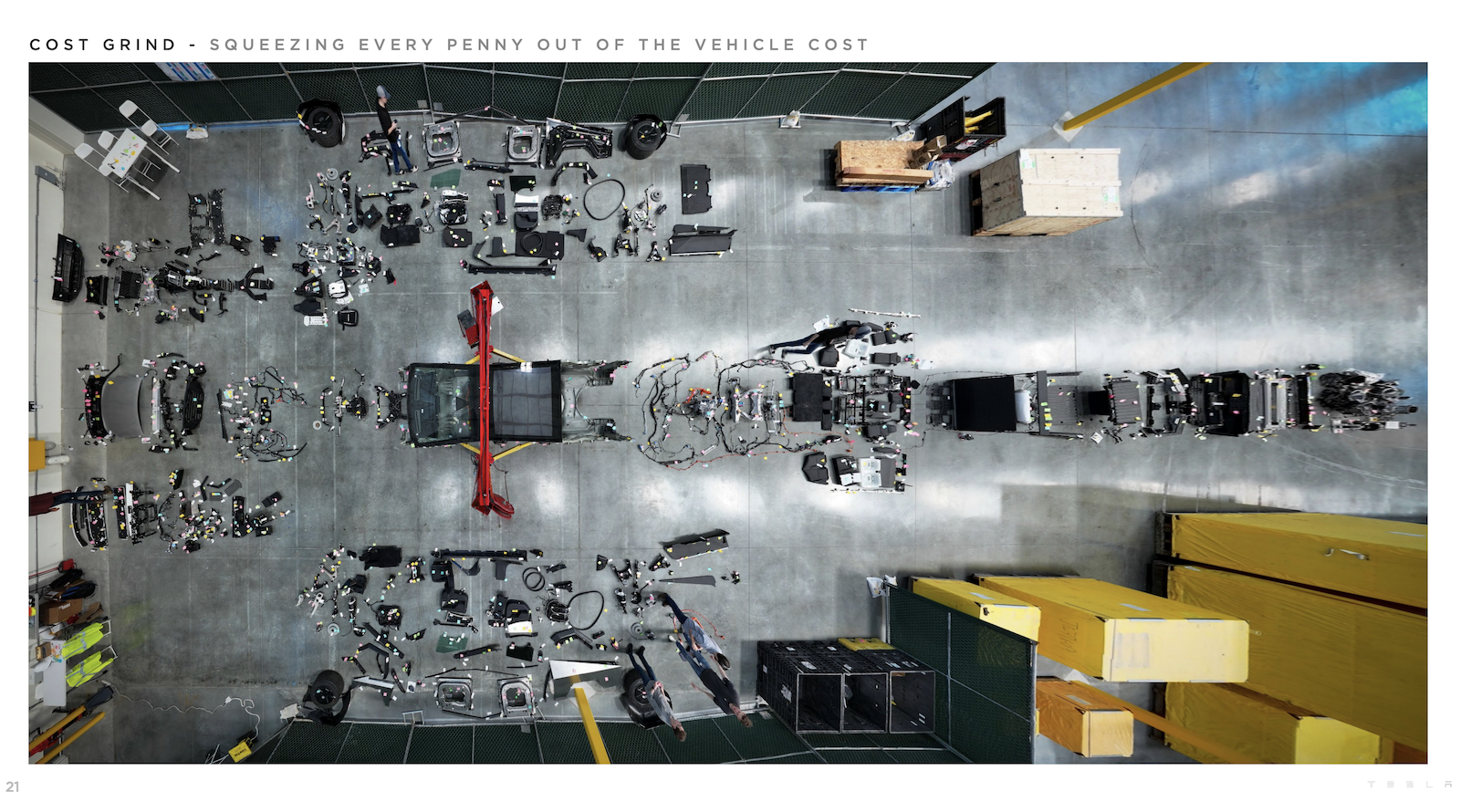

The Renewables MMI (Monthly Metals Index) dropped by 5.47% from December to January. Overall, renewable energy materials and battery metals experienced a somewhat bullish Q4. However, weak demand within China weighed heavily on metals like lithium and copper, and many market analysts expect the incoming Trump administration to place additional bearish sentiment on renewable energy initiatives.

Lithium Market Remains Bullish in the Long Term

In October 2024, Rio Tinto agreed to acquire Arcadium Lithium for $6.7 billion. This clearly reflects significant confidence in the long-term demand for lithium, mainly driven by industrial electrification and the global shift toward electric vehicles.

The move comes despite lithium prices dropping steadily in 2024. In general, lithium remains oversupplied in certain parts of the globe, mainly due to Chinese stockpiling. However, lithium still has a long-term bullish overall outlook due to the ongoing push for green energy.

With MetalMiner’s Weekly Newsletter, you can get crucial updates on metal prices and industry news delivered straight to your inbox.

Cobalt Supply Chain Challenges Continue

The cobalt market continues to grapple with challenges stemming from oversupply. For example, the opening of the Kisanfu mine by Chinese mining companies in the Democratic Republic of Congo, along with increased production from other Chinese mining operations, have driven prices downward.

In the long term, cobalt will continue to face bearish pressure unless stockpiles of the metal deplete significantly. As one of the most important battery metals, any major changes could have major repercussions.

Get all of the latest metal price trends from MetalMiner’s free Monthly Index report. This document contains monthly price-indexes for 10 different metal industries, including aluminum, copper and battery metals.

Steel Plate and the Green Steel Transition

China’s position as a leading consumer in the metals market plays a significant role in shaping global demand and prices, particularly for steel and copper. However, recent predictions suggest an ongoing downturn in China’s steel consumption. This includes an expected 4.4% decline in 2024 and an anticipated 1.5% drop in 2025.

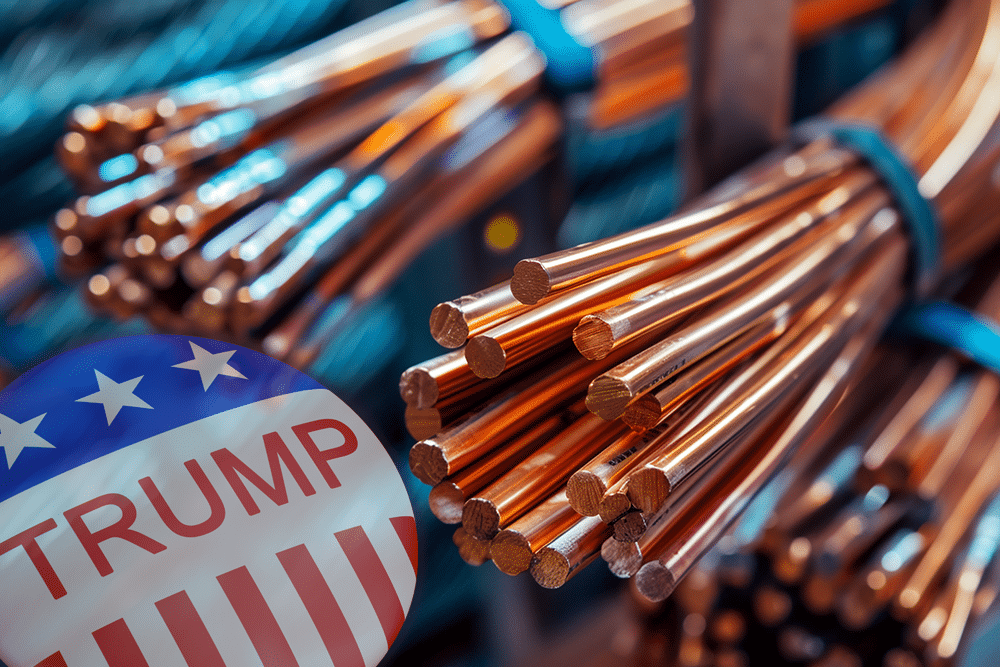

Moreover, many predict that China’s demand for copper will hit its highest point by 2030, with growth slowing sharply in the years leading up to that. Experts currently predict a steady drop in yearly growth from 2023 onward, primarily due to changes in China’s economy and efforts to use less copper in key industries.

Implications for the Renewable Energy Market

Copper is essential to renewable energy infrastructure. As a result, both demand and pricing remain crucial to the sector’s growth. A decline in China’s copper consumption might boost global supply, potentially stabilizing or lowering prices at least temporarily. Despite this, most experts anticipate that the worldwide shift toward renewable energy will serve to maintain somewhat strong copper demand.

According to the International Copper Association projects that the metal’s usage in energy transition sectors will grow at a compound annual rate of 10.7%. The organization likewise predicts increases of 14.3% for electric vehicles, 5.6% for solar energy and 9.3% for wind power.

Anticipated Impact of the Incoming Trump Administration

As the United States prepares for President-elect Donald Trump’s inauguration, the renewable energy industry faces potential policy changes that could shift demand. Trump’s energy plan focuses on a balanced strategy, prioritizing traditional energy sources while making measured investments in renewables. Fossil fuel supporters have largely welcomed this approach, but it has sparked concerns among environmental advocates.

Moreover, Trump’s emphasis on boosting energy production may drive policy changes to simplify the development of energy projects on federal lands. Plans for “American Abundance Zones” propose accelerating energy infrastructure development, including renewable projects, by reducing permitting delays.

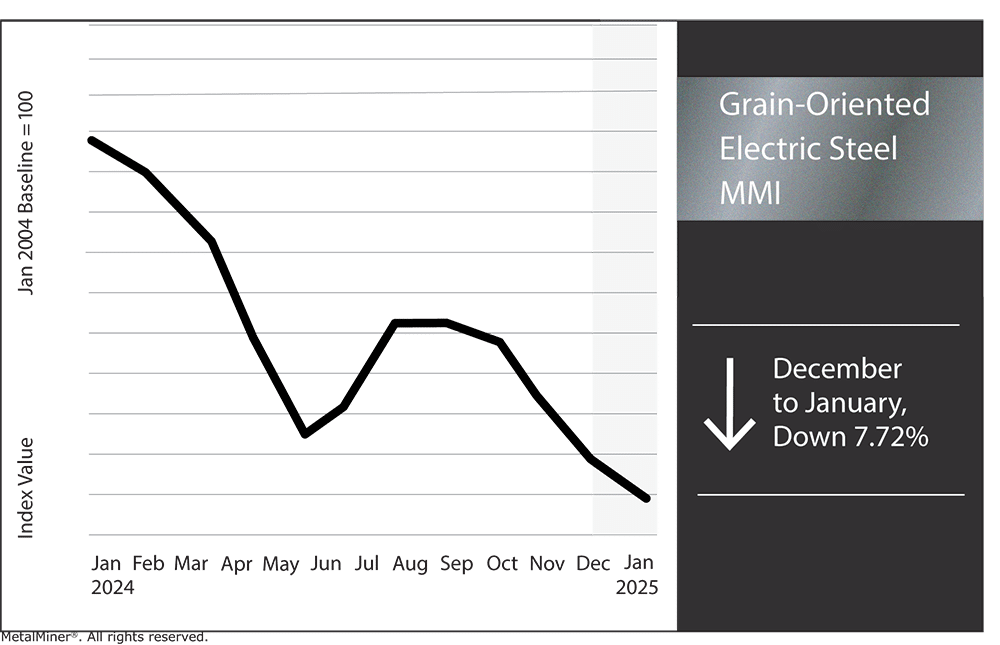

Grain-Oriented Electrical Steel MMI

The Grain-Oriented Steel MMI (GOES) dropped by 7.72% to $3,359 per metric ton.

Renewables MMI: Battery Metals & Other Metal Prices Shifts

Battery metals continue to experience global volatility. Stay alert to rapid shifts in metal market prices and make timely decisions with MetalMiner Insights’ instant alerts. Ready to learn more?

- Chinese cobalt prices dropped by 6.9% to $21.20 per kilogram.

- Neodymium prices dropped by 5.17% to $66,870.28 per metric ton.

- Finally, steel plate prices moved sideways, dropping by 2.03% to $916 per metric ton