The oil market is finally starting to flicker into life — and nowhere is that clearer than in the prices of crude like Saudi Arabia’s, where output cuts are quietly transforming the supply landscape.

The kingdom and its partners in the OPEC+ oil producer alliance have been restraining supply for months now, with relatively little impact on the futures market. Brent oil traded in London had been stuck around the $75-a-barrel mark for weeks. That shifted a little Friday, when the contracts rose to about $78, a level they have largely held at since.

But the tiny and tentative rally tells only part of the story. Brent oil differs to the kind produced by Saudi Arabia in two important aspects: its density and sulfur content. And across the world, where varieties of crude more closely resemble those of the world’s top exporter, prices are shooting up faster as refineries clamor for alternatives to the barrels that the kingdom has cut.

Meanwhile supplies of lighter, sweeter oil that’s similar to West Texas Intermediate and Brent, the world’s main futures grades, have been relatively plentiful.

“Mediums and heavy sour barrels are becoming increasingly scarce given OPEC+ cuts,” said Michael Tran, managing director at RBC Capital Markets LLC. “Much of the physical looseness in the market has stemmed from lighter, sweeter barrels and sneaky surging US shale production has been under-appreciated.”

In the Middle East, important market timespreads — such as inter-month Dubai oil swaps — are also pointing to tighter supplies for what is a flagship price for the region’s medium and heavier sour grades. The rally has created an expectation that Asia’s refiners may look further afield for cargoes.

Diesel

Oil bulls have pointed to sharp jumps in premiums for refined fuels as a sign that, despite fears of a global economic slowdown, consumption remains healthy.

Even though macroeconomic data suggest a global manufacturing recession, Europe’s diesel benchmark — the fuel most closely linked to the region’s industrial production — last week spiked relative to later months on concerns about scarce supply.

By contrast, some lighter crudes have been hurt by weak demand for products like naphtha amid anemic margins in the petrochemicals industry.

Those moves, alongside relatively robust markets for gasoline and fuel oil, are also shaping the crude refiners look to buy, improving the attractiveness of heavier grades.

Heavy Rallies

Signs of the strength in heavier oil prices can be seen everywhere amid the start of new refineries in the Middle East and Asia, and a longlasting halt in Iraqi oil exports via the Turkish port of Ceyhan. Wildfires in Canada that sent oil production to the lowest in two years are also adding to concerns.

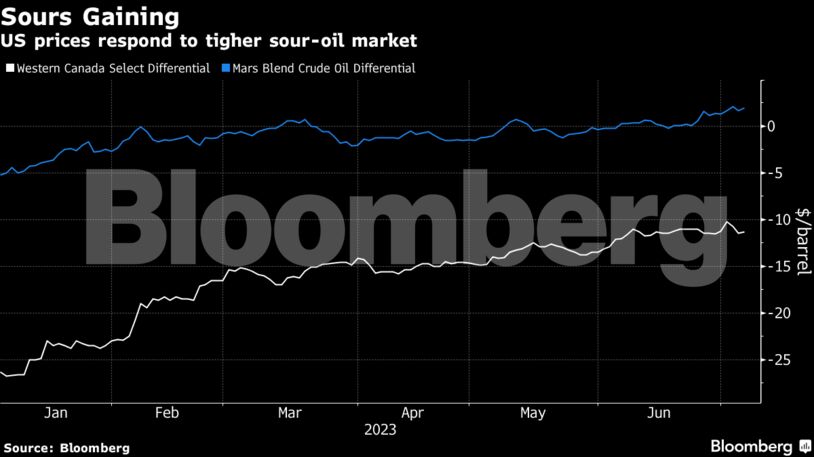

The premium of Norway’s Johan Sverdrup above a regional benchmark surged to a fresh record on Friday, having been at hefty discounts as recently as December. Mars Blend soared to a three-year high last week and industry consultant Energy Aspects forecast the supply of sour grades from the US Gulf Coast to stay tight this quarter. Ongoing purchases by the US government to refill its strategic reserve have also helped boost sour crudes.

Western Canada Select was recently at a discount of $10 to Nymex WTI benchmark prices, which is the strongest level seen since the government of Alberta implemented an OPEC-style production cut of 325,000 barrels a day between 2019 and 2021.

In contrast, light-sweet supplies such as West Texas Intermediate Midland crude remain relatively well supplied. Record volumes of the flagship US grade have been flooding the European market since its introduction into the region’s physical oil benchmark, Dated Brent. The move has also weighed on prices since it came into effect earlier this year.

“The OPEC+ cuts have meant a drop in medium-sour crude supply compared to a growth in light-sweet crude output,” said James Davis, director of short-term oil service at FGE. “For lighter crudes, which typically yield high levels of naphtha, the weak naphtha cracks are also going to be having a negative impact.”

The spread between Abu Dhabi’s Murban crude versus Dubai swaps has been narrowing too. Following Saudi Arabia’s price hike for August-loading barrels, the premium of the comparatively-light Murban started to shrink on a relative basis, according to data compiled by Bloomberg.

Brent-Dubai

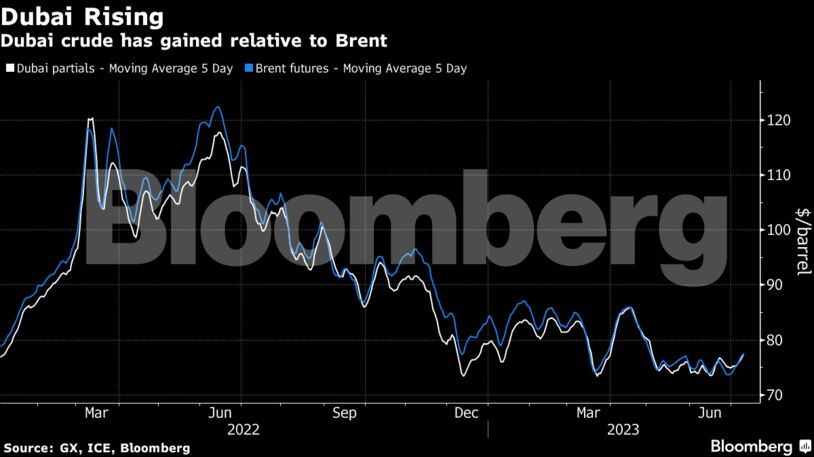

Brent swaps contracts have traded at a rare discount to Dubai swaps in recent days, following a precipitous slide over the past few months.

That slide creates potential pricing arbitrages to entice Asian refineries to purchase long-distance crudes. Some refiners there have already been snapping up millions of US barrels, along with some cargoes from West Africa in the spot market, according to traders.

In the latest move, at least two processors in Asia sought less from the Saudis for cargoes shipped next month, and another said it won’t take any cargoes after an unexpected price increase.

There are signs too that European buyers are taking fewer Saudi barrels. Ultimately that pushes them toward other markets.

“To me, it looks like the start of the hot summer in the crude market,” said Jorge Leon, senior vice president of oil market research at Rystad Energy. “It is the tipping point the market was expecting. Fundamentals are finally starting to drive the market.”

Share This: