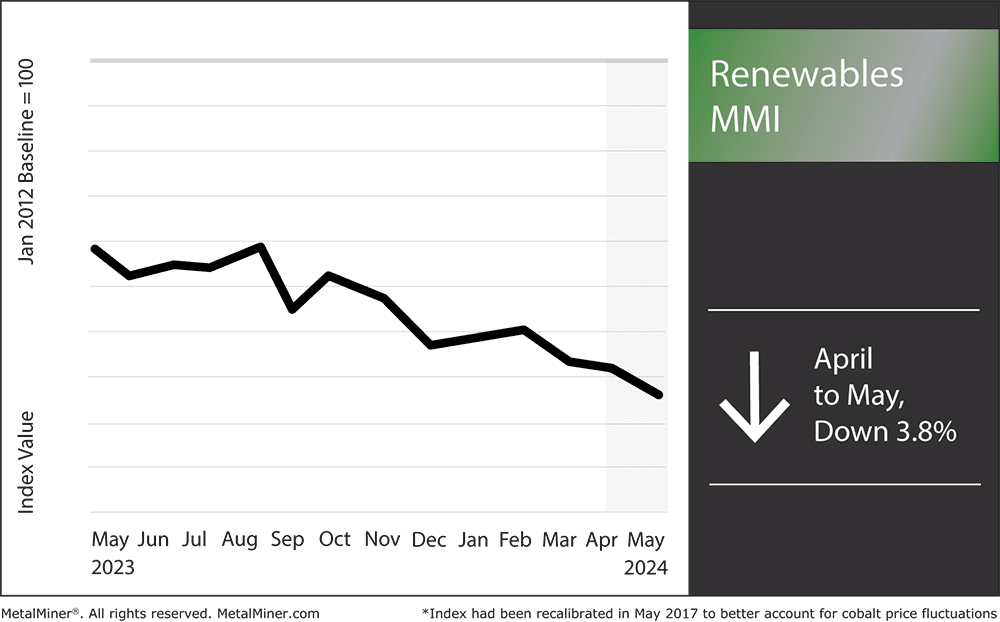

The Renewables MMI (Monthly Metals Index) continued its slight downward trend month-on-month, dropping by 3.8%. Two large components of the index, silicon and cobalt prices, continue to experience drops due to lingering renewable energy supply bottlenecks from 2023. This, along with falling grain-oriented electrical steel prices, brought the index down

Silicon for Solar Panels: A Geopolitical Imbalance?

The United States relies heavily on China for its solar panel supply. However, this dependence on Chinese manufacturing raises several concerns. One issue of note is the alleged use of forced labor in China’s Xinjiang area, which generates a significant portion of the world’s polysilicon, the primary component used in solar panels.

Due to evidence of forced labor abuses against Uyghur and other Muslim minorities, the U.S. government has placed restrictions on the importing of items made in Xinjiang. But because it is difficult for companies to obtain the required documentation to prove that their items have nothing to do with forced labor, shipments of solar panels from China continue to be delayed and confiscated as a result.

The hazards to the global supply chain posed by China’s dominance of solar panel production are another significant cause for worry. For example, 14% of the world’s polysilicon stems from a single facility in China, and interruptions at these plants have the potential to affect the entire global sector.

There are also many environmental concerns due to the over-dependence on Chinese manufacturing. The primary source of electricity used in China’s polysilicon manufacture is coal-fired power, which raises the carbon footprint of solar panels. That said, it is possible to decrease these overall emissions by moving production to areas with cleaner energy sources.

Receive indispensable updates on metal prices and market shifts, empowering your company to make informed purchasing decisions whether you’re invested in renewable energy. Opt into MetalMiner’s free weekly newsletter

Addressing These Issues

There are initiatives underway to support domestic solar panel manufacturing in the United States in order to overcome these problems. However, the nation’s demand continues to grow faster than its production capability, meaning imports will have to continue for the time being.

China is the world’s largest producer of solar panels, reducing prices and improving accessibility. However, the United States’ dependence on Chinese imports raises questions about forced labor, weak supply chains, and environmental effects.

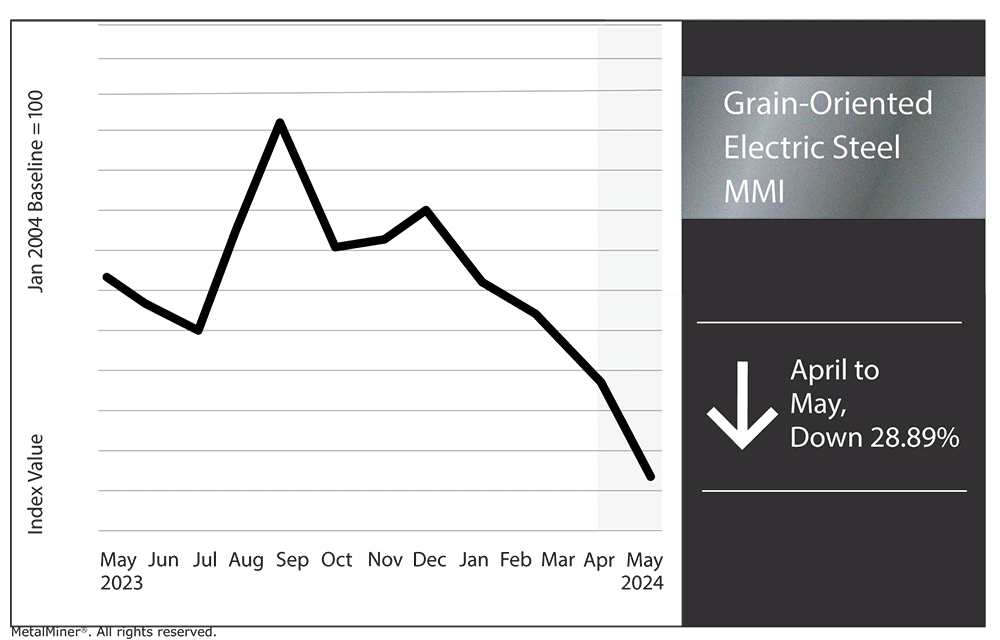

Grain Oriented Electrical Steel/GOES MMI

The Grain Oriented Electrical Steel MMI took another sharp dive in price action, dropping 28.89% to $3,399 per metric ton.

Tornadoes Knockout Transformers, Exasperating Ongoing Transformer Shortages

The electrical system in the U.S. suffered severe damage from the recent wave of tornadoes that swept across the country, which took out many transformer systems. This occurs at a time when the nation already faces a dire transformer shortage, making it extremely difficult to replace the damaged equipment.

As the main component of the electrical grid, transformers convert high-voltage electricity from power plants into lower voltages appropriate for use in homes and businesses. Nevertheless, a large number of these transformers are already nearing the end of their intended lives.

According to some estimates, 70% of U.S. transformer units are at least 25 years old, while 15% are older than 40 years. Meanwhile, the transformer scarcity has become worse as a result of catastrophic weather occurrences like tornadoes depleting transformer stockpiles, leaving utilities frantically searching for replacements.

Don’t miss out on valuable metal market insights. Subscribe to MetalMiner’s free Monthly Metals index report and gain a competitive edge with comprehensive market analysis for 10 different metal sectors.

Overcoming the Transformer Dilemma

To overcome this conundrum, experts advise developing a thorough resilience plan that emphasizes strengthening the electric power sector as a whole and bettering life-cycle management. This might entail using cutting-edge techniques to manage the capacity for emergency replacement, such as the Spare Transformer Equipment Program (STEP), which aims to create a strategic reserve of transformers that utilities can use in an emergency.

Furthermore, in order to reduce energy waste and carbon emissions by 340 million metric tons over the next 30 years, the Department of Energy recently suggested increasing the use of amorphous steel, a more efficient material for transformer cores. Estimates say this could save consumers an estimated $15 billion on their energy bills.

Nonetheless, a few legislators and industry experts worry that moving to a new kind of transformer would make the current supply chain issues worse and impede the grid’s growth and upkeep.

Renewables MMI: Noteworthy Price Shifts

See why technical analysis is a superior forecasting methodology over fundamental analysis and why it matters for your metal buys.

- Silicon prices dropped by 3.24% to $1,836.07 per metric ton

- Cobalt prices dropped by 5.2% to $26.89 per kilogram

- Neodymium prices rose by 7.67% to $64639.74 per metric ton

- Finally, steel plate prices moved sideways, rising by a slight 1.47%. This brought prices to $1,310 per short ton