Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

We’re back with our report on EV sales in Latin America! There are some novelties, but, contrary to my expectations, the distance between the laggards and the leaders is actually increasing: this means that the first part of the report will be full of bad (or, at best, “meh”) news, while the last part will be full of exciting changes.

This is likely to be the last report of this kind I write. In late 2023, the transition started to speed up in several countries, so there’s more to report than can be said in a couple of paragraphs every six months. Meanwhile, other countries are basically stagnant. Because of this, I’ll try to maintain bi-annual or yearly reports for the least electrified markets, but I’ll start writing sales reports more often regarding countries where EVs are advancing rapidly: I already hinted at this with the news on Brazil’s impressive growth in H2 2023.

Some of you may notice there are Latin American countries missing from this list. This mainly has to do with information on these markets being unavailable. I’ve searched far and wide, but if you have access to data for any of the countries I’m missing (Honduras, Nicaragua, Guatemala, Cuba, Venezuela, Bolivia, and Paraguay), please feel free to comment and I’ll be sure to add them in the next report.

Having said that, let’s begin! Remember that BEV or PHEV data will be presented depending on what’s available for each particular country.

#12. Argentina (0.08% BEV market share)

Argentina closes 2023 on a grim, if technically positive, note. BEV market share grew slightly to 0.8%, up from 0.6% in 2022. At this point, the Argentinian market has what I like to call a “symbolic” BEV presence, where the few vehicles that are sold are mainly a curiosity. BEV sales grew by 47%, reaching 384 units, but the overall market grew by 10% (to 449,438 units), so BEV market share barely moved.

As a testament to how protectionist the Argentinian market is, the locally produced Tito Corradir absolutely dominated, with 73% market share from 280 units sold. The 4.5kW motor, 8kWh battery mini-car is sold in the local market at a price that ranges from $8,000 to $17,000. Following, yet far behind, was the Ford Mustang Mach-E, with 30 units sold.

Argentina remains below 0.1% market share, still far from the symbolic 1% market share most countries in Latin America are already closing in on, or even surpassing. I have no big expectations for this market in 2024.

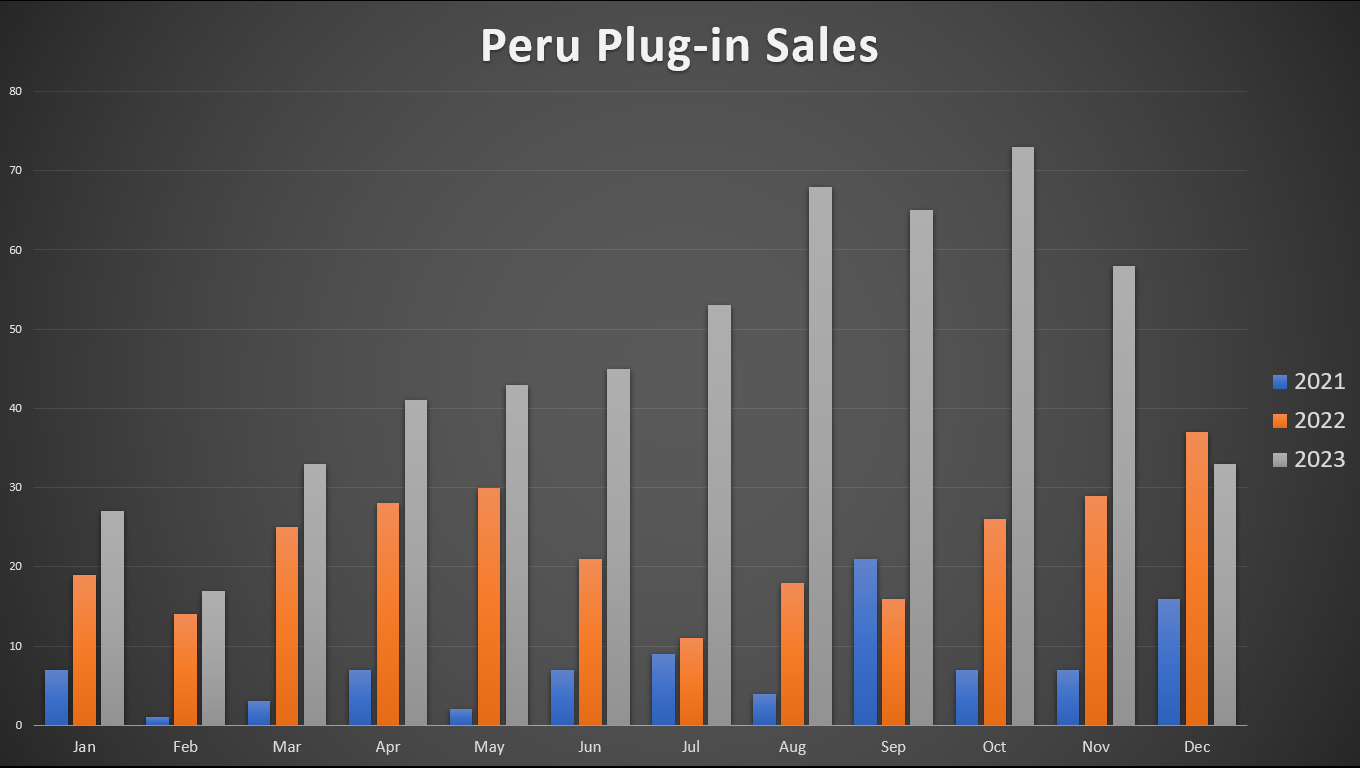

#11. Peru (0.3% plug-in vehicle market share)

Peru has presented significant growth YoY, but the overall EV market remains very low, with only 0.3% plug-in vehicle market share in 2023. That’s from nearly equal numbers of BEVs (267 units) and PHEVs (289 units). When a market sits this low, 102% growth YoY is actually underwhelming. Regardless, even if sales remained below one hundred units a month, the growth trend in 2023 was clear. I expect 2024 to continue or, hopefully, increase this. Who knows? Perhaps Perú could even pull off growth this year like Brazil did in H2 2023….

Peru’s total vehicle market (for light and heavy vehicles) consisted of 181,812 units in 2023, so the 556 units sold in 2023 stand, once again, at a merely symbolic level. Even worse, BEV market share in Peru sat at only 0.15% — so, it isn’t far from Argentina’s abysmal position. We’ll see how the market does in 2024.

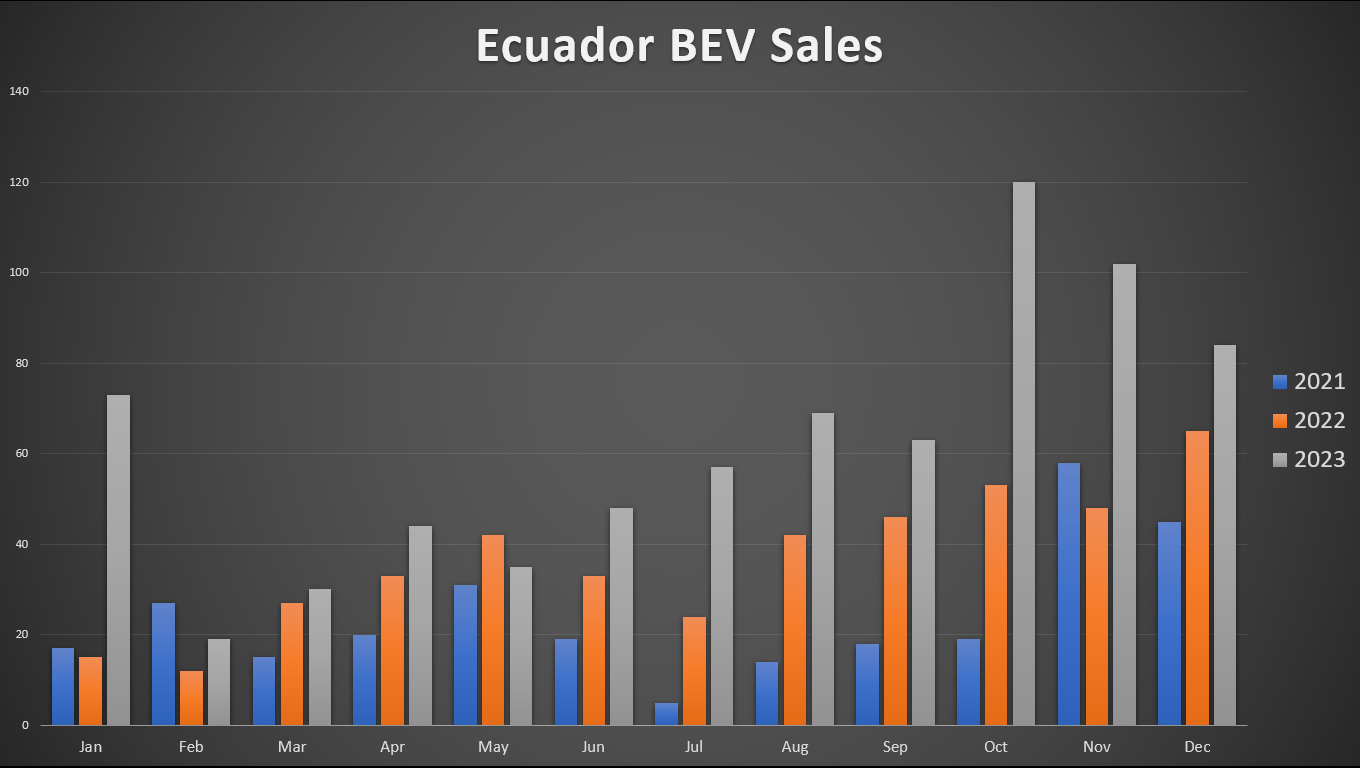

#10. Ecuador (0.5% BEV market share)

More than any other market, it was Ecuador that required most of my effort and attention to build this report. Not because growth was considerable, nor because there were interesting things going on … but because the official reports from late 2023 did not coincide with those from early 2023.

Believe me, dear readers, when I tell you that it was a nightmare first to locate and then to analyze the numbers, but after a few hours of work, I finally found the culprit: Nissan. Specifically, the Hybrid Nissan X-Trail … which, for some unfathomable reason, was classified as a BEV starting with the October report. That messed up all the data from then onwards. It seems Nissan scored a big one with the “E-Power” branding, somehow convincing the Ecuadorian government that its regular non-plug-in-hybrid (with a 2.1kWh battery) was a fully electric vehicle. I’m wondering at this point if they got any benefits out of this, because there were more X-Trail sold in Ecuador than overall BEV sales (which skewed the numbers quite a bit).

But enough complaining. It turns out that BEV sales grew 70% YoY, reaching 744 units in 2023 and, for the first time, surpassing one hundred sales a month. Once again, this includes light and heavy vehicles.

Ecuador’s total market stood at 134,037 sales, so, even if BEV market share nearly quadruples that of Peru, we’re still far away from a meaningful presence here. However, Ecuador’s situation seems to be better: EVs are receiving significant government support, and a charging network is being built. Ecuador is one of the countries with the largest Chinese presence, and by late 2023, it got much closer to reaching 1% BEV market share (actually surpassing it in October). 2024 should bring interesting news.

Leading the market were BYD (223 units) and Audi (136), which together got nearly 50% of sales in the country. It’s possible I may need to revise Ecuador’s numbers (hopefully upwards) once more precise information is published.

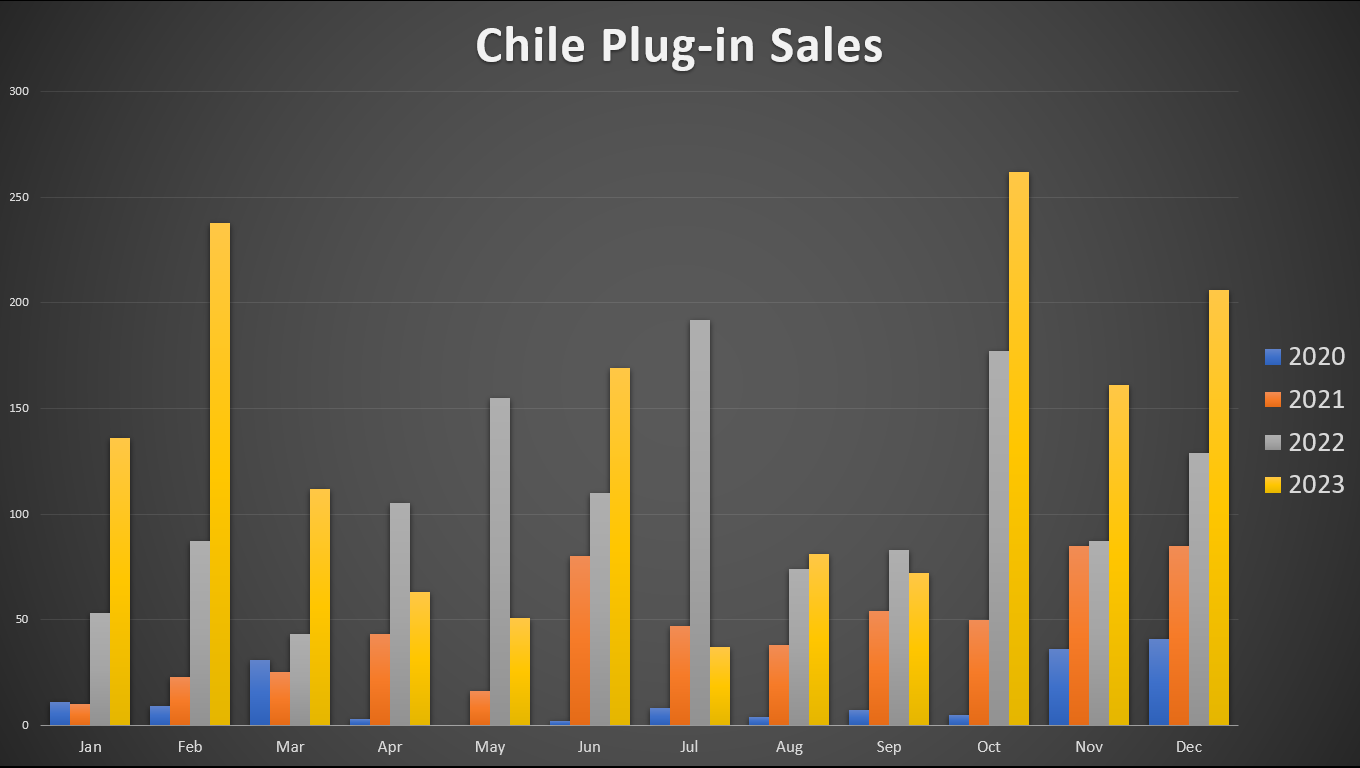

#9. Chile (0.7% plug-in vehicle market share)

Of all countries the in this report, Chile comes as the biggest surprise.

It’s a wealthy country with one of the best charging networks in the region. It’s quite long for sure, but most of the population lives in the Santiago–Valparaiso area, which is quite small. EVs receive significant support, including electric buses, of which Santiago has more than any other city in the world outside of China. Furthermore, EVs are cheaper than in most other countries in the region. And yet, it remains behind many others, when by all metrics it should be one of the leaders.

Plug-in registrations increased by a mere 18% in 2023, with BEVs growing 22%. In the context of a falling market (-27%), this meant an increase in market share from 0.5% in 2022 to 0.7% in 2023 (0.5% BEV). So, there’s growth, but … I would’ve expected much more.

Chile’s total light vehicle market stood at 313,865 units in 2023, well below the 426,816 units of 2022, placing it in third place in South America (behind Brazil and Argentina). That’s down from second place a year before. Tesla’s arrival may shake things up in 2024, so there’s hope there.

In 2023, the market was dominated by Chinese manufacturers, with the SAIC Maxus and Geely’s Maple leading in sales, followed by Kia, BYD, and MG.

#8. Dominican Republic (0.7% BEV market share)

We finish this first part of our report with the Dominican Republic, which, frankly, does not present much information to work with. However, we were able to find out that 936 BEVs were sold in 2023, which amount to 0.73% of the 126,914 total sales in this country. Year on year growth was not possible to calculate, but it seems BEV sales in 2022 were already around 700, so growth was quite underwhelming in any case.

As with Chile, I find the numbers in Dominican Republic disappointing. The country is small (no more than 500 km of range needed to go from one extreme to the other), is relatively prosperous, and lacks oil reserves. Even then, EV market share is growing quite slowly, much more slowly than I would expect in these circumstances.

Expect the second part of this report soon! And do not despair — next, we enter the land of markets with more significant market share and robust growth. Stay tuned!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica TV Video

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

CleanTechnica uses affiliate links. See our policy here.