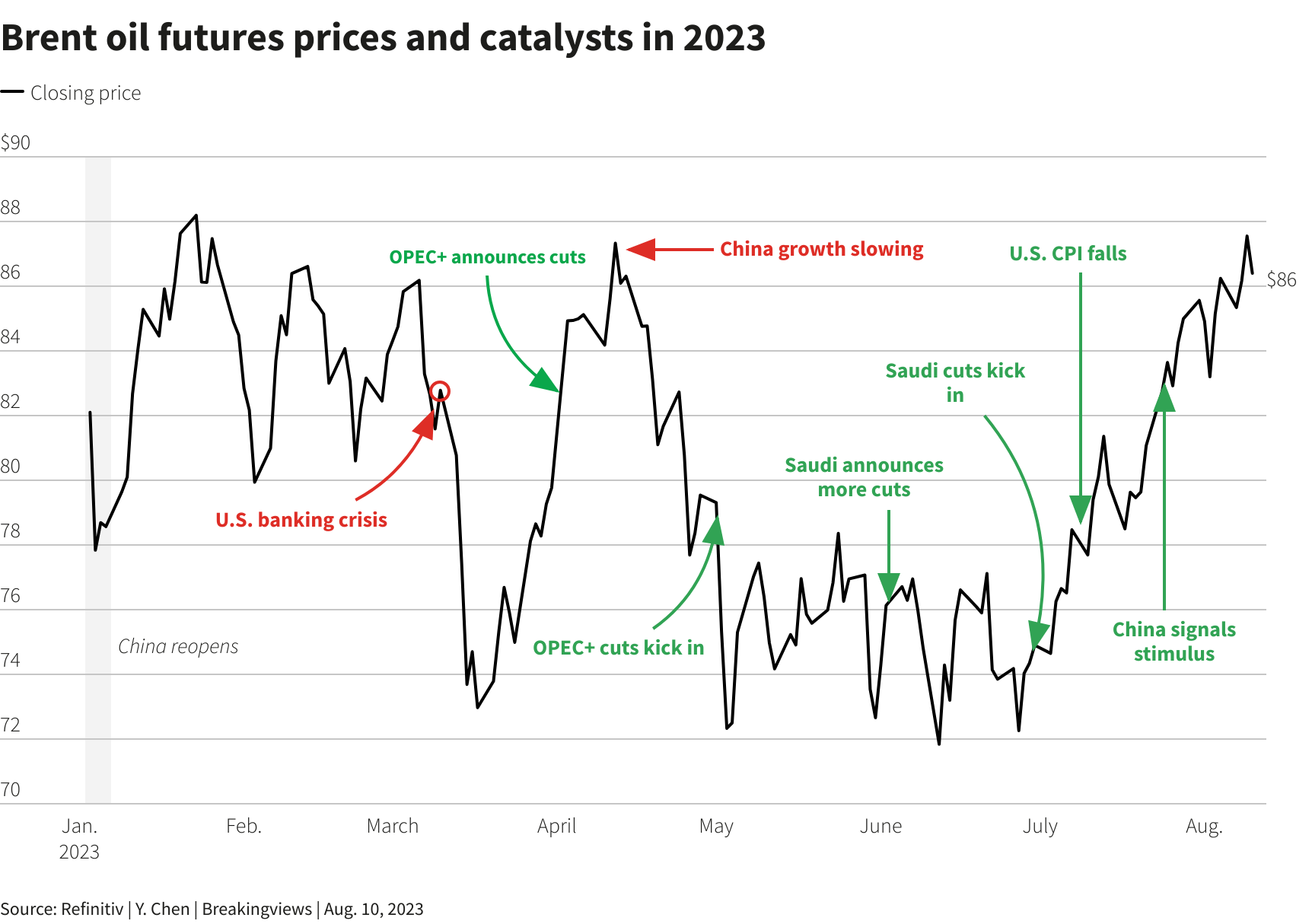

(Reuters Breakingviews) – Prince Abdulaziz bin Salman must be feeling vindicated. The Saudi energy minister in June corralled the Organization of the Petroleum Exporting Countries and its allies including Russia to extend their existing production cuts, with his own country even taking an extra million barrels per day off the market, his so-called “lollipop”. While crude prices have since soared 20%, both seasonal factors and a weakening global economy mean the producer bloc now cannot relax.

June’s package, in which the OPEC+ group agreed to renew existing cuts to the end of 2024 and Saudi Arabia further curtailed its own supply subject to rolling monthly renewals, was far from a guaranteed win. True, OPEC itself had been forecasting a 2 million barrel per day hike in global demand this year, and the International Energy Agency had warned repeatedly that crude supply would fail to keep up with the world’s needs. If traders believed that, they should have pushed crude prices far above the $75 per barrel level prevailing in May and June. But speculators were even more worried about the risk of a U.S. banking crisis, or a disappointing China reopening.

Fortunately for the cartel, the economic backdrop soon helped. Falling inflation expectations allowed the Federal Reserve in July to signal a potential end to rate hikes, fuelling hopes for a soft landing just as the extra Saudi cuts kicked in. Traders were also cheered by a decline in U.S. oil inventories. The fact that stocks have been falling on the U.S. Gulf Coast, where the country’s export infrastructure is located, was a particularly encouraging sign of growing demand. As a result, crude futures have risen steadily since the June agreement, and are now hovering just below $90.

But seasonal factors have also played a role, and these may soon wane. An unusually hot summer saw many Americans take to the road, which is a boon for downstream fuel such as gasoline. True, a likely El Niño weather event could bring a colder winter, boosting demand for gas and oil. But it may also lead to economic disruption and higher inflation, both of which hurt demand.

A U.S. soft landing and Chinese recovery would indeed be soothing, but neither looks very likely. China has sunk into deflation, with stimulus yet to materialise. And the true economic impact of interest rates has yet to hit. Goldman Sachs analysts are still pencilling in a 20% chance of a U.S. recession in the next 12 months. The current crude price is not even remotely factoring one in: it is currently about 25% above the long-term average of $70 in the two decades to 2022.

If prices fall back, OPEC and its allies may have few easy choices. Saudi Arabia has already extended its extra million barrels per day cut until September. But it will be hard for the kingdom to keep extending Prince Abdulaziz’s “lollipop” long into next year, without damaging its own finances. And such a move would strain relations with U.S. President Joe Biden, especially close to an election. Yet getting the rest of OPEC to pick up the slack won’t be easy either: Iran, for example, is busy cranking out as much oil as possible. OPEC’s sweet spot may not last.

CONTEXT NEWS

U.S. consumer price inflation rose 3.2% in the 12 months through July, government data showed on Aug. 10. That followed a 3.0% rise in June, which was the smallest year-on-year gain since March 2021. The Federal Reserve has a 2% inflation target.

At its policy meeting in June, the Organization of the Petroleum Exporting Countries and allies including Russia, known collectively as OPEC+, agreed on a broad deal to limit supply into 2024. At the same time Saudi Arabia pledged a voluntary production cut for July that it has since extended to include August and September.

Brent crude futures fell $1.15, or 1.3%, to settle at $86.40 a barrel on Aug. 10, while West Texas Intermediate crude futures settled down $1.58, or 1.9%, at $82.82.

Saudi Arabia told OPEC that it cut output by 943,000 barrels per day (bpd) in July to 9.013 million bpd, Reuters reported on Aug. 10. OPEC’s total output fell by 836,000 bpd to 27.31 million bpd in the same month.

Share This: