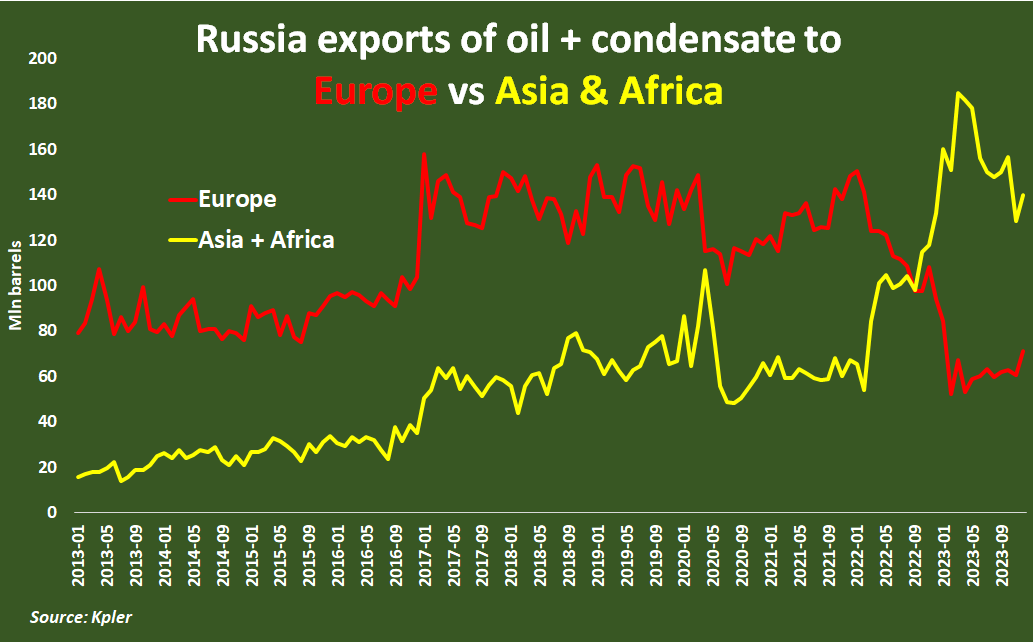

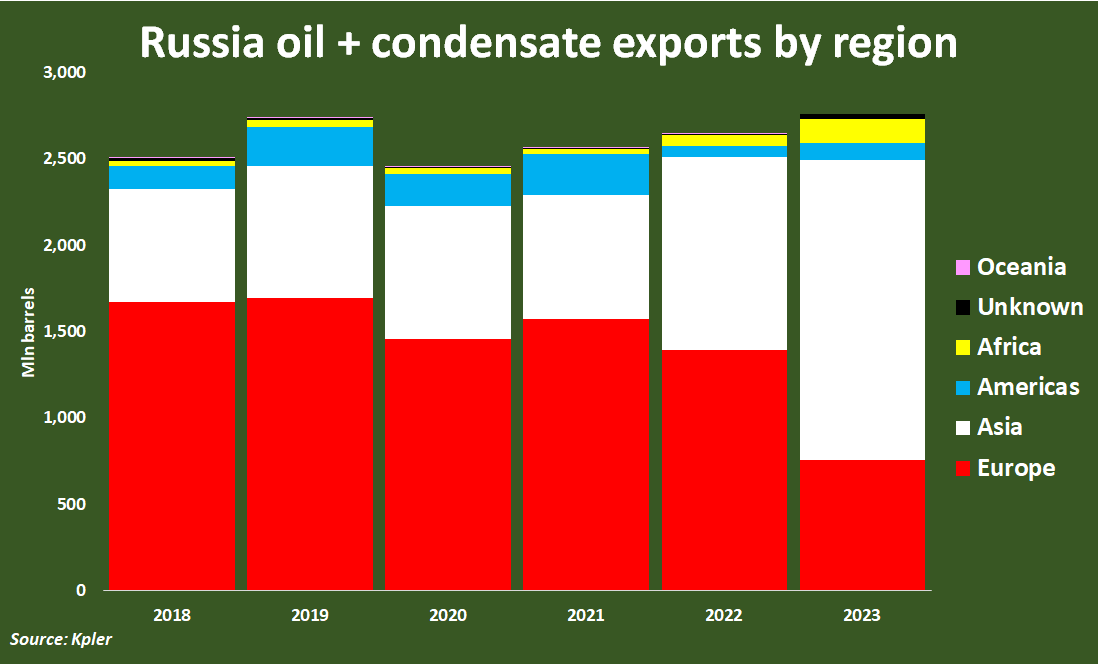

(Reuters) – Asia and Africa have replaced Europe as the top destinations for Russian crude oil exports since Moscow was slapped with European sanctions on sales of energy products following its invasion of Ukraine in February 2022.

Prior to the sanctions in mid-2022, Europe accounted for more than 60% of Russia’s oil exports and provided Moscow with a lucrative income stream for oil that was supplied cheaply to major European consumption hubs by pipeline.

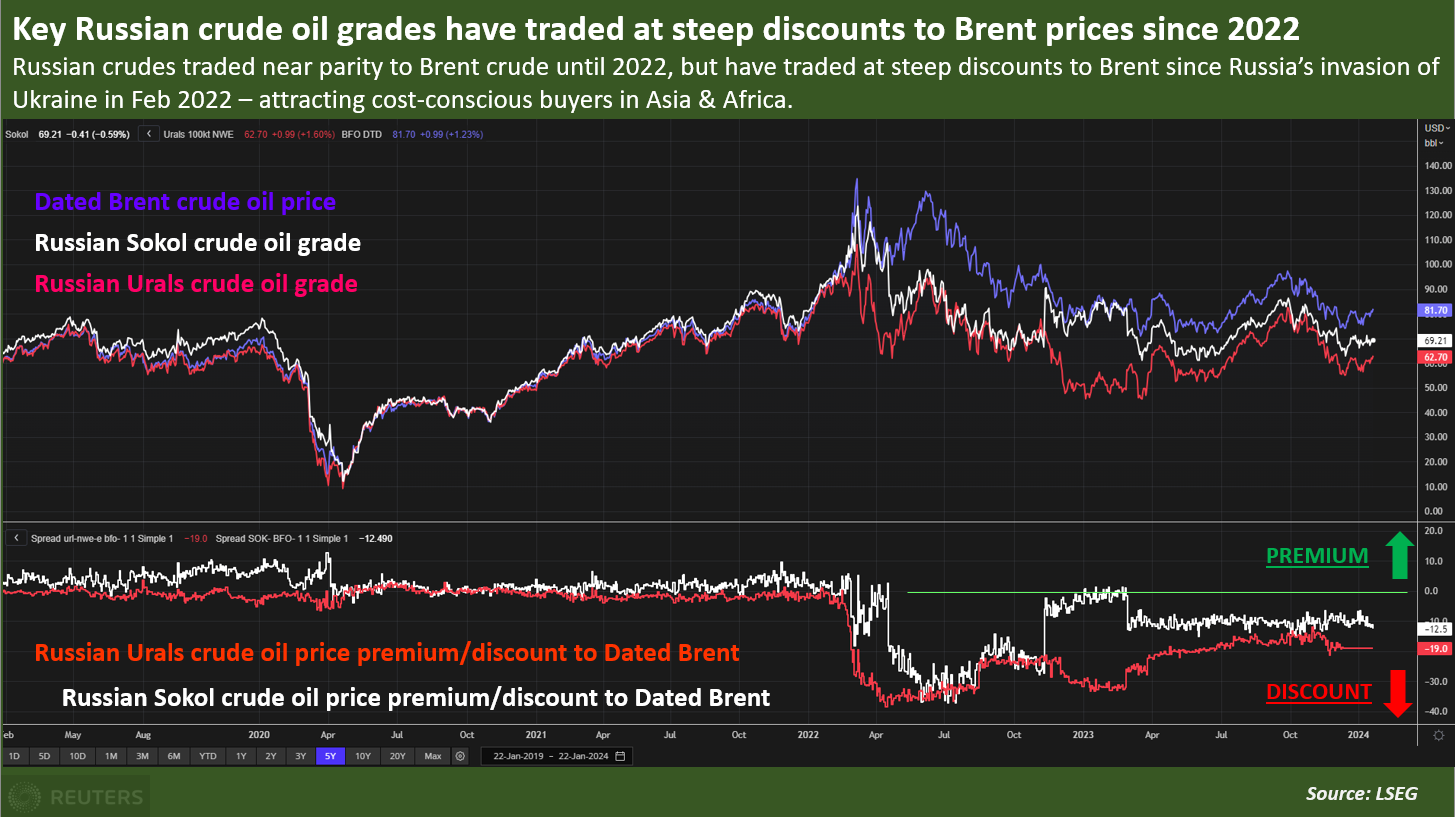

The main Russian crude oil grade, Urals, has traded at a discount of more than $20 a barrel to Dated Brent crude – Europe’s main cash oil benchmark – since mid-2022, versus an average discount of less than $2 a barrel in 2021, LSEG data shows.

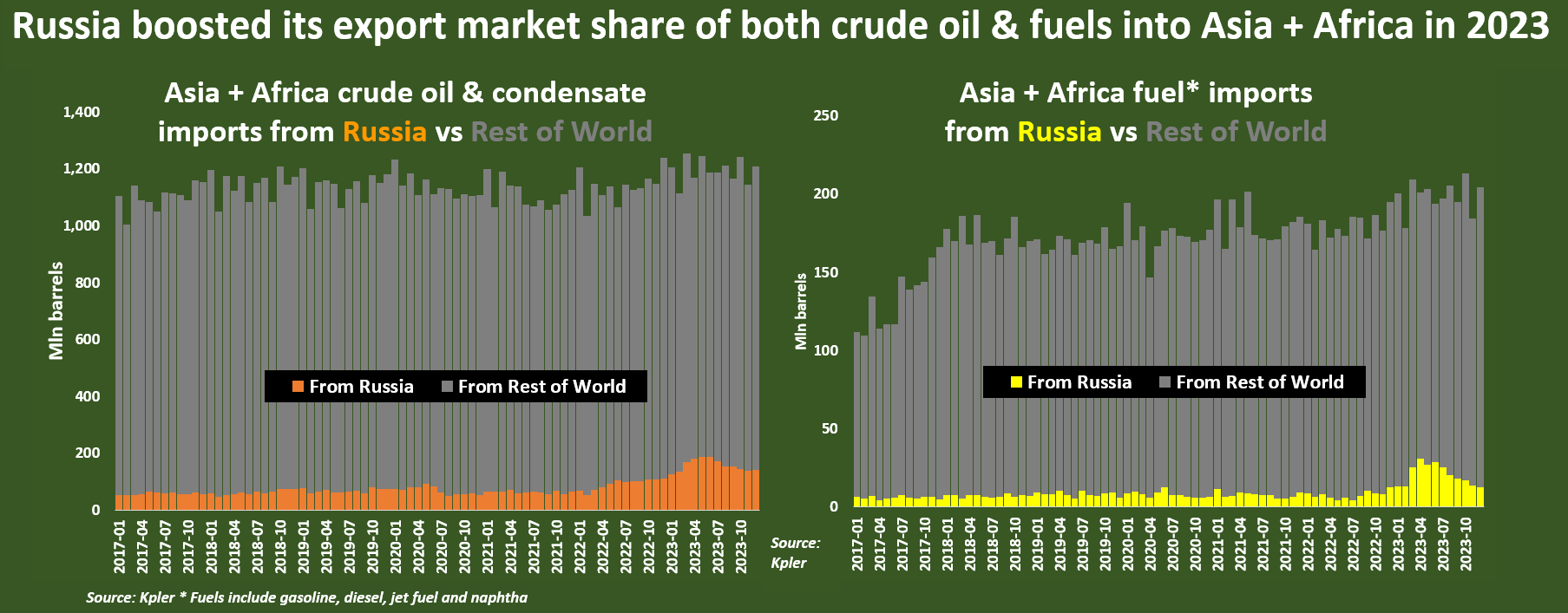

That aggressive discounting in turn resulted in steep jumps in Russian oil purchases by Asia and Africa, and record high overall crude imports by both continents in 2023, ship tracking data from Kpler shows.

Continued aggressive oil pricing by Russia is likely to spur additional increases in oil buying across both Asia and Africa in coming years, despite efforts everywhere to cut reliance on fossil fuels in energy systems.

GLOBAL PIVOT

For both Asia and Africa, the annual increase in oil purchases from Russia in 2023 was the largest ever, helping to push total oil and condensate imports to record highs in both regions.

CUT PRICE

In addition to discounting Urals crude shipped out of northern Russia, exporters also cut the price of Sokol oil, shipped mainly out of the Russian far east, to record discounts of more than $13 a barrel against dated Brent crude cash prices.

RISING STARS

Ghana, Libya, Tunisia and Togo all posted more than 100% annual growth in Russian oil imports in 2023, while Morocco, Senegal and even Nigeria – an oil producer and exporter – also showed steep jumps in Russian oil imports last year.

Some of the import volumes shattered previous records, with flows into Ghana alone topping 16 million barrels in 2023, against 600,000 barrels a year on average from 2017 through 2022, according to Kpler.

With Egypt, Libya, Morocco, Nigeria, Senegal and Tunisia bringing in an additional 109 million barrels last year, it is clear that Africa as a whole has quickly emerged as a key market for Russian oil sellers.

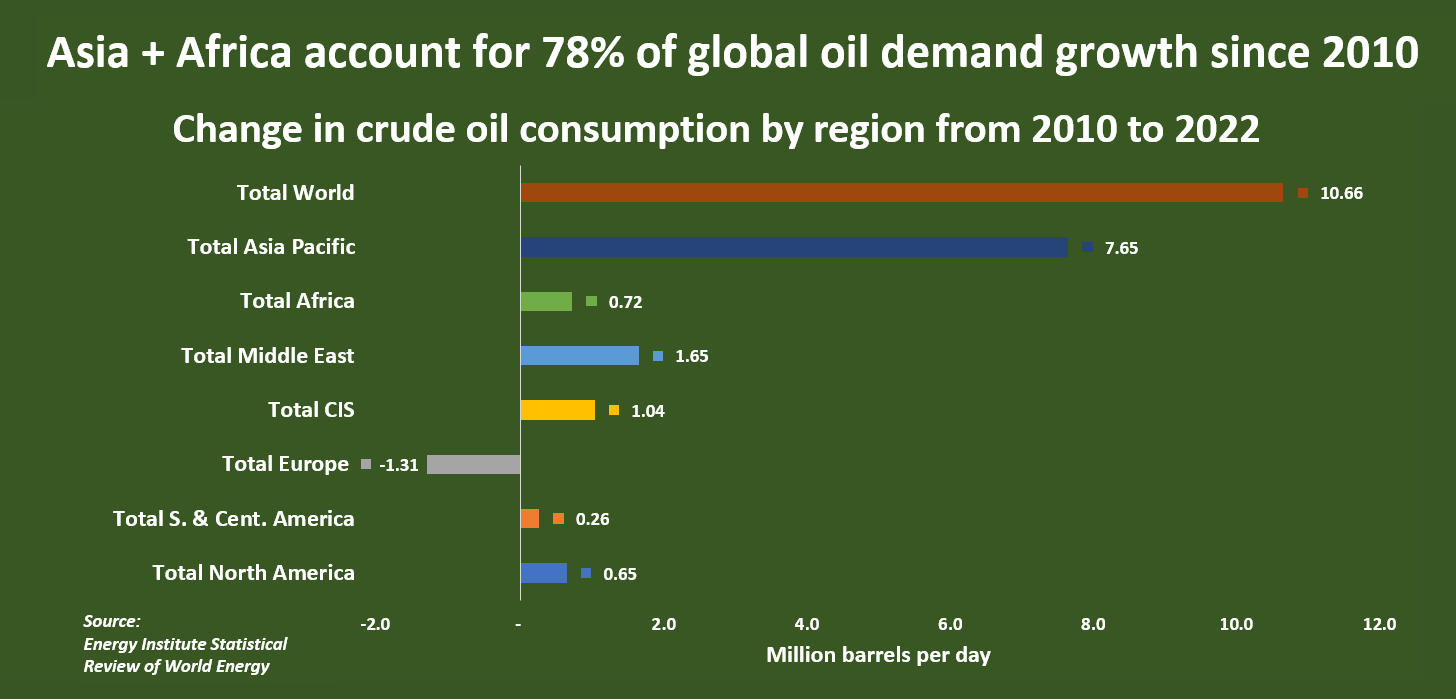

That growth lags the 28% expansion recorded by Asia-Pacific over the same period, but is expected to accelerate over the coming decades as the continent’s massive population and growing businesses dial up consumption of all types of energy.

Much of Africa’s additional energy consumption needs may be met by new and planned increases in renewable energy supplies, especially in households and offices linked to electric grids.

But strong growth in the region’s car numbers, along with rapid expansion of fuel station networks, looks set to bring steady increases in overall oil and fuel demand and so ensure a reliable and rising market for oil exporters such as Russia.

Reporting by Gavin Maguire; Editing by Clarence Fernandez

Share This: