And we’re back, with the last part of our report on Latin America EV market share! If you haven’t read the previous articles, you can check them out here:

In here, we will meet the market leaders, most of which have shown significant growth and could be ripe for rapid disruption … plus a leader that, to be honest, absolutely surpassed my expectations. Let’s begin!

#3. Colombia (3% plug-in market share)

Columbia’s EV market in 2023 is probably the most complex to understand in our entire list. In the face of it, the data would seem to point to a generalized stagnation of the market. Plug-in car sales have been dropping month after month, falling over 10% in H1. “Disaster!”, will scream the naysayers, having at last the definite proof that their omens were correct, and EVs were nothing but a fad, a short boom based upon governmental whims. Isn’t that how it normally goes?

But what if I told you that the naysayers are wrong, and the Colombian EV market is actually booming?

Monthly Plug-in Sales in Colombia (Light and Heavy Vehicles)

This is the crude data, and on the face of it, it would seem that the market is stagnant indeed. But this data is incomplete: Colombia’s 2022 numbers were heavily skewed due to the purchase of nearly 1.500 buses, half of which arrived in H1. In contrast, only 19 electric buses arrived in the country in H1 2023.

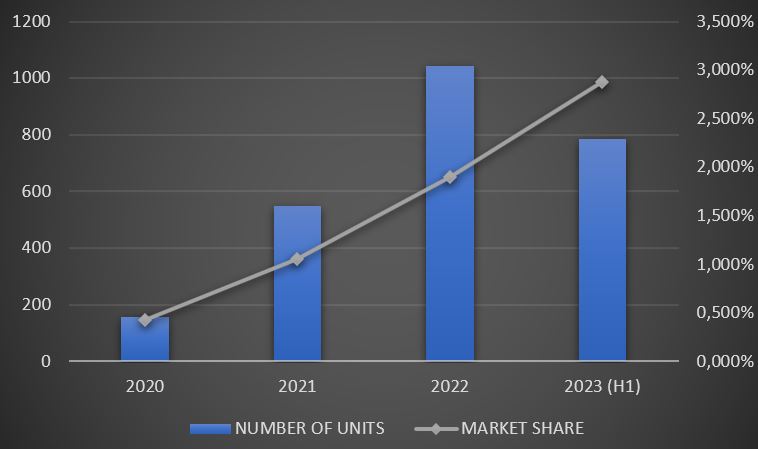

Once we take that into account, it turns out that BEVs are growing at a healthy 45% YoY rate. But PHEVs are still disappointing, with a 11% decrease that brings the total YoY growth rate to just 13%.

But wait! I thought we said the market was booming!

Yes, we did. Because, see, the buses are only half the issue. Context matters, and Colombia’s economic context for H1 2022 has been plagued with runaway inflation (that has just recently been controlled, but still stands over 10%), severe currency devaluation (once again, already improving, but it hit hard in the months prior), and very high interest rates. All of these factors have caused a massive (and worsening) fall in vehicle sales, 27% down YoY. And, in this context, plug-in market share has increased from 2.1% last year to 3.1% so far this year. Yes, this is including all of those buses.

Plug-in Market Share in Colombia (Light and Heavy Vehicles)

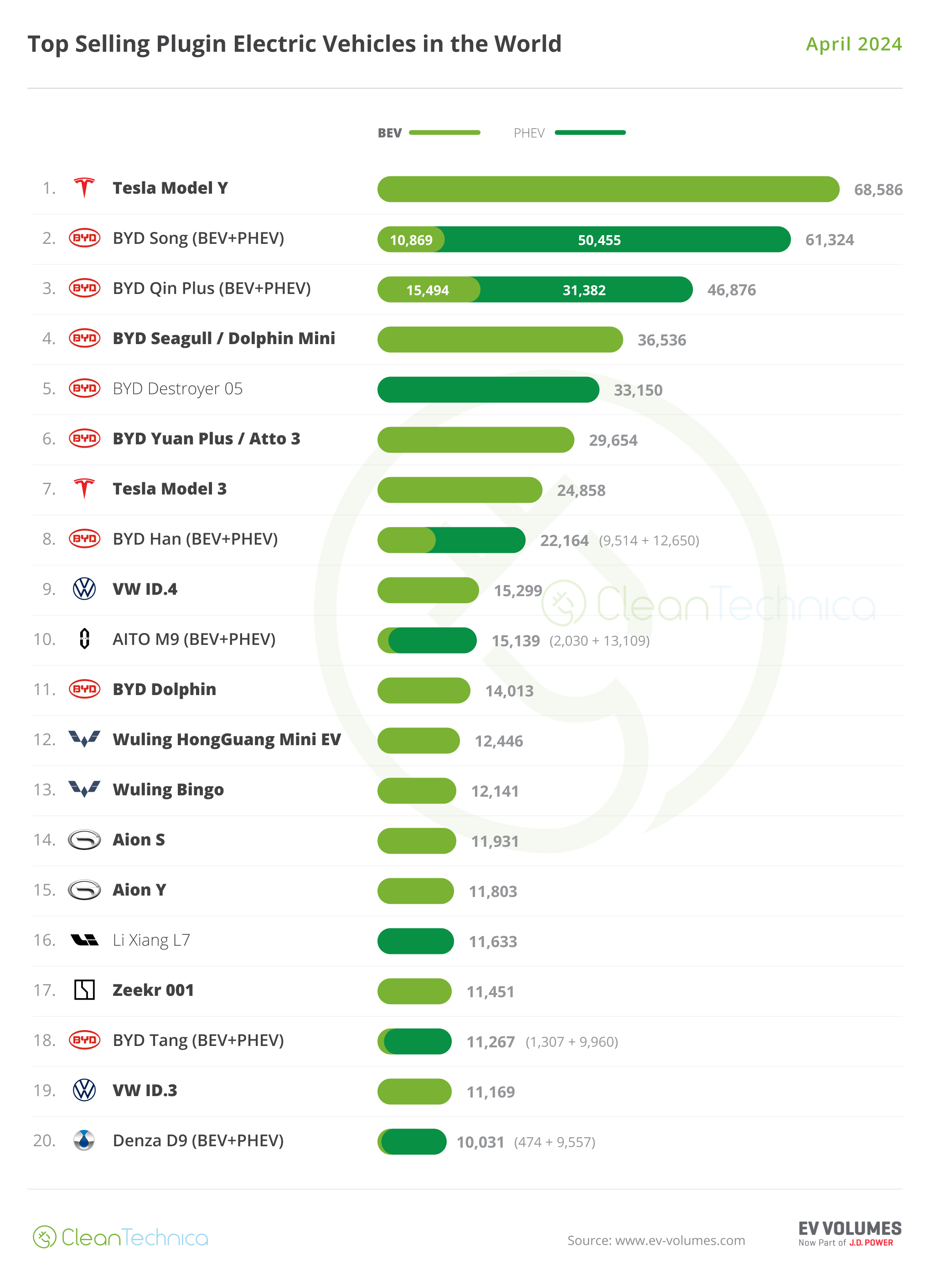

Colombia’s EV market situation is also complex. On one hand, the country has been flooded with Chinese models (and more are coming in H2), the government is finally cutting the gasoline and diesel subsidy, and cities have strict transit restrictions for ICE vehicles, which have greatly promoted EVs (and plug-less hybrids as well).

On the other hand, even though EVs are getting cheaper (and more affordable options are arriving, such as the $17,300 Changan Lumin), local currency revaluation has also fueled price reductions in ICEVs, many times in equal or larger proportion than EVs. Currency revaluation has happened so fast that many EVs with significant price reductions are nonetheless more expensive today (in USD) that they were a few months ago. A good example is the BYD Dolphin, which, despite a significant price cut, is now more expensive in USD than the day it arrived in the country:

This could be problematic for the EV market, as ICEVs are proving capable to at least maintain their USD cost, hence reducing prices more than EVs. As in most countries in the region, Colombia is in dire need of lower prices, perhaps even a price war that brings EV prices more in line with the rest of the world.

Market composition skews towards BEVs: 1,630 were sold in H1 as compared with 1,163 PHEVs. Given the 90,869 vehicles sold in total in H1, this means 1.9% market share for BEVs and 1.2% for PHEVs.

As in Chile’s case, 6 out of the top 10 are Chinese models:

#2. Uruguay (2.9% BEV market share)

In many senses, Uruguay is very similar to Argentina. It has similar culture, similar accent, shared history, and Montevideo is as close to Buenos Aires as a city can be while still existing in a different country. Yet, in respect to EVs, they are as far apart as two countries can be, with Argentina being one of the biggest laggards and Uruguay being one of the undisputed leaders.

27,264 vehicles (both light and heavy) were sold in H1 2023. Of these, 784 were BEVs, with a market share of 2.87%. Sadly, Uruguay’s official data does not include PHEVs, nor presents numbers in a month-to-month basis, so we can only provide yearly numbers:

Yearly BEV Sales and Market Share in Uruguay (Light and Heavy Vehicles)

Uruguay also has one of the most comprehensive fast-charging networks in the region. However, most of it is based upon AC Type 2 chargers capable of charging at 22 kW. Though not ideal, it’s a relatively small country, and no doubt many people will find these relatively slow chargers to be enough to let go of range anxiety.

As for the market composition, once again, we meet the reign of the Chinese: 8 out of the 11 most sold models come from a Chinese manufacturer.

Like the entire region, Uruguay suffers from extremely high EV prices. Given the popularity of EVs, the government support, and the comprehensive charging network, it wouldn’t surprise me if once they lower their cost, we will see massive increases in sales … but lower prices are needed.

#1. Costa Rica (11% BEV market share)

We finish our report with Costa Rica, a country with an absurd lead over the rest of the region, to the point that it actually leads the entire continent (presenting higher BEV market share than the US and Canada).

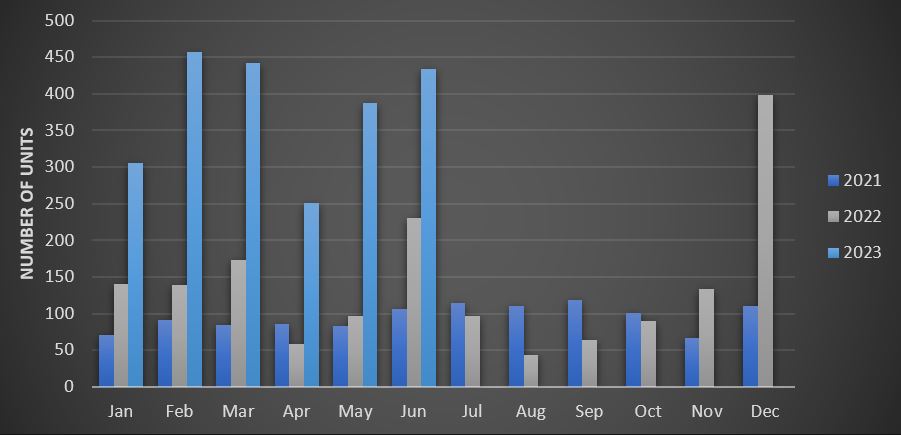

25,741 vehicles were sold in Costa Rica in H1 2023. Of these, 2,783 were BEVs, presenting an 11% BEV market share, an impressive number, and more so for a country with middle income status. Moreover, sales are growing at electrifying speed (pun intended), with a 171% increase YoY so far in 2023! Not only is Costa Rica the leader, but it’s also bolting ahead at a rate that makes it very difficult for anyone to catch it in the medium term.

BEV Monthly Sales in Costa Rica (Light and Heavy Vehicles)

This impressive performance is coming from a country where BEVs aren’t particularly cheap (as far as we’ve seen, they’re as expensive as they are in Colombia and Mexico) and where people aren’t particularly wealthy. It’s so impressive that I’m unable to find a reasonable explanation: Costa Rica does have some special perks for EVs (such as lower taxes, no tariffs, and free on-street parking), and it also has restrictions for ICEVs in the main cities, but, honestly, the difference isn’t all that much from countries like Uruguay, Chile, or Colombia. The country also has a very comprehensive fast-charging network, but Chile and Uruguay aren’t too far behind. And yet, Costa Rica’s lead is so large as to feel unsurmountable. Do any of you have an idea why this might be the case?

Market composition, once again, proves the power of the Chinese manufacturers: 6 out of the top 10 are Chinese.

However, when looking at the top models sold, only 5 are Chinese. Perhaps there’s still hope for the legacy automakers:

That’s all for today, folks. With Costa Rica’s impressive situation, we finish this report on Latin American EV market share. Hopefully, by the time we make the next one, prices will be lower, charging networks will be better, data will be more complete, and EVs will be far more popular in every single one of these markets.

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it! We just don’t like paywalls, and so we’ve decided to ditch ours. Unfortunately, the media business is still a tough, cut-throat business with tiny margins. It’s a never-ending Olympic challenge to stay above water or even perhaps — gasp — grow. So …