Robots integrated with AI are a way of ensuring that mines get “the right data” to help optimise performance, says Jake Loosararian, the CEO and co-founder of Gecko Robotics.

Gecko, which uses AI-powered data from robots to help maintain critical infrastructure, recently entered an agreement with mining giant Freeport-McMoRan, the world’s largest copper producer, which had an output of 1.9 million tonnes (mt) in 2023. Freeport currently operates ten mines in the US, two in South America and three in Indonesia, according to GlobalData. As with other copper producers, it is facing challenges with decreasing head grades, which requires an “increasing need for efficiency”.

Announcing Freeport’s collaboration with Gecko at the FT Mining Summit in September, Bill Cobb, the company’s vice-president and chief sustainability officer, pointed to the role of data science and technology such as automated systems and digital twins in improving mining processes and reducing cost.

“We collect a lot of data across the pits — [from] all the haulage equipment, the drills, the shovels, etc — and in the processing facilities. We employ a lot of data science, and we are talking about innovation and the potential to reinvent what we do.”

Cobb said that Bagdad, Freeport’s open-pit copper and molybdenum mine in Phoenix, Arizona, “will become the first autonomous hardware operation in the US next year”, adding that the company is evaluating what this will mean for mills and other operations.

Why use robotics and AI for predictive maintenance?

Loosararian, who founded Gecko Robotics from his college dorm room in 2013, reflects on his original mission “to build robotics and software to diagnose and help the world”.

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Your download email will arrive shortly

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

The main challenge, he tells Mining Technology, is that for many facilities usable data “simply doesn’t exist”. This is because historically – and oftentimes today – inspections are conducted manually, potentially leading to inconsistent or incomplete datasets.

“AI tightens our sensitivity to data fidelity, ensuring that we have the right source of information/data to build systems,” Loosararian says.

“Robots are our way of ensuring that we get the right data to ensure safety, efficiency, longevity and optimal performance at these facilities.”

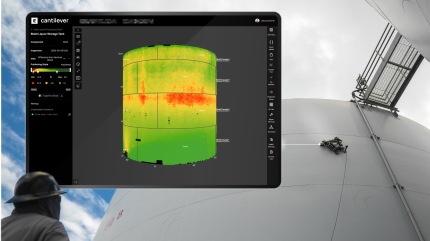

Gecko deploys various inspection robots, from wall-climbers to drones and robotic dogs, to assess the health of assets and to “figure out what they look like in reality”. It also obtains information from fixed sensors, which when combined with the historical records and operational data, can be used by Gecko’s AI-powered software – Cantilever – to provide critical operational insights.

Data collected can range from visual images to acoustic signals, LiDAR (light detection and ranging) and ultrasonics. Together, it can be leveraged with AI to make large capital deployments or develop predictive maintenance plans.

However, with thousands of assets at some mine facilities, it can take two to three years to gather the data needed, Loosararian says. Gecko focuses on mapping the most critical assets in the first year, with the goal of getting 80% of all assets modelled within 3–4 years.

How robots and AI support mine infrastructure

Gecko Robotics tells Mining Technology that it works “largely on infrastructure around the processing and leaching side of mines”. The company has also used its robots and AI platform on tailing thickeners, concentrators, as well as a variety of tanks, bins and process piping.

“We have seen a return on investment from 5–10 times annually by decreasing downtime, understanding the remaining useful life of assets to better utilise capital planning and avoiding catastrophic failures with predictive maintenance,” says Loosararian.

Gecko is using its technology to help Freeport extend the useful life of critical infrastructure at its mining facilities by 15–20 years. Later, it is also hoping that the AI platform can be used to increase production efficiency and support Freeport’s goal to double copper production by 2035.

Cantilever is also helping to integrate data from Freeport’s autonomous trucks with other robotic and sensor technologies, which can help inform operational decision making, as Cobb has suggested.

Freeport’s chief sustainability officer pointed to how robotics and AI can support predictive maintenance of tanks and heap leach facilities, potentially reducing the environmental impact of any failures.

“When a failure happens it is not just that single asset that suffers, it is the entire production chain – and the people side is even worse [as] our already-limited staff gets diverted to clean-up and regulatory paperwork that pulls them away from where they are needed,” Cobb told delegates at the FT Mining Summit.

Gecko looks beyond mining

Although Loosararian says mining was Gecko Robotics’ “fastest-growing sector” over the past three to four months, there are many other industries that are benefitting from its tech.

In fact, according to GlobalData, Gecko Robotics is the leading patent filer in inspection robotics, with the broadest geographical reach and application diversity of the 65-plus companies engaged in the development and use of inspection robots.

In May, Gecko and Al Masaood Energy partnered with ADNOC Gas, a subsidiary of the Abu Dhabi National Oil Company, on a $30m (Dh110.18m) multi-year contract that will facilitate predictive maintenance across its oil and gas (O&G) assets. During the pilot phase, Gecko’s solutions almost doubled asset coverage and improved efficiency by 93% compared with traditional manual methods.

Gecko is also working with the US Navy. Since 2023, it has been using wall-climbing robots and AI-powered software to build digital models that increase the speed of maintenance cycles and reduce the time Navy vessels spend in dry dock. This year, the partnership expanded to include its first aircraft carrier and Columbia-class submarines.

Emissions reductions benefits

In addition to these predictive maintenance applications, Gecko says its robots and AI platform can support emissions reduction.

A study completed in January claims better use of robotics and AI could reduce carbon dioxide (CO₂) emissions by up to 853mt annually across various sectors. It finds that detecting corrosion, leaks and other defects within the O&G sector could reduce fugitive emissions most — by up to 556mt of CO₂ equivalent per year by 2030.

Gecko notes that while emissions in the mining sector are harder to quantify, the research it has commissioned shows that by 2030, 18% of emissions in the US will be caused by unplanned failures in production sectors such as mining, steel and O&G.

Data from the US Energy Information Administration indicates that methane emissions from active and abandoned coal mines accounted for around 1% of the US’ total greenhouse gas (GHG) emissions in 2021. Meanwhile, methane emissions from natural gas, petroleum systems and abandoned O&G wells made up 4% of US GHG emissions that same year, according to US Environmental Protection Agency estimates.

Mining and the future of AI and robots

Gecko’s work with Freeport is just one example of how AI and robots are supporting mining operations. The company is also working with other mining majors, but details are not public.

“The narrative is changing because the most cutting-edge robotics technology, software and AI is being deployed practically at these facilities,” says Loosararian.

However, companies that do not embrace digital transformation soon could be “severely disadvantaged”, he says, pointing to case studies that show 20% reductions in capital expenditure and a 50–100% increase in the life of mining infrastructure through adopting the tech.

It looks like miners are taking heed. GlobalData’s Mine Site Technology Adoption Survey, published in June, found that close to half of the operating mines surveyed are planning to invest in predictive maintenance for mobile equipment (48.1%) or for plants (45.7%) within the next two years.