Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Last Updated on: 27th February 2025, 02:24 am

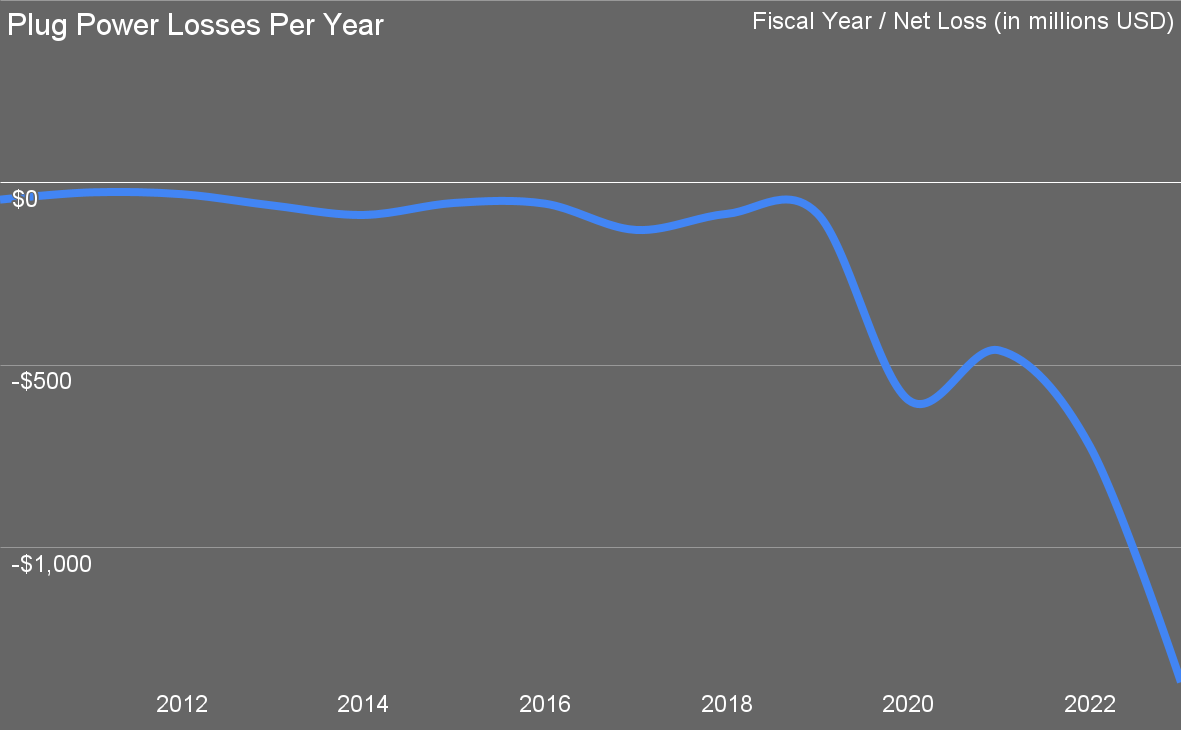

This is the year that the hydrogen bubble pops, especially for transportation, but increasingly for all hydrogen for energy plays. One of the firms on my hydrogen death watch is Plug Power, which has managed to lose $3.12 billion of other people’s money since 2010, about $200 million a year on average, and has never turned a profit in its 28 years of existence.

Plug Power Inc. was founded in 1997 as a joint venture between DTE Energy and Mechanical Technology Inc. (MTI), with a focus on developing proton exchange membrane (PEM) fuel cell technology. Initially targeting stationary power applications, the company later shifted its emphasis to hydrogen fuel cell systems for material handling and industrial vehicles. Over the years, Plug Power expanded its operations, securing key partnerships and contracts, including supplying fuel cell solutions for major warehouse operators like Amazon and Walmart. The company also invested in green hydrogen production, aiming to build a comprehensive hydrogen ecosystem.

I pulled this chart together rapidly this morning to show how much bigger its losses have become. In 2023 its losses were were almost $1.4 billion, and it’s on track to exceed a billion in losses for 2024 as well. That’s not the kind of news investors love to hear.

As a note about the Amazon and Walmart warehouses, there are only about 70,000 hydrogen forklifts in operation globally, and the vast majority are in US distribution centers where the US DOE paid for the hydrogen refueling system and the hydrogen is almost entirely gray. The first hydrogen forklift was manufactured and put into operation in the 1960s. As a contrast, in just 2023 ~1.52 million electric forklifts were sold globally. In other words, hydrogen forklifts are a rounding error on the thorax of a gnat that’s been on a hunger strike for a long time.

What triggered this dive into Plug Power’s perpetually abysmal fiscals was a press release promoted by someone who I really wish knew better by now. Plug Power announced that its 15-ton-per-day hydrogen plant in St. Gabriel, Louisiana remains on track to begin operations in Q1 2025. The facility, operated through Hidrogenii, a 50/50 joint venture with Olin Corporation, will use by-product hydrogen from Olin’s chlor-alkali production, integrating it into Plug Power’s North American hydrogen network. A dry-out process is underway to remove moisture and impurities including chlorine, ensuring the production of high-purity hydrogen.

In other words, zero news, just an announcement that they were still going to do something they started working on in October of 2022. That’s a long time to get to 15 tons of hydrogen a day.

Is it green? Not a chance. While some of Olin’s chlor-alkali plants run in regions with strong hydroelectric and renewables powering their grids, this is a St. Gabriel, Louisiana site getting grid electricity with 438 kg of CO2e emissions per MWh.

Chlor-alkali plants produce about 35.5 times the mass of chlorine as of hydrogen. It’s just electrolysis of salty water to unlock the chlorine from salt. The hydrogen is a waste byproduct, and historically it was mostly vented to the atmosphere, something considered just fine until recently when the indirect global warming potential of hydrogen was quantified as 12-37 times that of carbon dioxide over 100 and 20 years respectively. Companies like Olin have been struggling to find offtakers because the volumes are so low.

Every ton of chlorine requires about 2.5 MWh to manufacture, so that’s 1.1 tons of CO2 per ton of chlorine. The 15 tons of hydrogen per day are a byproduct of about 500 tons of chlorine, so about 550 tons of CO2. You can argue about attribution, but even the Olin CEO admits it isn’t green hydrogen.

This is par for the course for the hydrogen for energy crowd. Plug Power’s press release carefully doesn’t call this hydrogen green and leaves out all emissions, but uses “green hydrogen” four times in phrasing around it, leaving the strong impression that it’s green hydrogen.

To be clear, it is better that an off take is found for the waste hydrogen. Venting 15 tons of hydrogen to the atmosphere would be like venting 555 tons of CO2 per day on the GWP20 scale. More plants flare the byproduct than vent it for safety reasons, and some have found ways to make it useful economically. However, an estimate by a person who tracks this indicates that there are about 200 tons of un-utilized byproduct hydrogen produced every day in the United States.

These losses and the ongoing failure of hydrogen for transportation and energy to do anything except contract in recent years have a lot to do with this stock chart. The illusions and hype were high in 2000, just as they were for other deathwatch firms Ballard Power — $1.3 billion in losses since 2000, no profits ever — and FuelCell Energy, both of whose stock charts look almost identical.

Plug Power is trading at 0.1% of its peak. Its 2021 bump with the latest resurgence of hydrogen hype was a pimple, but it seems investors don’t hit that max button on stock charts to get a sense of the reality. And apparently they don’t read annual reports closely either, because who exactly would invest in a company with accelerating losses and zero profits in 28 years. That Plug Power’s actual business wasn’t particularly big — a few tens of thousands of forklifts’ worth of maintenance and hydrogen — didn’t seem to occur to investors.

Whose money is Plug Power burning? Norges Bank, Norway’s central bank, holds 88 million shares (about 8% of Plug’s outstanding stock), while BlackRock Inc. and Vanguard Group own 79.3 million and 87.4 million shares, respectively. South Korea’s SK Group remains a key strategic investor after its $1.5 billion stake purchase in 2021, acquiring about 10% of the company.

Norges more than tripled its stake in Plug Power in Q4 of 2024, raising its stake from 26 million shares it had lost a lot of money on to buy another 62 million shares which it has lost another $18 million on. BlackRock bought in a few times, including before and a couple of times after the 2021 pimple. Vanguard, like BlackRock, was in for the 2021 pimple and has bought in a couple of additional times. SK Group bought in in February of 2021 at around $48, an investment it’s lost most of its $1.5 billion on. These aren’t mom and pop investors, and they have jointly wasted billions of money by giving it to a dead end company with a legacy maintenance and fuel business without a credible growth model. The due diligence approached zero, clearly.

Plug Power is still pretending it’s a going and growing concern, staying in the European and North American markets. However, in October 2024, it halted construction of its hydrogen production facility at the Science Technology and Advanced Manufacturing Park (STAMP) in Genesee County, New York, due to financial constraints. Like Ballard, it’s starting to shutter, divest and retrench, but it won’t be enough.

Ballard and Plug Power have been struggling hard to stay above the $1 per share clip level for delisting, but at their burn rates, deep losses and lack of substantial revenue, they are most likely to drop into the delisting zone and go bankrupt. FuelCell Energy’s stock is above theirs, but it’s still 124 times lower than in 2021, so its investors are undoubtedly just as happy with them.

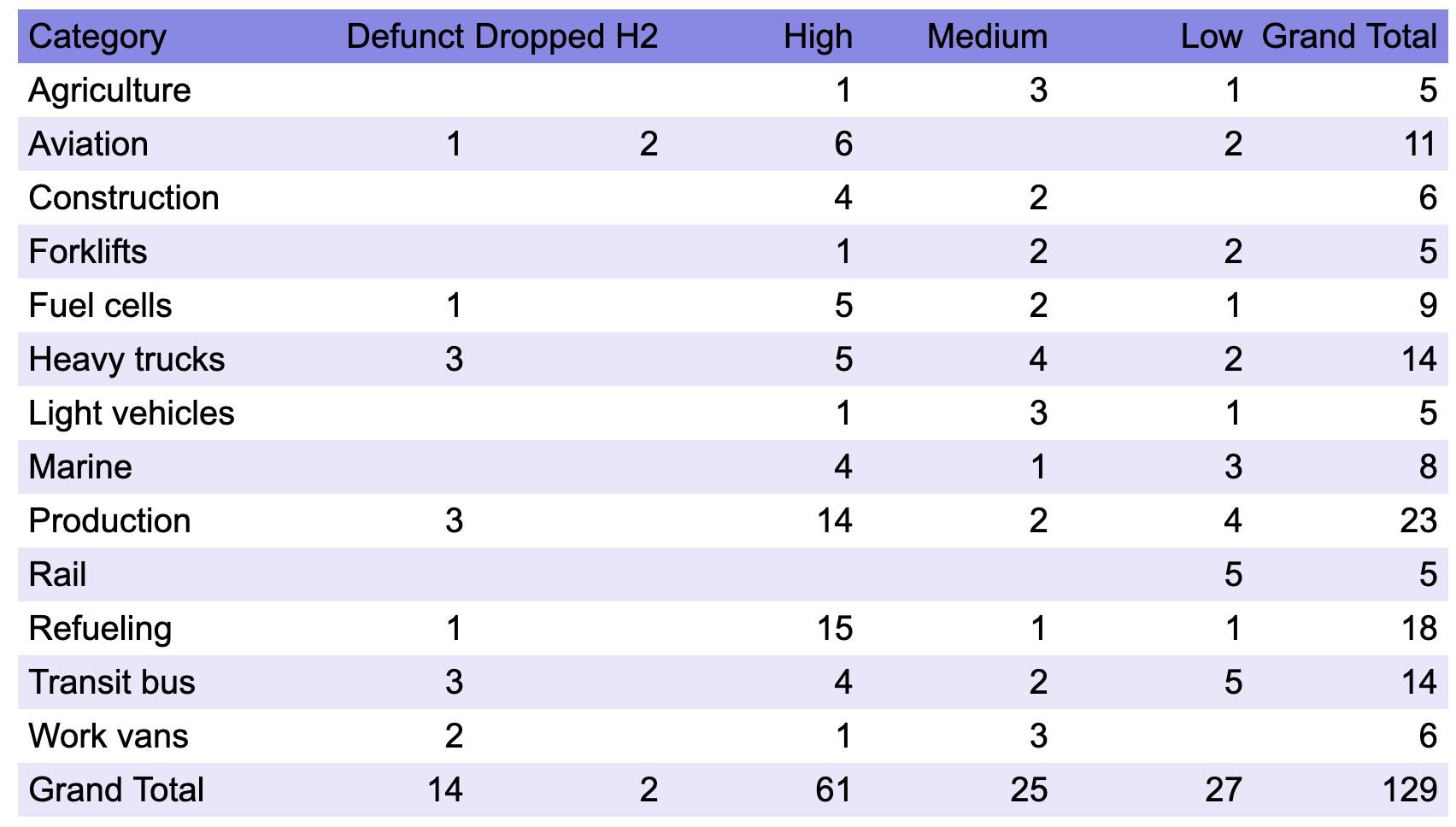

They aren’t alone. I continue to add firms to my hydrogen deathwatch list, which now sits at 129 after the addition of Norway’s HydrogenPro up on the news that it had reported a loss of $18 million for 2024. The easiest way to assemble a list of firms involved in hydrogen for energy is just to wait for headlines about financial losses and retrenching.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy