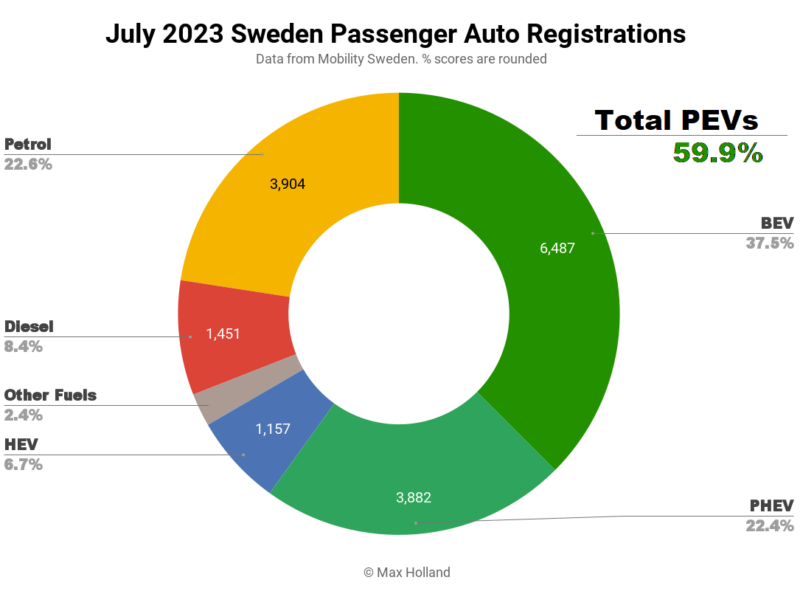

Sweden’s July auto market saw plugin EVs take 59.9% share, up from 50.1% year on year. Full electrics grew share YoY, and plugin hybrids remained flat. Overall auto volume was 17,300 units, down 3% YoY. The BYD Atto 3 was the best selling vehicle of any single powertrain in July.

July’s results saw EVs take 59.9% combined share, comprising 37.5% full electrics (BEVs), and 22.4% plugin hybrids (PHEVs). These compare with July 2022 figures of 50.1%, 26.3%, and 23.8%. While PHEV share remained almost flat, BEV share grew strongly.

In volume terms, PHEVs declined by 8% YoY to 3,882 units, while BEVs grew 39% to 6,487 units. This is strong growth from BEVs against the backdrop of 3% lower overall auto volumes.

HEVs lost YoY share from 8.4% to 6.7%. Combined combustion-only powertrains lost share from 40.4% to 31.0%, and lost over 25% of their volume YoY. Q4 this year will likely see combined combustion-only share fall below 25%, and largely remain there, going forwards.

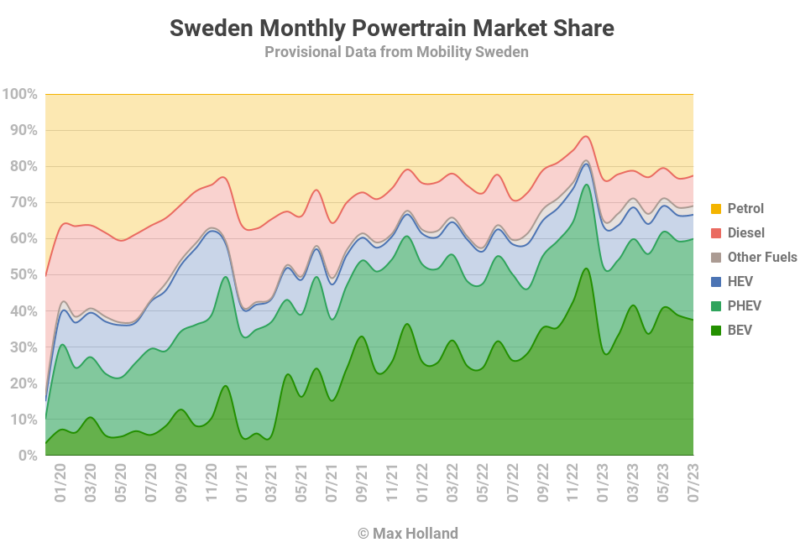

BEVs’ year to date cumulative market share now stands at 37.3% – by far the largest of any powertrain – with monthly scores now consistently in the mid-30s to 40% range. Full year share for 2023 is on track for over 40%, and is trending to be well over 50% by the end of 2024, if not before.

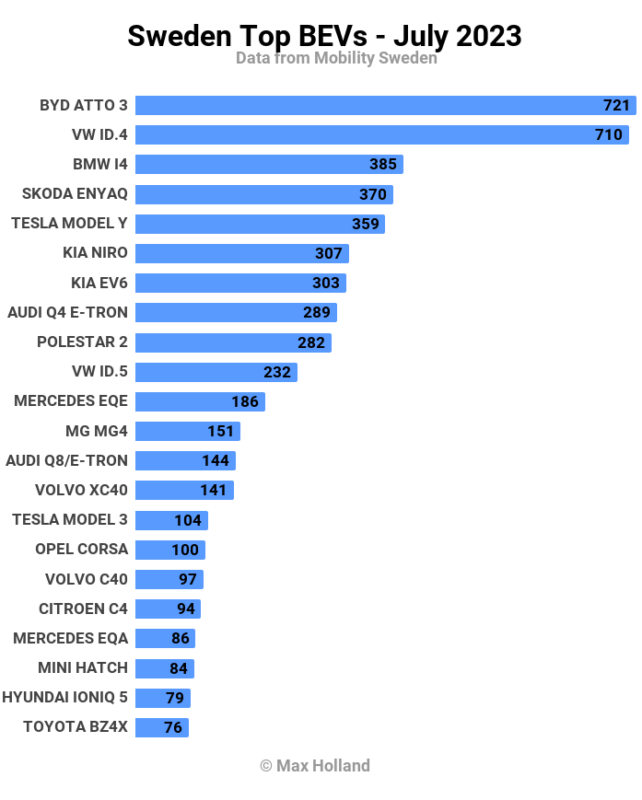

BEV Bestsellers

The best selling BEV in July was the BYD Atto 3, with 721 units registered. It was also the highest seller of any single powertrain, though the Volvo XC60’s combined numbers across all powertrain variants (PHEV + diesel + petrol) were slightly higher.

July’s runner up BEVs were the Volkswagen ID.4, and the BMW i4.

The Atto 3 saw its best volumes since December, helped by a large BYD vehicle shipment arriving in July (Han, and Tang models also saw volume jumps).

Other relatively strong performances in the top 20 were seen by the Mercedes EQE (186 units, a personal best), and by the refreshed Opel Corsa (100 units, also a PB).

Long term favourite brands, Tesla, and Volvo, were both at the low-ebb of shipping logistics in July, but will doubtless be back in force later this quarter.

There were no all-new BEV models released onto the Swedish market in July.

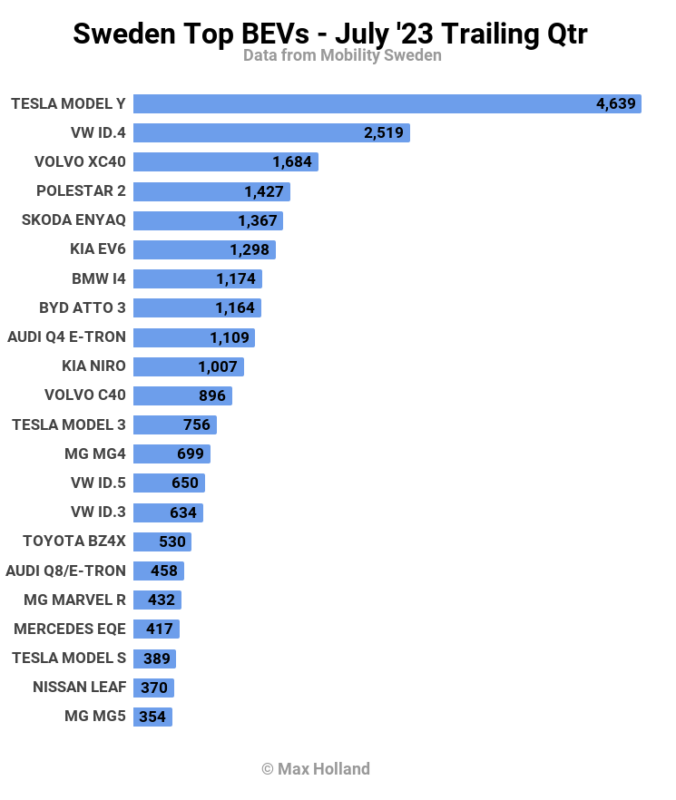

Now let’s turn to the 3 month picture:

Despite a low ebb in July, the Tesla Model Y still has a huge lead in the trailing 3 month charts, with 4,639 units. The number 2 spot has changed hands since the previous period; formerly the Volvo XC40, it is now the Volkswagen ID.4

On the strength of two good months, the BYD Atto 3 is now in 8th, from just 29th in the previous period. Hopefully BYD can smooth out the logistics in the coming months, and place consistently in the top 20.

There is no other major model news from the Swedish BEV market just at the moment. We did recently learn that Volvo will deliver a smaller, more affordable vehicle, the Volvo EX30, starting from mid 2024, and that should prove popular in its home market of Sweden.

Outlook

Sweden’s 3% YoY shrinkage of the auto market is roughly in line with the broader economy, which is currently showing an annual recession of -2.4%, one of the weakest in Europe. Inflation, and interest rates, remain high.

So far this year, plugin sales have been kept positive in large part from business purchases, with Mobility Sweden saying that “the private electric car market is still ice cold”.

The cut in incentives for plugin orders placed after last November is expected to weigh on registration results increasingly in the coming few months (given the common 6-12 months of delivery wait times). We will have to wait and see what happens.

I suspect that – even without incentives – most car buyers (whether business or personal) recognize the long-term running cost savings of plugins, and will not turn back to combustion vehicles. Gasoline prices have risen to $1.92 per litre in July, from $1.75 in June – hardly reassuring news when considering the running costs of combustion-only vehicles.

What are your thoughts on Sweden’s transition to EVs? Please join in the discussion below.

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it! We just don’t like paywalls, and so we’ve decided to ditch ours. Unfortunately, the media business is still a tough, cut-throat business with tiny margins. It’s a never-ending Olympic challenge to stay above water or even perhaps — gasp — grow. So …