Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

This past week green hydrogen for energy manufacturer and fuel cell vendor Plug Power announced that it was at risk of going out of business. Unsurprisingly, its stock price plummeted from a historical low to a slightly lower level.

What’s that? Well, Wall Street and analysts have short memories. Prior to the Plug Power analyst call on Friday November 10th it was 99.5% off its peak stock market valuation, something that occurred in March of 2000 at just under $1,500. Now it’s off 97.7%. That’s 0.2% variance in stock valuation, which is hardly news. Unless it’s about hydrogen in 2023 then breathless angst ensues.

Ballard Power, another fuel cell hydrogen for energy favorite of long standing, was ‘impacted’ by this news as well. It went from 97.1% off its peak stock market valuation to 97.5% off.

Fuel Cell Energy takes the prize. In September of 2000 it was at $6,928, and now it’s at $1.05. The Plug Power news barely stirred it from about to be delisted territory, and it’s been around 99.98% of peak valuation for a while. How it’s managed to stay listed despite clearly being a dead firm rolling will likely be a footnote in an obsessive book written by a failed hydrogen venture historian.

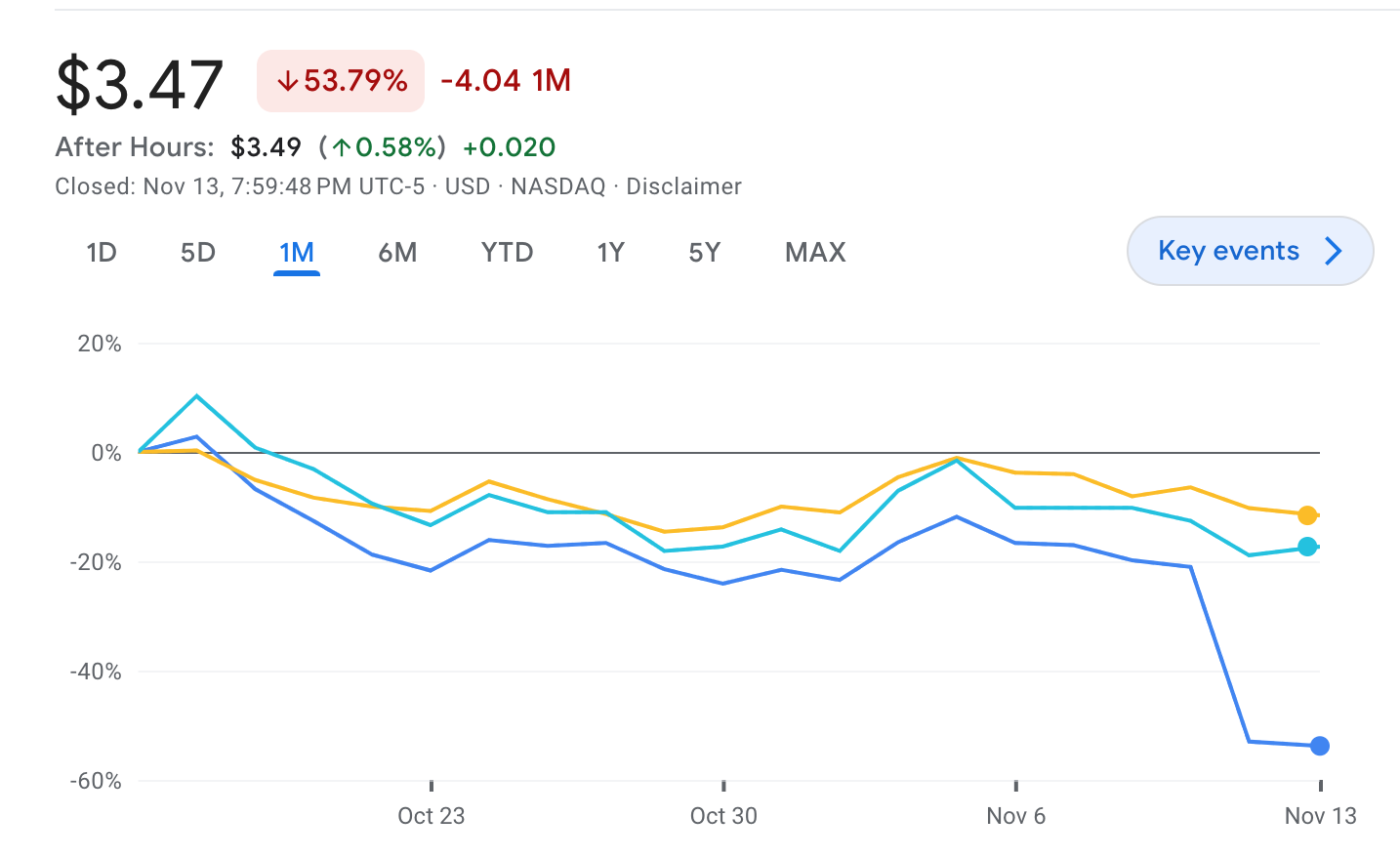

And it’s not like this is particularly new news for the past month. All three stocks have been trending downward for weeks. That Plug Power is 55% off of what it was a month ago, while Ballard and Fuel Cell Energy are merely 10% to 20% off is a rounding error on a dehydrated gnat’s thorax compared to their history.

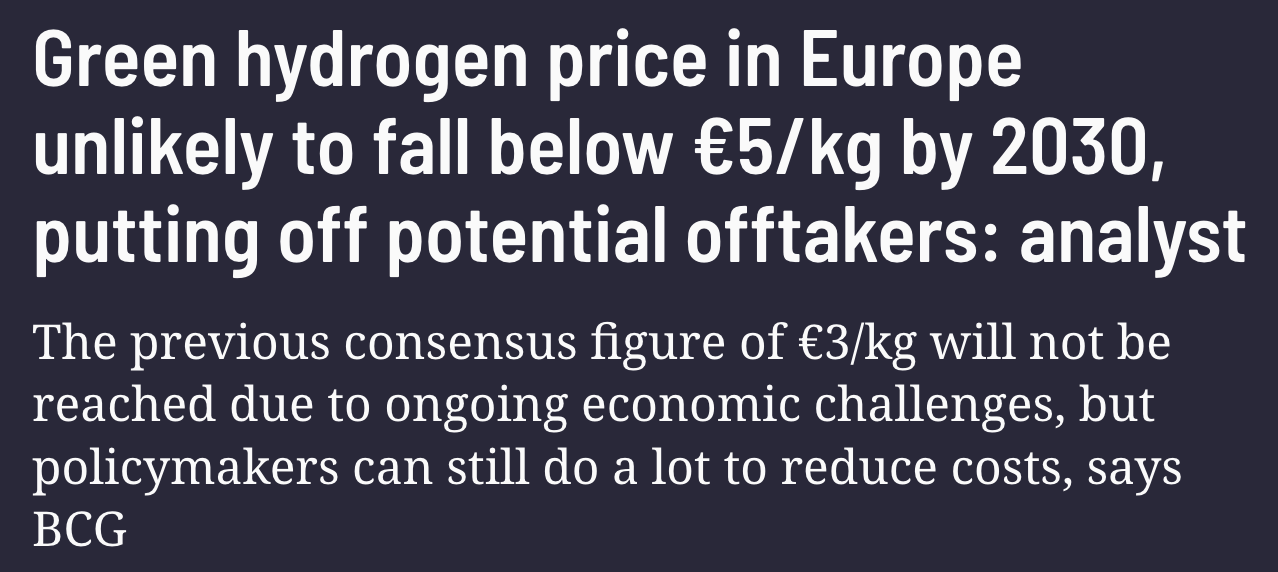

What might have happened roughly a month ago that has been weighing down these barely performing hydrogen for energy stocks? Clearly investors aren’t onboard with the hydrogen for energy hype that’s still visible in a lot of places.

Oops. So much for cheap green hydrogen. This is from BCG, which like McKinsey has a client portfolio that’s heavy on oil and gas companies and has as a result been a big hydrogen for energy booster for the past few years.

As I noted about the consensus comment, the consensus was of lobbyists, non-STEM policy makers, financiers and the like. The consensus of people who are STEM and economics literate and who have run the numbers remains unchanged.

The global hydrogen for energy bubble continues to deflate, as people like Michael Liebreich, the hydrogen-savvy engineers who founded the Hydrogen Science Coalition such as Paul Martin and random analysts who actually run the numbers like me have been saying would happen for years.

BCG continues out of one side of its mouth to say power to energy projects are amazing, while at the same time out of the other side of its mouth provide a lot of data that makes it clear that’s just not going to happen.

For example, in a recent white paper with Oxford Global Projects, the joint team were articulating how power to x projects could de-risk with quite sensible planning strategies that assumed power to hydrogen for energy made any sense, but the data in the paper showed something radically different.

Only 0.2% by tonnage of hydrogen power to x proposals, the vast majority for hydrogen for energy, had actually made it to producing hydrogen. That’s 99.8% that didn’t. But the white paper suggests that the data shows “that the green hydrogen market is showing strong momentum”. Really?

A fifth of one percent of announced projects, one in 500, actually in operation doesn’t seem like strong momentum. It seems more like something that people would look at and start asking questions about if it were presented more carefully. If it were framed more carefully.

Perhaps it’s the raw numbers of projects? Well, the number of announced projects in operation, per the BCG white paper data, is 5.6%. That actually seems more credible. More than one in twenty projects announced reaching operation seems like a reasonable ratio. Until you remember the 0.2% of tonnage. Only tiny projects are reaching operation. Biggies are not reaching final investment decision and construction.

But surely there’s good news in this morass of bad news about hydrogen for energy? Surely there are lots of buyers panting for green hydrogen? Well, not according to Bloomberg New Energy Finance aka BNEF (Liebreich’s former firm, now owned by another Michael, this one from New York).

They track only bigger deals, 149 of them per Martin Tengler, head of BNEF Hydrogen Research. Wait, how many announcements did BCG say existed in their white paper? Almost 1,350? That’s an order of magnitude difference. Is it because the deals are huge? No. The deal bottom that BNEF tracks starts at 20 MW of energy capacity — a stupid metric that should be ditched because it pretends hydrogen is energy — or 2,800 metric tons of hydrogen per year.

That’s a very low floor. The global market for hydrogen is in the range of 120 million tons per year. 2,800 metric tons is 0.2% of that. Rounding error territory. We would need to see 430 deals of that size just to decarbonize our current hydrogen climate problem, which is the same magnitude as all of aviation globally. So the 149 deals are unlikely to be remotely close to addressing just our current problem with hydrogen, never mind extending it to an energy source.

Of course, there have been a few other things helping the hands forcing the heads of hydrogen for energy plays under water. For example, yet another hydrogen fuel cell bus trial has failed miserably. They all do and usually it only take 3-4 years. This one was in the French township of Pau, a 70,000 citizen somewhat rural urbanish place that didn’t bother to lift its head above its parochial surroundings in 2019 to look at global examples of hydrogen buses failing and battery electric buses succeeding. Instead it took two-thirds of the cost of buying the buses and hydrogen refueling facilities from the EU and the government of France, and hoped that they would keep subsidizing the absurdly expensive hydrogen. Their hopes were dashed. And so, they ditched the trial, pretending that they had been brave Gallic pioneers when trials keep running and failing globally (outside of China at least because they just do the spreadsheet work without bothering with obviously fiscally stupid trials) because transit types refuse to look at empirical evidence that isn’t recorded within their narrow jurisdiction.

Smart organizations just run some well validated numbers through spreadsheets. Maersk’s APM Terminals division which owns and operates about 8% of the ports in the world was forced by stakeholders to recalculate empirical reality. The fundamentals of physics and economics clearly favored battery electric and yet they were required to run the numbers for hydrogen and undoubtedly explain many, many times why hydrogen vehicles were more expensive to buy and more expensive to operate.

Similarly, the German state of Baden-Würtemberg simply did basic business cases testing underlying assumptions and dodged the bullet of wasting money and time on hydrogen for rail. Grid-tied rail hybridized with batteries for the expensive bits was a third the cost of hydrogen. Easy peasy. But not for Lower Saxony, another German state. They didn’t bother to do the basic data validation and math up front, so bought a few hydrogen fuel cell passenger trains a couple of years ago, and now have buyer’s remorse. Back to batteries for Lower Saxony.

The data keeps making it clear that investors and spreadsheet jockeys who run the numbers aren’t putting money into hydrogen for energy. So why does it keep getting so much attention? It’s almost as if there’s a huge industry desperate to force hydrogen for energy down the world’s collective throat. Nah, couldn’t be.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

EV Obsession Daily!

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

Iontra: “Thinking Outside the Battery”

CleanTechnica uses affiliate links. See our policy here.