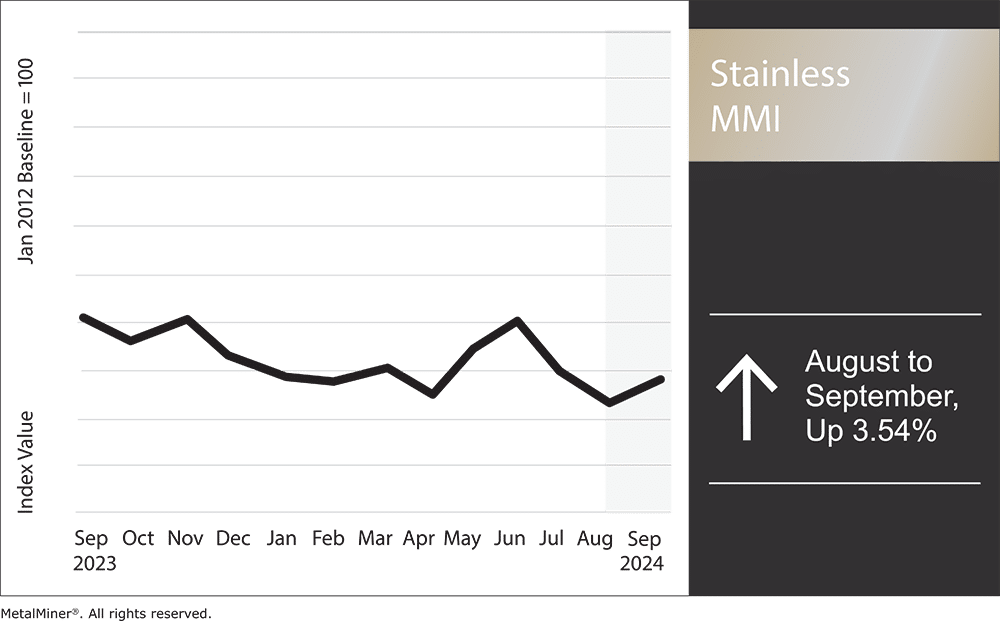

Overall, the Stainless Monthly Metals Index (MMI) posted slight growth, with a 3.54% rise from August to September.

Nickel prices rallied throughout August, halting months of steep declines. All in all, prices rose 3.18% during the month as they found a peak on August 30. However, the rebound proved short-lived. The price of nickel collapsed entering September, losing all of August’s gains in the first two weeks of the month.

Receive MetalMiner’s Weekly Newsletter and receive insights to help you navigate nickel and other metal price volatility and economic changes.

Bearish Conditions Lead to Reports of Aggressive Offers

Aggressive offers from one mill reverberated across the West Coast during August. Import brokers faced challenges breaking into the market as Outokumpu reportedly undercut offshore prices. Domestic mills have been on the defense for more than a year as bearish conditions and market oversupply have forced them to entice buyers with steep transactional discounts.

Despite those reports, import volumes continue to trend higher during 2024 than in 2023, even in recent months. Furthermore, data from WorldStainless indicates U.S. mills were able to increase stainless steel output during Q1 2024, which accounted for a 15.8% quarter-over-quarter rise and a 6.5% year-over-year rise.

Higher imports and production levels suggest that the U.S. market found a bottom at the end of 2023. However, it remains unclear whether mills managed to hold onto that capacity growth in the ensuing months, especially amid distributor reports of a summer slowdown. Lead times continued to trend historically short, between 4-6 weeks.

But while U.S. mills increased production, it appears demand has hardly proved strong enough to tighten supply. More about how supply and demand dynamics in the nickel and stainless market impact the overall supply chain are covered in 5 Biggest Mistakes Companies Make When Sourcing Metal.

Rate Cut Bets Fuel Short-Lived Rally in Nickel Prices

Buyers have appeared reluctant to enter the market in recent months due, at least in part, to the bearish nickel outlook. LME inventory stocks have shown a sharp and uninterrupted uptrend since mid-2023 as the nickel market appears increasingly oversupplied.

While nickel prices rose alongside other base metals during the second quarter, oversupply translated to a relatively smaller overall increase before prices found a peak. From there, nickel prices returned to a downtrend that brought them to their lowest level since 2021. Nickel remains the worst-performing metal so far this year.

In August, prices saw another modest jump as markets priced in the upcoming rate cut from the Federal Reserve. However, holding onto those gains for long proved impossible, and prices retraced sharply during the first half of September.

As they search for a new bottom, the overall downtrend for nickel prices has left the NAS 304 surcharge in freefall. Much like the price of nickel, the surcharge now sits at its lowest level since January 2021. Even if stainless steel demand picks up, the downside risks to the surcharge will leave buyers, including service centers, with little appetite to purchase ahead.

Indonesia’s Contribution to Global Oversupply

As the nickel supply glut weighs on prices, many blame Indonesia. Indeed, dominating the nickel supply chain has underpinned Indonesia’s economic growth strategy in recent years. This has translated to the substantial development of its nickel reserves and processing capacity. According to the USGS, the archipelago accounted for half of global nickel production in 2023, a share that appears likely to increase in 2024.

However, with this growth has come accusations of exploitive and destructive practices. Recently, the U.S. Department of Labor categorized Indonesian-sourced nickel as a product that uses forced labor. The move has no actual implications for Indonesia, nor does it come with any sort of trade barriers. However, that could change, especially considering how much influence China has over Indonesia’s nickel sector. After all, in recent years, Chinese investments in the country have increased substantially, significantly outpacing those of other countries.

Don’t settle for stagnant stainless savings. MetalMiner’s custom price forecasting unlocks the true potential of your volu me commitments, ensuring you maximize profit. View our full metal catalog.

U.S.-Indonesian Nickel Trade Relations At Risk

Complicating matters is the fact that the U.S and Indonesia are currently in the middle of negotiations for a potential “critical mineral agreement.” Indonesia does not have a free-trade agreement with the U.S., and the recent categorization of its nickel puts any change to that at risk. Without that agreement, batteries and EVs that contain Indonesian-sourced nickel will remain ineligible for tax credits afforded by the U.S. Inflation Reduction Act.

Regardless of the outcome of those negotiations, Indonesia is sure to remain a deflationary force on global nickel prices, something unlikely to change in the foreseeable future.

Biggest Nickel and Stainless Steel Price Moves

Do you have a buying strategy based on the nickel price trend? MetalMiner’s Monthly Buying Outlook Report provides monthly price forecasts and purchasing strategies for 10 different metal types. View a free sample copy.

- Chinese ferromolybdenum prices rose 3.1% to $33,643 per metric ton as of September 1.

- Indian primary nickel prices moved sideways, with a modest 2.85% increase to $16.97 per kilogram.

- Meanwhile, Korean 304 cold rolled coil prices edged lower, with a 1.93% decline to $2,543 per metric ton.

- The Allegheny Ludlum Surcharge for 316/316L coil fell 6.5% to $1.53 per pound.

- The Allegheny Ludlum Surcharge for 304/304L coil witnessed the largest decline of the overall index, with a 7.8% drop to $0.95 per pound.