The nature of the mining business is that metals prices tend to fluctuate. When the price of a particular metal rises, investor interest in that sector goes up, and usually wanes when the price falls. Resource investors naturally gravitate to other metals where the returns are higher. Bear markets can be murder on juniors exploring for only one commodity when the price of said commodity hits the skids.

Having other metals in their project portfolio helps a junior to spread the risk.

In 2024, we at AOTH are focused on four metals and the companies that are exploring for them: copper, silver, gold and graphite. One company that has three of the four, with deposits of sufficient size to attract a major mining company, and the potential for serious upside to boot, is Max Resource Corp. (TSXV:MAX; OTC:MXROF; Frankfurt:M1D2).

CESAR copper-silver project

Max’s CESAR project is situated along the copper-silver-rich Cesar Basin of northeastern Colombia. This region provides access to major infrastructure resulting from oil & gas and mining operations.

Max was the first to recognize the potential for the Cesar Basin and the company’s land package now spans more than 1,150 km of geology prospective for sedimentary-hosted copper and silver deposits.

Max’s field teams have so far identified 27 targets across three separate districts of the 120-km Cesar copper-silver belt: AM, Conejo and URU.

Initial efforts have been concentrated on those targets with the greatest size potential with work that includes the following field activities:

- Systematic chip and channel sampling of the mineralized outcrops;

- Detailed geological and structural mapping of each showing;

- Trenching where possible to expose additional mineralization;

- Target scale prospecting and soil sampling;

- Ground geophysical surveys.

The company announced on Nov. 8 that it has secured 12 more applications for mining concessions covering over 132 square kilometers. It means CESAR now spans 120 along strike, from the previous 90 km, in a north-northeast/ south-southwest direction.

In addition, Max has acquired the royalties associated with 19 mining concessions and 31 mining concession applications at CESAR.

Bay Street Mineral Corp held an underlying 3% net smelter royalty over 19 mining concessions covering 184 square km, and 31 mining concession applications covering 796 square km.

The royalty acquisition is through a share exchange agreement Max executed with Bay Street, whereby Max acquires all the issued and outstanding shares of Bay Street, an arm’s length Canadian corporation, in exchange for 14 million Max shares.

While Max has demonstrated that the Cesar Basin is fertile for copper-silver mineralization over a large area, only a fraction of the basin has been explored. Therefore, Max says its geological teams are dedicated to regional exploration, with the goal of discovering additional copper-silver prospects over 1,000 square kilometers.

Currently, there are two depositional models at the CESAR project. Drilling at AM has confirmed that the sediment-hosted stratiform copper-silver mineralization found in the north end of the project (AM and Conejo) is analogous to the Central African Copper Belt (CACB) and the Kupferschiefer copper-silver deposits of central Europe. Work at the south of the project has identified mineralization hosted along structures (faults) within the volcanic units of the La Quinta formation. It is theorized that the structurally hosted mineralization may represent the feeder system for the stratiform mineralization observed in the sedimentary layers.

Make no mistake. Sedimentary-hosted copper deposits can have staggering size and value. It’s estimated that nearly 50% of the copper known to exist in sediment-hosted deposits is contained in the CACB, headlined by Ivanhoe’s 95-billion-pound Kamoa-Kakula discovery in the Democratic Republic of Congo.

Kupferschiefer, considered to be the world’s largest silver producer and Europe’s largest copper source, is an orebody ranging from 0.5 to 5.5m thick at depths of 500m, grading 1.49% copper and 48.6 g/t silver. The silver yield is almost twice the production of the world’s second-largest silver mine.

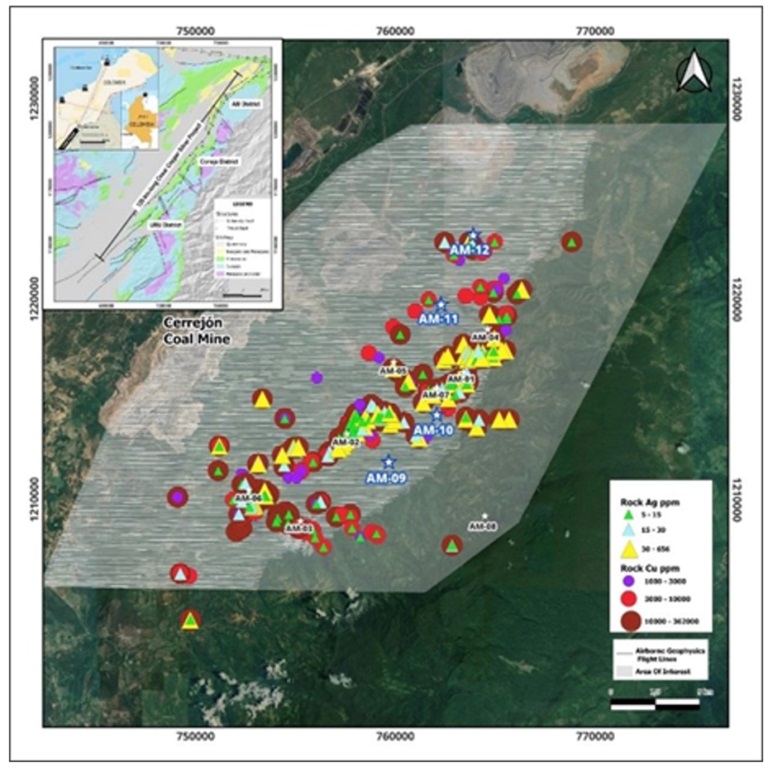

In late October, interpretation of preliminary airborne magnetic-radiometric survey data identified four new targets within the AM district. The targets are AM-9 to AM-12, seen on the map below.

AM District target map

According to Max, the success and effectiveness of the airborne survey has resulted in Max extending the survey by 6,000 line-km; it will now cover all three districts of the Cesar Project: AM, Conejo and URU.

The first 4,000 line-km of magnetic and radiometric data were collected along tightly spaced lines separated by 135m, providing Max with two detailed data sets that are packed with geological information important to the process of mineral discovery and development.

The airborne survey is targeting the La Quinta formation, a thick sequence of Jurassic-age (163 to 191 million-years before present) volcanic and sedimentary rocks in the Cesar Basin. Copper and silver mineralization has been discovered throughout the entire formation, but it is the sedimentary sequences that are of the greatest interest.

The four new targets were identified within the AM District where the sedimentary rocks are prevalent. The targets were identified in the airborne geophysical data by looking for structural patterns in unexplored areas of the CESAR property that are similar to those seen where mineralization is known to exist.

Radiometric surveys detect and map radiation from rocks and soils. The gamma radiation occurs from the natural decay of elements like uranium, thorium and potassium.

Max Resource unlocking the puzzle of a massive sedimentary basin

Magnetic surveys measure the spatial variations of the magnetic field. The results reflect the variations in the magnetic properties of the underlying rocks, and provide valuable information about their compositions and the structure of the Earth’s crust.

Magnetic and radiometric data were recorded simultaneously during the fixed-wing airborne survey. Max says the data sets will be instrumental for understanding the faults that act as conduits for mineralized fluids to infiltrate the sedimentary rocks and precipitate the copper-silver minerals.

Based on the strength of the data, Max has decided to extend the survey to cover the two districts south of AM: Conejo and URU. In total, 10,000 line-km of data covering 1,150 sq-km will be collected over all three districts of the CESAR copper-silver project.

“It is clear, even at this early stage, the techniques employed by Max will produce essential data sets for our continuing exploration efforts at CESAR,” said Max’s CEO Brett Matich, in the Oct 24 news. “The information from this survey will allow Max to evaluate its growing land package and pin-point new target areas for follow-up exploration. Equally important, the data will be used to expand existing targets through better understanding of their structural environment.”

In a year-end note to shareholders, Matich said the company’s success over the past 12 months “is underscored by the discoveries of compelling new target areas on the AM District, the acquisition of additional mineral tenures, and the continued exploration initiative along 120-km CESAR project.”

Max’s CEO Brett Matich on site

Aside from the four new target areas at AM, Matich mentioned the 12 additional mining concessions, and high-grade results from rock chip sampling at the AM-08 target. Notable results include 2.6% copper and 58 grams per tonne silver over 15 meters.

Last July, Max enhanced its leadership team by appointing Bruce Counts as Vice President of Exploration.

Matich reports the initial drill program at CESAR confirmed high-grade copper-silver assays, including 10.6 meters at 3.4% copper and 48 g/t silver.

In 2024, Max will undertake a second drill program targeting the AM District, having confirmed several highly prospective targets.

“Max stands at the forefront of unlocking significant mineral potential in the CESAR basin with the potential of making Colombia a world leading copper producer,” Matich wrote in his December note to shareholders. “Backed by a dedicated group of institutional and retail investors, a robust modern exploration strategy and a seasoned leadership team, and committed industry partners, the Company continues to advance the CESAR project through new high-grade copper-silver surface discoveries and by expanding its mineral tenure.”

Along with Max’s progress in the field, another reason we like CESAR is the electrification metals it contains — copper and silver.

Copper

Copper is one of the most important metals with more than 20 million tonnes consumed each year across a variety of industries, including building construction (wiring & piping,) power generation/ transmission, and electronic product manufacturing.

In recent years, the global transition towards clean energy has stretched the need for the tawny-colored metal even further. More copper will be required to feed our renewable energy infrastructure, such as photovoltaic cells used for solar power, and wind turbines.

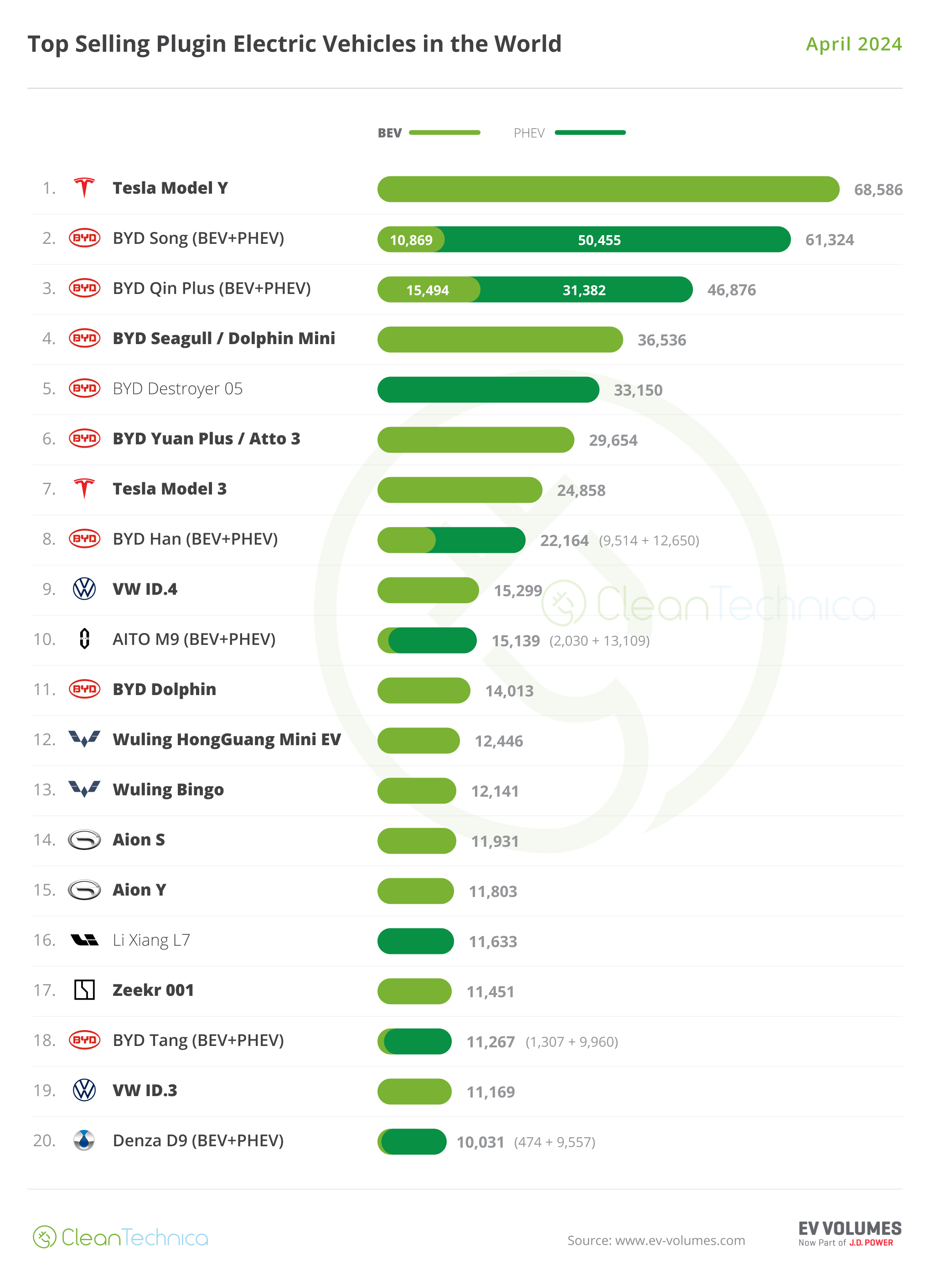

The metal is also a key component in transportation, and with increasing emphasis on electrification, demand is only going to increase.

Millions of feet of copper wiring will be required for strengthening the world’s power grids, and hundreds of thousands of tonnes more are needed to build wind and solar farms. Electric vehicles use triple the amount of copper as gasoline-powered cars. There is more than 180 kg of copper in the average home.

However, some of the world’s largest mining companies, market analysis firms and banks, are warning that by 2025, a massive shortfall will emerge for copper, which is now the world’s most critical metal due to its essential role in the green economy.

The deficit will be so large, The Financial Post stated, that it could hold back global growth, stoke inflation by raising manufacturing costs and throw global climate goals off course.

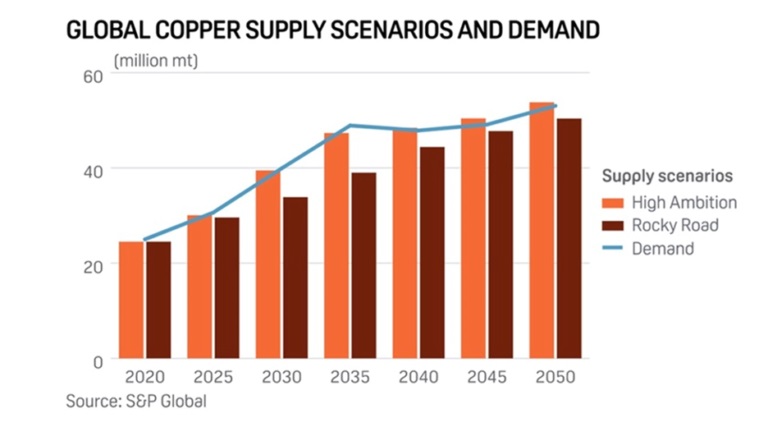

How big are we talking? Well, the speed at which copper demand outpaces supply will depend on the successful meeting of net-zero emission goals. According to a 2022 study by S&P Global, these goals will double the demand for copper to 50 million tonnes annually by 2035. BloombergNEF predicts demand will increase by more than 50% from 2022 to 2040.

“The energy transition is going to be dependent much more on copper than our current energy system,” Daniel Yergin, S&P Global vice chairman, told CNBC. “There’s just been the assumption that copper and other minerals will be there. … Copper is the metal of electrification, and electrification is much of what the energy transition is all about.”

According to consulting firm McKinsey, electrification is expected to create a 6.5 million-ton shortfall at the start of the next decade, highlighting a substantial output gap that the mining industry has to address.

Silver

Silver, like gold, is a precious metal that offers investors protection during times of economic and political uncertainty.

However, much of silver’s value is derived from its industrial demand. It’s estimated around 60% of silver is utilized in industrial applications, like solar and electronics, leaving only 40% for investing.

As the metal with the highest electrical and thermal conductivity, silver is ideally suited to solar panels. About 100 million ounces of silver are consumed per year for this purpose alone.

Battery electric vehicles contain up to twice as much silver as ICE-powered vehicles. A 2021 Silver Institute report says the auto sector’s demand for silver will rise to 88Moz in five years as the transition from traditional cars and trucks to EVs accelerates. Others estimate that by 2040, electric vehicles could demand nearly half of annual silver supply.

Analysts have long been pointing to a severe shortage of silver due to the relentless growth in demand for the metal, which is used in many industrial applications such as automotive and electronics.

Falling production in Mexico and China, the top two producers; resource nationalism in Peru, the number 3 producer; too low of an incentive price; and higher input costs are all feeding into a global silver supply deficit.

Mexico could run out of silver by 2026, worsening supply deficit — Richard Mills

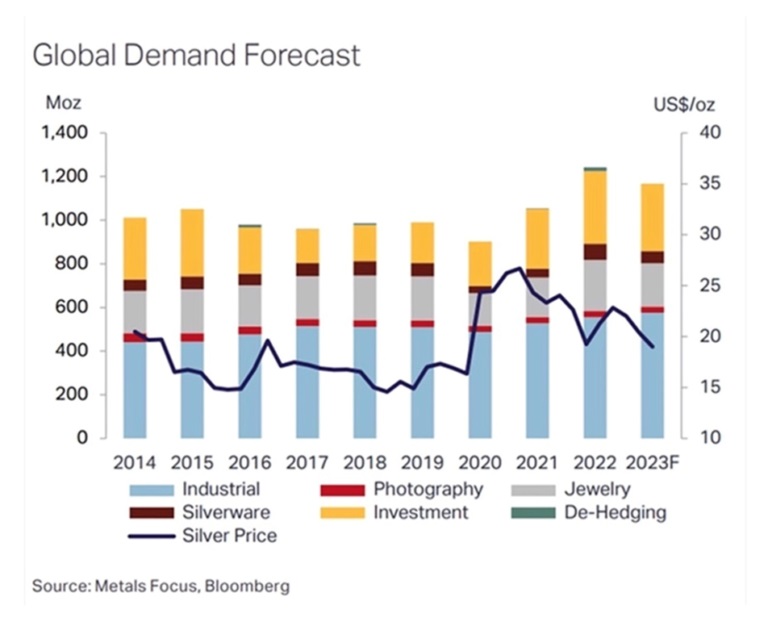

According to the 2023 World Silver Survey, the global silver market was undersupplied by 237.7 million ounces in 2022, which the Institute says is “possibly the most significant deficit on record.”

It took just two years of undersupply — the 2022 deficit and the 51.1 million oz shortfall from 2021 — to wipe out the cumulative surpluses from the previous decade.

Global silver mine production is projected to fall 2% this year to about 820 million ounces, compared to forecasted demand of 1.2 billion ounces.

First Majestic Silver’s CEO Keith Neumeyer recently commented that the solar panel and electric car industries now consume about 30% of mined silver supply. Moreover, he said one primary silver mine produces about 10 million ounces a year, meaning it has “zero impact” on the deficit, which represents many mines worth of production.

The Silver Institute forecasts a 140Moz silver deficit this year, the third consecutive annual shortfall, against robust silver industrial demand, which is expected to grow 8% to a record 632Moz. Key drivers include investment in photovoltaics, power grid and 5G networks, growth in consumer electronics, and rising vehicle output.

“We are moving into a different paradigm for the market, one of ongoing deficits,” said Philip Newman at Metals Focus, the research firm that prepared the Silver Institute’s data.

Metals Focus believes the deficit will persist in the silver market for the foreseeable future.

Graphite

Max doesn’t have graphite in its mix of metals, but the critical mineral is among our favorites this year for a reason.

AOTH — Our Battery Metal and Stock for 2024 — Richard Mills

Graphite is a key ingredient in EV batteries and energy storage systems for which there are no substitutes.

Analysts estimate that by 2030, it will take at least 5 million tonnes of graphite per year to fill battery demand. This is roughly four times the 1.3 million tonnes mined globally, according to the USGS’s Mineral Commodities Summaries 2023.

This is why the Department of Energy ranked graphite near the top of its list of minerals critical to America’s energy future. The US federal government’s critical minerals list also has graphite as one of five key battery minerals that are at risk of supply disruptions.

The only way to alleviate that risk is for the United States to find its own source of graphite production, and at AOTH we believe a project like Graphite One’s (TSXV:GPH), OTCQX:GPHOF) Graphite Creek deposit ticks all the boxes.

The results of its 2022 drill campaign demonstrate the potential, in my opinion, for significant resource expansion. Step-out hole 22GC079 intercepted a combined 58.2m of mineralization averaging 4.18% graphite. These are excellent grades; flake graphite ore suitable for electric-vehicle batteries typically grades 2-3% Cg.

The 2023 drill program quadrupled the scope of 2022’s, with 57 holes completed for a total of 8,736 meters — the largest drill program in GPH’s history.

Graphite One could represent a significant portion of the amount of graphite demanded by the United States, currently.

Consider: In 2022 the US imported 82,000 tonnes of natural graphite, of which 77% was flake and high-purity, suitable for electric vehicles.

Based on the PFS, the Graphite Creek mine is anticipated to produce, on average, 51,813 tonnes of graphite concentrate per year during its projected 23-year mine life.

If all goes according to plan, the feasibility study — ahead of schedule by one year — would move Graphite One’s Graphite Creek deposit that much closer to becoming America’s only source of mined graphite, helping to shed its import reliance. (In fact, the FS contemplates a tripling of production, from 50,000 tonnes of graphite concentrate per year as estimated in the PFS to more than 150,000 tonnes)

RT Gold project

In addition to CESAR, Max controls the RT Gold property (100% earn-in) in Peru, encompassing a bulk tonnage primary gold porphyry zone, and 3 km to the northwest, a gold-bearing massive sulfide zone. Historical drilling in 2001 returned values ranging from 3.1 to 118.1 g/t gold over core lengths from 2.2 to 36.0m.

RT is located 760 km north-northwest of Lima in the district of Tabaconas, in the northern part of the Department of Cajamarca (hence the project is named “Rio Tabaconas”, or simply RT). It consists of two contiguous concessions that cover an area of 980 and 1,000 hectares, respectively.

The property sits along the Cajamarca metallogenic belt, extending north from central Peru into southern Ecuador. This prolific belt hosts a number of world-class deposits (see map below).

Location of RT Gold project

In Ecuador, there is the Fruta Del Norte discovery (15.5Moz Au), Mirador (2.7Mt Cu, 2.74Moz Au), and the new discovery by Solaris Resources at its Warintza deposit (2.7Mt Cu, 0.9Moz Au). On the Peruvian side, it has Newmont’s Yanacocha (8.61Moz Au).

Recently, Max filed a technical report that it believes “validates the true potential of the two distinct gold-bearing systems” found on the RT property — namely, the Cerro bulk-tonnage porphyry zone and the Tablon massive sulfide zone.

Cerro hosts several mineralized zones. Soil geochemistry has outlined a 2 km by 1.5 km gold anomaly that is open in all directions, with gold values ranging from 0.1 to 4.0 grams per tonne (g/t). The soil geochemistry is coincident with IP chargeability. A continuous channel sample across the zone assayed 3.3 g/t gold over a width of 25.5m.

Tablon, located 3 km to the northwest, was drilled in 2001 by Golden Alliance Resources Corp. In February 2021, Max obtained the historical drill core and commenced a re-logging and resampling campaign. The resampling confirmed thickness and grade of the 2001 drill intercepts and reasonably well reproduced the reported grades.

Results included high-grade gold values ranging from 3.1 to 118.1 g/t gold over core lengths from 2.2 to 36.0m. One intercept returned a metallics re-assay value of 186 g/t gold over 2.2m, indicating the presence of coarse gold.

The next step for the project is an environmental survey, followed by drilling application.

Gold

Max is exploring the RT Gold project at an interesting time for the gold market.

Gold has held up quite well despite the Fed’s tightening cycle, gaining 13% in 2023.

Source: Kitco

Remarkably, the Federal Reserve has raised interest rates high enough to bring down the rate of inflation, without causing a severe economic downturn.

Market expectations of the Fed lowering interest rates as early as March, 2024 lifted gold to a new record high of $2,135 an ounce on Dec. 3. Since then, the gold price has drifted lower (though still holding above $2,000), as the US dollar and bond yields turn upward after dropping throughout the fourth quarter.

The case for gold revolves around three main factors: an increasingly dovish Fed monetary policy; unsustainably high debt, fueled by excessive government spending; and central bank buying.

Will 2024 be the year for precious metals?

It remains to be seen if and when the Fed lowers interest rates, sparking the next leg up in the gold price.

There are multiple reasons to trade gold — US dollar movements, geopolitical tensions, ETF outflows, central bank buying, negative real rates, etc., but only one reason to own it: maintaining your purchasing power against dollar (or other currency) losses incurred by inflation.

Aside from purchasing gold bullion, another way to play gold is to invest in a gold company. While carrying more risk than an established producer, early-stage junior gold companies offer substantially higher leverage to a rising gold price.

Conclusion

It’s not often that a junior holding two promising assets covers such a large underexplored land position in South America like Max does.

Better yet, the mineralization found on each project is quite unique.

CESAR potentially hosts two well-known deposit types, and RT is found to contain two separate gold systems, giving the company an ideal lineup of minerals for diversification purposes.

At AOTH, we’ve been placing emphasis on electrification, a dominant investment theme that will only rise in prominence moving forward. Max’s CESAR property hosts copper-silver mineralization. With both metals facing deficits, that makes the CESAR project relevant to the new electrified economy and helpful to end users wanting security of supply at reasonable prices.

The prices of industrial metals rise and fall with the health of the global economy, though, so this could impact the project negatively. Gold tends to do well in low-growth cycles, so Max’s RT Gold project is a kind of insurance policy for hard times.

As Max continues to develop RT Gold and CESAR, major mining companies, imo, would be wise to keep an eye on these projects, since we believe both have the size and scalability that majors need in new deposits that will add to their reserves.

RT Gold has the Cerro bulk-tonnage porphyry zone and the Tablon a massive sulfide zone.

At CESAR, drilling at the AM District has confirmed that the sediment-hosted stratiform copper-silver mineralization found in the north end of the project (AM and Conejo) is analogous to the Central African Copper Belt (CACB) and the Kupferschiefer copper-silver deposits of central Europe. Work at the south of the project has identified mineralization hosted along structures (faults) within the volcanic units of the La Quinta formation. It is theorized that the structurally hosted mineralization may represent the feeder system for the stratiform mineralization observed in the sedimentary layers.

Sedimentary-hosted copper deposits can have staggering size and value. It’s estimated that nearly 50% of the copper known to exist in sediment-hosted deposits is contained in the CACB, headlined by Ivanhoe’s 95-billion-pound Kamoa-Kakula discovery in the Democratic Republic of Congo.

Kupferschiefer, considered to be the world’s largest silver producer and Europe’s largest copper source, is an orebody ranging from 0.5 to 5.5m thick at depths of 500m, grading 1.49% copper and 48.6 g/t silver. The silver yield is almost twice the production of the world’s second-largest silver mine.

Max Resource Corp.

TSXV:MAX; OTC:MXROF; Frankfurt:M1D2

Cdn$0.11 2024.01.23

Shares Outstanding 161.9m

Market cap Cdn$19.3m

MAX website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

**********