Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

The California New Car Dealers Association (CNCDA) reported on November 1, 2023, that sales of battery electric cars accounted for 21.5% of new car sales in the Golden State during the first 9 months of the year and 22.3% in the third quarter. At the end of Q3 in 2022, sales of electric cars stood at 16.4%. In 2021, that number was 9.1%. So, despite all the weeping and wailing and gnashing of teeth lately about how the EV revolution is stalling, the news is pretty good, at least in California.

When hybrid and hydrogen fuel cell vehicles are included in the calculations, the figure jumps up 35.4% for all vehicles sold year to date in California. Not surprisingly this means gas-powered sales are falling in the state, with the CNCDA reporting ICE market share (including gasoline and diesel vehicles) was 64.6% so far this year, down from 71.6% in 2022 and 88.4% in 2018.

California is known as the vanguard for automotive trends in the country, with shifts in preferences and government policy eventually spreading to the rest of the country. While the state’s share of electric cars exceeds one fifth of all vehicles sold year to date, the figure for the US as a whole stands at 7.4%. California has banned the sale of gas-powered vehicles starting in 2035, although the steady increase in the sale of electric cars suggests that ban may never need to be implemented as people embrace the EV revolution.

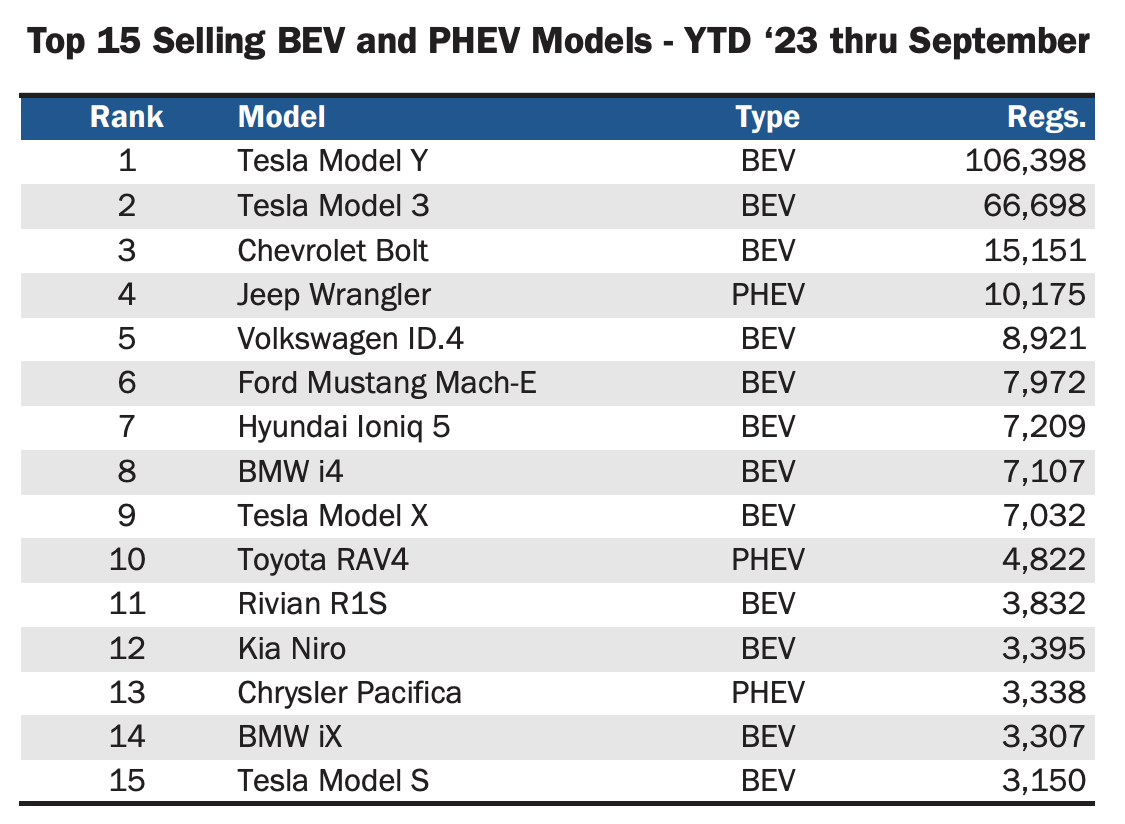

Not surprisingly, when digging deeper into the sales data, the Tesla Model Y and Model 3 dominate sales in electric car in the state, at 103,398 and 66,698 respectively. Tesla’s overall market share of battery electric car sales is at 62.9%. In fact, the Tesla Model Y is the top selling vehicle overall in California, followed by the Model 3, the Toyota RAV4 (40,622), and the Toyota Camry (39,293).

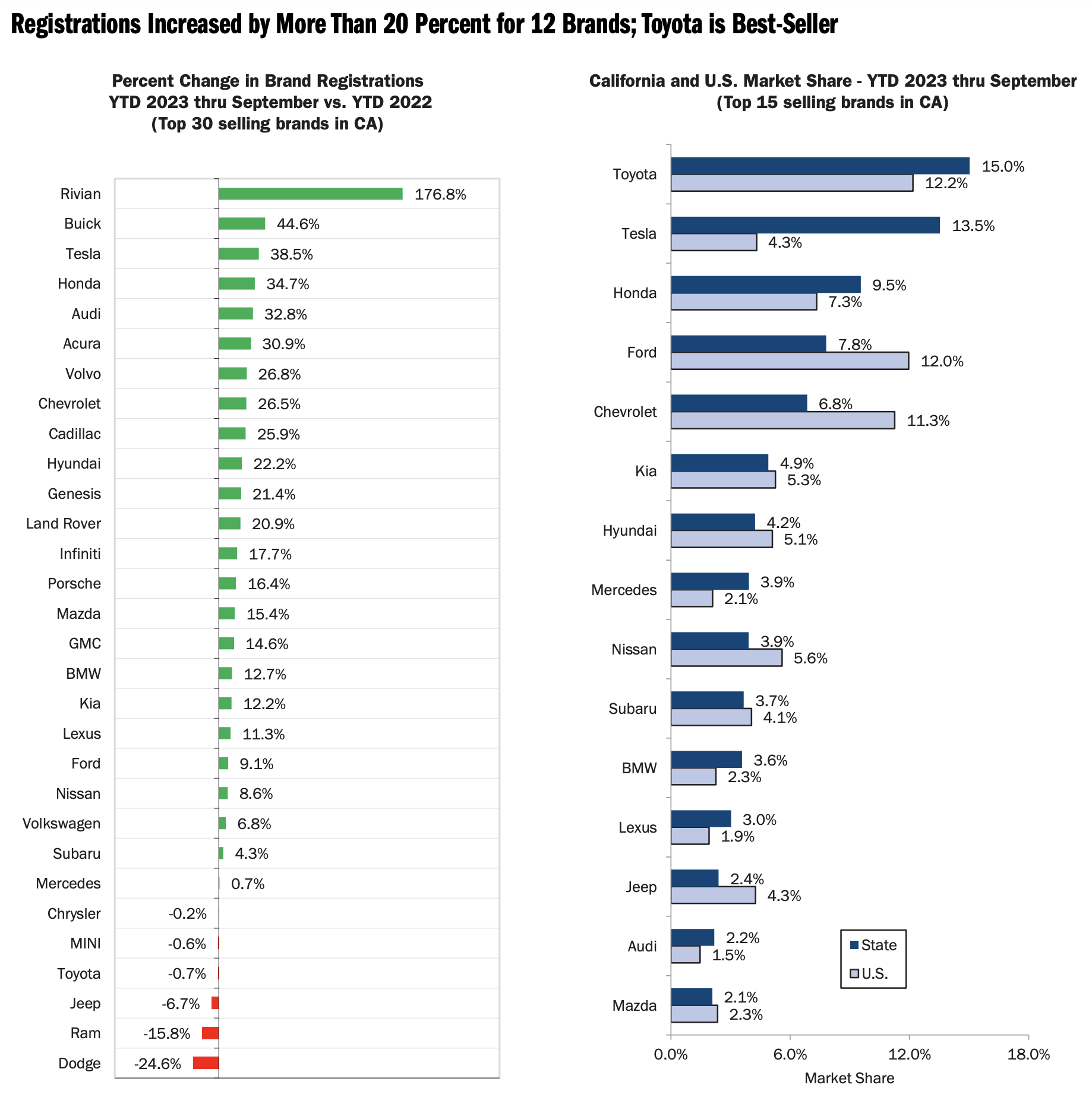

While that is good news for Tesla, its overall market share has slipped from 71.8% year to date last year at this time. Competing models from brands like Chevrolet, BMW, Mercedes, Hyundai, Volkswagen, and Kia have been slowly eating into Tesla’s market share. Overall, in California, Toyota is the sales king with 15% of sales, followed by Tesla at 13.5%. In the second quarter, Tesla narrowly edged out Toyota for top sales in the state before sales swung back in Toyota’s favor in the third quarter.

That being said, Tesla’s sales in the state climbed by 38.5% year to date, while Toyota’s actually shrank by 0.7%. Time will tell if Tesla’s popularity with the state’s car buyers improves and it can overtake Toyota for the 2023 crown, or if other EV makers can offer better products at better prices and lure California customers who want to purchase electric cars away from the Tesla brand. Certainly, no company can expect to have two thirds of the market to itself forever.

California Strengthens Dealer Franchise Law

Electric cars may be growing in popularity in California, but the state’s new car dealers won a major victory in the legislature this year in the form of a new law, AB 473, which includes several fundamental new provisions that benefit dealers.

- Preserving Franchise System Integrity — It prevents manufacturers from introducing new vehicle brand names that would directly compete with their established franchised dealer network.

- Equitable DC Fast Charging — The bill establishes fairness in manufacturer-imposed DC fast charging programs. It prohibits manufacturers from burdening their dealers with the entire cost of installing and maintaining public facing DC fast chargers.

- Post sale Subscription Limits — AB 473 limits manufacturers’ ability to offer post-sale subscriptions for features already integrated into the vehicle, ensuring fairness in consumer choices.

- Transparent Reservation Process — Manufacturers are now mandated to adopt an open and fair process for vehicle reservation systems, enhancing transparency for both dealers and consumers.

- Reimbursement for Digital Services — Manufacturers are now obligated to reimburse dealers for any losses incurred due to the use of a non-compliant digital service, particularly if the manufacturer pre-selected the service.

We discussed the new law over watercress sandwiches (with the crusts removed, of course) at our daily confab in the organic vegetable garden of the roof of the CleanTechnica tower today and agreed we didn’t understand all the nuances of the new legislation, but it seems clear that part about equitable fast charging is a slap in the face to Ford CEO Jim Farley, who a year ago blindsided dealers with an ultimatum that they install fast chargers at their stores if they wanted to be full fledged members of the Ford sales process for electric cars.

Dealer Push Back

The dealers howled and kicked up a fuss, claiming the mandate placed a huge burden on them since doing so could cost up to half a million dollars. That seems preposterous when the price of a 250 kW Supercharger is presumed to be around $50,000 or less. We know that demand chargers from local utility companies can be onerous, but there are strategies for managing such things — such as storage batteries — that cost far less than half a million dollars.

What dealers are really afraid of is that electric cars will be less profitable and so it will be harder to recoup their investment in charging equipment. In the final analysis, Farley ambushed the dealers and they went scurrying to the state legislature for protection — and got it.

That part about post-sale subscriptions is also noteworthy. BMW has been the posterchild for greedy manufacturers by making access to seat heaters a subscription service for some models in some markets. People really don’t like being charged extra for features after they buy a car, and that is understandable. But we suspect what is really going on here is the dealers want to be cut in on those after-sale subscription fees. We’ll be curious to see how this plays out.

The big win for the dealers is the provision that prevents manufacturers who have an established dealer network from trying to create a new marketing unit that would sell directly to the public the way Tesla and Rivian do. It may be that the dealers are thinking about how Volkswagen is in the process of creating a new division known as Scout that will offer a lineup of rugged battery electric cars aimed at the off-road market.

Volkswagen is already marginalizing its dealers in Germany when it comes to selling electric cars. California dealers may be anticipating something similar and making a preemptive strike to prevent that from happening in their state. The takeaway here is that franchise dealers have a lot of clout in state legislatures. AB 473 is proof positive that the power of the dealers remains intact.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

EV Obsession Daily!

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

Community Solar Benefits & Growth

CleanTechnica uses affiliate links. See our policy here.