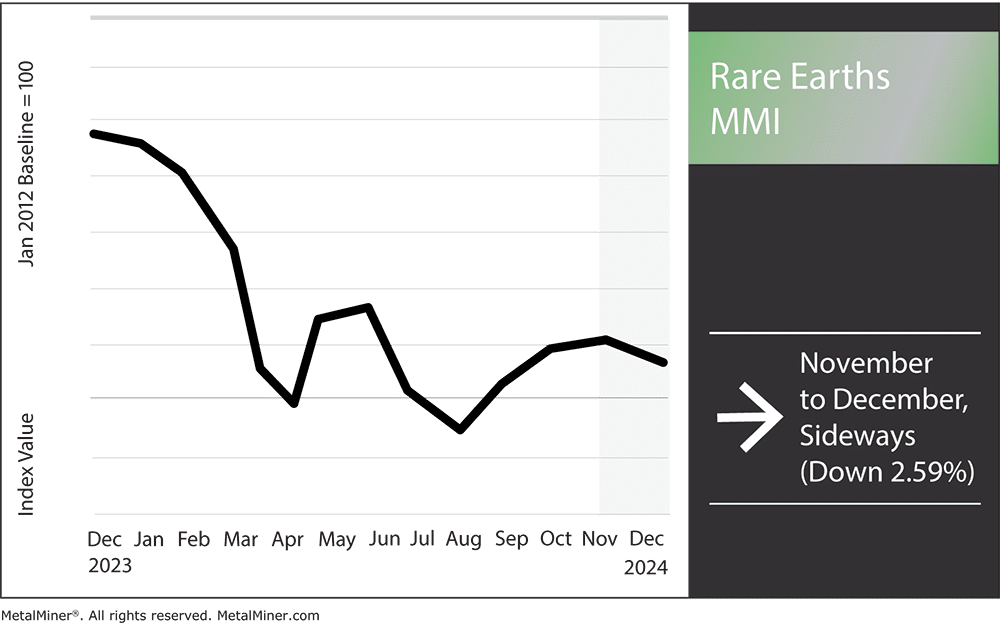

The Rare Earths MMI (Monthly Metals Index) trended sideways with a slightly downward movement of 2.59%.

Numerous factors remain at play within the global rare earths market. One of the most significant factors rare earths buyers need to remain aware of is the ongoing conflict within Myanmar, one of the world’s key rare earth suppliers, regarding rebel mine takeovers. The Kachin Independence Army (KIA) caused numerous problems throughout November, including seizing control of Kanpaiti, a pinnacle rare earths trading point within Myanmar’s Kachin state.

For the moment, the rare earths market remains sideways. That said, if these rebel groups continue to seize control of this vital upstream sourcing point, the global market may face price increases and volatility. Despite this, China’s overabundance of rare earth elements continues to place bearish pressure on the market. However, this could change if the Trump administration places tariffs on Chinese imports in the coming years.

Elevate your industrial metal market intelligence, Subscribe to MetalMiner’s free Monthly Metals Index report to gain a deep understanding of the dynamics affecting rare earth markets, along with 9 other metal industries.

Rare Earths Mining Woes: Kachin Independence Army Takeover

In November 2024, Myanmar’s rare earth mining sector experienced significant disruptions due to intensified conflicts involving the Kachin Independence Army. The KIA’s attacks led to the capture of key mining hubs, notably the town of Kanpaiti near the Chinese border, a pivotal center for rare earth mineral extraction. This development has profound implications for global supply chains.

The KIA’s capture of Kanpaiti represents a critical blow to Myanmar’s military regime, reducing its control over border towns to a single location. This loss not only diminishes the military’s territorial control over mines in the region, but also cuts off significant revenue streams from rare earth minerals previously supplied to China.

Myanmar is a crucial supplier of heavy rare earth elements (HREEs) to China, accounting for approximately 50% of the country’s feedstock. The KIA’s takeover of mining areas, including the largest rare earth mine at Pang War, has forced the suspension of all mining activities.

Exploring Global Market Repercussions

Myanmar’s rare earth production disruption could drive global prices higher. For example, dysprosium oxide prices already jumped to 2,610 yuan ($356) per kilogram, their highest level since May 2022. China’s halt on rare earth imports from Myanmar has also intensified pressure on global supply chains, raising concerns about the availability of these essential minerals.

The expansion of rare earth mining in Myanmar has sparked environmental and social concerns for quite some time. Reports suggest that mining operations, predominantly controlled by armed Chinese groups, have caused significant ecological damage while negatively impacting local communities.

Gain access to expert metal market insight, ensuring your company is well-informed and prepared to tackle oncoming volatility. Opt into MetalMiner’s free weekly newsletter.

The Future Outlook for Myanmar’s Mining Sector

The KIA’s control over key mining regions adds additional uncertainty to the global rare earth supply chain. Although the KIA has not disclosed its intentions for these mining operations, the disruption will likely continue to affect global supply and drive up prices. Therefore, industries reliant on rare earth materials may need to explore alternative sources or invest in recycling technologies to reduce the impact.

The KIA’s takeover of Myanmar’s rare earth mining regions has far-reaching consequences for global supply chains, the environment and local communities. Tackling these challenges will require coordinated international efforts by the rare earths industry to promote responsible sourcing and sustainable practices.

Rare Earths MMI: Noteworthy Price Shifts

Metal prices can be difficult to predict, making it hard to make timely purchases. This is where price forecasting comes in handy. Learn more about how MetalMiner Insights can help you save money on sourcing

- Neodymium prices declined 4.48% to $70,519.59 per metric ton.

- Dysprosium oxide prices dropped by 7.06%, bringing prices to $227.54 per kilogram.

- Terbium metal prices prices fell as well. In total, prices dropped by 3.88% to $995.15 per kilogram.

- Lastly, yttrium prices moved sideways, dropping down a slight 0.8% to $28.50 per kilogram.