“Money changes everything,” according to Cindi Lauper. She’s right. Money, or the quest for things that can be exchanged for it, is one of the principal motivators for all human activity. It’s what sent Columbus off on his journey across the ocean in search of the riches presumed to be awaiting him on the other side. In recent times, lithium has become “more valuable than gold” as the quest to build battery-powered vehicles has accelerated.

The Chinese were way ahead of the rest of the world when it came to recognizing the value of lithium. While most nations slept, China was busy identifying lithium deposits around the world and either buying them up or negotiating sweetheart deals with those who perhaps did not fully appreciated lithium’s value. It has leveraged its market power to become the dominant producer of lithium-ion batteries, with virtually complete control over every step in the process from mining to making battery components and manufacturing finished battery cells.

For the past decade, people have been wringing their hands in despair at how China pulled this off and bemoaning the fact that the United States is being left by the wayside. They assume America will always be beholden to China for this indispensable technology.

But a funny thing happened on the way to China’s brave new world of mineral dominance. It incentified others to seek alternatives. New companies sprang up to extract lithium from salt brine, especially in the Salton Sea area of California, but despite rosy projections, they are years away from extracting enough to meet America’s needs. Currently, Australia is the largest lithium supplier in the world.

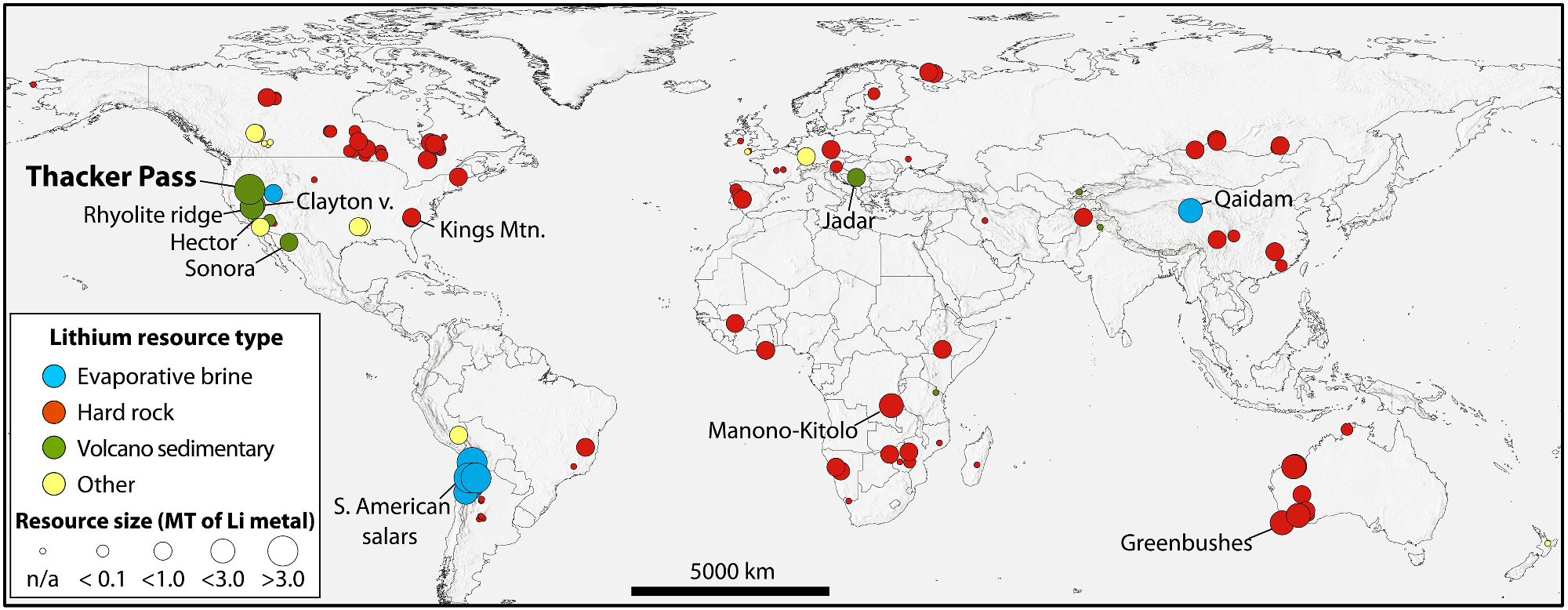

Map showing type and relative size of global lithium resources. Current production is predominantly spodumene from pegmatites in Australia (47%) and brines underlying salt flats in Chile (30%), China (12%), and Argentina (5%). Credit: Benson, et al.

On August 30, 2023, three researchers — Thomas Benson, Matthew Coble, and John Dilles — published a paper in the journal Science Advances in which they report the discovery of what may be the largest lithium deposit known to exist anywhere in the world inside the caldera of an extinct volcano in Nevada near the Oregon border. If their discovery turns out to be accurate, it could have a dramatic impact on America’s ability to manufacture batteries without relying on Chinese sources. Here’s the abstract from their paper:

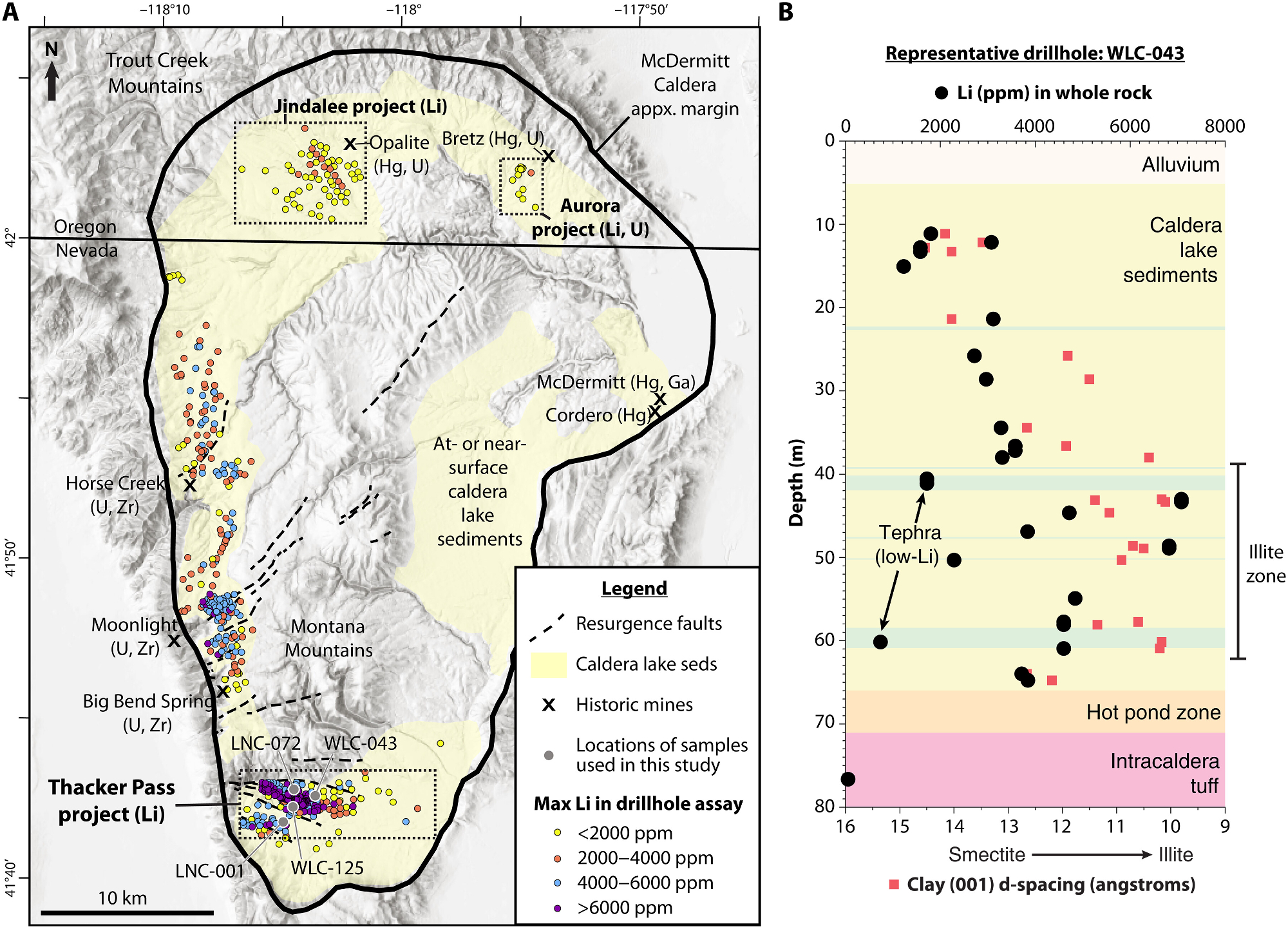

“Developing a sustainable supply chain for the global proliferation of lithium ion batteries in electric vehicles and grid storage necessitates the extraction of lithium resources that minimize local environmental impacts. Volcano sedimentary lithium resources have the potential to meet this requirement, as they tend to be shallow, high-tonnage deposits with low waste:ore strip ratios. Illite-bearing Miocene lacustrine sediments within the southern portion of McDermitt caldera (USA) at Thacker Pass contain extremely high lithium grades (up to ~1 weight % of Li), more than double the whole-rock concentration of lithium in smectite-rich claystones in the caldera and other known claystone lithium resources globally (<0.4 weight % of Li). Illite concentrations measured in situ range from ~1.3 to 2.4 weight % of Li within fluorine-rich illitic claystones. The unique lithium enrichment of illite at Thacker Pass resulted from secondary lithium- and fluorine-bearing hydrothermal alteration of primary neoformed smectite-bearing sediments, a phenomenon not previously identified.”

According to Chemistry World, the trio believes 20 to 40 million tons of lithium metal lie within a volcanic crater formed around 16 million years ago. That’s more than the deposits found beneath a Bolivian salt flat, which up until now has been considered the largest in the world.

An analysis found that an unusual claystone, composed of the mineral illite, contains 1.3% to 2.4% of lithium in the volcanic crater. This is almost double the amount present in magnesium smectite, which is more common than illite.

“If you believe their back-of-the-envelope estimation, this is a very, very significant deposit of lithium,” said Anouk Borst, a geologist at Belgium’s KU Leuven University. “It could change the dynamics of lithium globally, in terms of price, security of supply and geopolitics.

“This would be a multi-step alteration of lithium-bearing smectite to illite, where hydrothermal fluids enriched the clays in potassium, lithium and fluorine. They seem to have hit the sweet spot where the clays are preserved close to the surface, so they won’t have to extract as much rock, yet it hasn’t been weathered away yet,” he added.

How Did The Lithium Get There?

To a geologist, the story of how these deposits were created is a fascinating tale. The McDermitt Caldera formed 16.4 million years ago when some 1000 cubic kilometers of red hot magma exploded outwards. The caldera was filled with erupted products of an alkaline magma rich in sodium and potassium, as well as lithium, chlorine, and boron. This quickly cooled to form a finely crystalline glassy volcanic rock — ignimbrite — which weathered to produce lithium-rich particles.

A lake subsequently formed in the crater, persisting for hundreds of thousands of years with weathered volcanic and surrounding materials forming a sediment rich in clay at its bottom. The new analysis suggested that after the lake emptied, another bout of volcanism exposed the sediments to a hot, alkaline brine, rich in lithium and potassium.

“Previous research assumed that the illite was everywhere at depth in the caldera,” says Benson, who is a geologist at Lithium Americas Corporation (LAC), and was formed when high temperatures and pressures turned smectite to illite.

Benson’s team proposed that a layer of illite about 40 meters thick was formed in the lake sediments by this hot brine. The fluid moved upwards along fractures formed as volcanic activity restarted, transforming smectite into illite in the southern part of the crater known today as Thacker Pass. The result was a claystone rich in lithium.

The material could be best described as looking “a bit like brown potter’s clay,” said Christopher Henry, emeritus professor of geology at the University of Nevada in Reno. “It is extremely uninteresting except that it has so much lithium in it. There’s been a lot of searching for additional deposits,” Henry added. “The United States currently has just one small lithium producing brine operation in Nevada.”

Economically Significant

Benson says his company expects to begin mining in 2026. It will remove clay with water and then separate out the small lithium bearing grains from larger minerals using a centrifuge. The clay will then be leached in vats of sulfuric acid to extract the lithium.

“If they can extract the lithium in a very low energy intensive way or in a process that does not consume much acid, then this can be economically very significant,” says Borst. “The US would have its own supply of lithium and industries would be less scared about supply shortages.”

The Takeaway

All the handwringing about how America doesn’t have enough lithium to produce all the batteries it will need in the future is overblown. Resource scarcity always leads to the discovery of new resources. It has happened in the coal, oil, and gas industries for decades. Just when the fear mongers started saying we were about to run out of those commodities, either new supplies were found or new ways were discovered to extract more of them from beneath the surface of the Earth. Fracking is a perfect example of how new technology can keep extractive enterprises profitable far longer than anyone expected.

If America needs lithium, the glories of the free market will find it. Those with really long timelines can already envision a future in which it is replaced with other cheaper and more plentiful materials. Perhaps one day, future CleanTechnica writers will be talking about “peak lithium.”

Relax, people. Everything is happening just as it should and right on schedule. Of course, it would be nice if nations learned to cooperate in order to preserve the Earth for future generations, bug that will never happen. There’s no money in it.

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it! We just don’t like paywalls, and so we’ve decided to ditch ours. Unfortunately, the media business is still a tough, cut-throat business with tiny margins. It’s a never-ending Olympic challenge to stay above water or even perhaps — gasp — grow. So …

.jpg)