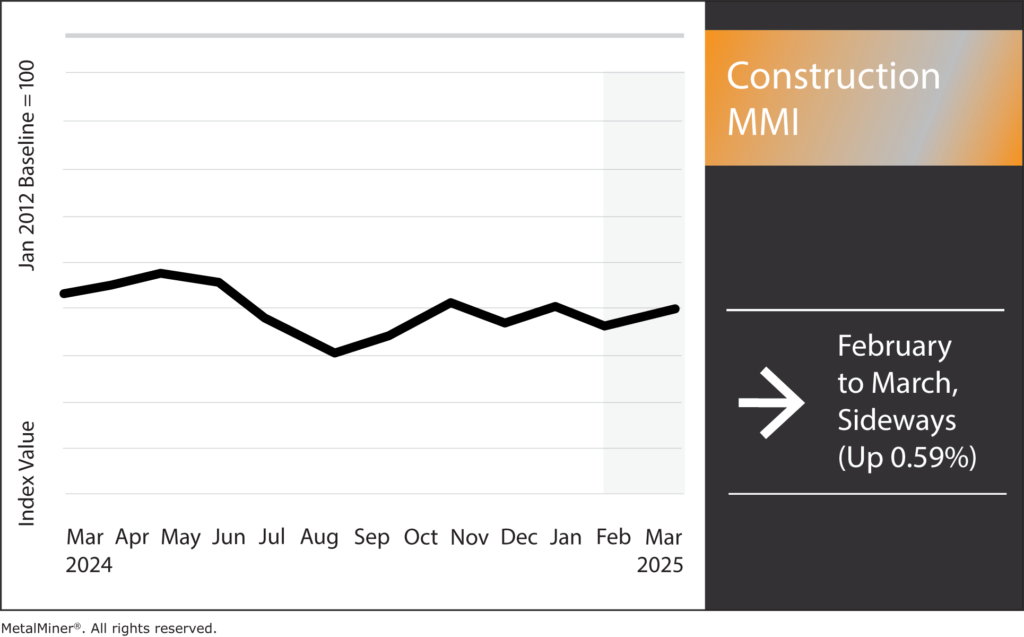

The Construction MMI (Monthly Metals Index) held its five-month-long sideways trend, only moving up by .59%. Meanwhile, the latest tariffs on construction materials from China have not taken a massive toll on metals prices. However, another 10% increase in Chinese tariffs by the Trump administration this past month (raising the total percentage to 20%) may have a short-term impact on the index in the near future.

Metals Prices & Tariffs: Impact on the Construction Industry?

In 2025, the U.S. construction sector faces some challenges stemming from recent policy shifts, specifically the Trump administration reinstating and expanding tariffs on steel and aluminum imports. However, to what degree the ongoing tariff battle will hinder or promote construction at home is not yet clear.

MetalMiner’s monthly free MMI report gives monthly trends for metals prices, including copper, stainless, aluminum and stainless. Sign up here.

Tariffs on Steel and Aluminum Imports

The administration announced the tariffs in early 2025 as part of its plan to boost American manufacturing and protect national employment. The move revoked previous exceptions and tightened requirements, mandating metal processing within North America. This decision aims to promote domestic production and decrease reliance on international imports, with the potential to impact construction firms that rely heavily on foreign materials.

Rising Construction Costs and Supply Chain Disruptions

The U.S. construction sector will likely experience rising costs and supply chain disruptions stemming from newly imposed tariffs on steel and aluminum. These tariffs could impact the availability and pricing of essential building materials, including structural steel, reinforcing bars and aluminum parts commonly utilized in residential, commercial and public infrastructure projects.

As materials become more expensive, the increased expenses could drip down through the supply chain, ultimately elevating overall construction costs. Consequently, builders and contractors may have to choose whether to absorb these additional expenses or pass them onto customers.

Want to know what’s affecting metals prices the most? Subscribe to MetalMiner’s weekly newsletter and conquer market volatility with valuable weekly market insights and macroeconomic news.

Federal Reserve’s Monetary Policy and Interest Rates

As of early 2025, the Federal Reserve has maintained its benchmark interest rate within a range of 4.25% to 4.50%. This follows a series of late 2024 rate cuts aimed at supporting economic growth while controlling inflation. Meanwhile, economic projections suggest further reductions may be possible later in the year, depending on financial indicators.

Fluctuating interest rates could also impact construction costs, as decreased borrowing costs make financing more accessible for developers and builders, which could potentially spark investment in new projects. If the Fed did cut rates, it could lead to increased activity across both residential and commercial sectors.

However, lower interest rates alone may not be enough to offset all tariff costs. Increased material prices will typically impact developers’ profit margins, making them more cautious in their investment decisions. Additionally, the rising expenses could be transferred to consumers, further adding to concerned of housing affordability.

MetalMiner can unlock customizable price forecasting for your unique metals, forms and gauges. View our full metals catalog.

Industry Outlook

Ultimately, while reduced interest rates could ease financing burdens somewhat, higher costs for construction materials, driven by tariffs, threaten to complicate budgets and affordability for new projects. Therefore, construction industry leaders need to focus on careful cost control strategies while closely monitoring broader economic shifts, all covered in the Comprehensive Steel & Aluminum Tariffs report.

Navigating this uncertain environment successfully will require adaptability, vigilance and a proactive balance between cost efficiency and responding to changing market dynamics.

Construction MMI: Noteworthy Shifts in Metals Prices

Why buy price points for all metal type when you only need price points for a few? Only purchase the metal price points you need with MetalMiner Select. Learn more.

- Weekly Gulf Coast bar fuel surcharges increased by 10.02% to $0.44 per mile.

- Chinese H-beam steel prices moved sideways, dropping by a slight 0.96% to $440.48 per metric ton.

- Chinese steel rebar prices also moved sideways, dropping by 1.06% to $480.37 per metric ton.

- Lastly, European commercial aluminum 1050 sheet prices traded flat, remaining at $3,709.11 per metric ton.