The overall German auto market was up by 5% in October, and the BEV market was back in the black after September’s subsidy-derived hangover (+4% year over year).

37,334 BEVs were registered in October, 17% of the auto market and up 4% YoY. On the other hand, PHEVs continued to be deep in the red. Plugin hybrids had 16,361 registrations, 7.5% of the total market, which is approximately half of what they had a year ago. The recent pure electrics hangover is still visible in the BEV vs. PHEV sales breakdown, with pure electrics representing just 70% of all plugin sales in October, still 5 percentage points below this year’s average.

In total, plugins had 25% share of the auto market in October, keeping the year-to-date count at 24%. With November and especially December said to be strong months, expect plugins to end north of the 25% mark.

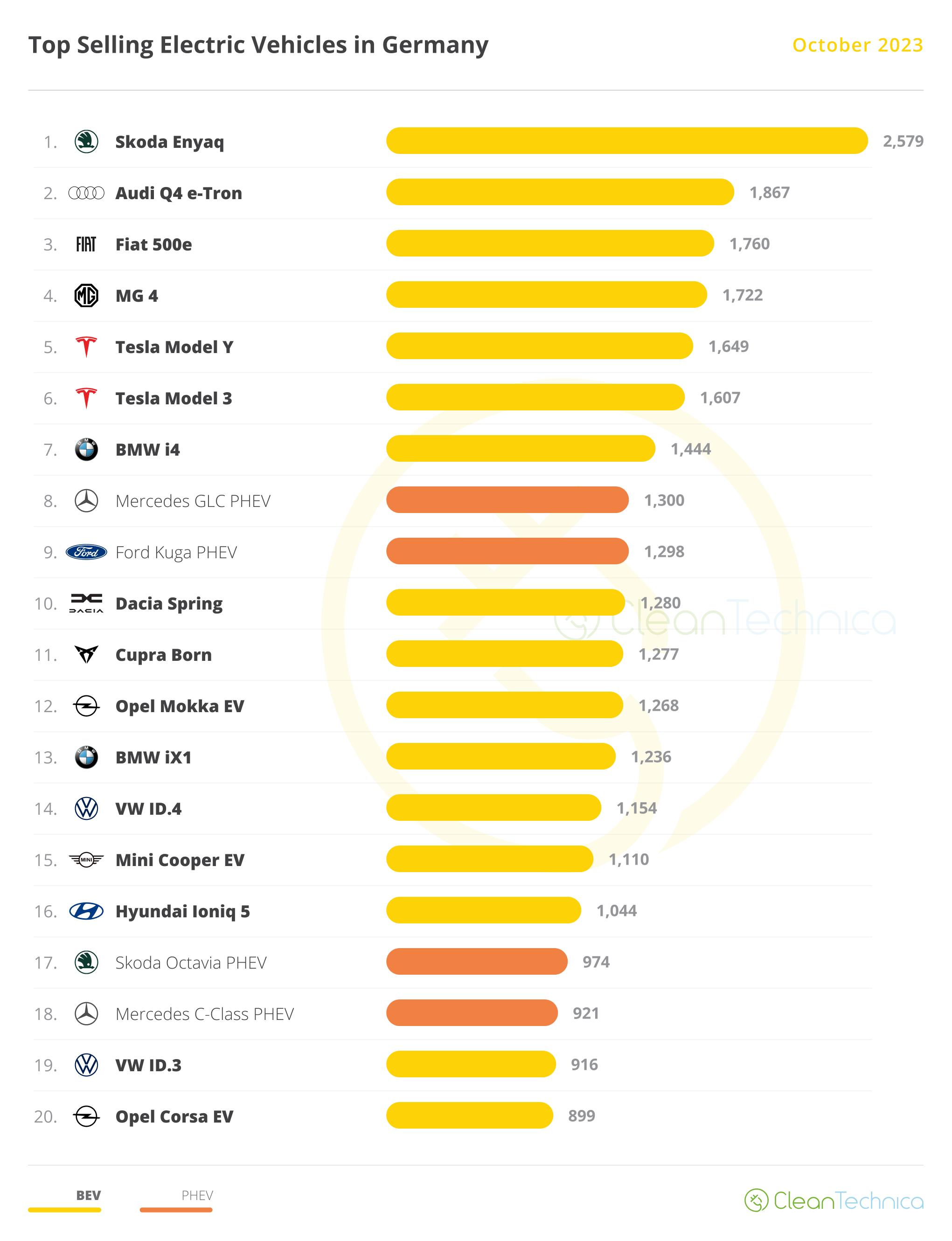

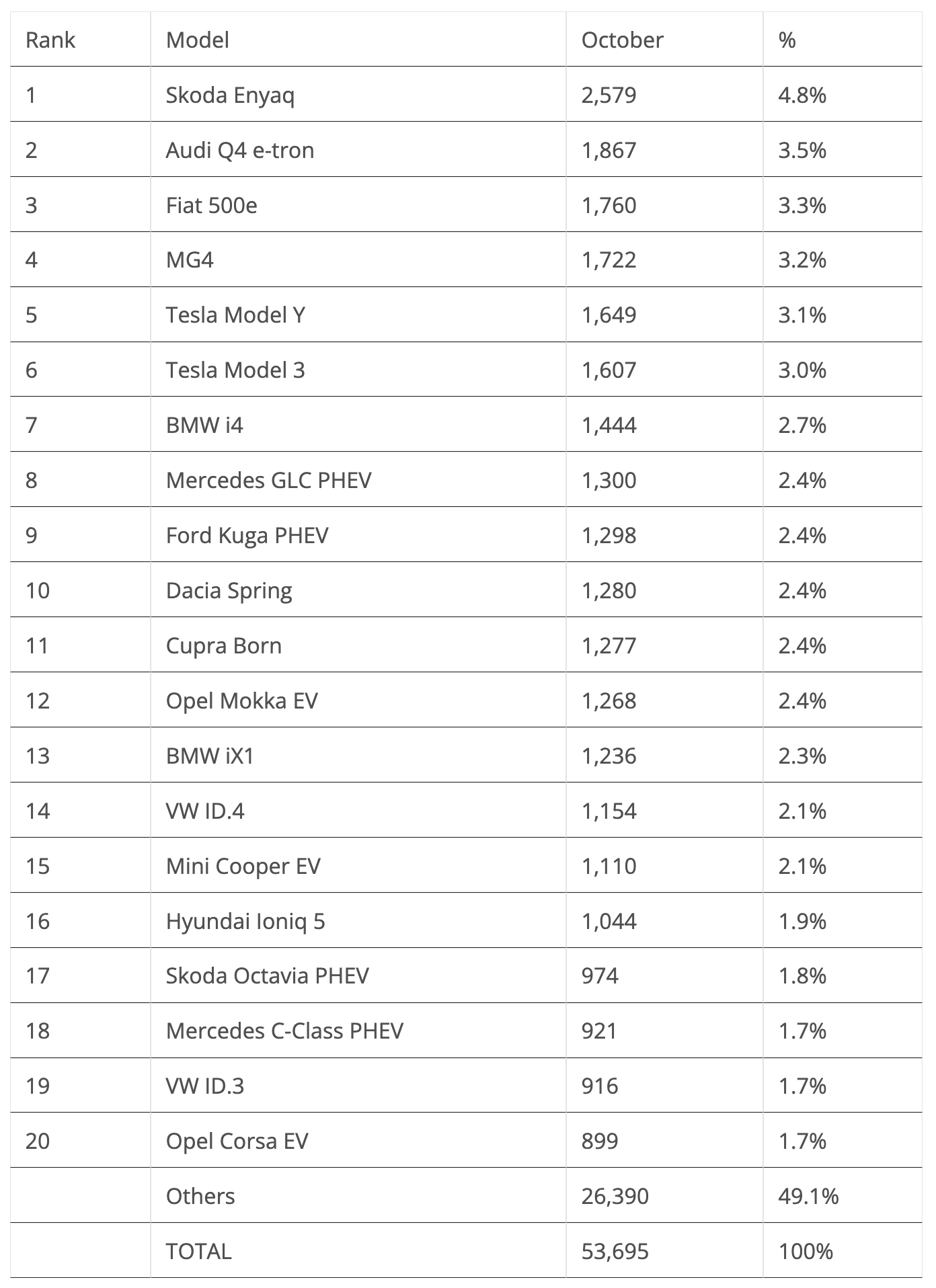

The 20 Best Selling Electric Vehicles in Germany — October 2023

The winner was something of a surprise. The Skoda Enyaq won the best seller trophy thanks to 2,579 registrations, beating not only the current sales king in Germany, the Tesla Model Y (5th, with 1,649 units), but also its superior in rank, the VW ID.4, which ended the month in 14th. Now we get why VW was so worried about demand issues — its bread and butter company car market crashed with the end of subsidies, and with it, demand for its ID models.

Silver went to the Audi Q4 e-tron, with 1,867 registrations, while the last position on the podium went to the Fiat 500e. With 1,760 registrations, it managed to overcome the surprise #4 MG4 (1,722 registrations), which managed to end the month ahead of both Teslas!

Another surprise was the 7th position of the BMW i4. With a record 1,444 registrations, it finally had a decent performance in its home market. The result is even more relevant when we consider that it was achieved just two months after company car subsidies ended. Was this a one-time thing, or is the midsize Bimmer finally living up to expectations?

Just below the BMW liftback, there is another surprise, with the Mercedes GLC PHEV scoring its best result of the current generation and the nameplate’s best score since December 2021, 1,300 registrations, allowing it to be October’s best selling plugin hybrid in the table. This shows again that when you use a decent-sized battery (31 kWh, in this case), PHEVs can become a valid alternative on the market, even without subsidies.

The remaining surprises were in the lower half of the table. Opel placed two models on the table — the Mokka EV in 12th with 1,268 registrations and the Corsa EV in 20th, with the stylish crossover being something of a surprise.

Another surprise was the Skoda Octavia PHEV joining the table, in #17, with 974 registrations. The Czech model is having its best result in over two years, highlighting Skoda’s good month in October.

Outside the top 20, a few models deserve mention, like the Audi Q8 e-tron (786 units) reasserting its dominance in the full size category, after September’s surprise win by the Mercedes EQE sedan. Additionally, we have good performances from the BMW iX3 (799 units) and Renault Twingo EV (763), with this last one being Renault’s best selling model last month. The Twingo’s result highlights two different things:

First, that city EVs are very much in demand, and because there aren’t that many models to choose from, even a 9-year old design can sell in volume.

Second, the Renault Megane EV is not living up to expectations, and it needs a refresh, but above all, it needs a significant price cut. Maybe when the upcoming Renault Scenic crossover lands?

A final note on Great Wall’s ORA Funky Cat (euro-spec Good Cat). The cuddly hatchback delivered 411 units in October. China is rising in Europe….

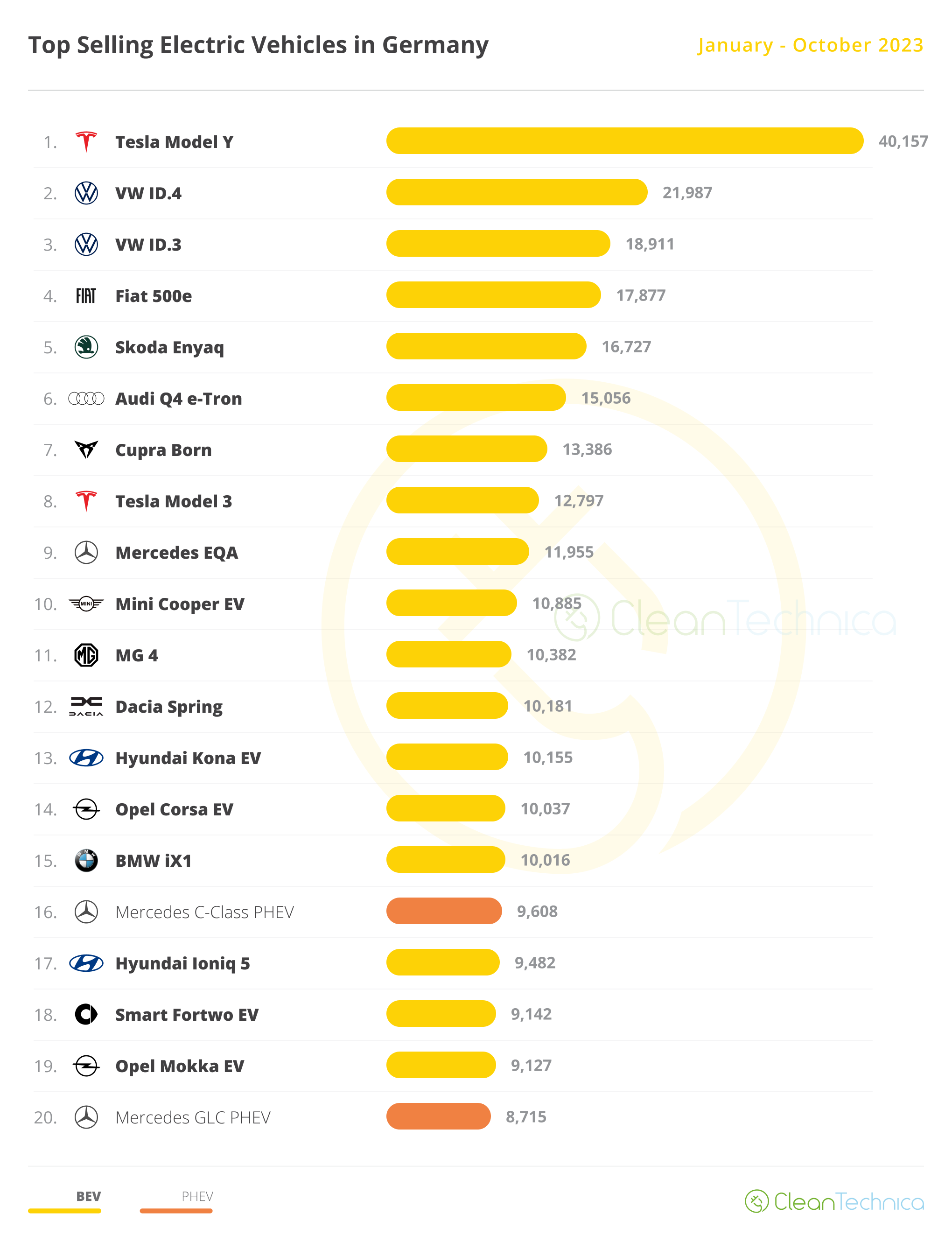

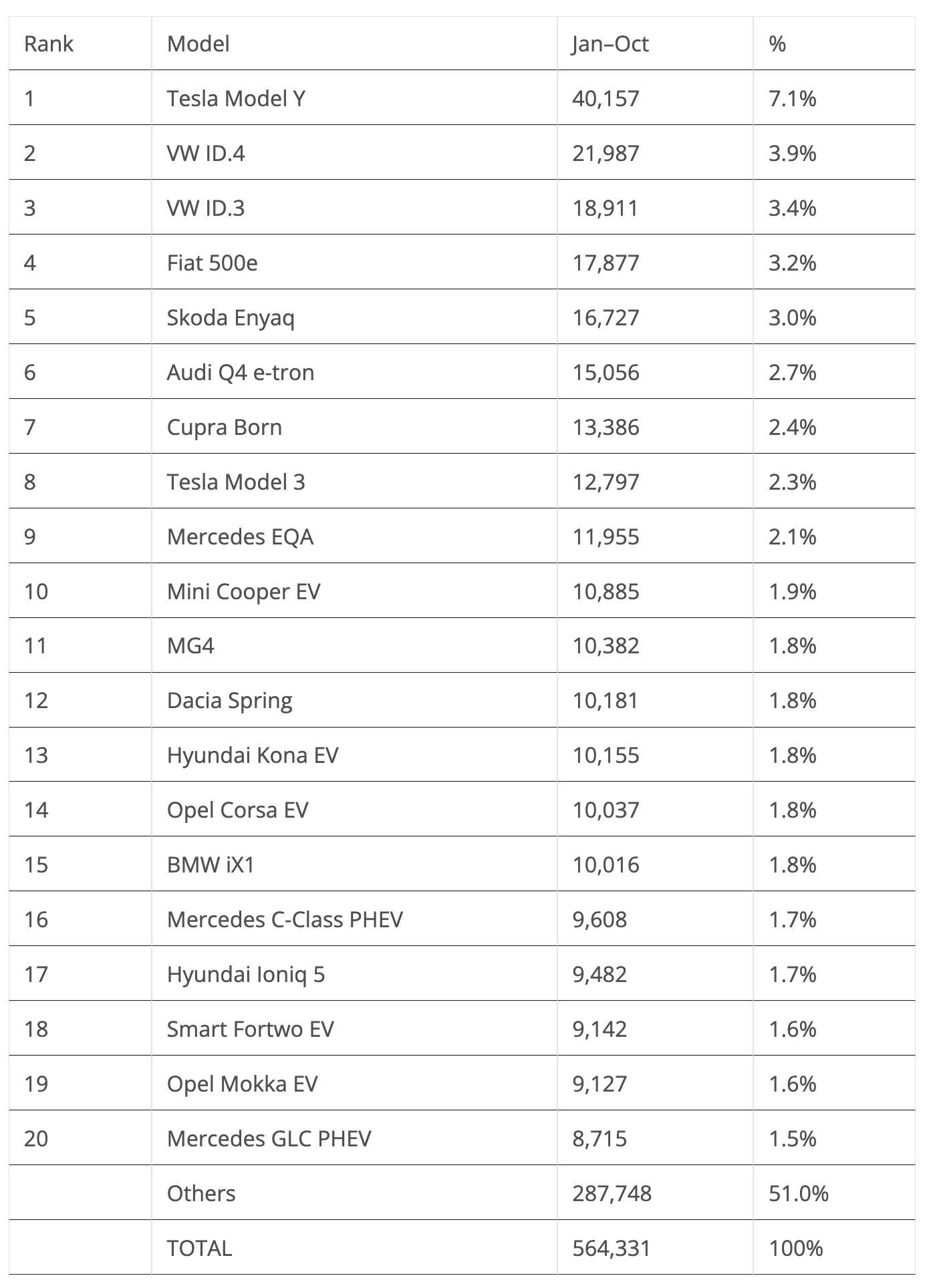

The 20 Best Selling Electric Vehicles in Germany — January–October 2023

Regarding the 2023 table, the Tesla Model Y sits well above everything else, with an 18,000-unit advantage over the runner-up VW ID.4. So, it looks like the US crossover will win its second consecutive best seller trophy in this market. This is disruptive performance for a foreign model in German lands — not only in the EV category, but also in the mainstream market. Expect it to again be the main candidate for the 2024 best seller title, which would allow it to equal the Renault Zoe’s three-year winning streak (2018–2020).

The remaining top positions stayed more or less the same. Despite a significant slowdown, the VW ID.4 should end the year on the podium, which amazingly would be its first medal in its domestic market! The also slowing #3 VW ID.3 has its podium presence in danger, including from the consistent #4 Fiat 500e, which again recovered ground over the German hatchback. With little more than 1,000 units separating the two, the little Italian could displace the German EV from the last place on the podium. Unless …

… the #5 Skoda Enyaq continues to surprise, and surprises both of them in the last days of December.

What about the refreshed Tesla Model 3, some might ask.

While the US sedan should climb some positions, above its current 8th position standing, it is more than 6,000 units behind the #3 VW ID.3, and while it should experience a high tide in December, that shouldn’t be enough to cover the difference, especially considering that by then, Tesla will likely prioritize France due to the end of subsidies for China-made EVs on January, 1st, 2024.

This could mean that for the first time since 2018, and after two bronze medals (2019 & 2020), one gold (2021), and one silver (2022), we won’t see the Tesla midsizer on the German podium!

The only position change in the top 10 happened in the 10th position, with the Mini Cooper EV climbing one spot. It benefitted from the generational transition that the Hyundai Kona EV is currently going through.

The second half of the table looks far more interesting, with five position changes. The Climber of the Month was the MG4. Thanks to a strong result in October, it surged six positions, into 11th, cementing its position as one of the surprises of the year.

Just below, the Dacia Spring was up one position in October to 12th, with the Sino-Romanian model being the third made-in-China model in this ranking.

Still on the topic of the YTD table, the rolling artwork Hyundai Ioniq 5 jumped two positions, to 17th, while the Opel Mokka EV climbed one spot, to 19th. Thanks to the surprisingly good October, Opel kept two models in the top 20 table, something that hadn’t happened for a while.

On a different note, plugin hybrids managed to add one more model to the table, with the Mercedes GLC PHEV returning in #20, helping the #16 Mercedes C-Class PHEV to not feel as lonely in the top 20. Will the 2023 top 20 end this way? If so, that would be half as many PHEV representatives as in 2022, and it might mean that 2024 would be the first year without any PHEVs in the table. … Fingers crossed!

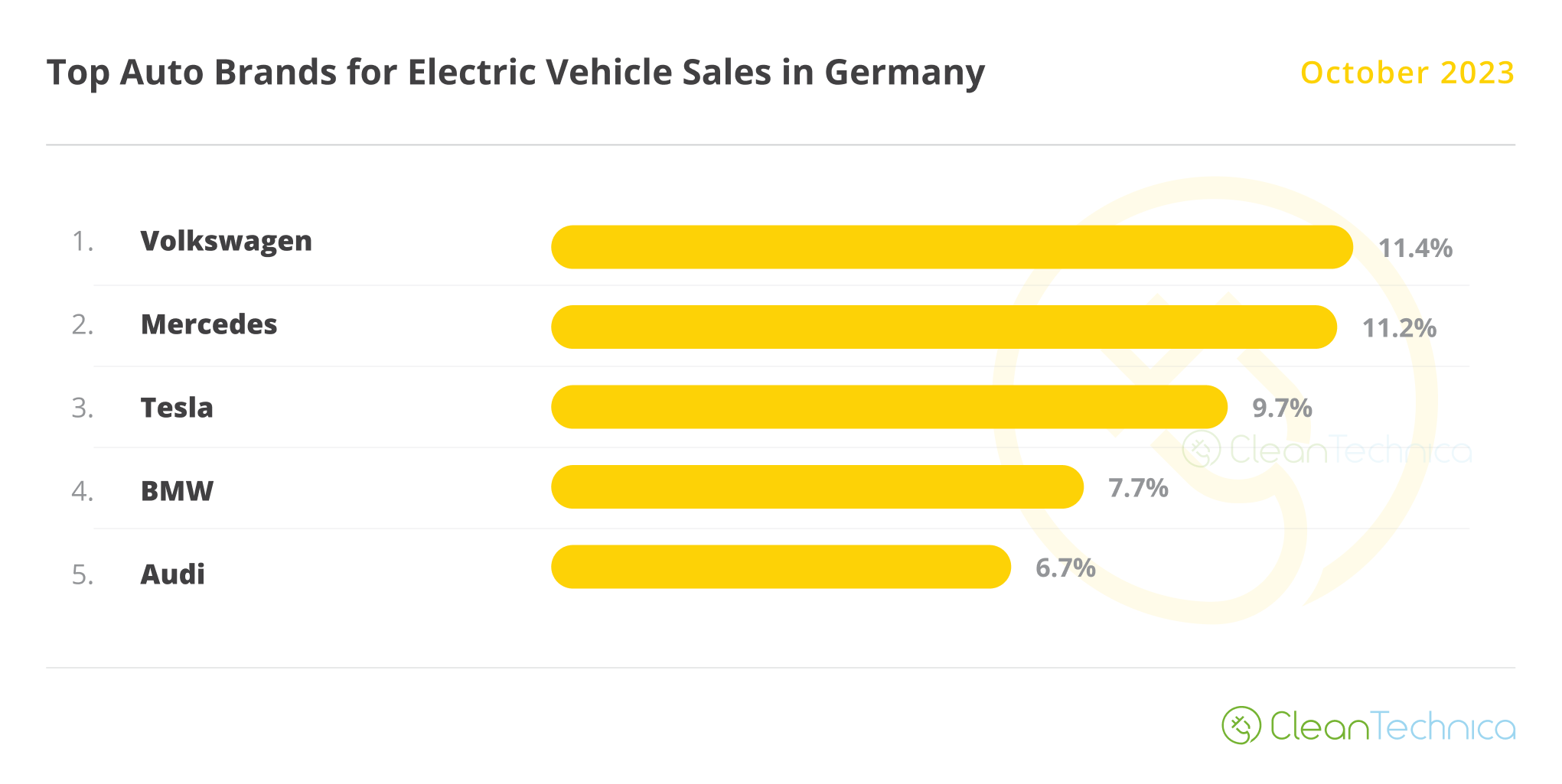

Auto Brands Selling the Most Electric Vehicles in Germany

In the brand ranking, Volkswagen (11.4%, down from 11.9%) kept the leadership spot, but it has lost close to 1.5% share in the most recent months (it had 12.8% in July). This significant demand slowdown could endanger the title revalidation, preventing VW from winning its 4th title in a row, which would equal BMW’s four-win streak between 2016 and 2019.

As for #2 Mercedes (11.2%), despite not gaining share in October, the Stuttgart company won on all fronts, by watching its most direct competitors — #1 Volkswagen and #3 Tesla — lose share. The US company dropped from 10% in September to its current 9.7%. Added to the small share drop in September (down from 10.1% to 10%), this 0.4% drop in two months could mean disaster, but in this particular case, it has to do with two conjoining instances happening at the same time: the Model 3 refresh and the first quarter of the month. Expect the US brand to recover in November, and especially in December — although, that recovery shouldn’t be enough to place it higher on the podium.

The same might not be the case for #2 Mercedes. With leader Volkswagen significantly slowing down, 2023 could the the year that the three-pointed-star make finally wins its domestic manufacturer trophy, after three consecutive runner-up spots….

Another winner in October was BMW (7.7%, up from 7.5%). With the BMW i4 in record heights, the Bavarian make is on the rise, having won 0.4% share in the last two months.

#5 Audi (6.7%, up from 6.6%) seems to have already recovered from the end of BEV subsidies and should end the year in 5th.

As for #6 Hyundai (5%, down from 5.1%), with rising #7 Opel (4.8% share, up from 4.7% in September) closing in, expect a close race for the 6th spot by year end. Fingers crossed.

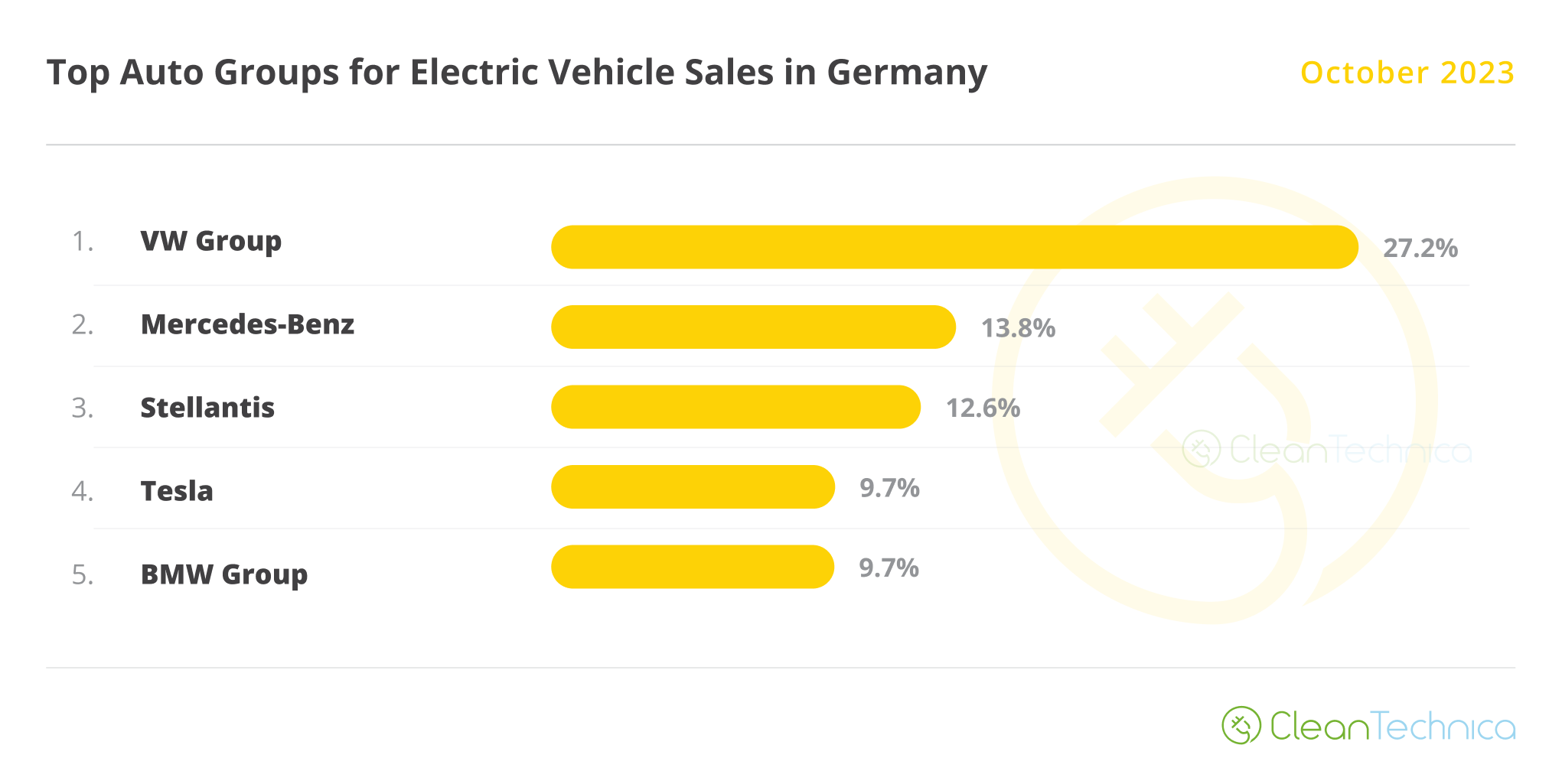

Auto Groups Selling the Most Electric Vehicles in Germany

Looking at the OEM ranking, Volkswagen Group has its domestic market well in hand with 27.2% share. But it lost 1.6% share in just three months, which could mean that some dark clouds could obscure the German OEM’s domination of its domestic market in 2024.

Volkswagen Group is followed at a distance by #2 Mercedes-Benz (13.8%). The OEM profited from a solid performance from its namesake brand.

Stellantis also benefited from a strong month, and although the gains were more modest, up by just 0.1%, the multinational conglomerate raised its share to 12.6%.

In 5th, we have rising BMW Group at 9.7%, up 0.2% share month over month, which would like to surpass #4 Tesla (also 9.7%), but expect the US make to rebound in November, keeping the German OEM at bay.