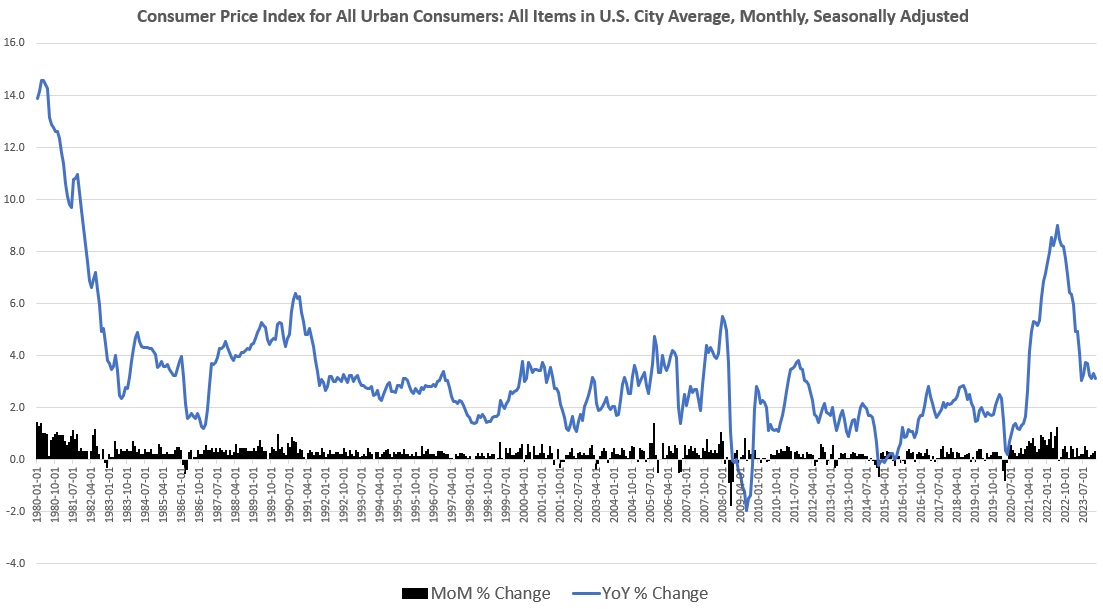

According to the Bureau of Labor Statistics’ latest price inflation data, CPI inflation in January accelerated, and price inflation hasn’t proven nearly as transitory as the regime’s economists have long predicted.

According to the BLS, Consumer Price Index (CPI) inflation rose 3.1 percent year over year during January, after seasonal adjustment. That’s the thirty-fifth month in a row of inflation well above the Fed’s arbitrary 2 percent inflation target.

Month-over-month inflation accelerated, with the CPI rising 0.3 percent from December to January. Month-to-month growth had been 0.2 percent from November to December.

The ongoing price increases largely reflect growth in prices for food, services, electricity, and shelter.

For example, prices for “food away from home” were up 5.1 percent in January over the previous year. Gasoline prices fell 6.4 percent over the period, but electricity was up 3.8 percent. Prices for “services less energy services” rose 5.4 percent, year over year, while shelter rose 6.0 percent over the period.

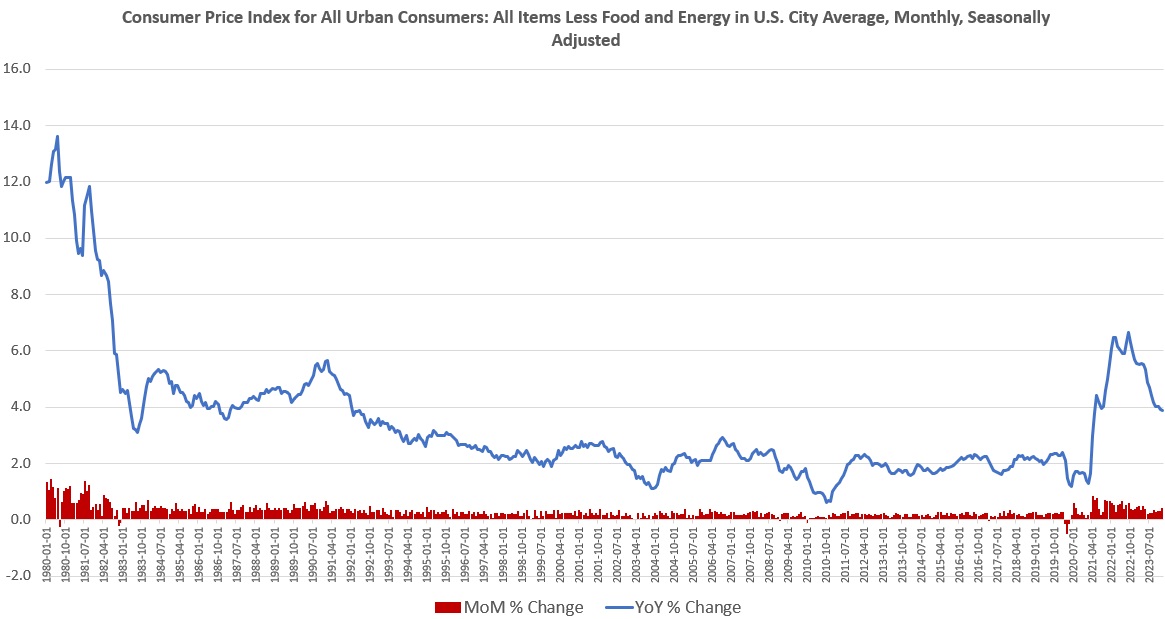

Pulling out volatile energy and food prices, we find price inflation remains stubbornly high. So-called core CPI growth remains near four percent, keeping it near thirty-year highs. In other words, core CPI is a long way from returning to “normal.” Moreover, January’s month-over-month increase was the largest in nine months.

There’s still no sign that the rate of price inflation is approaching zero or going away. In fact, it may be headed in the opposite direction. The slogan of “transitory inflation” has now proven to be wrong every single month for nearly three years.

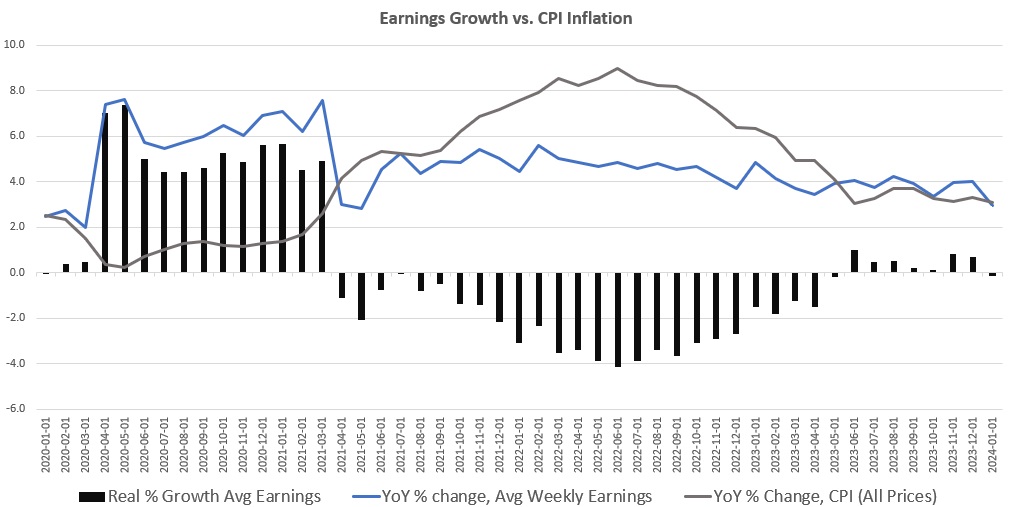

The dangers of persistent price inflation were further driven home in January by the fact that real wages turned negative for the first time in nine months. In the most recent jobs data, the BLS reported that the year-over-year change in average weekly earnings was 3 percent. That might seem like good news were it not for the fact that CPI inflation was up by 3.1 percent during the same period. In other words, if you’re an average wage earner, your income went down in January. This is what happened for twenty-six months between early 2021 and early 2023. Average wage earners experienced falling wages for more than two years. If January is an indication of a new trend, workers are back to enduring falling wages after only seven months of mild increases in real earnings.

While wages are falling for many, the Wall Street Journal last week identified another new trend: the amount of disposable income spent on food has reached a thirty-year high. The WSJ reports:

Eating continues to cost more, even as overall inflation has eased from the blistering pace consumers endured throughout much of 2022 and 2023. Prices at restaurants and other eateries were up 5.1% last month compared with January 2023, while grocery costs increased 1.2% during the same period, Labor Department data show.

Relief isn’t likely to arrive soon. Restaurant and food company executives said they are still grappling with rising labor costs and some ingredients, such as cocoa, that are only getting more expensive. Consumers, they said, will find ways to cope.

Much of the increase has been fueled by increases in the cost of dining out. Yet, as a percentage of disposable income, even grocery shopping has increased to twenty-year highs in recent years.

It’s now been more than two years since price inflation surged well above the Fed’s target rate, and stayed there. This, of course, is what we’d expect after record-breaking monetary inflation fueled by Fed asset purchases and relentless suppression of interest rates.

Nonetheless, apologists for the administration continue to insist that inflation is “falling”—or even slowing—even though price inflation has continued to surge upward. Since January 2021, in fact, the CPI has risen 18 percent. Weekly earnings, over the same period, rose only 13 percent.

The Biden administration, however, would have us believe that inflation is going away because the CPI’s measure of price inflation has somewhat stabilized around 3.2 percent over the past six months. That’s not “falling” inflation. it’s just price inflation that’s rising more slowly than it was last year. Moreover, for every new monthly increase in prices, new price growth accumulates on top of the old price growth. All that value stolen from your dollars over the past three years? It’s gone forever unless some serious deflation sets in and the value of your money actually go up. The Fed is committed to making sure that never happens.

Meanwhile, both the administration and the Fed itself continue to think up excuses for why prices of food, services, and housing continue to surge beyond wage growth. During the Super Bowl, for example, President Biden released a video statement attempting to blame corporate greed for “shrinkflation.” This claim, however, is just the latest in a series of false narratives used to blame price inflation on everything but the real cause—the central bank. Before Biden’s diatribe against shrinkflation, the “cause” of price inflation was “Putin’s war,” and before that it was problems with global supply chains. Before that, the problem was covid lockdowns.

With food prices surging, real wages falling, and housing costs reaching record levels of unaffordability, look no further than the Fed for the real cause.

Courtesy of Mises.org

*********