AUSTIN, Texas & NEW YORK–(BUSINESS WIRE)–Advantage Capital, a leading impact investment firm, announced that it has committed to provide a $137 million investment to Sabanci Renewables, a North American subsidiary of Sabanci Holding, to complete the financing of its Oriana Solar Project. Located approximately 120 miles southeast of San Antonio, Texas in Victoria County, Oriana is a 232 MWdc utility-scale solar project currently under construction.

Advantage Capital’s investment, which leverages Investment Tax Credits (ITCs) under the Inflation Reduction Act, will provide the remaining capital Sabanci Renewables needs to complete the project’s construction. This closing represents the second tax equity financing in Texas between Advantage Capital and Sabanci Renewables during the past year, bringing the combined total energy capacity of Sabanci Renewables’ projects in the Electric Reliability Council of Texas (ERCOT) to more than 500 MWdc.

“We are pleased to expand our partnership with Sabanci Renewables to support building out the power grid in Texas through another utility-scale solar project,” said Tom Bitting, Managing Director at Advantage Capital. “Oriana will have a profound impact on the Gulf Coast region by increasing the clean power supply to critical energy load centers, and Victoria County will reap the added benefit of new job creation for local workers.”

With operations expected to commence in Spring 2025, the Oriana Solar Project includes 425,000 solar modules to be installed on 1,100 acres (equal to more than 800 football fields) and will be able to provide sustainable electricity to the equivalent of 65,000 homes in the region. The project will create more than 300 employment opportunities during the construction period and 10 permanent jobs in its operation phase for local employees.

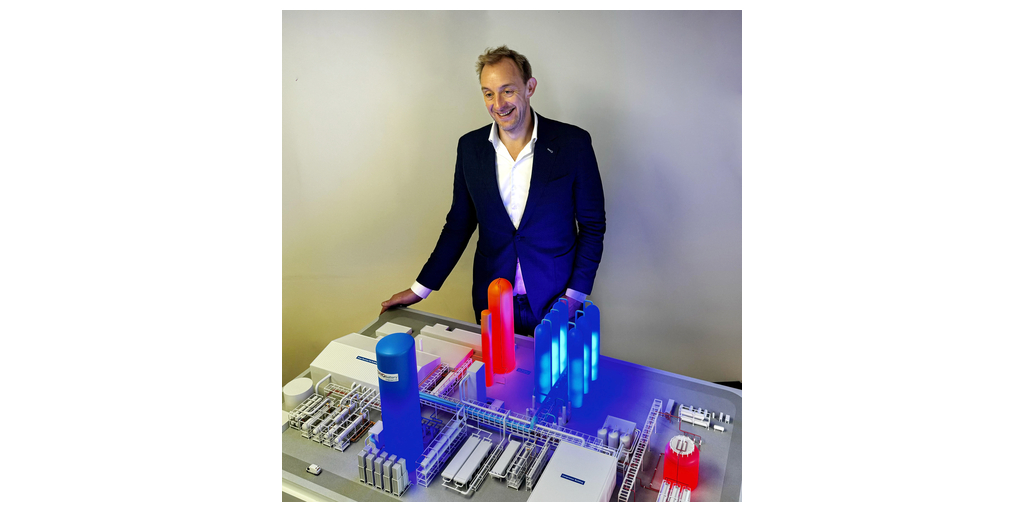

“We are thrilled to reach another key milestone in our renewable energy journey in the United States with the Oriana Solar Project,” said Tolga Kaan Doğancıoğlu, CEO of Sabanci Renewables. “This project highlights our strong commitment to accelerating the clean energy transition not only in Texas but throughout the U.S., while contributing to the economic growth of local communities. Our ongoing partnership with Advantage Capital plays a pivotal role in realizing our goal of delivering sustainable and dependable energy to numerous households and enterprises. Together, we are confidently building a brighter and more sustainable future.”

A&O Shearman and K&L Gates served as counsel for Advantage Capital on the transaction, and Troutman Pepper and Husch Blackwell served as counsel for Sabanci Renewables. Carbon Reduction Capital (CRC-IB), also served as exclusive financial advisor.

On Dec. 18, 2023, Sabanci Renewables closed $185 million in tax equity financing with Advantage Capital for the Cutlass Solar II project outside of Houston. Cutlass II was completed and commissioned at full capacity ahead of schedule in May 2024.

About Advantage Capital

Advantage Capital works with renewable energy developers to expand community access to clean energy and invigorate local economies, providing tax-advantaged financing for high-impact renewable energy projects across the U.S. In recent years, the company has invested in over 100 non-residential projects (including C&I, community solar, and utility-scale) in addition to more than 10,000 residential rooftop systems throughout the U.S. and its territories. Since 1992, Advantage Capital has invested more than $4.2 billion in companies from a diverse array of industry sectors and has helped support more than 70,000 jobs. Learn more at advantagecap.com, or via X or LinkedIn.

About Sabanci Renewables

Sabanci Renewables is a wholly owned subsidiary of Sabanci Holding, a leading Turkish conglomerate founded in 1967. Sabanci Holding is engaged in a wide variety of business activities through its subsidiaries and affiliates, mainly in the energy, banking, financial services, industrials, building materials, digital and retail sectors. Within its energy business, Sabanci has a strong reputation developing and operating energy projects, and currently operates more than 4 GW of diversified power plant portfolio in Turkey. Sabanci Renewables is targeting to establish 3 GW of renewable portfolio consisting of utility-scale solar and onshore wind projects all over the U.S. by the end of 2029. With Cutlass II and Oriana Solar, Sabanci Renewables owns 500 MW of capacity operating or under construction. Learn more at sabanciclimatetech.com.

Advantage Capital is an Investment Adviser registered with the U.S. Securities & Exchange Commission. Such registration, however, does not imply a certain level of skill or training. This release has been prepared for informational purposes and to announce a prior event, and nothing herein should be construed as an offer of investment advisory services or as an offer to sell or a solicitation of an offer to purchase any securities or investment product. All offers of investment interests in any fund or investment vehicle managed directly or indirectly by Advantage Capital are and will be made only to qualified prospective investors pursuant to separate and definitive offering and subscription documents in accordance with applicable federal and state securities laws. Advantage Capital is an equal opportunity provider.

Any third-party statements herein are by persons other than current clients or investors in any private fund directly or indirectly managed by Advantage Capital, and although Advantage Capital did invest cash funds in Sabanci Renewables (“Sabanci”), Tolga Kaan Doğancıoğlu (Sabanci Renewables Chief Executive Officer) has not received any direct compensation, whether in cash or non-cash form, for the statements or opinions expressed herein. There are no known material conflicts of interest on the part of any third party making or expressing such statements or opinions resulting from such party’s relationship with Advantage Capital or from Advantage Capital’s investment in Sabanci.

Contacts

Advantage Capital

Joe Stosberg, Communications Manager