstream anticipating a lower interest rate environment moving forward.

The irony is the mainstream is excited because it anticipated victory over inflation and a return to easy money. But in the long run, more easy money means more inflation. It isn’t actually a victory – it’s a surrender.

The Fed Doesn’t Have a Very Good Track Record Projecting Interest Rates

Given that the Fed hasn’t done anything yet, all of the excitement in the mainstream might be a bit premature.

The fact of the matter is the Fed doesn’t do a very good job of predicting the trajectory of its own interest rate policy.

How bad is its track record?

Fund manager David Hay analyzed past dot plots and found the FOMC only got interest rate projections right 37 percent of the time. And as Hay pointed out, “They control interest rates!”

For instance, in March 2021, the FOMC projected the interest rate would still be zero in 2022. The actual 2022 rate was 1.75 percent. And in 2023, the vast majority of FOMC members thought the rate would still be at zero. The actual rate was over 5 percent.

The FOMC would probably get better results throwing darts at a chart.

My point is we don’t have a good reason to believe anything Powell & Company said or to think their musings tell us anything about the central bank’s next moves.

But make no mistake; the markets will get their easy money drug.

Here’s the reality: rate cuts (and more inflation) are screaming down the tracks. It’s just a matter of time. When something breaks in the economy – and something will break in this debt-riddled economy with interest rates at 5.5 percent (or even at 4.5 percent if the Fed delivers on its cuts – the Fed will be forced to cut (more). We’re talking about interest rates going back to zero and more quantitative easing.

That’s what the Fed does during an economic crisis.

It’s not so much that the Fed is in danger of breaking the economy with higher interest rates today. The Fed broke the economy more than a decade ago when it pushed rates artificially low and left them there for years. This incentivized debt and malinvestments. It’s only a matter of time before the house of cards falls down.

The Fed is stuck between a rock and a hard place. It knows that higher rates will eventually cause the economy to collapse. It also knows that inflation hasn’t been beat. So, it faces a choice: higher inflation or an economic crisis.

Or perhaps both.

This is why I think Powell is suddenly signaling rate cuts despite virtually all of the data screaming “Hold rates higher for longer!” or even, “Raise rates more!”

Financial analyst Jim Grant came up with the perfect analogy in an interview earlier this year. He said Powell and other Fed officials seem to look in the mirror and see themselves as Captain Chesley Burnett “Sully” Sullenberger who managed to land a crippled U.S. Airways jet on the Hudson River.

“The Fed has arrogated to itself the role of central planning agency. … It’s going to try to balance economic growth with the stability and integrity of the currency. How do they do that? I don’t think it’s given to mortal man and woman to do these things.”

********