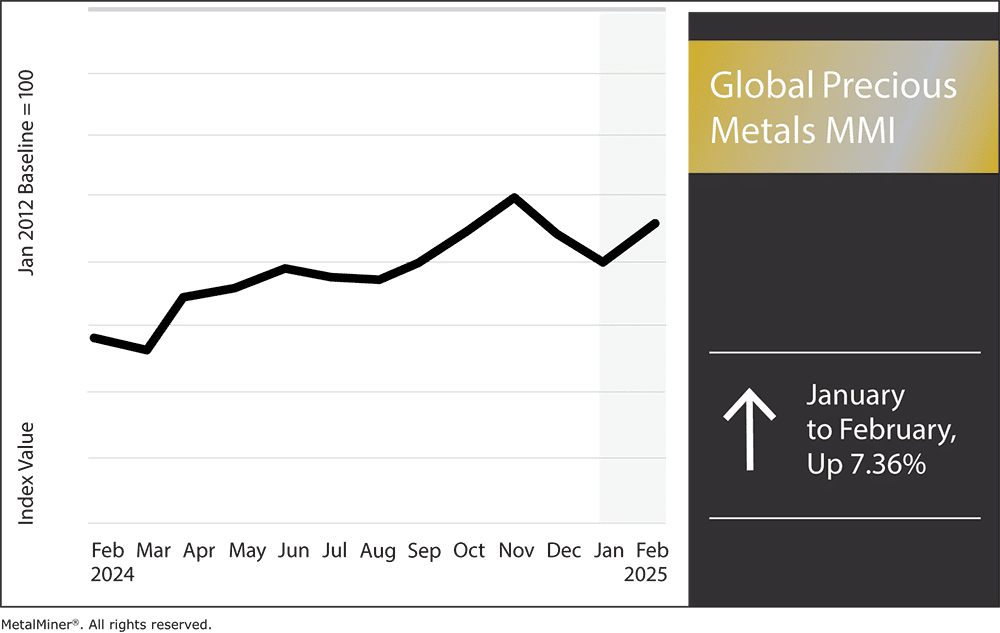

The Global Precious Metals MMI (Monthly Metals Index) experienced a significant rise month-over-month, shooting up 7.36%. The past month proved a whirlwind for the precious metal prices, with each metal reacting to shifting economic conditions and recent policy changes.

Palladium: Market Uncertainty Takes Center Stage

Palladium experienced a particularly volatile month. Prices initially climbed in January due to seasonal demand and a broad rally across the precious metals market. However, according to macrotrends.net, early February erased some of those gains. As of February, Sibanye Stillwater still has palladium output reductions, which could add some long-term bullish pressure to the market.

Meanwhile, the Trump Administration introduced new tariffs, injecting additional uncertainty into the palladium markets. While none of the international tariffs included palladium specifically, general volatility in global metal markets seemed to reverberate on the palladium market. Despite this, analysts expect palladium prices to decline in the coming months.

Subscribe to MetalMiner’s weekly newsletter and conquer precious metal market volatility with valuable weekly market insights and macroeconomic news.

Platinum: Signs of a Comeback?

Platinum prices have held relatively steady despite recent policy changes. Overall, they experienced only minor fluctuations month-over-month. Despite a strong U.S. dollar and shifting industrial demand, most market experts remain optimistic about platinum’s future. Meanwhile, analysts project a supply deficit through 2025 as demand from the automotive and industrial sectors continues to grow.

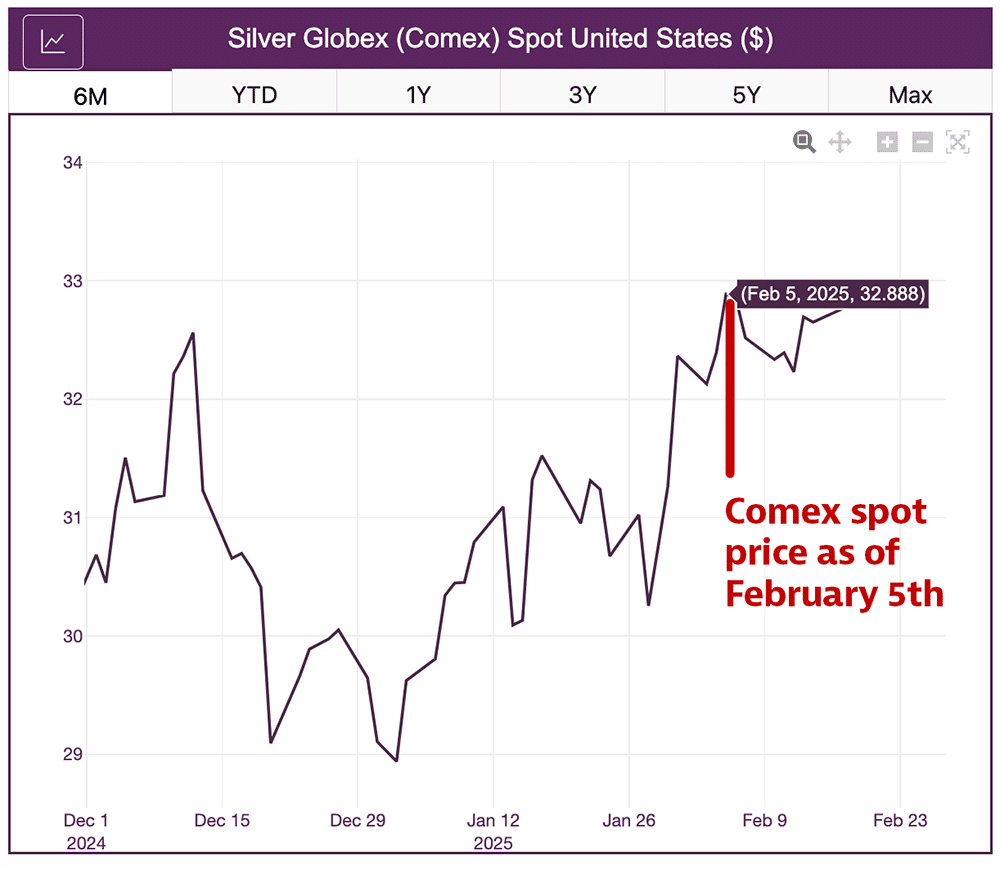

Silver: Strengthening on Industrial Demand

Silver prices have climbed steadily in the new year, reaching $32.80 per ounce in mid-February—the highest level since mid-December 2024.

Due to ongoing economic uncertainties and geopolitical risks, investors have turned to silver as a safe haven asset. As a result, analysts remain bullish on silver’s outlook throughout 2025.

Subscribe to MetalMiner’s free Monthly Metals Index report and use it to anticipate precious metal market changes and make strategic purchasing decisions.

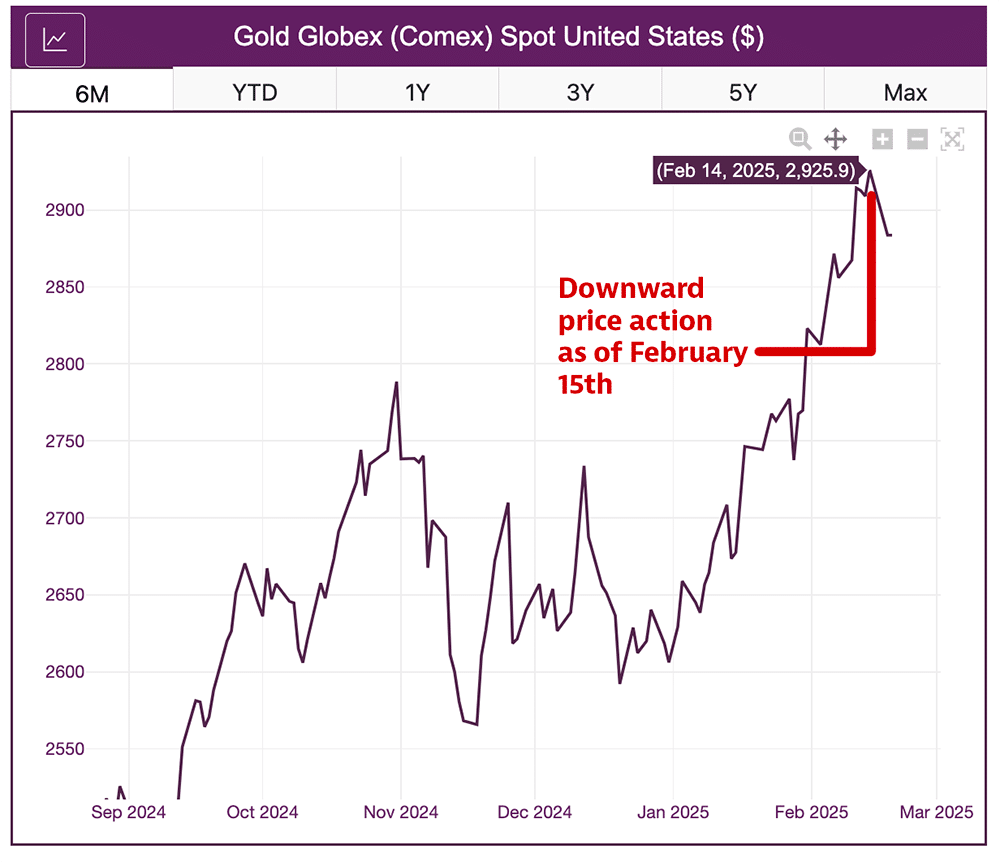

Precious Metal Prices: Gold Breaks Records Highs…Again

Gold has taken center stage in the precious metals market month-over-month. According to Reuters, the asset hit an all-time high of $2,942.70 per ounce due to a combination of economic policy uncertainty, geopolitical tensions and aggressive central bank purchases. Despite this, prices began retracting again as of mid February.

Major financial institutions have raised their forecasts in response to gold’s momentum. For example, UBS analyst Joni Teves recently predicted that gold could peak at $3,200 per ounce later this year before stabilizing. Meanwhile, Goldman Sachs has increased its year-end projection to $3,100 per ounce.

Precious Metal Prices: Noteworthy Price Shifts

Stop overpaying for metal price points you don’t need. Get only the metal price points needed for your business with MetalMiner Select. Learn more.

- Palladium bars rose in price drastically, increasing by 9.17% to $976 per troy ounce.

- Platinum bars also saw a significant rise. Month-over-month, prices increased by 6.63% to $965 per troy ounce.

- Silver ingot prices also went up. Month-over-month, prices rose by 8.66% to $31.36 per try ounce.

- Lastly, gold bullion prices rose by 6.52% to $2795.60 per troy ounce.