In a recent interview with Arcadia Economics, Chris Marcus explored the state of the gold and silver markets with Stefan Gleason, President and CEO of Money Metals Exchange, and JP Cortez, Executive Director of Money Metals’ Sound Money Defense League.

The conversation explored the dynamics shaping precious metals markets, legislative efforts advocating for sound money, and the growing role of gold and silver as alternative assets.

Gold and Silver Markets Surge Amid Global Demand

Gold and silver prices have reached significant highs, with gold trading at $2,690 per ounce and silver at $30.50. These price movements were primarily driven by Central Bank purchases and robust Asian retail demand, particularly from China.

Interestingly, this surge occurred without substantial participation from U.S. retail or European institutional investors, highlighting untapped potential in Western markets. Should these markets reengage while Asian and Central Bank demand remains strong, it could lead to even greater price momentum.

Post-Election Trends and Shifting Market Dynamics

The U.S. election also impacted market trends, with many conservative investors easing off large purchases amid a perceived reduction in economic threats. Stefan Gleason noted a decline in big-ticket transactions post-election, although overall demand remains higher than it was a decade ago.

Another significant factor has been the emergence of premiums on U.S. gold and silver prices due to geopolitical uncertainties and potential tariffs. This development has sparked a substantial inflow of metals from international markets into the U.S., setting the stage for further market volatility.

Retail Selling and Supply Challenges

While gold and silver prices have risen, retail selling has also increased, as some investors take profits or address financial needs driven by inflation. Money Metals has observed more customers selling back their metals, often to local dealers.

However, local sellers often receive significantly lower bids compared to online platforms, with some local dealers offering as much as $3 to $4 under the spot price for silver and $100 to $200 under for gold. This disparity highlights the advantages of selling to reputable online dealers like Money Metals, which provide higher payouts.

Silver Ownership Remains Underrepresented

The estimated global retail silver inventory currently stands at around three billion ounces, with an additional two billion ounces in stockpiles. Despite this supply, silver remains an under-owned asset in the U.S., with less than 2% of Americans holding even a single ounce of precious metals. This limited ownership underscores the immense growth potential for silver and gold as mainstream investments.

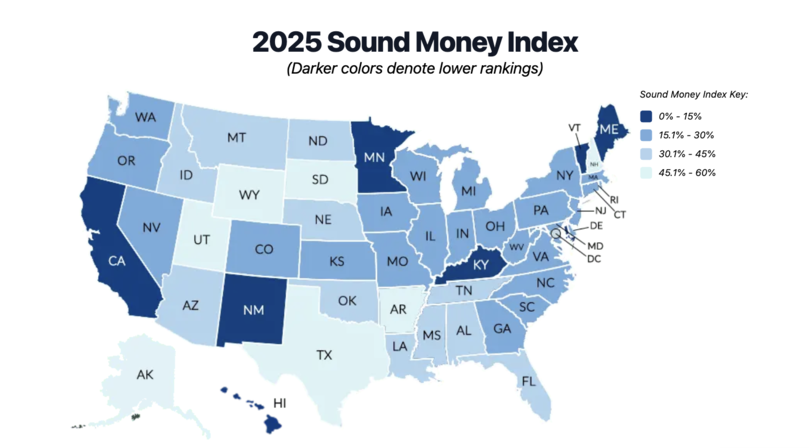

Legislative Progress for Sound Money

One of the most significant developments in the precious metals space is the legislative progress spearheaded by the Sound Money Defense League. In 2023 alone, 68 bills promoting sound money policies were introduced across 28 states.

To date, 45 states have fully or partially eliminated sales taxes on gold and silver, and some are now tackling capital gains taxes, further reducing barriers to ownership. States like Utah and Tennessee have taken steps to establish strategic gold reserves, with Utah allocating $180 million for physical gold investments.

This growing recognition of gold and silver as essential reserve assets reflects the increasing global trend of de-dollarization.

Texas Leads the Charge in Sound Money Initiatives

Texas has emerged as a key player in the push for sound money. Recent legislation proposes a $5 billion investment in precious metals, with $4 billion allocated to gold and $1 billion to silver. Additionally, the state is considering the issuance of gold-backed currency, further solidifying its commitment to sound money principles.

Similar measures are gaining traction across the U.S., with states seeking to diversify their reserves and reduce exposure to the U.S. dollar.

Younger Investors and the Shift to Precious Metals

The global trend of de-dollarization and diversification into alternative assets is reshaping investment landscapes. As younger investors find themselves priced out of traditional wealth-building avenues like homeownership, many are turning to alternative assets such as cryptocurrencies and precious metals.

However, the volatility of cryptocurrencies, such as Bitcoin, could prompt a shift toward more stable and inflation-resistant assets like gold and silver, especially during market corrections.

Innovations in Precious Metals Storage and Investment

Money Metals Exchange is also innovating in the storage and investment space with its state-of-the-art facility in Idaho, the largest precious metals depository west of New York. This 37,000-square-foot facility offers unparalleled security and auditing, addressing long-standing concerns about transparency in government-held reserves like Fort Knox.

The company provides unique services such as monthly purchase plans for automated investments, IRA options for holding physical metals, and collateralized loans that allow customers to access liquidity without selling their assets.

The Importance of Grassroots Advocacy for Sound Money

JP Cortez emphasized the critical role of sound money in addressing government overreach and inflation. Gold and silver have long been the foundation of stable monetary systems, offering protection against devaluation and financial instability.

Grassroots advocacy has been essential to the success of sound money initiatives, with engaged citizens lobbying for tax reforms and increased adoption of precious metals as legal tender.

A Bright Future for Gold and Silver

The future of gold and silver as investment assets remains bright. As inflation and debt levels continue to rise, more individuals, states, and institutions are recognizing the value of sound money principles. While the journey to mainstream acceptance may take time, the foundations being laid today promise a more stable and secure financial future.

For those interested in exploring gold and silver investments or learning more about sound money advocacy, Money Metals Exchange offers a wealth of resources and services.

Visit MoneyMetals.com to learn more about precious metals offerings and join the growing movement toward sound money.

********