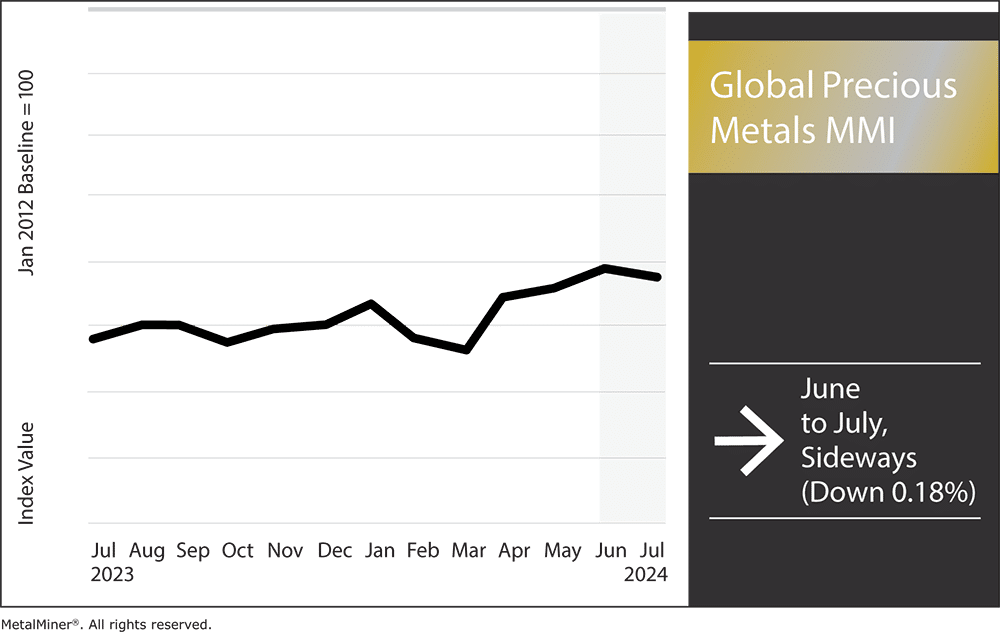

The Global Precious Metals MMI (Monthly Metals Index) held its four-month long sideways trend month-over-month. All in all, the index narrowly missed trading flat, only budging down 0.18%. However, numerous factors continue to pull at precious metals prices in general. Gold, for one, appeared to finally be settling down after reaching record highs earlier in the year. However, by mid July, gold prices began climbing again, meaning Gold prices have yet to peak.

With wars in other parts of the globe, inflation still somewhat elevated, and a presidential election on the horizon, precious metals prices could witness more price volatility in the latter half of 2024. This is often especially true right before an election takes place. In the months (and particularly weeks) leading up to a U.S. presidential election, precious metals prices tend to experience increased volatility mainly due to the future policies of the U.S. being up for question. As such, investors are advised to watch market patterns carefully before investing.

Receive indispensable updates on precious metal prices and market shifts, empowering your company to make informed purchasing and investing decisions. Opt into MetalMiner’s free weekly newsletter

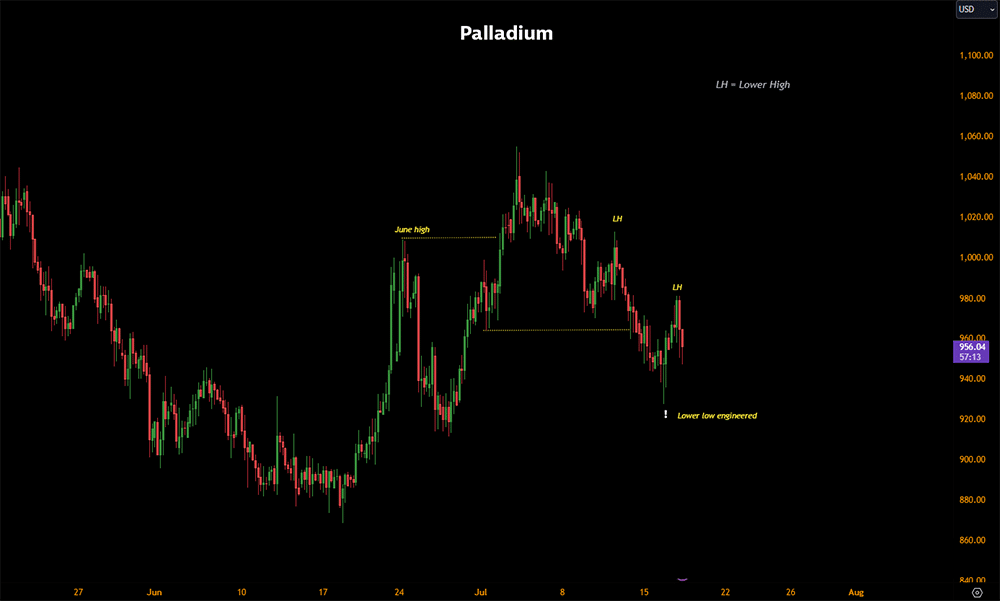

Volatility in Palladium Prices

Palladium prices remained highly volatile, showing sudden spikes to the upside followed by reversals to the downside. After palladium prices breached last month’s high, the trend quickly reversed and traded down, forming lower highs and lower lows. Palladium prices continue to remain extremely volatile, thus increasing the overall risk of uncertainty in the market.

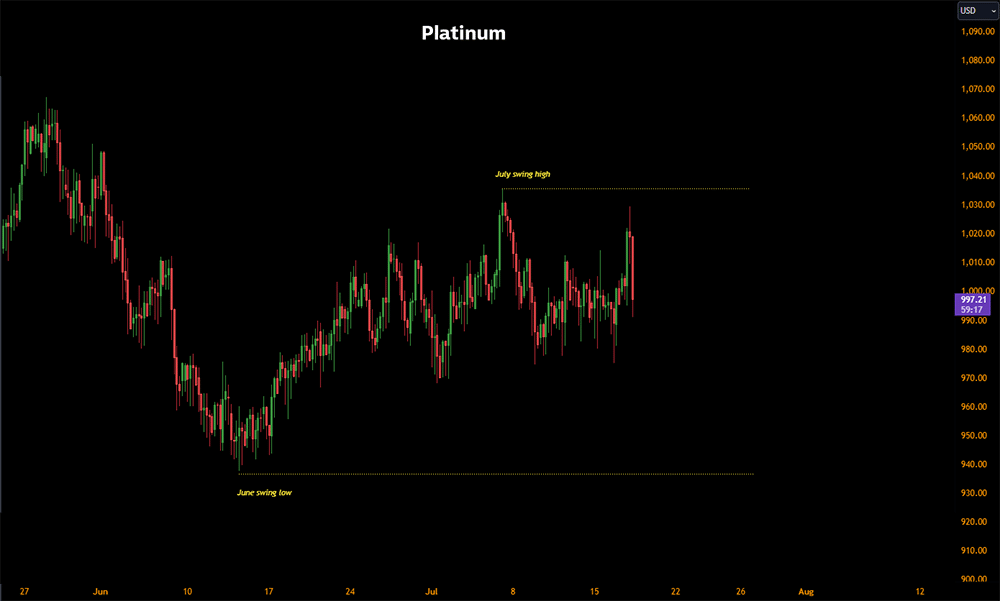

Precious Metals Prices: Platinum

Platinum prices remained in a sideways trend, showing little to no sign of any strength to either side of the market. As the current market trend remains flat, platinum prices will remain uncertain until a break above range occurs.

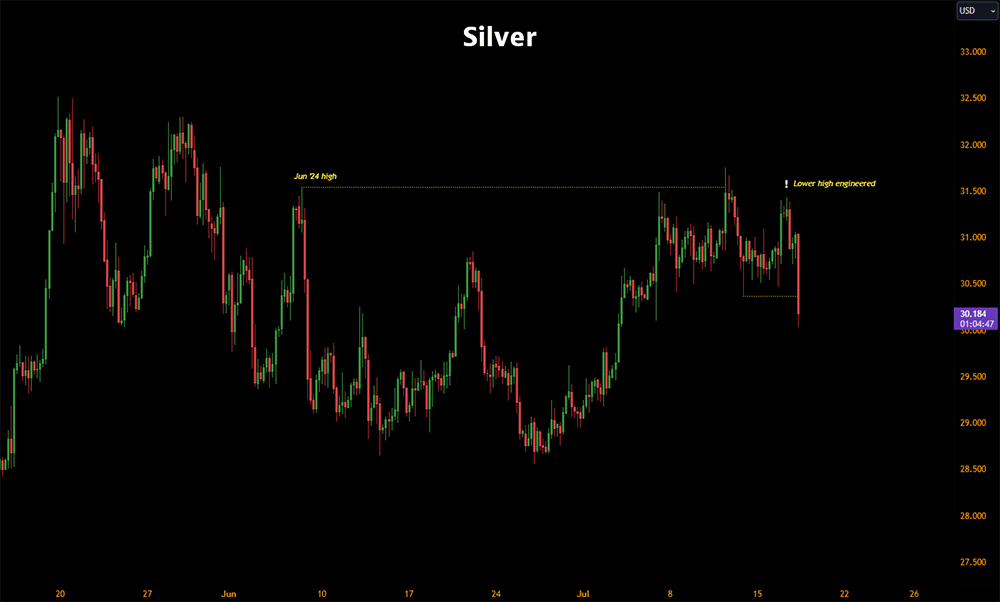

Silver Prices Falter

Meanwhile, silver prices failed to continue their uptrend. Although prices did see a modest increase earlier this month, they failed to engineer a new high and ultimately reversed to the downside, forming a lower low and lower high. As market trends continue to show volatility, the overall direction for silver markets remains uncertain. Stay posted on monthly updates regarding precious metals price trends with MetalMiner’s free MMI report.

Precious Metals Prices: Gold

Following a gold rally that began earlier this month, prices are now up over 6% since the month of June. A combination of the ongoing geopolitical uncertainty and economic data revolving around Federal Reserve interest rate policies continued to drive gold prices. which reached a notable high of 2,480.23 on July 16. Given this new peak and the fact that prices remain at historically high levels, traders should watch prices closely for a continuation to the upside or possible bearish reversal.

Global Precious Metals MMI: Noteworthy Price Shifts

Looking for historically accurate precious metal price forecasting? View MetalMiner’s full metals catalog and let MetalMiner customize your specific forecasting needs.

- Palladium bar prices rose by 4.19% to $970 per ounce.

- Platinum bars on the other hand, dropped. Overall price action fell by 4.08%, which left prices at $987 per ounce.

- Silver ingot prices dropped the most out of all of the precious metals, falling 6.6% to $29.17 per ounce.

- Finally, gold bullion prices moved sideways, only dropping by 0.7% to $2325.40 per ounce.