A report by USA Today claims that Tesla is taking a look at StoreDot XFC battery technology. While there is no suggestion of a merger, acquisition, joint venture, or collaboration between the two companies, Tesla is always interested in new technologies that may enhance the performance of its electric vehicles or how to manufacture them more competitively. That sort of curiosity led to it purchasing Maxwell Technologies in 2009.

StoreDot has gained recognition for its revolutionary battery architecture, which leverages nanomaterials and organic compounds to enable rapid charging without compromising overall battery capacity. The examination of StoreDot’s XFC batteries by Tesla underscores the company’s dedication to improving charging experiences and reducing charging times for its customers.

USA Today says that while the examination of StoreDot’s XFC batteries by Tesla is not indicative of an immediate partnership or collaboration, it signifies Tesla’s continuous pursuit of next-generation battery technologies. Tesla’s expertise in battery management systems and vehicle integration makes it a leading authority in evaluating and optimizing new battery technologies for use in its electric vehicles.

As Tesla explores StoreDot’s XFC battery technology, it is expected to conduct rigorous testing to evaluate safety, reliability, and longevity. Tesla’s commitment to ensuring the utmost quality and performance in its electric vehicles will play a vital role in assessing the viability of StoreDot’s batteries for future integration. StoreDot’s XFC batteries have the potential to accelerate the adoption of electric vehicles by providing faster charging capabilities, thereby driving the widespread acceptance of cleaner transportation alternatives.

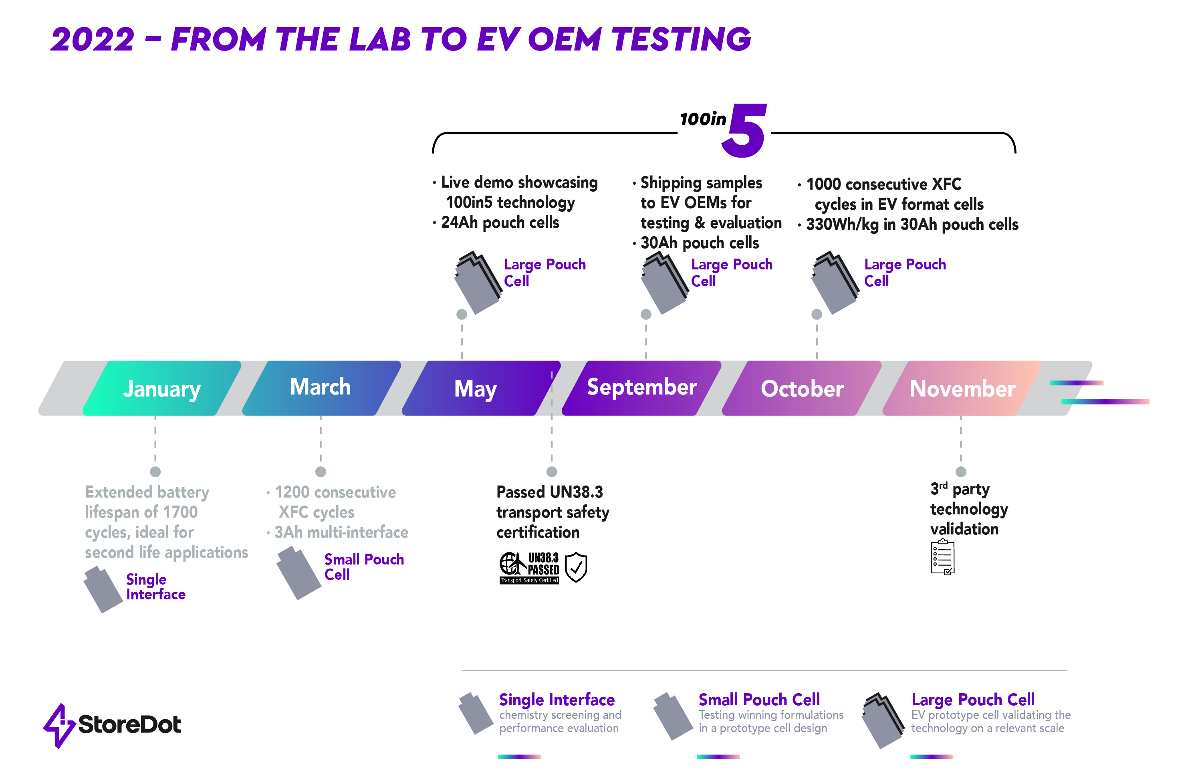

Tesla may have decided to take a closer look at StoreDot’s XFC (extremely fast charging) batteries after its performance was verified in independent tests late last year. Shmuel De-Leon, an internationally renowned expert in the field of energy storage and electric mobility, subjected StoreDot’s production-ready XFC batteries to a series of in-depth tests, confirming the technology’s commercialization viability and its superior fast charging and high energy performance in comparison to any known XFC battery solutions for the EV sector.

The intensive independent testing program covered energy density, charging rate, operating conditions, and cycling. The results corroborated a sector-leading energy density of 300Wh/kg and 1000 consecutive XFC cycles for StoreDot’s proprietary technology, which uses existing manufacturing equipment. The tests proved that the StoreDot technology exceeded the performance of all other battery solutions.

At that time, Doron Myersdorf, CEO of StoreDot, said, “In recent months we have successfully concluded live public charging demonstrations of StoreDot’s XFC batteries. However, handing over our technology for independent assessment by leading battery labs of Shmuel De-Leon Energy was essential for us for independent validation of our extreme fast charging technologies.

“We are delighted to have passed yet another milestone on our strategic road map to deliver mass adoption of EVs with flying colors. It is particularly gratifying to have the commercialization validity and superior performance of StoreDot’s XFC and high energy technology verified by leading experts in the field. In addition, our technology continues to be trialed in the real world by our leading automotive partners.”

Slow Progress For Tesla Mexico

Chinese media source LatePost is reporting that the new Tesla factory planned for Mexico may be larger than originally expected but production won’t begin until 2025, based on feedback from potential suppliers based in China who say that 2025 is the date Tesla has told them to be ready to ship components to Mexico.

Several suppliers have said Tesla has told them that if they fail to get local production up and running in Mexico by 2025, it will not only be difficult to get a Giga Mexico order in the future but orders for other Tesla plants could also be lost. According to one supplier, the production costs for the same component in Mexico are about 15% higher than in China. This means that the purchase price for Tesla would be around 18% to 20% higher.

Based on the information Tesla has shared with its suppliers in China, the company wants to make certain that enough components will be ready for the start of production in about one and a half years. The model established at Giga Shanghai of sourcing over 95% of the components locally does not seem to be applied in Mexico, at least to begin with.

But Eugenio Grandio, who is leading the construction of the new factory in the state of Nuevo León, claims Tesla is focusing on finding local suppliers for its next-generation vehicle, according to a report from Bloomberg. He said Mexico has an “amazing” amount of automotive suppliers, many of which already supply parts to Tesla. He also says that opportunities for manufacturers of internal combustion engine parts are anxious to transition their businesses to making parts for electric vehicles.

“There are a lot of possibilities where some older suppliers that used to make components for combustion cars will transition to electric. There are going to be a lot of possibilities for companies from all over the world coming to Mexico, joining us, and creating also talent that could innovate internally to help us continue growing,” he said.

Giga Mexico To Be Twice The Original Size

When Tesla announced last March that it plans to build a new factory in Mexico, the information provided by the company was that it would invest about $5 billion to build a factory with an annual capacity of 1 million electric cars. The latest report from LatePost suggests the factory may actually be capable of building up to 2 million vehicles a year. The projected investment by Tesla is now $10 billion and the factory is expected to employ more than 7,000 workers when it is completed.

According to the LatePost, the construction of the factory appears to be proving more difficult than expected, which is pushing the start of production back to 2025 rather than late 2024 as originally expected. Work on Giga Texas began within days after it was announced, but that has not been the case for the Giga Mexico factory. The report cites logistical hurdles, but also poorer existing infrastructure and higher labor costs.

The wait will be worth it, however. Giga Mexico is supposed to become the first plant to manufacture Tesla vehicles on its latest “Gen3” platform. After the launch in Mexico, Tesla will also use the new platform in its other factories. According to Elon Musk, Tesla expects to build 5 million new cars a year that are based on the new platform.

The Takeaway

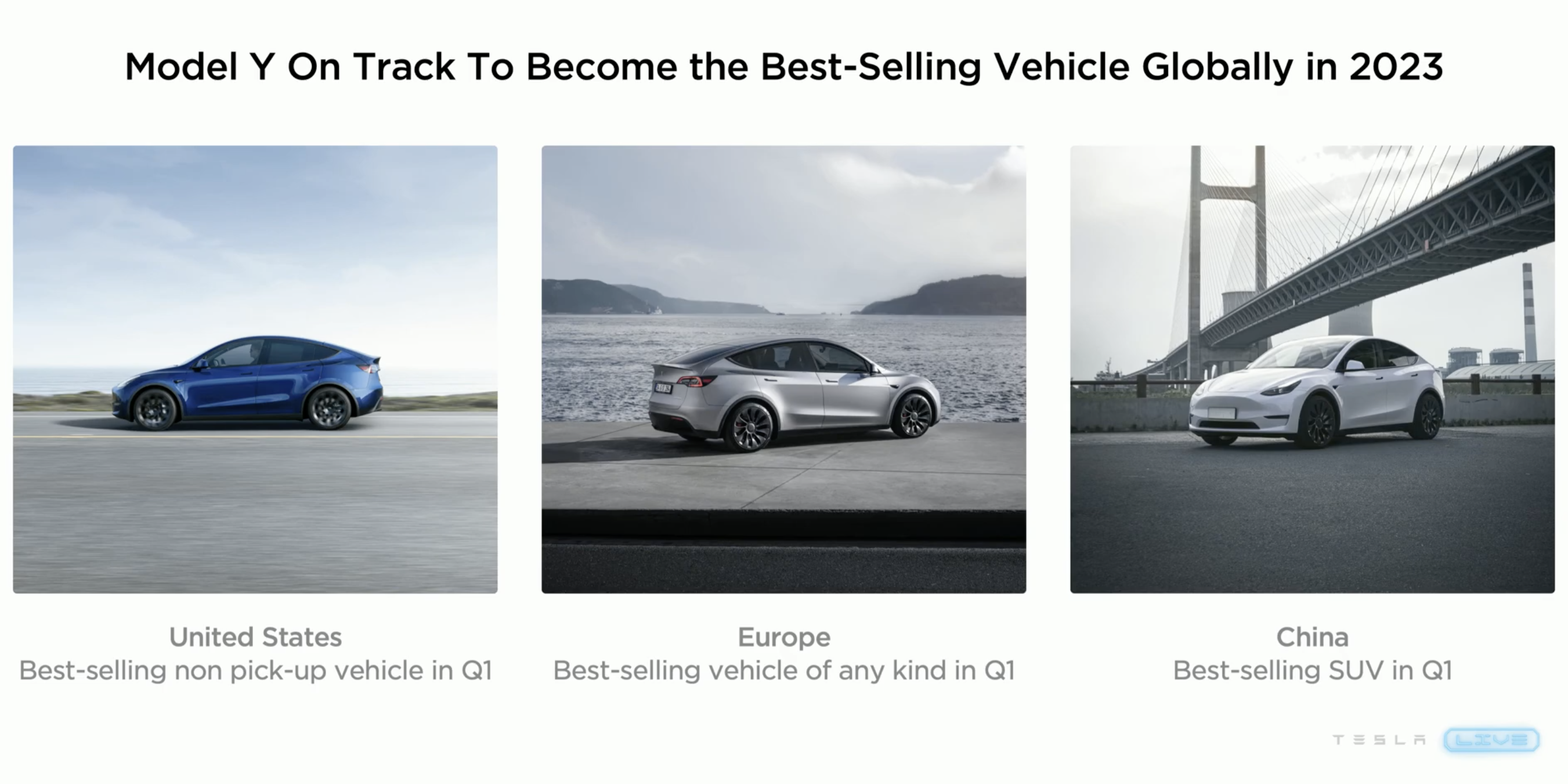

The upshot from the Tesla news this week is that the company continues to power its way ahead as the leader of the EV revolution while the rest of the automotive world struggles to keep pace. In the short term, its stock price gyrates up and down, which gives shareholders moments of great joy followed by times of deep despair, but the long-term prospects for the company are excellent. It is not too proud to look at new technologies from other companies, although what may come of that nobody knows. Nor is it resting on its laurels when it comes to formulating bold plans for the future and then executing them.

Things inside the company may be turbulent, but to those on the outside, Tesla gives the appearance of a juggernaut rolling over any and all obstacles on its way to becoming the largest, richest, and most powerful company in the galaxy. Those who get against Tesla being successful do so at their peril.

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it! We just don’t like paywalls, and so we’ve decided to ditch ours. Unfortunately, the media business is still a tough, cut-throat business with tiny margins. It’s a never-ending Olympic challenge to stay above water or even perhaps — gasp — grow. So …