The Raw Steels Monthly Metals Index (MMI) remained sideways, with a modest 1.33% decline from May to June.

As a whole, U.S. flat rolled steel prices appeared bearish, accelerating declines throughout June. HRC prices fell nearly 9%, their most significant month-over-month drop since February. CRC and HDG prices saw respective 6% declines, while plate prices fell 4%.

MetalMiner should-cost models: Give your organization levers to pull for more price transparency from service centers, producers, and part suppliers. Explore these models, download here.

Bearish Steel Prices Search for New Bottoms

Steel prices remain in search of new bottoms as the market appears increasingly soft. As of June 13, hot rolled coil prices managed to hit their lowest level since October 2023 amid reports of slow demand conditions. Mills reportedly held back on scrap orders, leading some to speculate that June could also see a drop in scrap prices.

Last quarter, mills reported variable performances. While Nucor and SDI saw a pickup in demand from Q4 2023 to Q1 2024, shipments from Cliffs and U.S. Steel declined. All four of these mills saw shipments decline year over year. By the start of Q2, mills were warning markets that impending maintenance outages could substantially tighten domestic supply. However, those warnings offered only temporary support to prices in early April before the downtrend resumed.

Despite the tepid market response, outages saw domestic raw steel production levels dip throughout April, followed by a gradual recovery during May. By June, domestic steelmakers appeared to tighten output levels again, likely in an attempt to regain control over the market. As of mid-June, steel prices remained bearish, while mill lead times edged lower. This may ultimately force mills to constrict production levels further.

Imports Surge, Especially From Vietnam

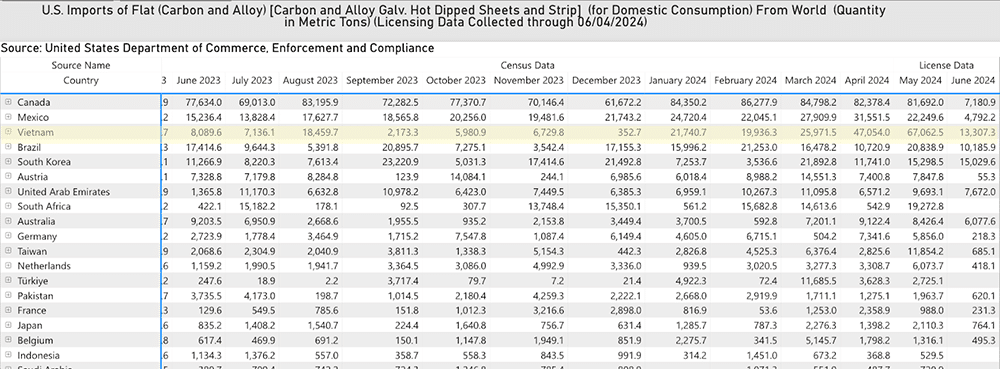

Import demand likely played a role in dragging domestic prices lower. After all, U.S. prices carried a wider premium over their global counterparts in early Q2, which helped incentivize import demand. Both March and April saw a jump in flat-rolled steel imports, and license data suggests that trend continued during May as well.

Curiously, since the start of 2024, flat rolled steel import volumes from Vietnam have increased substantially. In fact, their average monthly volumes during the first five months of 2024 rose over 453% from the same period of 2023.

The jump appears driven primarily by HDG, although CRC volumes also saw a considerable rise from their recent average. Beginning in March, Vietnam overtook Mexico as the second-largest exporter of HDG to the U.S. During May, license data showed Vietnam represented over 23% of total volumes. While this is not unheard of, it does raise a few red flags. For more information on how to leverage geopolitical shifts to your advantage, read The Art of Timing Your Buy.

Vietnamese Imports Fuel Chinese Dumping Concerns

Vietnam has faced longstanding accusations of being a dumping ground for Chinese steel. Many point toward the high volume of Chinese HRC imports that enter Vietnam, which the country then processes into CRC and HDG. Such processing efforts make it easier to disguise the material’s origin before it finds its way to the export market, potentially circumventing duties placed on Chinese steel.

High import volumes of low-priced Chinese HRC into Vietnam have so far caught the attention of at least two Vietnamese steel manufacturers. On March 19, Hòa Phát Group and Formosa Hà Tĩnh Steel Corporation submitted a proposal to the Ministry of Industry and Trade (MoIT) to initiate an anti-dumping investigation on Chinese HRC imports.

However, it remains uncertain whether Vietnam’s MoIT will agree to an investigation amid pushback from other steel manufacturers. The two companies that leveled anti-dumping complaints are the exclusive producers of HRC in Vietnam. Other steel manufacturers, including producers of HDG, noted concern over the impact such an investigation could have on Vietnam’s overall steel sector. A potential curtailment of Chinese steel supply would invariably mean higher steel prices in Vietnam, making the final products less competitive in the global marketplace.

Expert sourcing strategies, right at your fingertips. The Monthly Metals Outlook report is your guide to sourcing success. Check out a free sample copy and secure your subscription.

Vietnam’s Steel Influx Could Threaten U.S. Market

Currently, the influx of imports from Vietnam to the U.S. appears to have placed significant weight on domestic steel prices. This could see the U.S. initiate a separate anti-dumping investigation or level new protectionist measures directed at Vietnam, as curbing China appears increasingly like a game of whack-a-mole.

Steel tariffs announced in recent months targeted China directly, but those may prove insufficient in holding back the flood of Chinese exports. After all, China’s steel industry continues to fuel global steel oversupply. While consumer demand within China appears tepid and its construction and property sectors remain in an ongoing downturn, Chinese steel output continues to boom. Meanwhile, industry subsidies allow Chinese steel prices to hold at the bottom of the market, eroding profitability from manufacturers of steel elsewhere.

Biggest Moves for Raw Material and Steel Prices

Get all the news on shifts in steel prices and other valuable commodities. Sign up for the free weekly MetalMiner newsletter here.

- Chinese HRC prices remained sideways but saw the largest increase of the overall index. Prices rose 1.15% to $495 per short ton as of June 1.

- Korean standard steel prices inched higher, with a 0.99% rise to $204 per metric ton.

- Comex HRC futures dipped 1.91% lower to $823 per short ton.

- U.S. shredded scrap prices fell 2.48% to $394 per short ton.

- Chinese coking coal prices appeared bearish, with a 4.58% drop to $237 per metric ton.