Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

A few days ago, my colleague Remeredzai Joseph Kuhudzai wrote a story about how more affordable electric cars are beginning to arrive in many places around the world, particularly China, but also in South America and parts of Europe. This week, the people at Transport & Environment write that automakers are failing to deliver affordable electric cars. The lack of cars in lower price ranges is holding back the EV revolution, they argue.

It wasn’t supposed to be this way. When the Tesla Model S arrived more than a dozen years ago, Elon Musk made it clear that it was aimed at the high end of the market and that the profits from selling that car would make it possible to make lower priced cars in the future. That was the essence of Musk’s super secret plan, Part One. The reality is that Tesla has talked the talk but failed to walk the walk. Rumors of a new Tesla model priced around $25,000 are rampant, but as yet are just that — rumors.

In the US, GM and Ford have promised lower cost electric cars and trucks, but failed to deliver them. The $30,000 Chevy Equinox EV is now priced at $35,000 for a heavily de-contented model. All the trim levels actual buyers will want are priced $10,000 to $15,000 higher. The vaunted Ford F-150 Lightning work truck costs $10,000 more than promised and better equipped versions are up to $20,000 more expensive than promised. The price of electric cars isn’t dropping, it’s going up instead.

Electric Cars In EU Are Too Costly

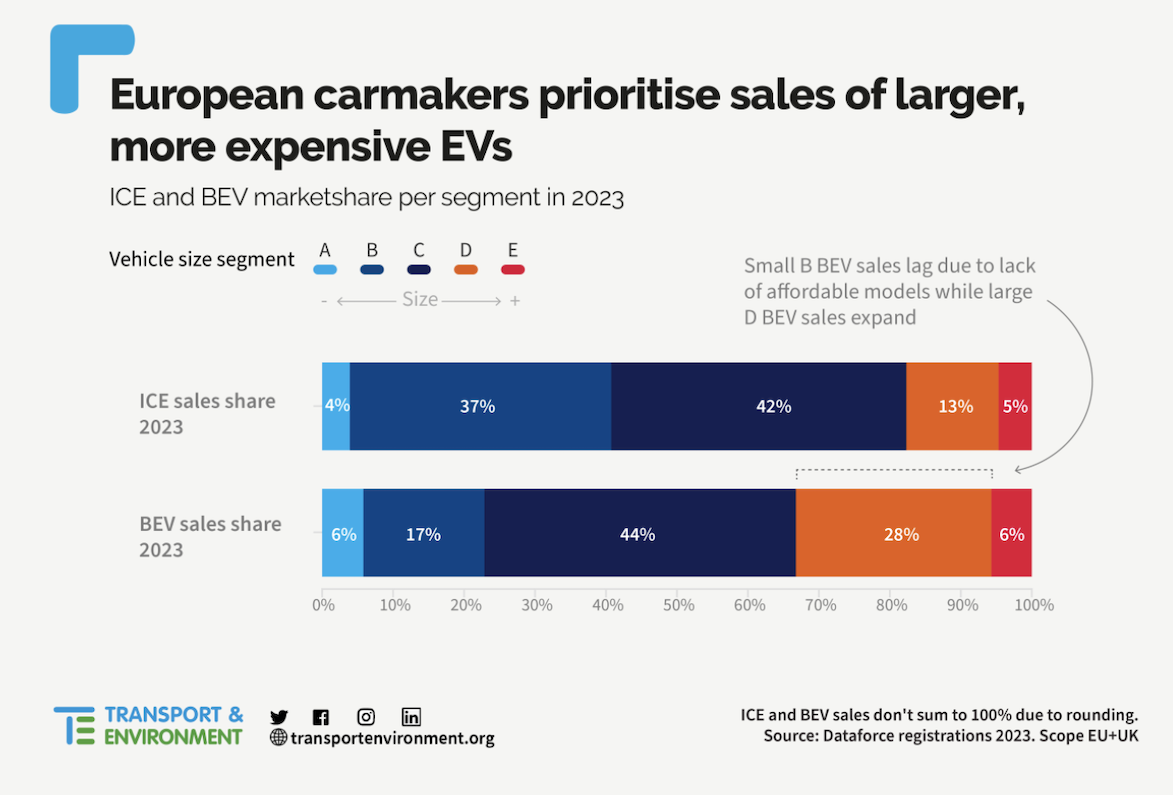

“A disproportionate focus of manufacturers on large SUVs and premium models means we have too few mass-market cars,” T&E says. Just 17% of electric cars sold in Europe are compact vehicles in the cheaper B segment, compared to 37% of new combustion engines. Carmakers are slowing EV adoption by prioritizing sales of larger, more expensive electric cars, according to Transport & Environment, which conducted the research. Only 40 fully electric models were launched in the compact segments (A and B) between 2018 and 2023 compared to 66 large and luxury models (D and E), according to T&E.

In Europe, 28% of electric sales are in the large car D segment compared to just 13% of new combustion cars, according to T&E’s analysis of 2023 sales figures from Dataforce. The average price of electric cars in Europe has increased by 39% (€18,000) since 2015, while in China it has fallen by 53%. This is due to European manufacturers’ disproportionate focus on large cars and SUVs, which carry a price premium.

Stagnating car CO2 targets until 2025 have allowed carmakers to prioritize the limited supply of BEVs required by the CO2 regulation by focusing on the premium and large segments while failing to deliver affordable, entry level models to the EU market at volume.

Anna Krajinska, vehicle emissions manager at T&E, said, “European carmakers are holding back the mass market adoption of EVs by not bringing affordable models to consumers faster and at volume. The disproportionate focus of manufacturers on large SUVs and premium models means we have too few mass-market cars and too high prices.”

75 Models Of Affordable Electric Cars In China

In China there are 75 models of electric cars available for less than €20,000, but only one in Europe. The average price in Europe remains high even in the compact segments, ranging between €34,000 for A segment cars and €48,200 for C segment cars. These high prices mean electric cars are not competitive for cost-conscious European consumers, since there are many models with internal combustion engines available for below €20,000, such as the Citroen C3 or the Seat Fabia.

Of the sub-€25,000 models carmakers have planned, only 42,000 vehicles are likely to be produced for the European market this year, according to T&E analysis of production data from GlobalData. But despite the lack of affordable models, the EU market share of battery-electric cars still grew by 2.5 percentage points to 14.6% in 2023.

T&E says the share of electric cars in the EU market could already be at 22% if the corporate car segment, which accounts for most new car sales, was leading on electrification. Currently, with electric cars at 14% of sales, the corporate sector is lagging behind the private market, which is at 15%.

Taxation plays an important role in incentivizing electric car uptake, but in countries such as Germany, carmakers have opposed the reform of company car taxes that would increase the tax burden on petrol and diesel cars. Setting binding electrification targets for corporate fleets will also be key to accelerating electrification in Europe. T&E is calling on the EU to set targets for fleets to be 100% electric by 2030 at the very latest.

On that subject, Anna Krajinska said, “Corporate cars are the perfect candidate for accelerated electrification. They are heavily subsidized through tax cuts, and companies have the financial muscle to invest in EVs. That’s why the EU must come forward with a law that covers a large portion of the company car market, by regulating leasing giants and companies with big car fleets.”

Promises, Promises

There have been some announcements by European carmakers that less expensive compact electric cars such as the Renault 5 and Volkswagen ID.2 will be coming in 2024-2027. Yet fewer than 50,000 cars of the announced low-priced models are expected to be produced for Europe in 2024, which is unlikely to satisfy demand. This leaves the European market for compact electric cars wide open to Chinese competition.

That has led the EU to open an investigation into whether China is subsidizing its manufacturers of electric cars too much, making it possible for them to sell them in Europe at prices that will seriously erode the sales and profits of European automakers. In the US, there is a new hysteria about Chinese electric cars vacuuming up petabytes of sensitive information about drivers and military installations and sending it back to China where it will be weaponized and turned against the American people. We swear we are not making this up.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

The Takeaway

T&E is trying to lock the barn door after all the horses have escaped. The trend toward larger, heavier, thirstier cars began more than twenty years ago when the Obama administration foolishly agreed to the “footprint rule” proposed by the major car companies. That rule essentially gave the industry a “get out of jail free” card.

The EPA imposed tougher rules on small cars than on large cars. So the car companies all stopped making small cars to focus on SUVs and light duty trucks. This sweetheart deal allowed the companies to wave their fists and stomp their feet about how tough the rules were while quietly filling dealer lots with larger, more profitable models that only needed to meet more lenient emissions standards. As a result, despite those more stringent Obama era rules, the average tailpipe emissions from new cars sold in America today are higher than they were before the new rules went into effect.

The upshot of all this smoke and mirrors is that automakers are now screaming about how nobody wants to buy their bloated, high-priced electric cars, and using that as an excuse to sell more high profit, high pollution vehicles at a time when the world desperately needs electric cars for the masses.

Meanwhile, the Chinese are ready to supply those low cost EVs and are just waiting for the right time to bring them to market in North America and Europe. When they do, lots of purveyors of high-priced cars are going to file for bankruptcy, or beg for government bailouts based on the principle of “too big to fail.” The world cannot tolerate a situation where everyone is driving around in Chevy Suburbans and Ford F-150s, but that is the future the auto industry wants. This is not going to end well.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica TV Video

CleanTechnica uses affiliate links. See our policy here.