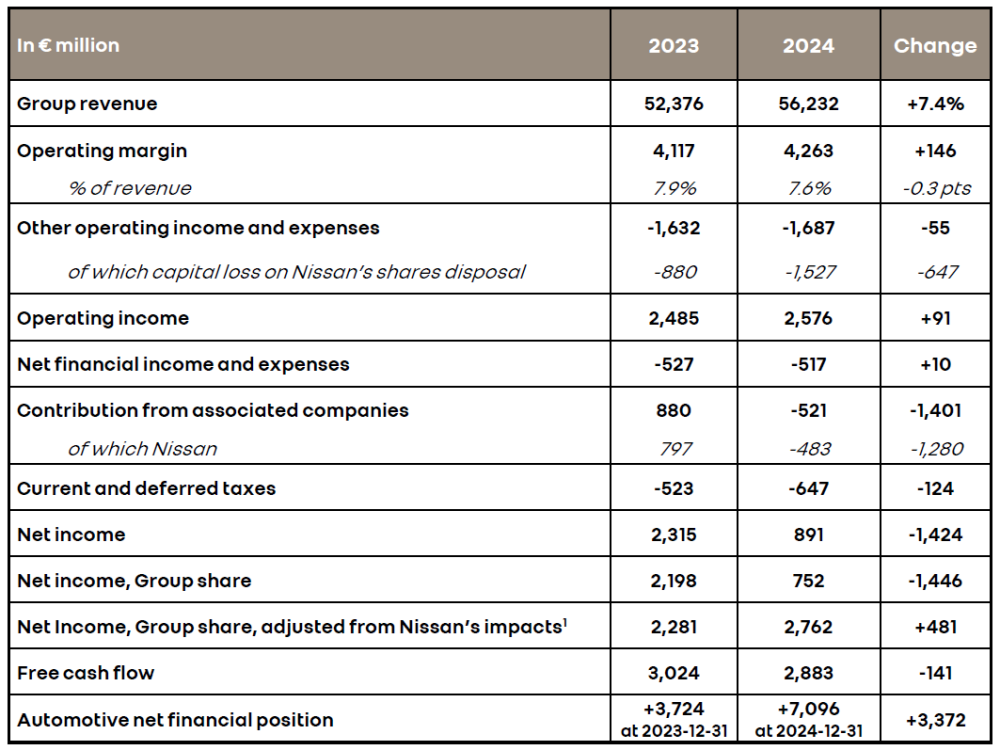

London, February 20, 2025, (Oilandgaspress) ––Renault Group reported a revenueof €56.2bn, +7.4% and +9.0% at constant exchange rates vs 2023. This robust performance is driven by our complementary auto brands, all 3 of which delivered growth

Historical Group operating profit in absolute value at €4.3bn (+€146m vs. 2023 and +15% growth when excluding Horse impacts[2]), 7.6% of revenue

– Net income – Group share:

€2.8bn (excluding a total of -€2.0bn of Nissan’s impacts related to capital loss on Nissan’s shares disposals, Nissan’s contribution and partial impairment of investment in Nissan)[3], +21% vs 2023

– Reported net income – Group share: €0.8bn

Solid free cash flow[4]: €2.9bn vs guidance at ≥€2.5bn, driven by a strong operational performance

– Record Automotive net cash financial position, almost doubled: €7.1bn at December 31, 2024 (+€3.4bn vs December 31, 2023)

• Solid orderbook in Europe around 2 months of forward sales

• A dividend of €2.20 (+19% vs last year) will be submitted to approval of the Annual General Meeting on April 30, 2025 versus €1.85 per share in respect of 2023 financial year

• In 2025, considering market uncertainties especially due to CO₂ emissions regulation impact in Europe (CAFE), Renault Group is aiming to achieve:

– A Group operating margin ≥7% (it includes around 1 point of estimated CAFE negative impact)

– A free cash flow ≥€2bn including €150m of Mobilize Financial Services (MFS) dividend (vs €600m in 2024) due to a minimum level of MFS equity to keep complying with European Central Bank and the credit rating agencies solvency ratios. From next year, MFS dividends will rise again to return to a level in line with historical average (subject to regulatory and MFS board approvals).

The consolidated financial statements of Renault Group and the company accounts of Renault SA at December 31, 2024 were approved by the Board of Directors on February 19, 2025 under the chairmanship of Jean-Dominique Senard.

Group revenue reached €56,232 million, up 7.4% compared to 2023. At constant exchange rates[11], it increased by 9.0%.

Automotive revenue stood at €50,519 million, up 4.9% compared to 2023. It included 1.4 points of negative exchange rates effect mainly related to the Argentinean peso, to the Turkish lira devaluation and to a lesser extent to the Brazilian Real. At constant exchange rates4, it increased by 6.3%, mainly due to the following:

Volume: +1.3 points, in line with the increase of our registrations thanks to the growing impact of our launches and a higher restocking within the dealership network compared 2023 to secure the ongoing product offensive.

As of December 31, 2024, total inventories of new vehicles stood at 540,000 vehicles, of which 437,000 at independent dealers and 103,000 at Group level.

Product mix: +2.7 points, in constant improvement over the year in line with the Group’s recent launches (Scenic, Rafale, Duster, Symbioz, Renault 5, Koleos, Espace…) which have more than offset the negative effect from the end of life of Zoe, the continuing success of Sandero and the transition to new Master.

Price: +0.6 points, as expected, reflecting the entry into a phase of price stabilization. Renault Group aims to offset negative currency effects by pricing actions while giving a portion of its cost reduction back to its customers mostly through content. Thereby, it further supports the competitiveness of the Group’s vehicles while protecting margins.

Geographic mix: +0.4 points.

Sales to partners: -0.9 points, due to the decrease of new vehicles sales to partners in a transition period before the launch of new products, partially offset by R&D billings to partners in line with the ramp-up of common projects.

Other: +2.2 points, primarily related to the strong performance of parts and accessories.

The Group posted a record operating profit in absolute value at €4,263m, up €146m vs. 2023. It represented 7.6% of revenue.

Adjusted from the impacts of Horse operations[12], the Group operating margin increased by 15% in absolute value and by 0.5 points from 6.9% in 2023 to 7.4% in 2024.

Dividend

The proposed dividend for the financial year 2024 is €2.20 per share, up 19% versus last year (+€0.35 per share). The payout ratio is 21.5% of Group consolidated net income – parent share[14]. It would be paid fully in cash and will be submitted for approval at the Annual General Meeting on April 30, 2025. The ex-dividend date is scheduled on May 8, 2025 and the payment date on May 12, 2025.

Renault Group’s consolidated results

Information Source: . Read More

Oil and gas press covers, Energy Monitor, Climate, Gas,Renewable, Oil and Gas, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas,