Tesla continues to be the best selling brand in Europe, but Volkswagen is recovering

Some 311,000 plugin vehicles were registered in June in Europe — which is +42% year over year (YoY). Unfortunately, the overall market also grew fast, +19%, as it is finally recovering from a couple of bad years.

Last month’s plugin vehicle share of the overall European auto market was 25% (17% full electrics/BEVs). That result pulled the 2023 plugin vehicle share to 22% (15% for BEVs alone).

BEVs kept gaining momentum in June, growing 57% YoY. Meanwhile, PHEVs (+17%, highest growth rate this year) had a surprisingly positive result, ending the month with close to 100,000 units. These performances allowed pure electrics to represent 68% of plugin registrations last month, keeping the YTD share at 66%.

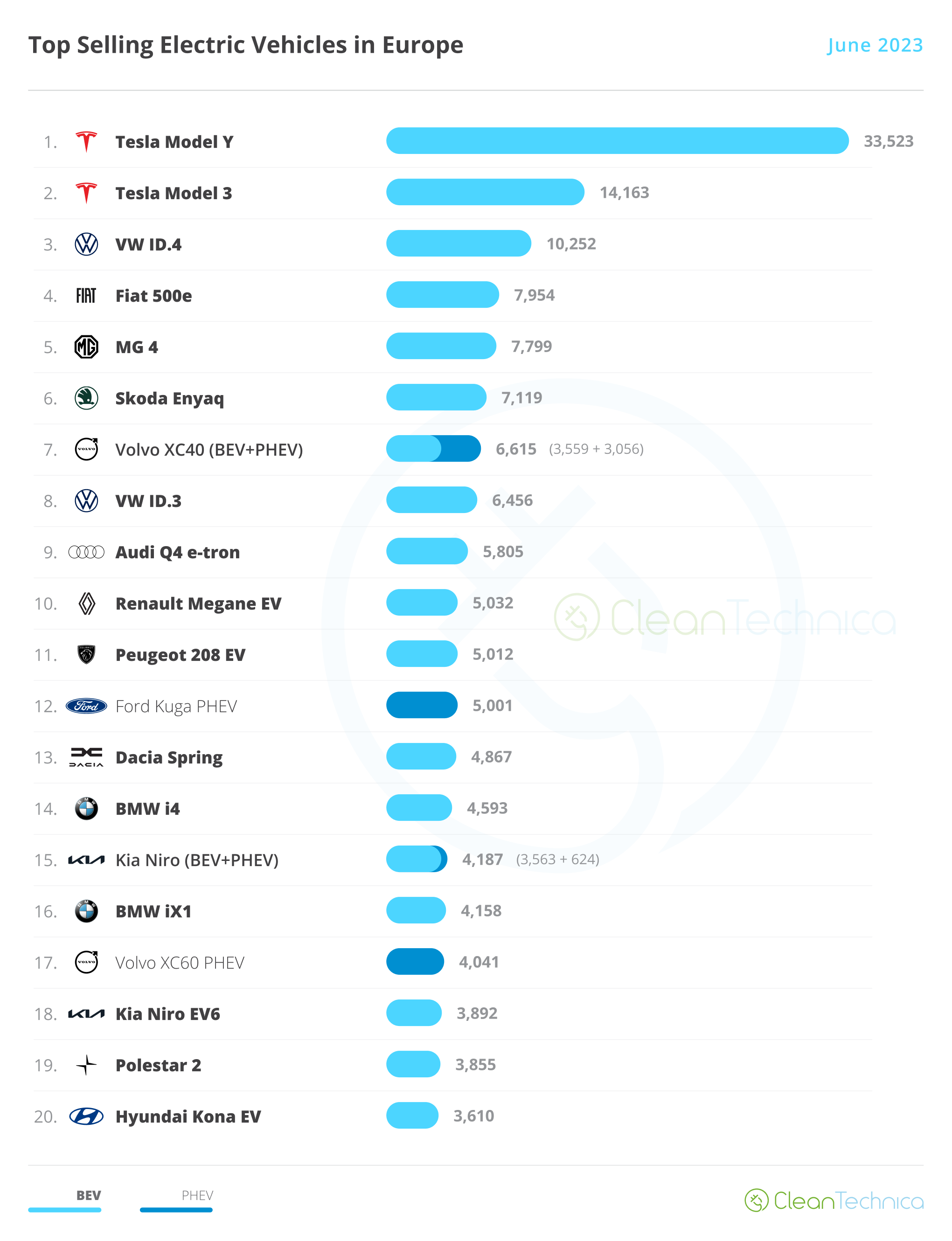

The highlight of the month was Tesla getting #1 and #2 in June. The Model 3 ended in the 2nd spot, but was still well behind the current EV superstar, the Tesla Model Y. But let’s look closer at May’s plugin top 5:

#1 Tesla Model Y — For the 8th month in a row, Tesla’s crossover was the best selling EV in Europe. In June, the midsizer had 33,523 registrations. It no doubt benefited from competitive pricing, and also from the fact that the Model Y is one of the few EVs that has a balanced supply-and-demand ratio, allowing for quick delivery for anyone interested in buying one. This year could be considered “Peak Model Y” in Europe. The midsize crossover should continue to post similar results in the coming quarters in Europe — but do not expect sales to increase significantly over current volumes, as I am confident the Model Y has already reached the market’s natural limits. Regarding last month’s performance, the Model Y’s biggest European markets included Germany (6,098 units), France (4,335), Norway (3,127), the UK (5,500 units), Sweden (2,408 units), Denmark (2,164), and the Netherlands (1,778 units), while Belgium had a surprisingly high number of deliveries as well, 1,300.

#2 Tesla Model 3 — The midsize sedan is a sure value in the EV arena, and although it is now relegated to the role of #2 in the Tesla lineup, the good looking sedan has managed to end June in the runner-up position thanks to 14,163 sales, allowing Tesla to get first and second place. Expect sales to rebound once the upcoming refreshed version lands. Although, it is anybody’s guess how much more volume it might add, and if the production ramp-up of the refreshed Model 3 goes smoothly enough. Regarding the Model 3’s June results, the distribution of deliveries was more unequal than in the Model Y’s case, with bigger markets like France (3,966 units), the UK (1,962 units), Germany (1,668 units), and Italy (1,010) taking the largest chunk of sales. Maybe Tesla is directing the Model 3 more to fleet sales?

#3 VW ID.4 — The Volkswagen crossover won another podium position in June thanks to 10,252 registrations. With increased production availability, thanks to local USA production and the start of production in Emden, the ID.4 now has enough firepower to compete for the #2 spot in 2023, looking to improve on the #3 spot it scored last year. Will the crossover get there? One thing is certain: last year’s runner-up, the Tesla Model 3, no longer seems unbeatable. Regarding the ID.4’s June performance, its main market was its home market of Germany (3,754 registrations), followed from a distance by Norway (1,176 units), the UK (1,016 registrations), and Sweden (972 registrations).

#4 Fiat 500e — Without reaching the sales levels of previous months, the little Italian nevertheless had a positive month, with the new Abarth hot hatch version probably helping a lot. With 7,954 sales, the best selling city car is currently in recovery mode after a slow start to the year. This time, Germany was its largest market, with 3,004 registrations, followed by France (2,781 registrations) and its home of Italy (452 registrations). This last result might seem a little low, given Italians’ love for domestic brands and small cars, but the explanation probably has more to do with the fact that Italy is below the curve when it comes to EV adoption.

#5 MG4 — The compact hatchback is fulfilling MG’s best expectations, earning another top 5 presence in June thanks to 7,799 registrations, which is a new record. With a purposeful look, good handling, and good enough interior materials, the Sino-British hatchback is sort of like an electric Ford Focus that the US brand has refused to make. With Dearborn’s European arm now little more than an extension of the US marketing team (SUVs = Freedom & Americana), there is a hole in the B and C segments for mainstream hatchbacks with a focus on good handling and smart design. With the MG4 now filling the role of the electric Ford Focus, who will fill the role of the electric Ford Fiesta? But I digress. Back to the MG4’s June’s performance. Its main markets were its (adopted) home market of the UK (2,213 registrations) and France (2,511 registrations), which incidentally are two big markets for hatchbacks. The remaining markets ended at some distance behind, like the case of Germany (928 registrations).

Looking at the rest of the June table, let’s look at a few highlights. The #6 spot of the Skoda Enyaq was celebrated with a record performance from the Czech model, 7,119 registrations, while the Renault Megane EV had a positive result, ending in 10th with 5,032 registrations. That made it the best selling French model in this table. The problem is that the best selling French model was only 10th….

The second half of the table also witnessed record performances, like the BMW iX1 scoring its second record result in a row, this time with 4,158 registrations, allowing it to be 16th.

Finally, the Kia EV6 scored a best ever score of 3,892 units, with the sleek hatchback-in-crossover-disguise being the best selling Korean model on the table.

Below the top 20, we had several models with positive performances, like the MG ZS EV, with 3,032 registrations. That was the crossover’s best result in two years, highlighting the good moment that MG is experiencing. Volkswagen Group had a #1 plus #2 win in the full size category, with the Audi Q8 e-tron taking the highest podium position thanks to 2,875 registrations, its best score since it changed its name to the current one, while the Porsche Taycan this time was #2, with 2,473 registrations. Will the sports sedan be able to reach the category top spot anytime soon?

Finally, in the Stellantis stable, besides having several solid results — from the Opel Corsa EV (3,072 units), the stylish Opel Mokka EV (3,587 registrations), and the slick crossover Peugeot e-2008 EV (2,688) — the Stellantis highlight this month is coming from Jeep, with the little Avenger EV scoring 1,206 deliveries in only its second month on the market. Expect for the Polish-made American model to start knocking at the door of the top 20 in a few months.

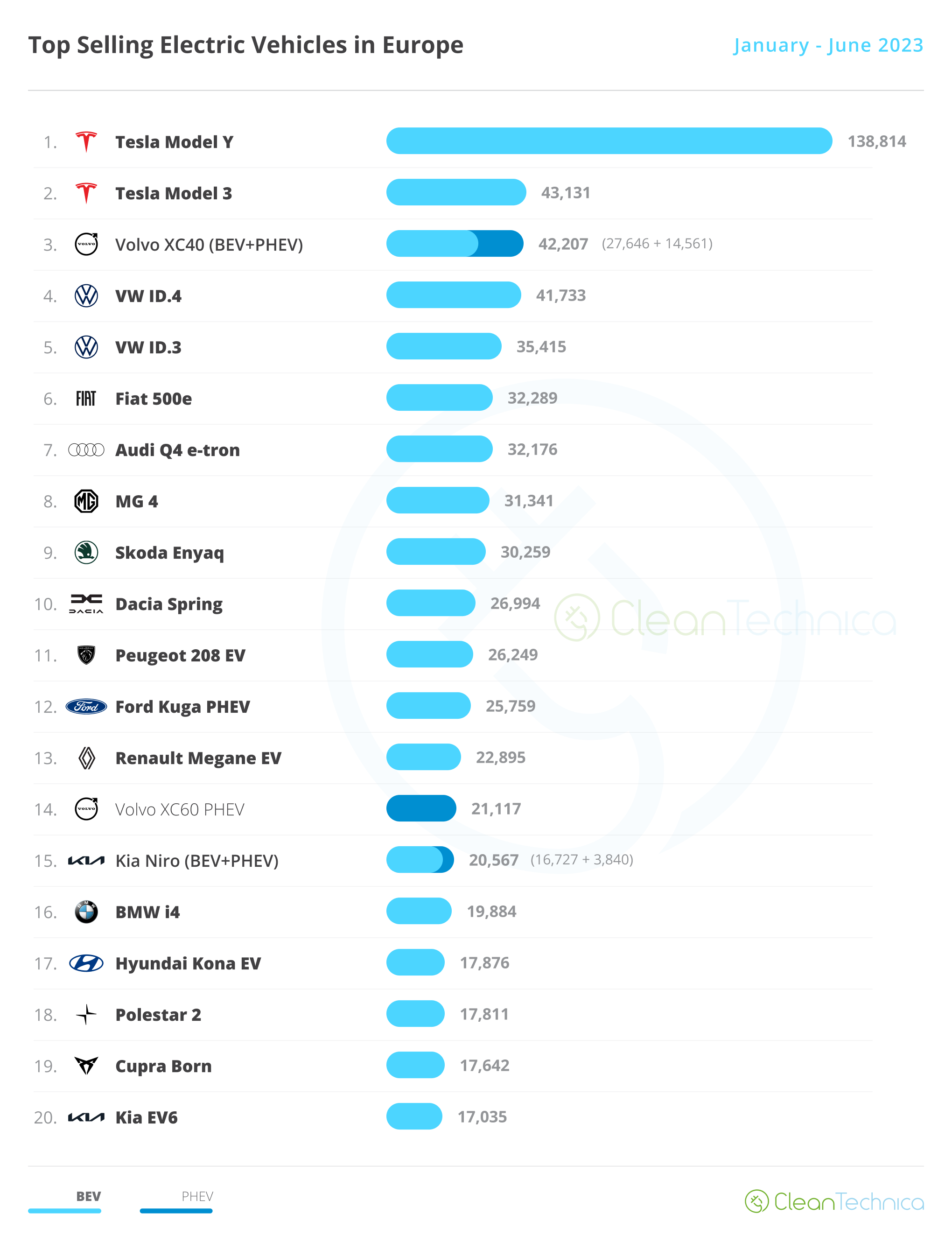

Looking at the 2023 ranking, with the Tesla Model Y having three times as many deliveries as the new runner-up Tesla Model 3, the attention is now focused on the remaining podium positions.

On that topic, the Tesla Model 3 jumped two positions in June, to 2nd place, allowing Tesla to have a #1 plus #2 lead in the European market. But the Tesla sedan will have a hard time holding onto silver, because both the Volvo XC40 and the VW ID.4 are fewer than 2,000 units behind. And while the Swede will probably start suffering from the comparison with Volvo’s newborn EX30, of which the 7th position in June could be an early sign of fatigue, the German crossover will surely be a tough adversary to beat.

Elsewhere, let’s look at the remaining position changes. The Fiat 500e continues to climb up the table, having risen in June to #6, gaining important ground over the #10 Dacia Spring, its most direct competitor in the city car category. With Renault’s Twingo EV and Zoe showing their age, the Megane EV suffering at the hands of the competition (and needing a price cut?), and the Nissan Ariya selling below expectations, cruising under 1,000 units/month, the Renault–Nissan Alliance is in real need of a sales champion to avoid an over-reliance on the Dacia Spring’s performances. In this context, it is strange that Renault has decided to end the production of the Zoe by next March, when its successor, the Renault 5, is only set to land by the end of 2024, assuming there are no delays in the meantime. Talk about a self-inflicted wound….

In the second half of the table, the highlight is the two-position jump of the Polestar 2, which was up to #18 and hopes to reach the #16 BMW i4 by the end of the year. Still in the midsize category, the Kia EV6 rejoined the table in #20, replacing the Lynk & Co 01 PHEV, which experienced a slow month and was kicked off the table. That means that now we have only two plugin hybrids in the table, the #12 Ford Kuga PHEV and the #14 Volvo XC60 PHEV.

It is interesting to see that while the Tesla Model 3 has three direct competitors on the table (BMW i4, Polestar 2, and Kia EV6 — let’s face it, removing all the marketing bla bla bla, the Korean is nothing more than a sightly raised hatchback), the Tesla Model Y black hole effect has effectively dried out its direct competitors, with the only other midsize crossover/SUV in the top 20 being the Volvo XC60 PHEV, which appeals to a different demographic.

Thinking deeper about this topic, the truth is that unlike the Model 3, the Model Y does not have relevant and direct competition coming from the local heavyweights. Audi is yet to release the Q6 e-tron (late 2023, early 2024?). The Mercedes EQC is 4 years old — but considering the evolution that Mercedes SUVs had in the past year (EQS SUV & EQE SUV), it looks to have double that age. The BMW iX3 … well, let’s not even go there. Currently, the only model that could tickle the Model Y’s category domination in Europe (and North America) would be the Ford Mustang Mach-E, but Ford’s current production constraints, allied to unjustifiably high pricing, is preventing Ford’s Model Y-fighter to go above the current 2,632 units in June, which is less than what the big, fat, pricey Audi Q8 e-tron had in the same period.

In the automaker ranking, Tesla is leading with a comfortable 13.1% share, up 0.7% compared to May, with Volkswagen in the runner-up position with 8.5%, up 0.2% compared to the previous month.

3rd placed BMW (7.9%) gained precious advantage over Mercedes (7.4%, down from 7.7%), but with only 0.5% share separating the two, a lot can still happen between them.

Finally, Volvo (6.2%, down from 6.5%) is still comfortable in 5th, with #6 Audi (5.3%) and #7 Peugeot (4.7%) at some distance behind.

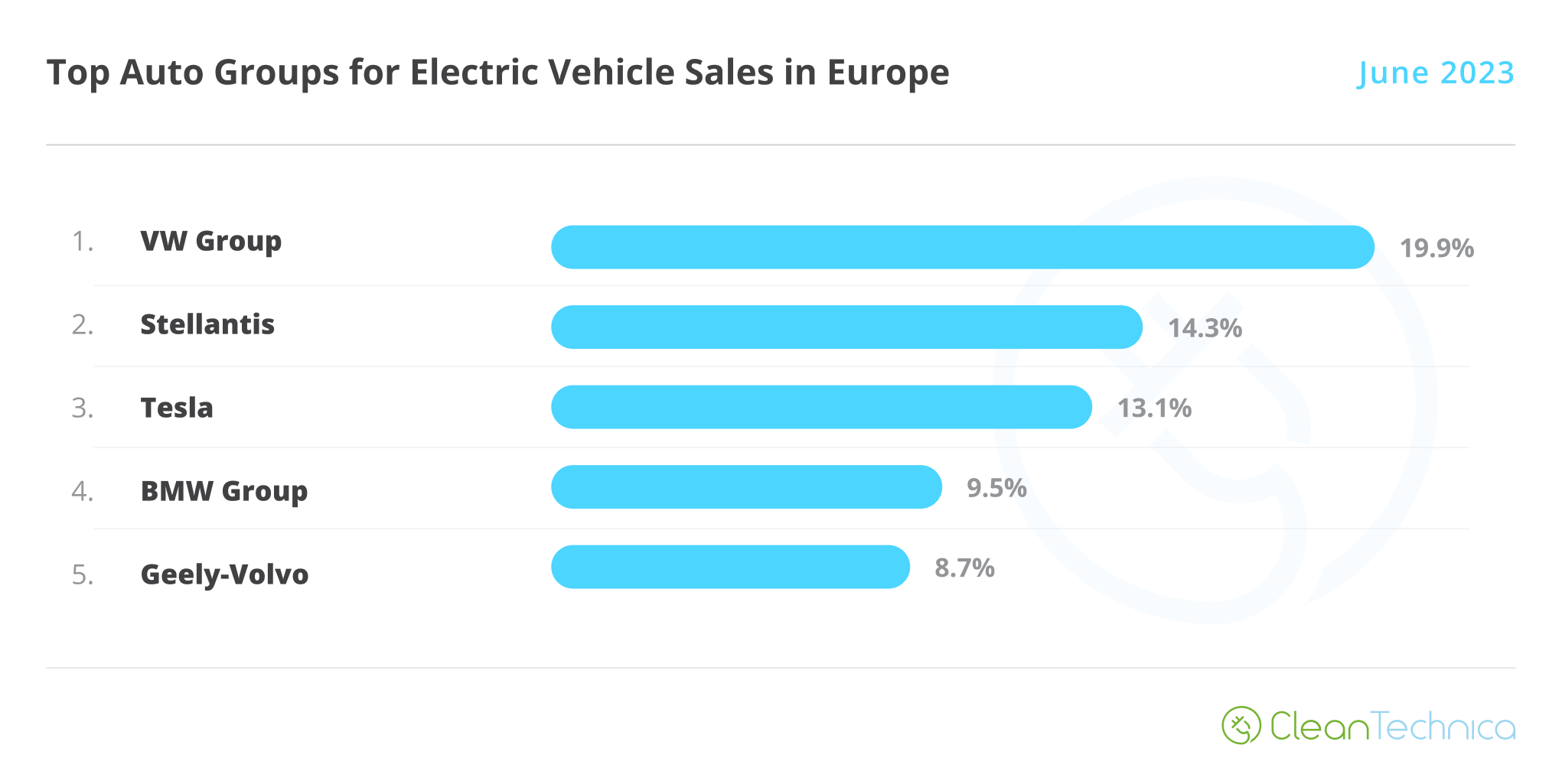

Arranging things by automotive group, Volkswagen Group was up to 19.9%, keeping a comfortable lead over new runner-up Stellantis (14.3%, up 0.4% from the previous month).

Peak Tesla jumped from 12.4% to 13.1%, and expect the US automaker to try and go after the #2 position in the second half of the year.

Off the podium, #4 BMW Group was stable at 9.5%, while #5 Geely–Volvo suffered from poor performances from Volvo and Lynk & Co in June and dropped 0.6% share, to 8.7%.

Still, with #6 Mercedes-Benz Group at some distance (8.3%, down from 8.6%) and #7 Hyundai–Kia stable at 8.2%, Geely should remain in 5th during the next few months.

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it! We just don’t like paywalls, and so we’ve decided to ditch ours. Unfortunately, the media business is still a tough, cut-throat business with tiny margins. It’s a never-ending Olympic challenge to stay above water or even perhaps — gasp — grow. So …