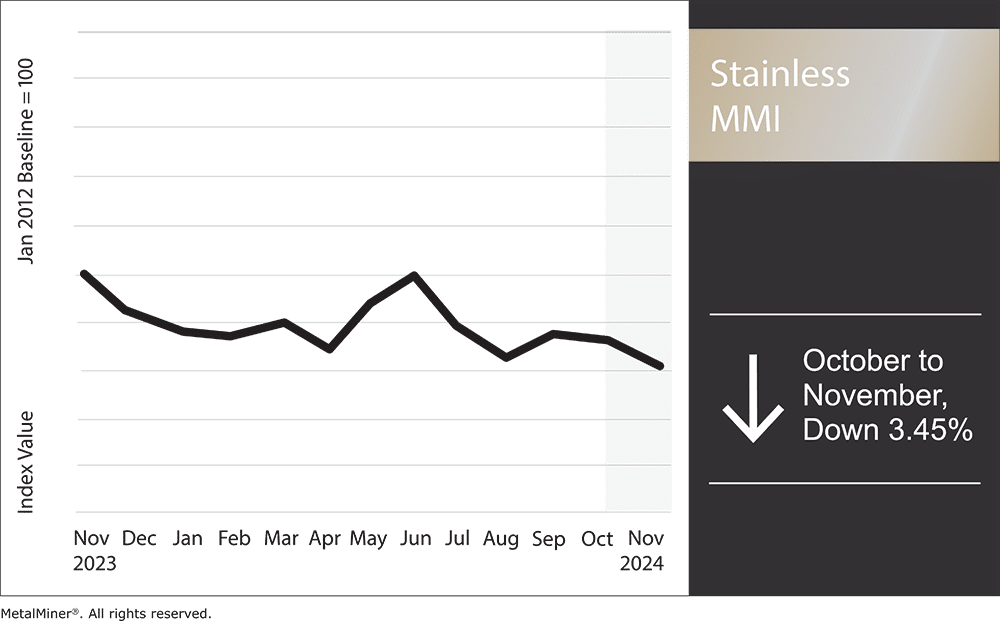

Overall, the Stainless Monthly Metals Index (MMI) accelerated declines from the previous month, with a 3.45% drop from October to November. Following a slight increase during September, nickel prices returned bearish. Prices fell 8.72% throughout October before they found a bottom at the close of the month, making them the worst-performing base metal.

Crush your competition by getting access to weekly exclusive nickel and stainless market intel. Opt into MetalMiner’s free weekly newsletter.

Stainless Mill Reports Show a Lackluster Market

Q3 financial results arrived showing no evidence of a turnaround in the stainless market. Months of contraction within the U.S. manufacturing sector offered no support to stainless demand, which remains plagued by weak conditions.

Both Outokumpu and Acerinox, the parent company of North American Stainless, reported year-over-year declines in net sales. Outokumpu witnessed a 0.85% decline from Q3 2023, while Acerinox saw net sales fall 10.28%.

Outokumpu Americas Dragged by Lower Prices

Largely emblematic of commentary from distributors in recent months, falling prices dragged on Q3 results from Outokumpu Americas. Despite a 9.03% increase in deliveries during the first three quarters of 2024 from the same period of 2023, net sales remained in decline.

Outokumpu attributed bearish pricing to competitively priced imports, which forced domestic mills to offer aggressive pricing during the year. While base prices held steady, mills relied on increasingly steep transactional discounts to attract buyers and maintain production levels.

Although Outokumpu noted a positive long-term outlook, imports will remain a challenge for the mill. High ocean freight rates have kept a certain volume of imports at bay over recent months. However, those rates have fallen considerably since they found a peak in July. Unless freight rates rebound, this will place a cap on domestic prices. For more information about how to react to market shifts like this, learn the 5 Mistakes Buyers Can Make When Sourcing Stainless Steel

Ryerson Plagued By Overpriced Inventory

The impact of lower stainless steel prices extended beyond mills, as Q3 financial results from leading U.S. distributor Ryerson echoed bearish results from Outokumpu. While deliveries during the first three quarters of 2024 appeared comparable to the previous year, average selling prices remained in freefall.

According to the report, Ryerson’s average selling price for stainless steel fell 11.9% from Q3 2023 to Q3 2024. Despite falling prices, shipments largely stabilized after they found a bottom at the end of 2023, with Q3 2024 witnessing a modest 1.8% year-over-year increase.

Falling prices appear to have left Ryerson holding overpriced inventory. Highlighting the issue, the company noted that “gross margins continued to be under pressure in the quarter as demand conditions saw continuing contraction and selling price declines continued to outpace the decline in our average inventory costs.”

Stainless Remains a Buyer’s Market

Bad news for suppliers is good news for buyers. The combination of competitively priced imports and domestic oversupply means buyers retain strong bargaining power. Moreover, conditions appear unlikely to change during the remainder of the year. In its outlook, Acerinox showed little optimism in the short term, noting, “ The weakness of the demand for stainless steel will continue for the fourth quarter.”

For 2025, the outlook appears somewhat mixed. Q1 typically witnesses a seasonal increase in demand, but it remains unclear whether that will be enough to halt price declines. One distributor stated that they believe the next quarter will see sales increase, but that they will remain disappointing overall.

Do you have a buying strategy based on the current trend for nickel prices? MetalMiner’s Monthly Buying Outlook Report provides monthly price forecasts and purchasing strategies for 10 different metal types. View a free sample copy.

Implications of a Trump Presidency

The conclusion of the U.S. election could spur some additional buying activity from those who held back due to uncertainty. However, a Trump presidency comes with a mixed outlook. Trade barriers and other protectionist measures would typically prove supportive for domestic prices. However, it also puts the outlook for renewables at risk. While Trump will not be able to undo most of what accompanied the Inflation Reduction Act, he could upend certain aspects, including subsidies for EVs.

Biggest Moves for Stainless Steel and Nickel Prices

- The Allegheny Ludlum Surcharge for 304/304L coil moved sideways, with a modest 1.04% rise to $0.92 per pound as of November 1.

- The Allegheny Ludlum Surcharge for 316/316L coil rose 1.0% to $1.47 per pound.

- Meanwhile, Korean 304 cold rolled coil prices declined by 3.8% to $2,447 per metric ton.

- Chinese primary nickel prices fell 7.06% to $15,940 per metric ton.

- Indian primary nickel prices witnessed the largest decline, with an 8.54% decline to $16.11 per kilogram.