Who would have thought that those markets are connected? They are.

Unexpected Connections

All right, bitcoin is an alternative to fiat currencies, just like gold and silver are, but what about tech stocks? What could they have in common with the precious metals market?

More than it seems at the first sight. In particular, values of mining stocks and tech stocks moved in a very specific way in the past, and since the current situation appears to be very similar to what we saw over two decades ago, it’s time to pay attention.

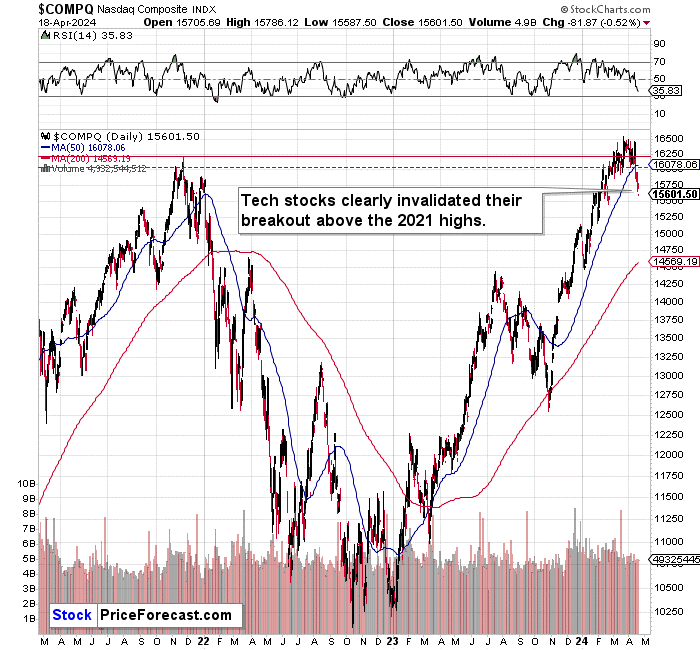

The NASDAQ just clearly (!) invalidated its breakout above the 2021 highs. This is a huge deal, as tech stocks were the most popular and leading ones during the current (previous?) rally.

AI will change the world! Bitcoin is the new dollar! And so on. The new paradigm.

And yes, AI will change the world, but it’s overhyped at the moment in my view. It’s Dot-com bubble 2.0. Just because AI will change the world, it doesn’t mean that it will all happen now. Sure, some advancements have become immediately useful, but the hype was way too big – just like it was the case with the Internet in general. It did change the world, but the initial rally in tech stocks – and in the stock market in general – was a speculative bubble. Most likely we saw one this time as well.

NASDAQ’s invalidation of the move above the previous highs is a huge deal, because it’s a clear technical sign that “this is it” – this is the top.

This is important for us, precious metals investors and traders, because of the specific link between tech stocks and mining stocks.

If this is the Dot-com bubble 2.0, then what happened in the 1.0 version is likely to apply this time a well – history rhymes, after all.

The decline tech stocks took mining stocks with them. To clarify – they both fell together until tech stocks reached their previous lows, and then miners bottomed while tech stocks continued to slide.

In this case, the previous low is at about 10,000, so it looks like we’re about to see miners fall in a MAJOR way.

NASDAQ fell decisively yesterday, proving that the breakout above the 2021 high is history, and confirming my bearish indications from the previous weeks.

This is major sell signal not just for tech stocks, but for all other stock market indices, as the U.S. tech stocks were so important in leading the recent upswing.

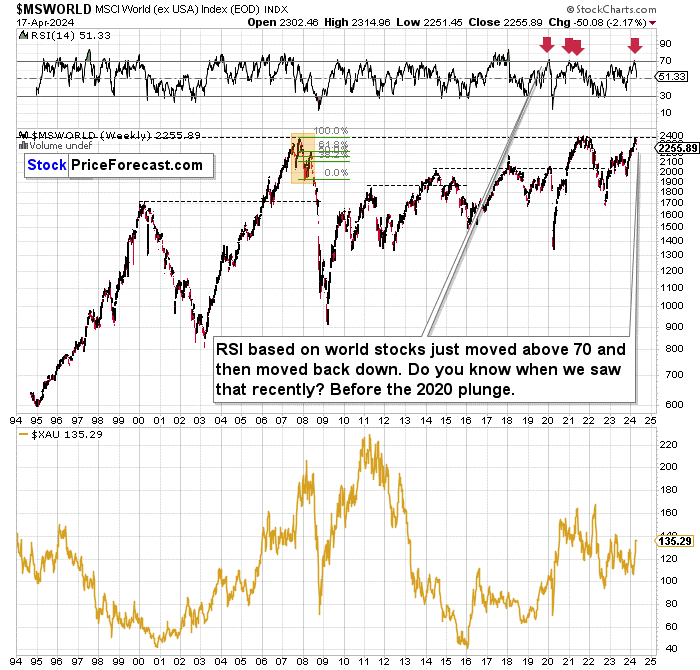

World stocks moved to their all-time high, which already worked as the ultimate resistance that stopped the rally, not just in stocks, but also in the miners (lower part of the chart).

And just as the miners topped along with stocks at those levels, the same thing is likely happening now.

Based on the most recent decline in world stocks (and RSI based on it), it seems that the slide has already begun.

The above 30-year chart also does a great job at putting the recent rally in the mining stocks into perspective. Can you see how little miners rallied in 2024 compared to where they were moving previously? And that’s what happened with gold rallying to new all-time (nominal) highs. Miners are truly extremely weak, and when stocks finally slide in a major way, miners are likely to decline in a really extreme way.

It seems that this enormous slide is already underway, but almost nobody is noticing that.

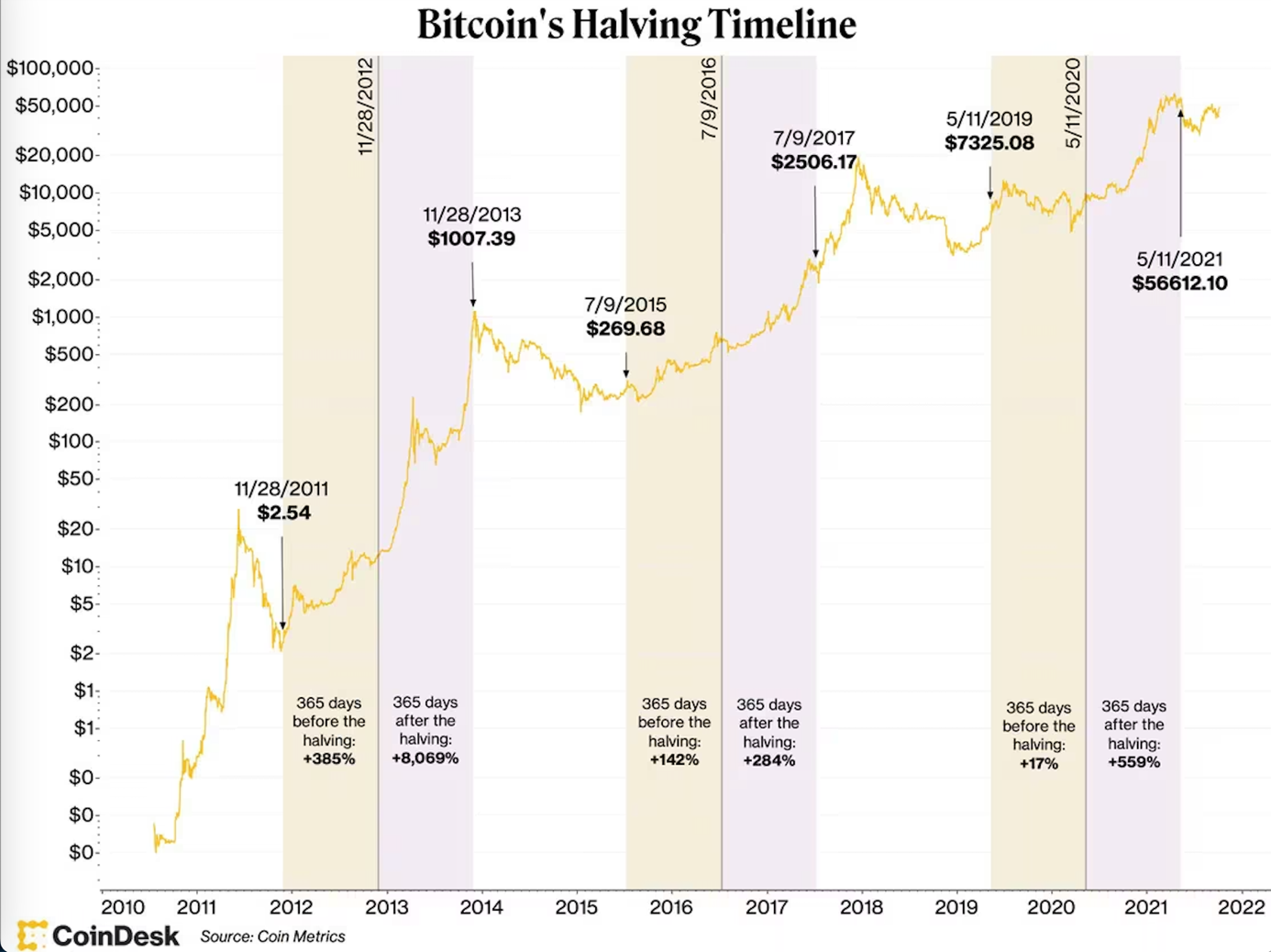

The situation in bitcoin supports all of the above.

The momentum is gone, the breakouts above the 2021 highs are invalidated, and this popular USD alternative is declining while the USD itself is rallying.

Interestingly, this is the time when people are expecting bitcoin’s halving to trigger a rally as that’s what’s been taking place in each case that it happened.

In my opinion, this argument is very weak. The truth is that bitcoin was in a long-term uptrend, and pretty much wherever you’d put any type of cyclical measure, it would show you that over the medium run, the price moved up.

And now, everyone and their brother (at least in the circles that are interested in cryptocurrencies) are expecting bitcoin to rally once again as the halving is [going to take place this weekend].

You know what happens when everyone interested in a given market expects some kind of event to trigger a substantial rally? They buy BEFORE that event takes place. And what – in this case – happens once the event does indeed finally take place? Since everyone interested had already bought, at that moment, the price… falls, despite the fundamental reasoning.

Sounds crazy?

That’s exactly what happened when the SLV ETF was launched. Remember what people were saying many years ago when this ETF was about to be launched? Silver was already rallying in expectation of this event that would make silver available to the wider public, huge amounts of investment capital were supposed to drive the price of silver to the moon. Triple-digit silver was a sure bet.

What happened?

Silver rallied in the immediate aftermath of the SLV ETF being launched and then it plunged – erasing 1/3 of its value.

The EXPECTATIONS of the launch have driven the price of silver higher, but when that finally took place, the rally was erased.

Market Realities

So, will bitcoin halving really drive its price higher in a sustainable way, just as it is widely expected? Nope. It might rally for several days, but then it’s likely to slide.

With rallying USD and declining… Stocks, bitcoin, and many other assets will gold, silver, and mining stocks really hold ground? The history and analogies to 2008 and 2020 suggest otherwise. Precious metals and miners are likely to slide along with stocks as the USD rallies, at least initially (in terms of weeks/months). Then, as stocks continue to move lower, PMs and miners are likely to start a massive rally. The current rally in gold is likely over, and what we see now are likely just temporary, geopolitically driven upswings that are likely to be followed by bigger declines, just like what we saw after powerful reversals that formed on huge volume levels.

Is this time really different? Those are expensive words on the market. What is much more likely is that the history is rhyming once again. Let’s profit from it.

*********