A much-reported but little-understood development in the aluminum market this month has the potential to significantly alter the supply chain landscape for aluminum semi-finished metals in the year ahead. Beyond that, it could have serious repercussions for the price of aluminum around the globe.

As my colleague Nichole already reported, China’s Ministry of Finance canceled the 13% VAT refund or rebate on exported aluminum and copper semi-finished products effective December 1.

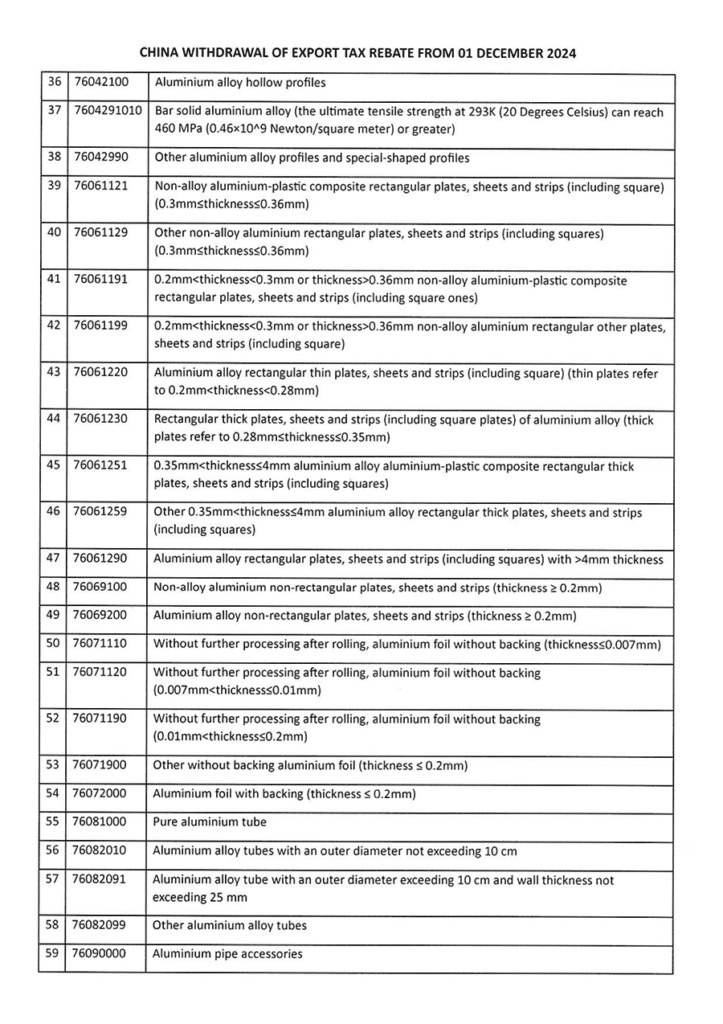

The summary of HS codes covered appears below. However, at a specific ten-digit HS code level, some uncertainty remains about how much the loss of the rebate will impact the price of aluminum, particularly since a few codes lost their rebate some years ago.

Uncertainty Regarding the Price of Aluminum

First, let’s look at the scope. China exports approximately 700,000 tons of copper products and 5,200,000 tons of aluminum, accounting for about 12% of its total aluminum production. Following the loss of Russian semi-finished products after the country’s invasion of Ukraine, the European market has grown heavily dependent on Chinese rolled and extruded products. Meanwhile, the U.S. has seen imports of Chinese material dwindle to almost nothing after the previous imposition of import tariffs.

Not surprisingly, the recent news sent shockwaves through the European market as buyers scrambled to expedite shipments before the December 1 deadline. While the broad impact will cause a 13% cost increase for Chinese aluminum exporters, a growing expectation suggests that export prices next year may not rise as severely. In terms of the current price of aluminum, the news caused the LME price to surge by about $200/ton, while the SHFE price dropped by about half that.

Make informed metal purchases. Subscribe to MetalMiner weekly newsletter with important macroeconomic information and metal market intel to negotiate with power.

Benefits for China and Potential Motives

Chinese mills price exports based on the LME while purchasing primary metal at the SHFE price. This pricing structure allows them to save about $300/ton, or roughly half the rebate cost, in the improved delta between these two dynamics.

This delta has widened slightly since the announcement, but remains at about half what it was a year ago. With businesses likely switching to European mills, the market expects these mills to raise their conversion premiums. By the end of Q1, Chinese metal will likely remain largely competitive for heavy plate and bars, though less so for commercial sheet.

There is considerable speculation surrounding Beijing’s decision to make this move now. Some observers suggest that Beijing bowed to pressure from the incoming Trump administration’s tariff threats, cutting export-supporting taxes early as a bargaining chip. However, since U.S. imports of aluminum semi-finished products have already dwindled to near zero, it remains unclear what Beijing could use as a bargaining tool.

Some Insiders See the Move as a “Preemptive Strike” in a Looming Trade War

Speaking off the record, several Chinese producers claimed that Beijing seeks revenue-raising opportunities. In their words, the government is broke and aims to cut costs. Saving 13% on 5.2 million tons of exports would provide a meaningful boost. However, this is likely not sufficient to serve as the primary reason for the move.

The most plausible explanation frames this decision as part of a broader strategic initiative that achieves several objectives. For instance, Beijing has channeled massive support into the renewable energy, battery and EV transport sectors, enabling China to rapidly become the global leader in these industries.

If a trade war with both the U.S. and Europe looms on the horizon, reducing the cost of domestic inputs for these growth sectors, such as copper and aluminum products, aligns with Beijing’s goal to help these industries navigate expected challenges and remain cost-competitive. Therefore, Europe’s aluminum and copper consumers appear to be collateral damage and will need to adjust to the new normal of relying on a supply source that does not necessarily align with their interests.

Time your aluminum purchases correctly with expert sourcing advice. Lower average aluminum costs with with the Monthly Metals Outlook report. Download a free sample and subscribe today