Soon-to-be-sworn-in U.S. President Donald Trump has not been shy about his interest in “purchasing” Greenland, and it is possible rare earths are a big reason why. However, Trump is not the first President to consider adopting the northern landmass, which is currently an autonomous region under the Kingdom of Denmark. It remains to be seen whether this attempt will be successful or not.

A Long History of U.S. Interest in Greenland

According to media reports, the earliest recorded attempt by the U.S. to acquire Greenland was in 1868. More recently, President Harry Truman’s administration made an effort, and Trump himself proposed doing so in 2009. However, nothing further happened in the latter case, except that he had to cancel an upcoming visit to Denmark.

Earlier U.S. efforts were primarily driven by trade and, to some extent, strategic considerations. However, Trump’s renewed push incorporates national security alongside these traditional motivations. After all, Greenland sits on some of the largest deposits of rare earths in the world, including metals like neodymium, dysprosium and scandium, to name a few.

Nowadays, all of those are required to manufacture critical components in things like computers, mobile phones, electric vehicle batteries and wind turbines, as well as technology related to the defense sector. Greenland is also home to the Kvanefjeld deposit, one of the world’s richest rare earth reserves, which contains significant uranium deposits essential for nuclear applications. Trump has already declared that Greenland is needed for “national security” purposes. This sets up the potential for an arctic “tug of war” in his coming term.

Want to keep up with the latest rare earths news? Receives metal price trends and relevant economic news to plan your metal purchases effectively. Opt into MetalMiner’s Weekly Newsletter.

Some Facts About Rare Earths

- As per statistics released by the U.S. Geological Survey and the International Energy Agency, most global rare earths production and processing is currently handled by China. Production-wise, Beijing controls about 70% of the total production, while it processes about 90% of mined rare earths.

- As much as 99% of the processing for heavy rare earths, a subset of primary rare earth elements, is also done by China. These are important for the production of EVs, fiber optic cables and more.

- Because China controls most of global rare earth exports, it has been using rare earths as a tool to gain geopolitical advantage.

Reasons for Chinese Dominance

Beijing not only declared rare earth elements a property of the state, but it banned the export of technologies used for their extraction in October 2024. For many reasons, it has always been a challenge to diversify the rare earths supply chain beyond China. This is despite the fact that nations like Australia, Brazil, Angola and Canada sit on plentiful rare earth deposits, and despite mines opening up in other countries.

According to this analysis, the main issues with countering Chinese dominance in the industry stem from the subsidies the Chinese government provides to rare earth miners, the extensive deposits the country has already stockpiled and economies of scale. The analysis quotes Neha Mukherjee, a senior critical minerals analyst at Benchmark Mineral Intelligence, as saying that all these reasons help Chinese firms undercut competitors with low prices.

Also, many rare earths are by-products of mining other minerals like iron ore, which keeps them from being produced consistently. This further complicates efforts to establish alternative supply chains.

Why the U.S. Continues to Eye Greenland

Because of China’s tight-fisted control over the supply of rare earths to global markets, the U.S. must look at other countries or regions outside its borders to break the Chinese stranglehold. Greenland offers that opportunity. Gaining access to Greenland’s resources could enhance Washington’s supply chain security and reduce China’s potential leverage.

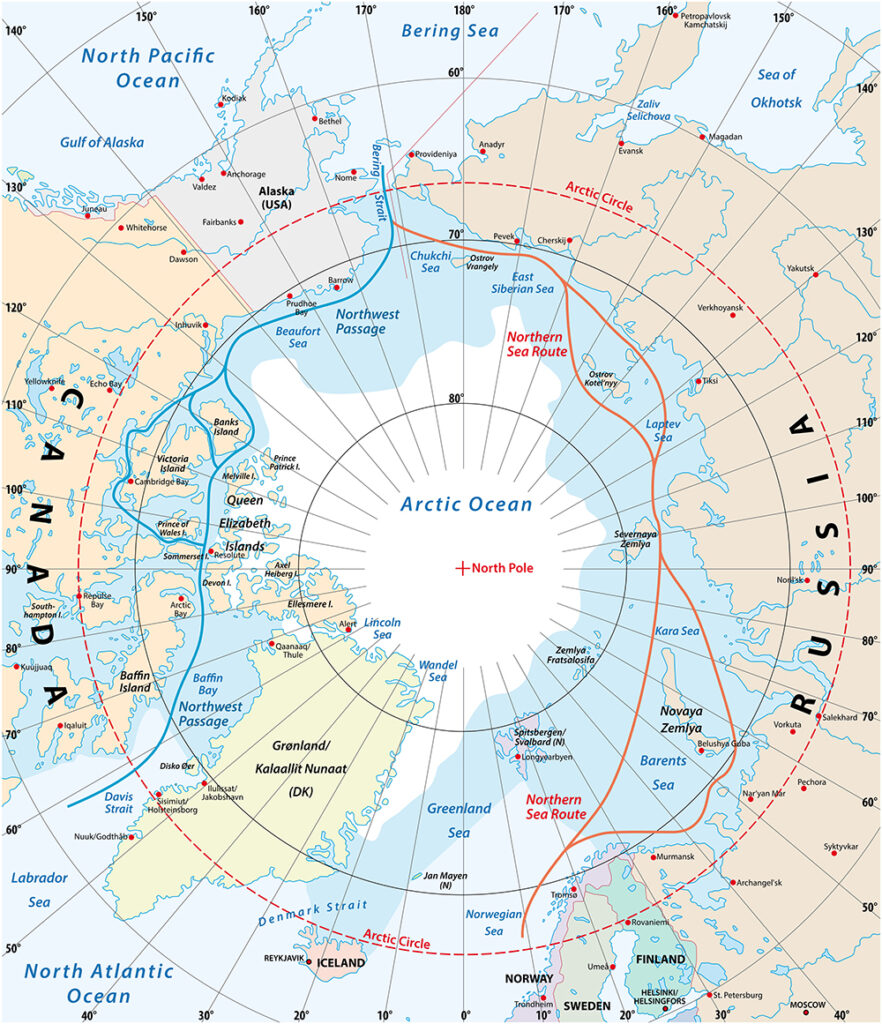

At the same time, the U.S. remains acutely aware of Russia’s focus in the Arctic, which revolves around both rare earth minerals and maritime transport. For example, the Northern Sea Route, a historic Arctic shipping lane officially recognized under Russian law, extends from the Barents Sea, located north of Finland, to the Bering Strait.

Looking for historically accurate metal price forecasting? View MetalMiner’s full metals catalog and let us customize your needs based on your specific metal types, forms, and gauges.