Each week Josef Schachter gives you his insights into global events, price forecasts and the fundamentals of the energy sector. Josef offers a twice monthly Black Gold newsletter covering the general energy market and 36 energy, energy service and pipeline & infrastructure companies with regular quarterly updates. We also hold quarterly webinars and provide Action BUY and SELL Alerts for paid subscribers. Learn more.

Economic, Political & Military Update:

Market bulls jumped all over the bond and stock markets on the tepid CPI report today. They have renewed the call for the Fed to cut rates at their September FOMC meeting. We suspect this is premature as PPI data was disconcerting and blew past forecasts. The CPI today came in at 3.6% year-over year, in line with estimates and below the last data point of 3.8%. Cheaper airfares and hospital prices helped this decline. On the other hand, the core PPI data released yesterday, showed a sharp rise of 0.5% for the month (forecast was for a rise of 0.2%), an annualized rate of 6.0%. Final demand for services saw a rise on an annualized basis of 7.2%. This will likely mean each new economic data point will get more scrutiny.

Some of the other new data points include:

- US Manufacturing is slowing with the NY Empire State Manufacturing Index for May coming in at a minus 15.6 compared to a forecast of minus 9.9.

- US Retail Sales came in flat versus a forecast of up 0.4% and a prior reading of up 0.6%.

- US Consumer Sentiment is falling sharply according to the University of Michigan survey. It fell to 67.4 from a forecast of 76.2 and was down from 80 just a few months ago.

- Canada beat on its job data for April, coming in at an increase of 90,000 jobs roughly 20,000 higher than forecast.

- The US – China tit for tat continues with President Biden putting on higher tariffs (US$18B) on their electric cars, solar panels and semiconductors. The 100% tariff rise for EV’s is ridiculous as the US does not import EV’s from China. It was a political gift to his auto union supporters.

- China is seeing more weakness in their business activity. MSCI China companies saw a 5% drop in sales in Q1/24.

On the wars front:

- The chance for a ceasefire and hostage release deal between Israel and Hamas has deteriorated with Israel’s move into Rafah to destroy the last of the Hamas terrorists.

- The US which was against this incursion have halted munition shipments of large bombs to Israel. Israel has noted that the US pressure will not halt their intention to end the Hamas threat.

- Hezbollah has daily increased Katyusha rocket salvos into northern Israel. Large wildfires are being reported across the area of the agricultural heart of Israel. Whole swaths of land are on fire.

- US campuses remain a focus of protests by those supporting Hamas and the Palestinians. Blue States are having the worst of this.

- Russia is expanding its offensive to capture the second largest city in Ukraine, that of Kharkiv in eastern Ukraine and near the Russian border. It is Russia’s largest offensive since the start of the war in February 2022.

Market Update: The general stock market has lifted in recent days as MEME stocks rocket higher as the Reddit chat lines get neophyte investors to chase stocks no matter the lack of value. Gamestop (GME) and AMC Entertainment (AMC) had two or three days of rocketing upwards and today are backing off. Front runners win and the lemmings are being shafted. GME, which rose from US$17 per share to US$64.83 per share in three days, is down today as I write this, by over 30% to $33.94 per share or down US$14.81 per share on the day.

The general consensus of bullish stock market investors is that the Fed will cut rates in September and that earnings will hold up justifying much higher levels for the indices. If earnings become problematic as we are seeing from most of the S&P 500 (except for the AI, M7 and FAANG names) then stocks have a lot of air in them. We are watching the economic data carefully as it appears that consumers are getting tapped out and this could drag down the economy at some point. The offset is the 6% US deficit and large war spending that are keeping some areas of the US, with hot economies.

Energy stocks peaked in early April as crude reached its high of US$87.67 on the mideast war premium expansion. The run from early February was very rewarding and the ideas on our SER BUY List for the most part did very well. We see the general market and the energy sector as vulnerable. A correction should occur and that would provide the next low risk BUY signal which we see occurring during Q3/24. The S&P/TSX Energy Index peaked at 308 in week two of April and has fallen today to a low of 287 (now 292). A downside target below 240 in the coming months is likely. The overbought condition can be confirmed from the S&P Energy Sector Bullish Percent Index which rose from 39% bullish in February 2024 to 91% three weeks ago. Recent weakness has pulled this Index down to 70% today. Over 90% is an overbought reading. It should decline below 20% to give off an oversold level and a BUY window once again.

Our new SER issue feature called ‘TOP PICKS NOW’ highlights the best ideas at the time of each SER report. The ideas have worked out very well as not all stocks rise and peak at the same time nor do they bottom at the same time. If you want to see what our subscribers are looking at, sign up now for access to the Schachter Energy Research reports at https://bit.ly/2FRrp6k.

Bullish pressure for crude prices comes from:

- The potential for a pick up in the Middle East war.

- The Ukrainian success in attacking refineries in western Russia and the Iranian backed Houthis Red Sea and Gulf Of Aden attacks on shipping.

- OPEC is planning to extend its official cuts to the end of 2024 with the hope this tightens up global inventories and raises oil prices much further. Compliance however is still a problem and there is now more than adequate world supplies.

- The area to watch now is China demand. It is quite weak now but could rebound if the government’s stimulus moves take hold.

Bearish pressure for crude comes from demand weakness in many OECD economies. Also, the US is an exporter of crude (4.1 Mb/d last week). We expect a decline below US$75/b based upon fundamentals as demand falls during the spring shoulder season by 2.0 – 2.5 Mb/d. Note the build in US stocks this week (next section). For a refresher, during the last correction WTI fell (in December) to an intra-day low of US$67.71/b from US$79.60/b from just a few weeks before. In 2023, WTI fell from US$83.53/b in April to US$66.80 in June. In 2021, crude fell from US$76.98 in June to US$61.74/b in August. Today’s intraday low was US$76.70/b.

We see a war premium still in the price of crude. If a ceasefire and hostage release is obtained during the talks sponsored by Egypt, Qatar and the US we may see a fall in prices of US$5-6/b as a result of this action alone. Overall we could see prices US$10/b lower than today if events unfold successfully.

So remain patient and let the market do its normal swinging around and use the next period of market and energy price weakness to build up your energy weightings.

EIA Weekly Oil Data: The EIA data released today May 15th showed increases in overall inventories despite a small US Commercial Crude Inventory decline of 2.5 Mb to 457.0 Mb. The reason for the commercial crude decline was refinery runs rose 1.9% to 90.4% from 88.5% The Strategic Reserve showed an increase of 0.6 Mb on the week to 367.8 Mb and is above last year’s level of 359.6 MB or up by 8.2 Mb. Motor gasoline inventories fell 0.2 Mb and are now 8.3 MB above 2023 levels. Distillate fuels saw no change in inventories and are 10.1 Mb above last year’s storage levels. Total Stocks including the SPR rose 4.1 Mb last week and are now 8.9 Mb above last year or at 1,610.8 Mb.. Cushing inventories fell 300 Kb/d to 35.0 Mb. US Exports fell 333 Kb/d to 4.14 Mb/d.

US Crude production was flat at 13.1 Mb/d and is up 900 Kb/d above last year’s level. Motor Gasoline consumption rose by 78 Kb/d to 8.88 Mb/d while Jet Fuel saw a rise of 146 Kb/d to 1.64 Mb/d. Total Demand fell 234 Kb/d to 20.0 Mb/d as Residual oil and Propane demand fell. Year-to-date US demand is up 0.4% or at 19.87 Mb/d versus 19.79 Mb/d last year.

OPEC Monthly Report:

The May 2024 report released yesterday showed that in April OPEC lowered production by 48 Kb/d to 26.58 Mb/d as Nigeria saw a decrease of 46 Kb/d to 1.35 Mb/d and Iraq saw a decrease of 32 Kb/d to 4.18 Mb/d. Others increasing production were Congo up by 21 Kb/d to 271 K b/d and Iran raising production by 14 Kb/d to 3.21 Mb/d. The Saudis increased production by 2 Kb/d to 9.03 Mb/d. Russia lowered production by 154 Kb/d as Ukrainian attacks on refineries impacted their sales of refined products.

OPEC’s rhetoric of having cut 2.2 Mb/d is just BS. Using base production in June 2023 of 26.7 Mb/d, OPEC has cut back only 512 Kb/d and not the 2.2 Mb/d that they repeatedly broadcast. These are far away from the stated cut of 1.2 Mb/d by OPEC and the cut of 1.0 Mb/d by Saudi Arabia. So while cutbacks in production, they are not the 2.2 Mb/d cuts that have been repeatedly announced. Of note US production increases have more than offset the real OPEC cuts by a significant margin. These excess barrels are the reason we have adequate supplies

Canada is seeing growing production as the TMX line starts taking crude next month. In 2023 Canada produced 5.7 Mb/d and the forecast is for 5.9 Mb/d this year and 6.1 Mb/d is forecast for 2025 due to the TMX expansion. The EIA forecasts that the US will produce 21.45 Mb/d of crude and liquids in 2024, up 540 Kb/d from 2023. This may prove light as liquids production last week was 22.0 Mb/d (EIA data).

OPEC has extended its production cutbacks to the end of June and members continue talking about extending the official cuts to the end of 2024 to curtail inventories and firm prices up even further. OPEC will decide their next move at a face-to-face meeting in Vienna on June 1st.

EIA Weekly Natural Gas Data:

The natural gas report out last Thursday showed a normal rise in storage levels. The increase was 79 Bcf, with the largest rise in the East at 29 Bcf. This compares to an injection of 78 Bcf last year and the 5-year average injection rate of 66 Bcf. Storage is now at 2.56 Tcf. US Storage is now 21.0% above last year’s level of 2.12 Tcf and 33.3% above the five year average of 1.92 Tcf.

NYMEX is today priced at US$2.33/mcf, up over a dime from last week and up 41% from the low of US$1.65/mcf seen in mid-April. The recovery was due to the Freeport Texas LNG facility reopening and exports rising. Demand in Asia is picking up and Egypt is now importing more LNG as it is in short supply ahead of an expected very hot summer season and high air-conditioning usage.

We recommend buying the very depressed natural gas stocks during periods of market weakness (these stocks are very cheap now) as we see higher natural prices in Q4/24 (above US$3.00/mcf) and much higher prices in 2025. We plan to add additional natural gas names to our Action BUY list when we get the next low risk energy BUY signal.

Baker Hughes Rig Data: In the data for the week ending May 10th, the US rig count fell two rigs to 603 rigs (they fell eight rigs in the prior week). Rig activity is now 18% below the level of 731 rigs in 2023. Of the total rigs working last week, 496 were drilling for oil and this is 15% below last year’s level of 586 rigs working. The natural gas rig count is down 27% from last year’s 141 rigs, now at 103 rigs due to the weak natural gas prices at this time. This sharp decline in drilling should continue for a few more months but the industry is seeing declining production. Recent data shows US daily natural gas production at 95.5 Bcf/d down from the high in December 2023 of 105.5 Bcf/d. Once storage comparisons improve we should see natural gas prices lift.

In Canada, there was a decline of four rigs to 116 rigs working (versus a rise of two rigs last week). Canadian activity is up 23% from last year’s 93 rigs. Activity for oil is at 60 rigs compared to 37 last year or up by 62% as companies add more oil to meet TMX pipeline heavy crude demand. Activity for natural gas is at 56 rigs compared to 57 last year and condensate rich wells are the focus of this activity. The industry needs north of $2.50/mcf to see the economics attractive to drill more gas wells. As we get closer to LNG Canada ramping up in Q4/24 and natural gas fills the Coastal GasLink pipeline, prices should lift.

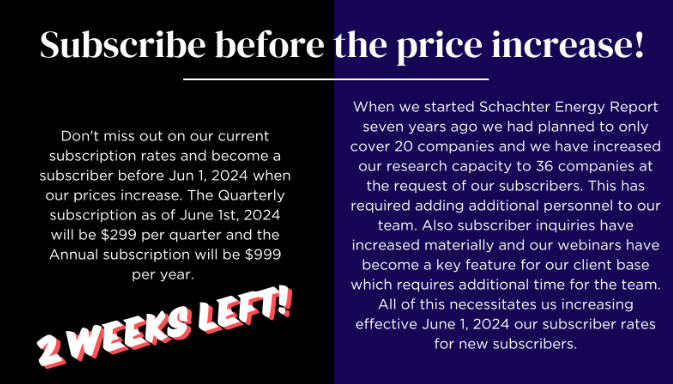

Current subscribers will not be affected by the price change as long as they keep an active subscription. Subscribers who sign up before Jun 1, 2024 will be grandfathered in at the original prices of $249 per quarter or $799 per year as long as their subscription remains active.

Subscribe now to lock in the savings!

Energy Stock Market: The S&P/TSX Energy Index today is at 292, down three points from our last issue. We would not chase the sector here but wait for the developing correction to lower prices and then add to portfolios. We are bulls but we don’t want to chase stocks. We like to BUY when stocks are cheap and are being ignored. That is not the case now. There still are some stocks that are BUYS but that list has shrunk. We cover those that remain cheap in our TOP PICKS NOW section of our SER reports.

Investors should decide what you want your energy weighting to be for this long energy super cycle. Our BUY List includes ideas from the Pipeline & Infrastructure area, Canadian oil and natural gas ideas, energy service ideas and companies working internationally. Our list includes large Conservative ideas and small to large caps in our Growth and Entrepreneurial categories. Add to your current ideas or add new ideas. We expect that WTI should lift above US$90/b in 2H/24 as winter 2024-2025 demand should exceed supplies at that time and we see recovering economies globally.

CONCLUSION:

Longer term we remain very bullish. Our view remains that before the end of this decade we expect to see WTI prices exceeding the high in 2008 of US$147.27/b.

Please take advantage of the current SER pricing structure to become a subscriber before our price increase on June 1st. We are in an exciting energy super cycle and there is a lot more to the upside. To get our specific views and to learn about the companies we cover, become a subscriber. Getting a subscription will help you navigate your energy investments as this cycle unfolds into the end of this decade.

WTI is priced now (as we write this report) at US$78.20/b (low so far today US$76.70/b). Near term we see a break of US$75/b occurring as inventories build during this shoulder season. We expect to take advantage of the bargains in energy stock prices with new BUY ideas if one more of our BUY signals is triggered. Down market days for energy stocks are the best days to build your positions for the lengthy energy super cycle we see lasting into the end of the decade.

Our quarterly webinar was held on Thursday May 9th. It covered details of the markets and I spent time on the best ideas now (Top PIcks Now). If you are interested in listening to this 90 minute event in our archives this is another reason to become a subscriber before the June 1st price increase.

Our new ‘TOP PICKS NOW’ section in each report has been very well received and has had significant positive performance. It covers the best ideas from our five groupings that we cover (Pipelines/Infrastructure/Royalty Companies. Domestic Natural Gas Companies, Domestic Liquids Producers, International E&P Companies and Energy Service Companies). Not every issue will have an idea in every grouping if the stocks in such a group are not at bargain buy levels. If interested in these reports, become a subscriber. Go to https://bit.ly/2FRrp6k.

Please save the date for our 2024 ‘Catch The Energy’ conference on Saturday October 19th at MRU. We have received confirmation that the Honourable Brian Jean, Minister of Energy and Minerals of Alberta will be our opening Speaker. We have started to meet with Presenter energy companies and have started signing up presenters for this year’s conference. As this list develops we will start providing you with the names of the Presenting companies in our upcoming reports as we did last year. We have space for 35 companies in the energy industry of today and 10 spots for the TMX sponsored energy industry companies of the future (clean-tech, renewable energy, and critical minerals). This mix can change depending upon response from our meetings. If you know of companies that are public or nearing going public and have a compelling story to tell, have them contact us at [email protected].

As usual subscribers will receive two complimentary tickets to the event, so another great reason to become a subscriber.

Please feel free to forward our weekly ‘Eye on Energy’ to friends and colleagues. We always welcome new subscribers to our complimentary energy overview newsletter.

Share This:

Next Article

.jpg)