While the gold space has been obsessed over the gold streaming from London to New York in reaction to President Donald J. Trump’s tariff threats, even as it had little effect on price, the bigger story is that the People’s Bank of China (PBoC) is quietly stockpiling gold at a frenetic rate.

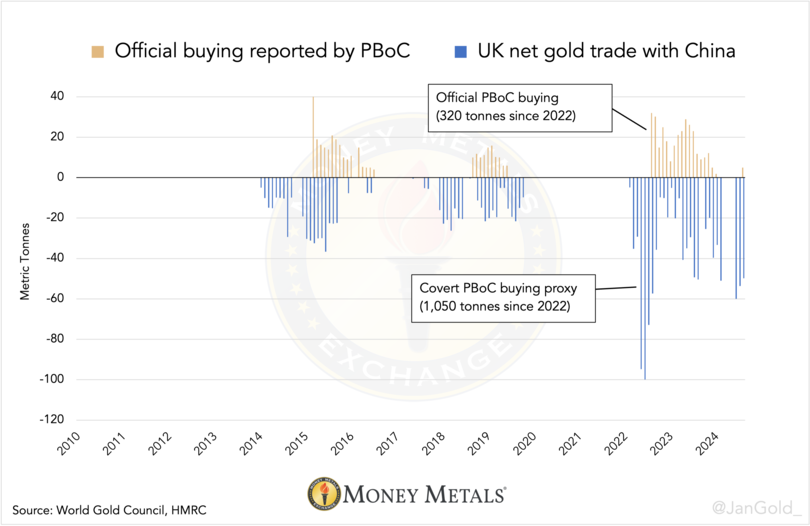

Direct gold exports from the U.K. to China—a proxy for PBoC purchases—remained impressively strong in November at 50 tonnes. As the Chinese central bank (PBoC) in 2024 has secretly bought approximately 600 tonnes with $50 billion U.S. dollars, it’s confident about where the dollar price of gold is going: UP.

An Exceptional Bull Case for Gold

Since February 2023, I have been publishing evidence of the PBoC buying significantly more gold than what it reports to the IMF. These purchases have broken the West’s dominance in the market by driving the price higher (see here and here).

I found the smoking gun of the PBoC’s secret gold operations in November 2024. As private demand in China declined and premiums on the Shanghai Gold Exchange (SGE) turned negative in September, Chinese imports remained robust.

For those with knowledge of the Chinese market, there can only be one explanation for stout inflows when SGE gold is trading at a discount: the central bank is bringing in gold. It also fits hand in glove with the other evidence.

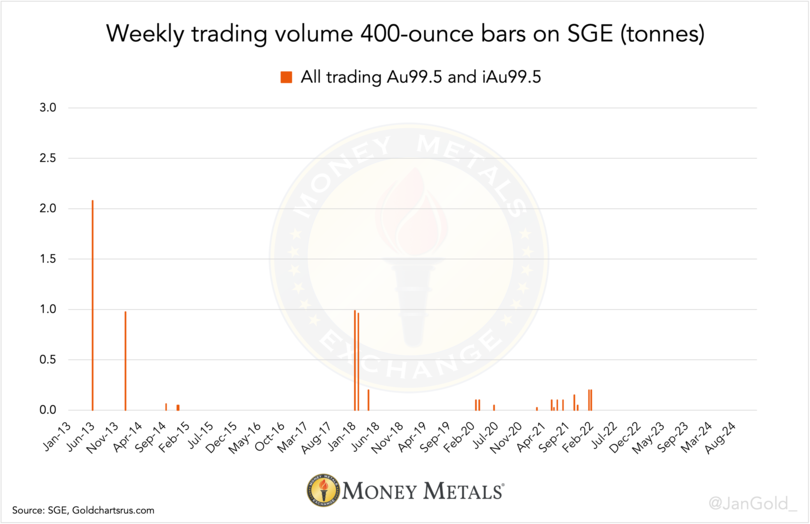

There can be no reasonable doubt that export of large 400-ounce gold bars from the London OTC market to China reflect PBoC purchases. 400-ounce bars aren’t even traded over the Chinese central bourse (SGE).

Chart 1. Virtually zero large bars have ever traded over the SGE.

After I published these revelations, Goldman Sachs replicated my work for themselves, which in time will help bring this story to a wider audience. Western institutional investors have already spotted this trend in 2024 and joined the bull market.

Before long, this will go mainstream and gold could more than double in price this decade.

How Much Gold Did the PBoC Buy in November?

In my last article, I wrote:

The PBoC’s “unreported” purchases in London accounted for a stunning 60 tonnes in September and another 55 tonnes in October.

…while cross-border trade statistics from the U.K. for November have yet to be released, I foresee another purchase of a similar magnitude.

By now we know from U.K. customs (HMRC) that it was 50 tonnes, bringing total exports to China since 2022 to 1,050 tonnes. Over this period, China’s monetary authority has bought at least three times as much gold than formally reported.

Chart 2. Note that London is not the only place where the PBoC snaps up gold.

I was able to foresee strong buying because Chinese customs (GACPRC) is quicker to release its statistics than HMRC. For November—when the SGE was still trading at a discount—China’s gross import accounted for 124 tonnes.

Nations don’t import 124 tonnes when demand is subdued. And again, the majority of this gold was imported into the Beijing region where the central bank vaults are located.

All signals flash PBoC buying.

Chart 3. In November China also imported gold from Hong Kong, Switzerland, and Canada.

China, as well as Saudi Arabia, are obviously preparing for a multipolar world in which the dollar’s role as a reserve asset will be gently reduced.

Gold’s hedging benefits against geopolitical shocks, and fears of a debt spiral and yield curve control will keep central bank gold demand in the East structurally higher. (Eastern central banks own a lot less monetary gold relative to their Western counterparts.)

Chart 4. Gold’s share of international reserves is rising fast, from 10% in 2015 to 20% in 2024.

There is no indication the PBoC has bought any Bitcoin.

*******