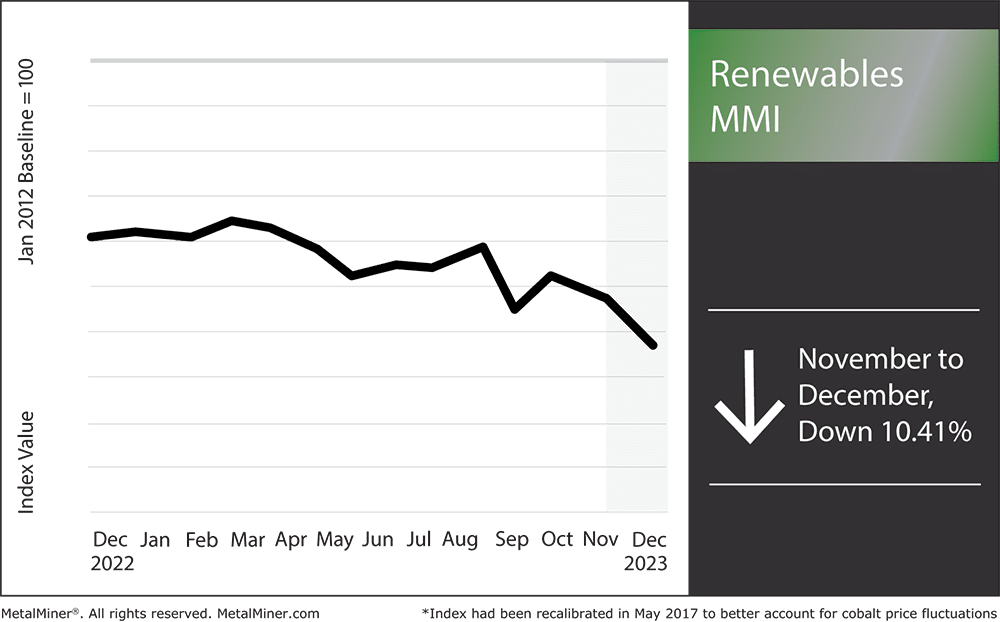

The Renewables MMI (Monthly Metals Index) took a noticeable dive month-over-month, dropping by 10.41%. Indeed, neodymium, cobalt, and steel plate all suffered drops in price, making them the main culprits for the index falling. Meanwhile, the latest renewable energy news sources suggest green initiatives could be in for a rocky ride in 2024. This is due to a number of factors, including the ongoing elevation of interest rates from the Fed. Despite this, several global renewable initiatives saw boosts in 2023, which could help the index seek out bullish pressure. Still, for the moment, the index remains bearish.

Latest Renewable Energy News Suggests Green Energy May Struggle

Despite its previous surge, green energy in the U.S. continues to face fresh obstacles. Declining expenses, readily available capital, and supportive political backing drove the shift toward renewable energy. However, fragmented supply chains and elevated interest rates now dominate the marketplace, resulting in heightened costs that continue to test the determination of both consumers and governments.

According to the latest renewable energy news, this transformation is part of a worldwide trend. Not long ago, analysts predicted that global spending on renewables would surpass investments in oil and gas production in 2023. Though energy firm difficulties vary by sector, the escalation in interest rates is increasing borrowing expenses for a wide range of stakeholders. This means everyone from individuals purchasing electric vehicles to utilities constructing large-scale renewable energy projects is currently feeling the strain.

Richard Kauffman, the chair of a green investment fund, has likened the current challenges clean energy enterprises face to the early stages of personal computer and cellphone development. He underscores the notion that long-term trends still suggest the continued growth of clean energy. Moreover, he believes that the problems hindering green energy in the U.S. are part of a more extensive global dialogue concerning the transition to renewable energy sources.

While this analysis does not aim to provide an exhaustive enumeration of causes, it appears that both domestic and international factors are affecting the U.S. green energy transition. Indeed, moving towards a more sustainable energy future requires a complex economic, political, and environmental equilibrium, which could prove difficult to sustain.

Gain access to MetalMiner Insights and harness accurate metal price forecasts for well-informed, proactive procurement savings. Click here

2023 Initiatives for Green Energy: A Year in Review

In 2023, various organizations and nations took active steps to accelerate the shift towards environmentally-friendly energy sources. The International Energy Agency (IEA) reported channeling more than $1.7 trillion into clean energy endeavors, including renewable energy, nuclear power, grid infrastructure, energy storage, and low-emission fuels. The pressing need to combat the global energy crisis and the unpredictable fluctuations in fossil fuel markets caused by geopolitical events primarily motivated this upsurge in clean energy investments. Remarkably, investors directed the most substantial funds towards renewable energy and electric vehicles (EVs), with solar energy funding surpassing investments in upstream oil for the first time.

Additionally, during the 28th Conference of the Parties (COP28), the United States actively introduced a comprehensive global strategy to promote nuclear fusion as a clean energy source. This strategy aims to foster collaboration with other nations to accelerate the development of nuclear fusion as a carbon-free energy alternative. According to renewable energy news outlets, this clearly aligns with the objective of limiting global warming to 1.5 degrees Celsius.

At the same COP28 climate summit, 118 governments actively committed to tripling the world’s renewable energy capacity by 2030. The overarching goal of this initiative is to reduce reliance on fossil fuels in global energy production. It is also part of a broader effort to decarbonize the energy sector, which also involves expanding nuclear power and reducing methane emissions.

These initiatives highlight the growing worldwide consensus regarding the urgency of transitioning towards green energy sources. Meanwhile, the International Renewable Energy Agency (IRENA) emphasized the necessity for a profound and systemic transformation of the global energy system, supported by a record-high investment of $1.3 trillion in energy transition technologies in 2022.

Stay up to date on the latest renewable energy news and how it’s affecting metal prices. Sign up for MetalMiner’s weekly newsletter.

Grain-Oriented Electrical Steel MMI

The GOES (Grain-Oriented Electrical Steel) MMI managed to break its bearish pattern and flatten out this past month. Despite this, it’s unclear which direction the index will take in the long term. All in all, the index moved sideways, only rising by 1.45%.

Renewables MMI: Notable Price Shifts

- Chinese silicon moved sideways with only a mere 0.04% drop. This left prices at $2,016.75 per metric ton.

- U.S. steel plate prices decreased by 8.5%, which brought prices to $1,357 per short ton.

- Chinese cobalt dropped by a drastic 24.42%, mainly thanks to supply overabundance. This put prices at $31,639.34 per metric ton.

- Finally, Chinese neodymium dropped by 3%, leaving prices at $85,561.2 per metric ton.

Enjoying this article? MetalMiner’s monthly MMI report gives you price updates, market trends and industry insight for renewables and 9 other metal industries. Sign up for free.