Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

How can a company never make a profit for over 50 years and still be around? How can it still find investors? FuelCell Energy is that company, and its continuing existence, like that of other perpetual money losing hydrogen fuel cell firms Ballard Power and Plug Power, is deeply perplexing. Thankfully, it’s unlikely to be a question much longer.

Founded in 1969, FuelCell Energy was originally branded Energy Research Corporation (ERC). Like Ballard Power, it began as a developer of advanced battery technology before making exactly the wrong strategic decision and shifting its focus to fuel cells in the 1980s. The company even picked an also ran fuel cell technology, molten carbonate fuel cells (MCFCs) for stationary power generation. Throughout the 1980s and 1990s, ERC secured government research contracts and industrial partnerships that never went anywhere.

In 1992, ERC went public on the Nasdaq stock exchange, using the capital for its fuel cell research and commercialization efforts. By 1999, ERC completed its transition, rebranding as FuelCell Energy, committing itself fully to the dead end technology.

Like Ballard Power and Plug Power, FuelCell Energy’s stock price saw one glorious spike in 2000, peaking over $6,400 per share — the $200,000 is an artifact of a late 2024 30-to-1 reverse to stock split — and a long, long decline and flatlining, with a pimple of market interest in 2014 and 2021. The original founders are long gone, with other people choosing, oddly, to jump into a firm which never made a profit and has no pathway to making a profit.

One has to wonder what competent CEO or senior executive would choose to jump into these money pits. Having one of these perpetual money losers on their resume surely can’t be a marketing coup. Perhaps there’s a rotating mill of D-list executives who happily sign up for a couple of years on money loser after money loser.

Of course, this being hydrogen, a fair amount of governmental money kept the firm inching along. Here’s a likely very incomplete list. It received a $32 million DOE contract in 1990 to develop natural gas-based fuel cells. The company secured a $135 million DOE cost-sharing agreement in the 1990s to further advance molten carbonate fuel cell technology. In the 2000s, FuelCell Energy partnered with the U.S. Navy on a $16.8 million project for a 500 kW fuel cell demonstration at the Philadelphia Navy Yard. It received a $19.4 million DOE contract under the Vision 21 program to develop fuel cell-turbine hybrid power plants. In 2018, the DOE awarded FuelCell Energy $1.5 million to explore fuel cell integration with nuclear power plants for hydrogen generation. In 2021, the DOE awarded FuelCell Energy $8 million to advance solid oxide fuel cell technology for power generation and electrolysis.

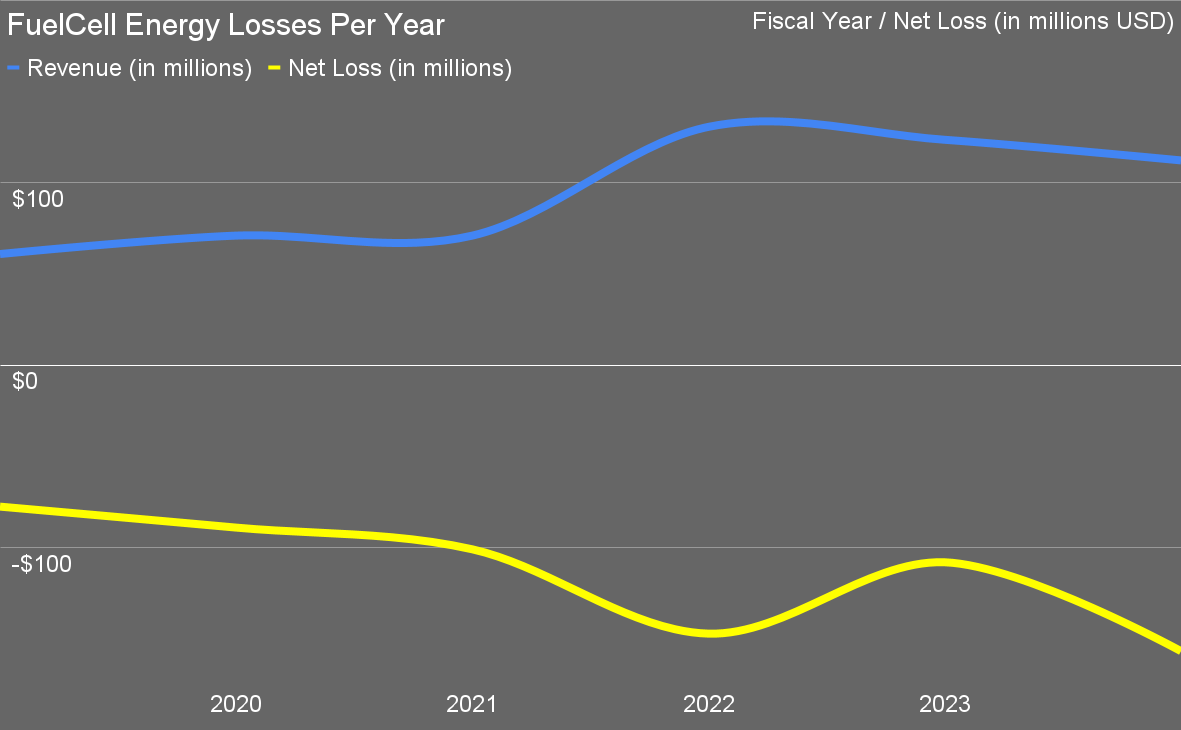

This is another chart to throw fear into the hearts of investors. That’s losses of $680 million from 2019 to 2024, an average of $113 million per year. At least that’s lower than Plug Power, although over double Ballard. It tends to average twice the losses as revenue, hence the revenue and losses matching each other in amplitude in most years. But 2024 saw declining revenue and increasing losses. The company has never posted a profit since it was founded in 1969, which makes you wonder, as with the other two firms, exactly how they survive.

FuelCell Energy has recently undertaken significant restructuring efforts in response to financial challenges and market conditions. In November 2024, the company announced a global restructuring plan aiming to reduce operating costs by approximately 15% in fiscal year 2025. This plan includes a 17% reduction in its workforce, affecting operations in the U.S., Canada, and Germany. The restructuring focuses on prioritizing core technologies such as distributed power generation, grid resiliency, and data center growth, while scaling back on other areas. The company stated that its carbonate manufacturing capabilities in Torrington, Connecticut, will remain unaffected.

Additionally, in November 2024, FuelCell Energy implemented a 1-for-30 reverse stock split. This action was intended to increase the company’s stock price to meet the Nasdaq’s minimum bid price requirement of $1.00 per share for continued listing.

That explains the current valuation that’s 4-5 times Plug Power’s and Ballard’s which are inching toward penny stock category themselves. Certainly there’s nothing about FuelCell Energy that suggests it should be valued at more than they are, although I’m perplexed that any of them are clinging to stock values above zero.

Plug Power and Ballard Power Systems have both taken steps to adjust their stock structures over the years, but their approaches have differed significantly. In 2011, Plug Power executed a 1-for-10 reverse stock split, consolidating every ten shares into one to boost its share price. The move aimed to keep the company in compliance with the Nasdaq Capital Market’s minimum bid price requirement, ensuring it remained listed on the exchange. I suspect it will be doing that again if it doesn’t just go out of business entirely, something that’s more appropriate given the nature of the beast.

Ballard Power Systems, on the other hand, took the opposite approach in 1998, implementing a 3-for-1 forward stock split. This move increased the number of shares available while proportionally lowering the stock price, making it more accessible to investors. Ballard’s decision reflected confidence in its long-term growth potential, which is amusing in retrospect, but of course it did that a couple of years before the 2000 spike, so it probably felt like they were brilliant at the time.

Another fuel cell firm, Bloom Energy has reported net losses annually since its founding in 2001. For instance, in 2023, the company reported a net loss of $307.9 million, slightly improving from a $315.1 million loss in 2022. In 2021, the net loss was $193.4 million, and in 2020, it stood at $179.1 million. Remarkably, it managed to eke out a meager $22 million in net income in 2024 on revenues of $1.7 billion or so, also not something to make sensible investors excited. That’s after losing a cool billion over the previous four years.

Apparently that profit was based on orders booked related to US data centers for AI. That’s likely to end poorly given the efficiencies found with DeepSeek and NVIDIA’s new GPUs, along with the clear geopolitical strategic requirement to get data processing out of the United States.

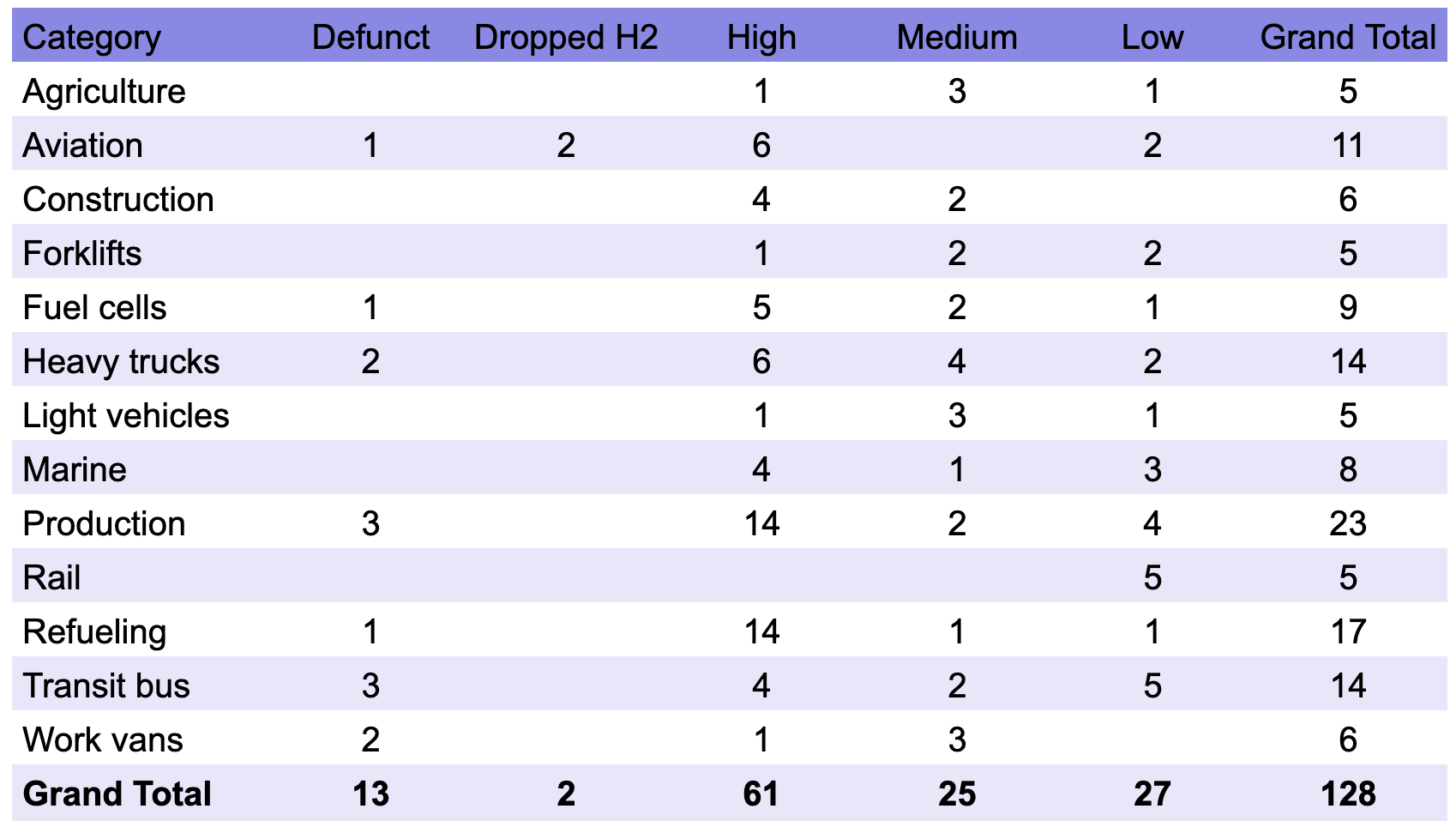

There are more fuel cell manufacturers that are head scratchingly still in business competing for a virtual non-existent and dead end market. Cellcentric, Hexagon Purus ASA, HyAxiom, Symbio and Loop Energy are also all high risk on my hydrogen transportation deathwatch list. Hyundai and Toyota make fuel cells too, but they are still selling a lot of useful products as well, so are merely going to lose money on effort, not waste billions of investors’ money before going out of business.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy